FL Entertainment: FY 2022 results

Press Release

Paris – March

16th, 2023

Full-year 2022

results

STRONG FINANCIAL PERFORMANCE

IN LINE WITH GUIDANCESOLID GROWTH

ACROSS BOTH

BUSINESSESSTRONG

FREE CASH FLOW GENERATION AND RAPID DELEVERAGING

MID-TERM OUTLOOK CONFIRMED

2022 HIGHLIGHTS

-

Revenue up +15.7%1 to €4,047m

driven by strong performance of both businesses

- Content production &

distribution: content catalogue up 30% to 160,000 hours, streaming

platform revenues up 61% y/y, 15 bolt on acquisitions in 10

geographies

- Online sports betting & gaming:

Unique Active Player numbers up 25% y/y, partly driven by strong

football World Cup performance

- Adjusted

EBITDA2 rose by +10.0% to €670.2m in

2022, resulting in an EBITDA margin of 16.6%

- Adjusted

net income2 rose to €307m (+8.6% versus

2021), net income stood at -€81m

(2021: -€73m) due to the one-off impact of the Group’s

reorganization and listing

- Further improvement of

Adjusted free cash flow

conversion1 to reach 83% (82% in 2021)

and a record-high €555m in 2022 driven by tight

control of cash expenses and capex

- Continued reduction

of net financial debt to

reach €2,091m, leading to a leverage3 ratio of 3.1x as of 31

December 2022 compared to 3.7x as at 31 December 2021

- Strong

liquidity position (€689m on 2022 year-end),

S&P rating on Banijay4 upgraded to B+ in September 2022, Fitch

Ratings rating on Banijay upgraded to B+ in March 2023

- ESG continued

rollout of initiatives with focus on executing Responsible Gaming

roadmap and fostering Diversity & Inclusion across Group’s

portfolio

- Proposed

dividend of

€0.36 per share, equal to 49% payout ratio on Adjusted net

income

2023 OBJECTIVES & MID-TERM

OUTLOOK

- 2023 objectives in

line with mid-term outlook:

- Revenue: mid-single digit organic

growth for Content production & distribution and double-digit

organic growth for Online sports betting & gaming

- Adjusted EBITDA of around

€710m

- ~80% free cash flow conversion

- Dividend payout ratio of at least

33.3% of the Group’s Adjusted net income

- Mid-term outlook presented at the

time of the business combination and listing confirmed

François Riahi, CEO of FL Entertainment,

said:

“2022 was an outstanding year for FL

Entertainment. As a Group, we delivered strong results in line with

our guidance, demonstrated rapid progress against the strategy

presented at our listing and strengthened our financial

position.

In Content production & distribution, strong

profitable growth is linked both to new shows, including scripted

hits Marie-Antoinette and SAS Rogue Heroes, and the continued

evolution of our unscripted superbrand offering built on powerful

IP such as Masterchef, Big Brother and Survivor which are

relaunching in key markets and entering new territories. This

production, as well as our successful execution of 15 bolt on

acquisitions in 10 territories have driven a 30% increase of our

overall content catalog, cementing our position as the number one

global independent content producer. We are perfectly positioned in

this business to capture market consolidation opportunities going

forward.

In Online sports betting & gaming, the

growth of our revenues has been also very strong, despite a high

comparison base in 2021. The overall number of Unique Active

Players increased by 25%, powered in part by our strong commercial

performance during the football World Cup. Betclic has been the

most downloaded sports betting app in our core markets of France,

Poland and Portugal, and the second most downloaded across Europe,

thanks to our state-of-the-art technology platform which leads the

way in terms of reliability and efficiency. Looking ahead we will

capitalize on increased player numbers to drive continued organic

growth at a high pace.

Fl Entertainment’s first yearly results are a

testimony to the strength of our business model. We are well

positioned to reinforce our leading positions in our structurally

growing markets in 2023 and continue to demonstrate our proven

ability to delivery profitable growth at scale”.

*****

FL Entertainment invites you to its 2022 results conference call

on:

Thursday, March

16th 2023, at 6:00pm

CET

Webcast live:You can watch the

presentation on the following

link:https://edge.media-server.com/mmc/p/4i46xfmv

Dial-in

access telephone numbers:You need

to register to the following

link:https://register.vevent.com/register/BI60d2c660f0f54582b32a5db6f13db8d3

Slides related to 2022 results are available on

the Group’s website, in the “Investor relations” section:

https://www.flentertainment.com/

KEY FINANCIALS IN

2022

|

€m |

2021 |

2022 |

% change |

% constant currency |

|

|

|

|

|

|

| Group

revenue |

3 497.0 |

4 046.6 |

15.7% |

13.2% |

| Adjusted

EBITDA |

609.3 |

670.2 |

10.0% |

|

| Adjusted EBITDA

margin |

17.4% |

16.6% |

|

|

|

|

|

|

|

|

| Net income |

(73.4) |

(81.1) |

(10.5%) |

|

| Adjusted net income

excl. one-off items related to the transaction |

282.5 |

306.7 |

8.6% |

|

|

|

|

|

|

|

|

Adjusted free cash-flow |

497.5 |

554.7 |

11.5% |

|

| Free cash flow

conversion rate |

82% |

83% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the twelve-month period ended |

31-Dec-21 |

31-Dec-22 |

% change |

|

|

|

|

|

|

|

| Net financial debt

(reported) |

2 268.8 |

2 090.8 |

(7.8%) |

|

| Adjusted

EBITDA |

609.3 |

670.2 |

10.0% |

|

|

Net financial debt / Adjusted EBITDA |

3.7x |

3.1x |

|

|

2022 – KEY

EVENTS

Content production &

distribution: active

year 2022 in M&A

Banijay continued to execute its M&A

strategy in 2022, enriching its content and geographical footprint,

creating economies of scale and contributing to long-term

performance. Banijay completed 15 bolt-on acquisitions5 of

well-known production companies across both non-scripted and

scripted content in 10 countries - the US, Australia, Belgium,

France, Germany, Israel, Italy, the Netherlands, Spain and the

UK:

- Légende

Films (renamed Montmartre Films), a high-profile

filmmaker in France;

-

Znak TV, an

entity created by famous showrunner and executive producer on Fox's

"MasterChef" amongst other large-scale entertainment brands, which

operates in the US and the UK;

-

Groenlandia, an Italian premium

scripted producer;

-

Tooco, a specialist in the

creation, development and management of new formats for the French

and international markets;

- Pookepsie

Films, one of the most unique scripted production

companies in Spain focused on the fantasy, thriller, and horror

space;

- Kindle

Entertainment, a specialist in young adult and family

drama in the UK;

- Movimenti, an

Italian production company and animation focused creative hub;

- SONY Pictures Film

und Fernsehen GmbH, a German producer of high-quality, standout

entertainment formats and scripted content.

- Mam Tor, a

high-end original television drama producer from the UK;

- Beyond

International, a leading Australian producer of

media content with more than 8,000 hours of scripted and

non-scripted in-house and third-party acquired English content

across multiple territories and genres including factual

entertainment, premium documentary and drama;

- MoviePlus

Production, an independent Israeli production

company specialized in drama series, documentaries and

feature-length films;

- Puzzle Media, the

first French production company to deliver extreme and board sports

content in high volume, with top titles including Riding Zone;

-

Jonnydepony, an independent

production label specialising in the development and production of

high-quality drama series;

- Posh Productions

B.V., a storytelling production company working on the

basis of equality between people with a cinematic style; and

- Topkapi

Films B.V., an Amsterdam-based production company

dedicated to new ways of storytelling since 1994, creating

television drama and feature films for the international

market.

Online sports betting &

gaming: strong

performance during the Football World

Cup

In 2022, Betclic continued to demonstrate its

ability to attract and engage passionate sports fans thanks to the

quality of its content and its attractive and robust platform.

Betclic's performance during the World Cup was a

testament to its strong technology infrastructure, its commitment

to security and its ability to deliver a seamless user

experience.

During the tournament, Betclic handled 6 million

odds updates per day, rapidly settling 1.5 million bets just 13

seconds after the end of the football matches. Despite

exceptionally high betting volumes, the platform remained fully

secure, with no security breaches and zero app downtime.

ESG: At the heart of

the FL Entertainment business model

Banijay: improving its position in diversity, inclusion, and

environment

Banijay is committed to ensuring a truly

representative and inclusive workforce and has implemented a

framework to monitor the impact of these initiatives.

This framework has three pillars:

- Create global

employees’ groups (e.g., pride, disability, women-led) to foster

inclusion and promote diversity;

- Create a safe

working environment for all employees; and

- Equip all

employees with a sustainability-led mind-set to reduce carbon

footprint and overall impact on environment.

Banijay aims to create an environment where

employees can perform to the best of their abilities in an

inclusive work culture. In that context, it set up its first

dedicated Diversity & Inclusion Board in 2022 and will go

further in 2023 to effectively drive best practices and initiatives

around the world. Banijay also partnered with 3Degrees to create a

carbon emission measurement system for its operations, which will

be launched in 2023.

Betclic: pursuing the highest standards for responsible

gaming

Betclic puts player protection at the heart of

the company’s strategy and development. It ran three initiatives to

raise attention to responsible gaming through a dedicated campaign,

partnerships with associations with the launch of the first ever

French website to prevent underage gaming as well as a dedicated

communication during the FIFA World Cup Qatar 2022.

As part of its commitment to ensuring the

highest standards, Betclic ran three initiatives to responsible

gaming:

A major responsible

gaming education campaign in France in October

2022, based on four pillars:

- Educate players

via the Betclic app as well as large-scale marketing campaign

focused on playing with control;

- Increase public

awareness to prevent underage gaming

- Deepen training

on risky behavior prevention measures with all Betclic

employees;

- Innovate with a

responsible gaming “lab sprint” made up of 100 Betclic experts

including engineers, product managers and responsible gaming

experts.

Alongside those initiatives, Betclic had

two partnerships with two reference associations

in 2022:

- E-Enfance, to

build the first website for parents to help them prevent teenage

gaming together: www.pasdujeu.fr

- GamCare, a

recognized European expert in the prevention and treatment of

gaming problems.

During the FIFA World Cup, Betclic launched a

communication campaign to raise awareness among

players and public opinion on that matter.

Betclic also initiated actions related to its

social and societal impact including the introduction of a

sustainable mobility package to reduce its environmental

footprint.

More information on the Group’s existing

policies and action plans will be included in chapter 2 of the 2022

Universal Registration Document, that will be published at the end

of April 2023.

FL Entertainment will report annually in its

Universal Registration Document on the progress of its key

non-financial performance indicators.

Business

combination

On 10 May 2022, FL Entertainment N.V., announced

that it had entered into a definitive business combination

agreement with Pegasus Entrepreneurial Acquisition Company Europe

B.V., a special purpose acquisition company, to become a listed

company on Euronext Amsterdam.

The business combination was completed on 1 July

2022 and provided the Group with additional capital of around €608m

after deduction of the fees and expenses of the business

combination, at around €35m. The first day of trading on Euronext

Amsterdam took place on 1 July 2022.

Group reorganization

The Group conducted reorganization between

entities within Financière Lov group and with minority interests in

order to achieve the Transaction described above.

Liquidation of Bet-at-home Entertainment

Ltd

On 22 December 2021, Bet-at-home Group announced

the winding up by the court procedure of bet-at-home.com

Entertainment Ltd, a Maltese entity operating casino activities

under license by the Malta Gaming Authority, consolidated at 53.9%

as of December 2021, which took effect in the first half of

2022.

2022 - PROFIT &

LOSS STATEMENT

2022 “Normalized P&L” highlights the

underlying performance of the Group by removing the impact of

one-off items related to reorganization and business combination

(refer to page 11).

Accounts are presented under IFRS standards,

unless explicitly mentioned.

|

In € million |

2021Reported |

2022Reported |

2022Normalized |

% change vs 2021 |

|

Revenue |

3 497.0 |

4 046.6 |

4 046.6 |

15.7% |

| External

expenses |

(1 774.1) |

(2 050.6) |

(2 050.6) |

15.6% |

| Personnel

expenses excluding LTIP & employment-related earn-out &

option expenses |

(1 095.4) |

(1 287.2) |

(1 287.2) |

17.5% |

| Other operating

income (loss) excl. restructuring costs & other non-recurring

items |

(17.6) |

(29.0) |

(29.0) |

64.6% |

| Depreciation and

amortization expenses related to D&A fiction |

(0.6) |

(9.5) |

(9.5) |

|

|

Adjusted EBITDA |

609.3 |

670.2 |

670.2 |

10.0% |

| Adjusted EBITDA

margin |

17.4% |

16.6% |

16.6% |

|

| |

|

|

|

|

| Restructuring

costs and other non-recurring items |

(49.8) |

(127.4) |

(21.7) |

|

| LTIP &

employment-related earn-out and option expenses |

(308.0) |

(147.5) |

(114.5) |

|

|

Depreciation and amortization (excl. D&A fiction) |

(141.1) |

(140.6) |

(140.6) |

|

| Operating

profit/(loss) |

110.4 |

254.7 |

393.4 |

3.6x |

| |

|

|

|

|

| Cost of net

debt |

(135.3) |

(143.8) |

(143.8) |

|

|

Other finance income/(costs) |

1.9 |

(112.9) |

(16.5) |

|

|

Net financial

income/(expense) |

(133.4) |

(256.7) |

(160.3) |

20.2% |

| Share of net

income from associates & joint ventures |

(1.2) |

(2.2) |

(2.2) |

|

|

Earnings before provision for income taxes |

(24.2) |

(4.2) |

230.9 |

|

| |

|

|

|

|

| Income tax

expenses |

(49.2) |

(76.9) |

(76.9) |

|

|

Profit/(loss) from continuing operations |

(73.4) |

(81.1) |

154.0 |

|

|

Net income/(loss) for the period |

(73.4) |

(81.1) |

154.0 |

|

|

Attributable to: |

|

|

|

|

| Non-controlling

interests |

(30.4) |

6.9 |

6.9 |

|

| Shareholders |

(43.0) |

(88.0) |

147.1 |

|

|

Restructuring costs and other non-recurring items |

49.8 |

127.4 |

21.7 |

|

| LTIP &

employment-related earn-out and option expenses |

308.0 |

147.5 |

114.5 |

|

|

Other financial income |

(1.9) |

112.9 |

16.5 |

|

|

Adjusted net

income |

282.5 |

306.7 |

306.7 |

8.6% |

CONSOLIDATED REVENUE

In 2022, Group revenue increased by +13.2% at

constant currency to €4,046.6m, driven by solid growth across its

two business lines. This includes +15.7% in Q4 2022.

On a reported basis, consolidated revenue grew

by +15.7% over the period.

This is reflected as follows by business:

|

€m |

Q4 2021 |

Q4 2022 |

% change |

% constant currency |

2021 |

2022 |

% change |

% constant currency |

|

|

|

|

|

|

|

|

|

|

| Production |

763.8 |

920.5 |

20.5% |

|

2 263.2 |

2 664.6 |

17.7% |

|

|

Distribution |

139.0 |

120.5 |

-13.3% |

|

331.8 |

387.7 |

16.9% |

|

| Other |

52.9 |

48.8 |

-7.7% |

|

161.0 |

159.3 |

-1.1% |

|

|

Content production & distribution |

955.7 |

1 089.8 |

14.0% |

12.3% |

2 756.0 |

3 211.6 |

16.5% |

13.3% |

|

|

|

|

|

|

|

|

|

|

| Sportsbook |

143.0 |

193.0 |

34.9% |

|

588.6 |

670.1 |

13.8% |

|

| Casino |

25.1 |

33.0 |

31.3% |

|

102.0 |

104.8 |

2.7% |

|

| Poker |

12.0 |

15.0 |

24.9% |

|

44.1 |

49.9 |

13.1% |

|

| Other |

1.8 |

3.1 |

71.3% |

|

6.4 |

10.3 |

60.7% |

|

|

Online sports betting & gaming |

181.9 |

244.1 |

34.2% |

34.2% |

741.0 |

835.0 |

12.7% |

12.8% |

|

|

|

|

|

|

|

|

|

|

|

TOTAL REVENUE |

1 137.6 |

1 333.7 |

17.3% |

15.7% |

3 497.0 |

4 046.6 |

15.7% |

13.2% |

Content

production &

distribution:

Revenue totaled €3,212m, up +16.5% in absolute

terms and +13.3% at constant currency in 2022. Overall, growth was

fueled by high-quality IP, a comprehensive content offering to

serve clients needs and to a lesser extent the positive impact from

bolt-on acquisitions.

Content production revenue was

up +17.7% to €2,665m in 2022, driven by 216 launches of successful

new non-scripted shows and around 67 new scripted shows.

The Group delivered new shows with universal

appeal across both non-scripted (“Starstruck” in the UK, “Love

Triangle” in Australia), and scripted (“SAS Rogue Heroes” in the

UK, “Marie-Antoinette” in France and “Grantchester” in the UK).

Recommissioned or returning formats generated 69% of Content

production revenue. “Masterchef”, one of the top travelling

formats, was recommissioned in France, and aired in 39 countries in

2022. Other top travelling formats included “Survivor”, showing in

21 territories for its 25th anniversary and “Big Brother” in 33

territories.

Distribution

revenue increased by +16.9% to €388m driven by a

firm demand from both linear TV and streaming platforms (OTT) for

key non-scripted and scripted content such as “You” for Sky and

“Peaky Blinders” for Netflix in the UK.

In 2022, partly due to the delay in production

during Covid, scripted programs’ production has been higher than in

2021 and totaled 24% of Content production & distribution

revenue compared to 20% in 2021.

The share of OTT increased drastically in 2022

to 18% of Content production & distribution revenue, up 5ppts

compared to 2021.

Overall, the number of content hours at the end

of December 2022 increased sharply by +30% compared to 2021 to

~160,000 hours6.

Online sports

betting &

gaming:

The Online sports betting & gaming business

recorded +12.7% revenue growth on a reported basis7 in 2022 (+12.8%

at constant currency) with a strong performance in Q4 2022 (+34.2%)

boosted by the impact of the World Cup.

The football World Cup in Q4 2022 contributed

7.5% of Betclic Group annual sportsbook stakes and 31% in annual

new sportsbook Unique Active Players (UAP). The Group recorded +38%

increase in its UAPs’ base in December 2022 compared to prior to

the World Cup in October 2022.

By division and including Bet-at-home, revenue

rose by +13.8% in sportsbook in 2022 with +25% increase in UAPs, by

+2.7% for online casino due to greater gamification and launch of

new exclusive games (Mega Santos in Portugal), and by +13.1% for

online poker partly linked to cross-sell during the World Cup.

At constant exchange rates and excluding

discontinued Bet-at-home operations in certain jurisdictions,

revenue was up +19% in 2022, driven by the solid continued

performance of Betclic entity (+21%), offsetting the -10% decline

at Bet-at-home. In Q4 2022, growth stood at +36%.

As part of its commitment towards responsible

gaming standards, Betclic primarily operates in regulated markets.

This is illustrated by the proportion of its revenue generated in

locally regulated markets: 96.5% of 2022 revenue.

ADJUSTED EBITDA

Adjusted EBITDA rose by +10.0%

to €670.2m in 2022, on revenue up +15.7% on a reported basis. This

split into +9.1% rise to €472m for Content production &

distribution and +14.8% increase to €202.8m for Online sports

betting & gaming.

|

In € million |

Q4 2021 |

Q4 2022 |

% change |

2021 |

2022 |

% change |

| |

|

|

|

|

|

|

| Content

production & distribution |

191.9 |

174.9 |

-8.9% |

432.7 |

472.1 |

9.1% |

| Online sports

betting & gaming |

37.5 |

52.1 |

38.9% |

176.6 |

202.8 |

14.8% |

| Holding |

- |

(3.2) |

|

(0.1) |

(4.7) |

|

|

Adjusted EBITDA |

229.4 |

223.8 |

-2.5% |

609.3 |

670.2 |

10.0% |

| |

|

|

|

|

|

|

| Content

production & distribution |

20.1% |

16.0% |

|

15.7% |

14.7% |

|

| Online sports

betting & gaming |

20.6% |

21.3% |

|

23.8% |

24.3% |

|

|

Adjusted EBITDA margin |

20.2% |

16.8% |

|

17.4% |

16.6% |

|

NORMALIZED P&L: FROM ADJUSTED

EBITDA TO ADJUSTED NET INCOME

Normalized P&L highlights the underlying

performance of the group for 2022 without one-off items related to

reorganization and business combination.

Comments thereafter analyze the “Normalized

P&L” in 2022 compared to 2021 reported P&L.

|

In € million |

2021Reported |

2022Reported |

Transaction impact |

2022Normalized |

|

Revenue |

3 497.0 |

4 046.6 |

|

4 046.6 |

| External

expenses |

(1 774.1) |

(2 050.6) |

|

(2 050.6) |

| Personnel expenses

excluding LTIP & employment-related earn-out & option

expenses |

(1 095.4) |

(1 287.2) |

|

(1 287.2) |

| Other operating

income (loss) excl. restructuring costs & other non-recurring

items |

(17.6) |

(29.0) |

|

(29.0) |

| Depreciation and

amortization expenses related to D&A fiction |

(0.6) |

(9.5) |

|

(9.5) |

|

Adjusted EBITDA |

609.3 |

670.2 |

|

670.2 |

| Adjusted EBITDA

margin |

17.4% |

16.6% |

|

16.6% |

| |

|

|

|

|

| Restructuring costs

and other non-recurring items |

(49.8) |

(127.4) |

(105.7) |

(21.7) |

| LTIP &

employment-related earn-out and option expenses |

(308.0) |

(147.5) |

(33.0) |

(114.5) |

|

Depreciation and amortization (excl. D&A fiction) |

(141.1) |

(140.6) |

|

(140.6) |

| Operating

profit/(loss) |

110.4 |

254.7 |

(138.7) |

393.4 |

| |

|

|

|

|

| Cost of net

debt |

(135.3) |

(143.8) |

- |

(143.8) |

|

Other finance income/(costs) |

1.9 |

(112.9) |

(96.4) |

(16.5) |

|

Net financial

income/(expense) |

(133.4) |

(256.7) |

(96.4) |

(160.3) |

| Share of net income

from associates & joint ventures |

(1.2) |

(2.2) |

- |

(2.2) |

|

Earnings before provision for income taxes |

(24.2) |

(4.2) |

(235.1) |

230.9 |

| |

|

|

|

|

| Income tax

expenses |

(49.2) |

(76.9) |

- |

(76.9) |

|

Profit/(loss) from continuing operations |

(73.4) |

(81.1) |

(235.1) |

154.0 |

|

Net income/(loss) for the period |

(73.4) |

(81.1) |

(235.1) |

154.0 |

|

Attributable to: |

|

|

|

|

| Non-controlling

interests |

(30.4) |

6.9 |

- |

6.9 |

| Shareholders |

(43.0) |

(88.0) |

(235.1) |

147.1 |

|

Restructuring costs and other non-recurring items |

49.8 |

127.4 |

105.7 |

21.7 |

| LTIP &

employment-related earn-out and option expenses |

308.0 |

147.5 |

33.0 |

114.5 |

|

Other financial income |

(1.9) |

112.9 |

96.4 |

16.5 |

|

Adjusted net

income |

282.5 |

306.7 |

- |

306.7 |

One-off items related

to the

Transaction:

FL Entertainment recorded one-off items from the

Group reorganization and listing Transaction:

- Restructuring and other

non-recurring items:

€106m related to

listing and transaction fees and costs incurred to realize the

Transaction. Under IFRS, the merger with the SPAC is considered as

an equity-settled share-based payment for a service rendered by the

SPAC to list the Group. This service is valued at €86m and is

recorded as a listing fee;

- LTIP

& employment-related earn-out and

option expenses: €33m

mainly driven by the change in fair value of financial instruments

explained by the LTIP following the upward reassessment of the

Banijay Group’s shares;

- Other finance income /

loss: €96m attributable

mainly to the change in fair value of financial instruments. This

includes re-evaluation and the change in fair value of Vivendi’s

convertible bond derivatives following the upward assessment of the

Banijay Group’s shares. This bond was paid back as part of the

Transaction.

Exceptional income from the

deconsolidation of Bet-at-home

Entertainment Ltd

FL Entertainment recorded a net exceptional

income of +€11m mainly coming from the deconsolidation of

Bet-at-home Entertainment Ltd in H1 2022.

Net financial result

Net financial result amounted to -€160.3m in

2022 compared to -€133.4m in 2021. Of this amount:

- Cost of

net debt totaled -€143.8m in 2022 vs -€135.3m in 2021,

attributable to a higher level of interest charges due to a

currency effect in Content production & distribution and a

timing effect of interest charges related to Betclic loan issued on

13 December 2021.

- Other financial income and

expenses amounted to -€16.5m in 2022, compared to +€1.9m

in 2021, mainly explained by financial instruments in 2022.

Income tax expenses

The tax charge in 2022 rose to -€76.9m compared

to -€49.2 in 2021, due to greater use of tax loss carry-forward in

2021 and a change in country mix.

Adjusted net income

As a result of the above, Adjusted net income

amounted to €306.7m in 2022 compared to €282.5m in 2021.

FREE CASH FLOW AND NET FINANCIAL

DEBT IN 2022

FREE CASH FLOW

CONVERSION

Adjusted free cash flow (after lease payments)

reached €554.7m, up +11.5% in 2022, driven by the business

performance as well as a tight control of cash expenses and capital

expenditures.

The change in working capital reflected the

seasonality of the two businesses.

Adjusted free cash flow conversion after capex

and leases payment amounted to 83%.

The rise in income taxes paid was mainly

attributable to greater use of tax loss carry-forward in 2021.

Adjusted operating free cash flow rose by 11.1%

to €495m in 2022 compared to 2021.

|

€m |

2021 |

2022 |

% change |

| Adjusted

EBITDA |

609.3 |

670.2 |

10.0% |

| Capex |

(66.5) |

(68.1) |

|

| Total cash

outflows for leases that are not recognised as rental expenses |

(45.2) |

(47.3) |

|

|

Adjusted Free-cash flow |

497.5 |

554.7 |

11.5% |

|

|

|

|

|

| Change in working

capital* |

(9.2) |

14.7 |

|

| Income tax

paid |

(42.7) |

(74.5) |

|

|

Adjusted operating free cash flow |

445.7 |

495.0 |

11.1% |

*Excludes LTIP paid and exceptional items

cash-out

SOLID FINANCIAL

POSITION AND DE-LEVERAGING

The Group’s Net financial debt declined by €178m

to €2,091m as of 31 December 2022 compared to €2,269m as of 31

December 2021. This reflects the robust business performance over

the year.

Net financial debt mainly came from an increase

in Adjusted free cash flows for -€495m and cash proceeds received

following the transaction (-€121m), partly offset by LTIP paid

& exceptionals for €152m, net acquisitions for €130m and €144m

interests recognized during 2022.

The financial leverage ratio stood at 3.1x as of

31 December 2022, compared to 3.7x as of

31 December 2021, at the low end of 3.0-3.5x 2022

guidance.

The Group’s Net financial debt is at fixed rate

with no maturity before 2025. The Group may, from time to time and

depending on prevailing market conditions, seek to extend the

maturity of, or to refinance, all or part of its financial

indebtedness.

At Banijay level, two agencies recently upgraded

their ratings on its strong performance: B+ by S&P on 15

September 2022 and B+ by Fitch Ratings on 15 March 2023.

DIVIDEND

In line with its strategy presented at the

listing in July 2022, FL Entertainment plans to distribute

dividends in respect of the financial year 2022 which will

represent at least one third of Adjusted net income.

The proposed dividend for the financial year

2022 amounts to €150m, i.e. €0.36 per share, representing a 49%

payout ratio on Adjusted net income. It will be paid fully in cash

and will be submitted for approval to the Annual General Meeting on

15 June 2023.

2023 OBJECTIVES IN LINE WITH MID-TERM

OUTLOOK

In 2023, growth momentum will remain solid,

driven by:

- Content production &

distribution: continued focus on scripted and unscripted

opportunities from new content and the Group’s rich content

catalogue, as well as meeting client needs through non-scripted

offer of powerful superbrands well suited to the current economic

climate.

- Online sports betting &

gaming: leveraging on increased player numbers generated

in 2022 after the FIFA World Cup to drive increased betting volumes

as well as coming events such as UEFA Champions league, while

focusing on customer centricity and experience through market

leading technology & IT platform.

For the

financial year 2023, FL

Entertainment anticipates the following:

- Revenue:

- Mid-single digit organic growth for

Content production & distribution

- Double-digit organic growth for

Online sports betting & gaming

- Adjusted EBITDA of around

€710M

- ~80% free cash flow conversion

- Dividend payout ratio: at least

33.3% of the Group’s Adjusted net income

MID-TERM OUTLOOK

CONFIRMED

The Group confirms its mid-term outlook

presented at the time of the listing:

- Content production &

distribution: mid-single digit annual organic revenue growth and

stable Adjusted EBITDA margin

- Sports betting & online gaming:

low teens annual organic revenue growth and stable Adjusted EBITDA

margin

- Group Adjusted cash conversion rate

at around 80%

- Dividend payout ratio: at least

33.3% of the Group’s Adjusted net income

- Group Net financial debt / Adjusted

EBITDA below 3x

Agenda

Q1 2023 results: 30 May 2023

General Shareholders’ Meeting: 15 June 2023

A brand-new website now available

Investor Relations

Caroline Cohen – Phone: +33 1 44 95 23 34 –

c.cohen@flentertainment.com

Press Relations

flentertainment@brunswickgroup.com

Hugues Boëton – Phone: +33 6 79 99 27 15

Nicolas Grange – Phone: +33 6 29 56 20 19

About FL Entertainment

Founded by Stéphane Courbit, a 30-year

entertainment industry pioneer and entrepreneur, FL Entertainment

Group is a global leader in multimedia content and gaming,

combining the strengths of Banijay, the world’s largest independent

producer distributor, with Betclic Everest Group, the

fastest-growing online sports betting platform in Europe. In 2022,

FL Entertainment recorded through Banijay and Betclic Everest

Group, a combined revenue, and Adjusted EBITDA, of €4,047m and

€670m respectively. FL Entertainment listed on Euronext Amsterdam

in July 2022.ISIN: NL0015000X07 - Bloomberg: FLE NA - Reuters:

FLE.AS

Forward-looking statementsThis

communication contains information that qualifies as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

Forward Looking StatementsSome

statements in this press release may be considered “forward-looking

statements”. By their nature, forward-looking statements involve

risk and uncertainty because they relate to events and depend on

circumstances that may occur in the future. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors that are outside of our control and impossible to predict

and may cause actual results to differ materially from any future

results expressed or implied. These forward-looking statements are

based on current expectations, estimates, forecasts, analyses and

projections about the industry in which we operate and management's

beliefs and assumptions about possible future events. You are

cautioned not to put undue reliance on these forward-looking

statements, which only express views as at the date of this press

release and are neither predictions nor guarantees of possible

future events or circumstances. We do not undertake any obligation

to release publicly any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this press release or to reflect the occurrence of unanticipated

events, except as may be required under applicable securities

law.

Alternative performance

measuresThe financial information in this release includes

non-IFRS financial measures and ratios (e.g. non-IFRS metrics, such

as adjusted EBITDA) that are not recognized as measures of

financial performance or liquidity under IFRS. The non-IFRS

financial measures presented are measures used by management to

monitor the underlying performance of the business and operations

and, have therefore not been audited or reviewed. Furthermore, they

may not be indicative of the historical operating results, nor are

they meant to be predictive of future results. These non-IFRS

measures are presented because they are considered important

supplementary measurements of FL Entertainment N.V.'s (the

"Company") performance, and we believe that these and similar

measures are widely used in the industry in which the Company

operates as a way to evaluate a company’s operating performance and

liquidity. Not all companies calculate non-IFRS financial measures

in the same manner or on a consistent basis. As a result, these

measures and ratios may not be comparable to measures used by other

companies under the same or similar names.

Regulated information related to this

press release is available on the

website:https://www.flentertainment.com/results-center/https://www.flentertainment.com/

APPENDIX

Glossary

Transaction: business combination with Pegasus

Entrepreneurial Acquisition Company Europe B.V., a special purpose

acquisition company to become a listed company on Euronext

Amsterdam as well as the Group’s reorganization

Adjusted EBITDA: for a period

is defined as the operating profit for that period excluding

restructuring costs and other non-core items, costs associated with

the long-term incentive plan within the Group (the "LTIP") and

employment related earn-out and option expenses, and depreciation

and amortization (excluding D&A fiction). D&A fiction are

costs related to the amortization of fiction production, which the

Group considers to be operating costs. As a result of the D&A

fiction, the depreciation and amortization line item in the Group's

combined statement of income deviates from the depreciation and

amortization costs in this line item.

Adjusted net income: defined as

net income (loss) adjusted for restructuring costs and other

non-core items, costs associated with the LTIP and employment

related earn-out and option expenses and other financial

income.

Adjusted free cash flow:

defined as Adjusted EBITDA adjusted for purchase and disposal of

property plant and equipment and of intangible assets and cash

outflows for leases that are not recognized as rental expenses.

Adjusted

operating free cash flow: defined

as adjusted EBITDA adjusted for purchase and disposal of property

plant and equipment and of intangible assets, cash outflows for

leases that are not recognized as rental expenses, change in

working capital requirements, and income tax paid.

Net financial debt: defined as

the sum of bonds, bank borrowings, bank overdrafts, vendor loans,

accrued interests on bonds and bank borrowings minus cash and cash

equivalents, trade receivables on providers, cash in trusts, plus

players liabilities and escrow accounts plus (or minus) the fair

value of net derivatives liabilities (or assets) for that period.

Net financial debt is pre-IFRS 16.

Leverage: Adjusted net

financial debt / Adjusted EBITDA.

Number of Unique Active

Players: average number of unique players playing at least

once a month in a defined period.

Table 1: Content

production &

distribution: Key

indicators

|

In €million |

Q4 2021 |

Q4 2022 |

% change |

2021 |

2022 |

% change |

| Production |

763.8 |

920.5 |

20.5% |

2 263.2 |

2 664.6 |

17.7% |

| Distribution |

139.0 |

120.5 |

-13.3% |

331.8 |

387.7 |

16.9% |

| Other |

52.9 |

48.8 |

-7.7% |

161.0 |

159.3 |

-1.1% |

|

REVENUE |

955.7 |

1 089.8 |

14.0% |

2 756.0 |

3 211.6 |

16.5% |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

191.9 |

174.9 |

-8.9% |

432.7 |

472.1 |

9.1% |

| Adjusted EBITDA

margin (%) |

20.1% |

16.0% |

|

15.7% |

14.7% |

|

|

|

|

|

|

|

|

|

| Capex |

(19.8) |

(23.5) |

18.5% |

(56.0) |

(60.3) |

7.6% |

| Total cash

outflows for leases that are not recognised as rental expenses |

(10.5) |

(12.3) |

17.8% |

(41.5) |

(44.1) |

6.1% |

|

Adjusted free

cash flow |

161.6 |

139.1 |

-14.0% |

335.2 |

367.8 |

9.7% |

|

|

|

|

|

|

|

|

| Change in working

capital requirements* |

90.2 |

94.4 |

4.6% |

(2.4) |

(11.3) |

371.4% |

| Income tax

paid |

(9.3) |

(21.7) |

133.6% |

(26.9) |

(49.3) |

82.9% |

|

Adjusted Operating free cash flow |

242.6 |

211.8 |

-12.7% |

305.9 |

307.2 |

0.4% |

Table 2: Online sports

betting &

gaming: Key

indicators

|

In € million |

Q4 2021 |

Q4 2022 |

% change |

2021 |

2022 |

% change |

| Sportsbook |

143.0 |

193.0 |

34.9% |

588.6 |

670.1 |

13.8% |

| Casino |

25.1 |

33.0 |

31.3% |

102.0 |

104.8 |

2.8% |

| Poker |

12.0 |

15.0 |

24.9% |

44.1 |

49.9 |

13.1% |

| Other |

1.8 |

3.1 |

71.3% |

6.4 |

10.3 |

60.9% |

|

REVENUE |

181.9 |

244.1 |

34.2% |

741.1 |

835.0 |

12.7% |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

37.5 |

52.1 |

38.9% |

176.6 |

202.8 |

14.8% |

| Adjusted EBITDA

margin (%) |

20.6% |

21.3% |

|

23.8% |

24.3% |

|

|

|

|

|

|

|

|

|

| Capex |

(3.7) |

(1.4) |

-60.6% |

(10.5) |

(7.9) |

-24.8% |

| Total cash

outflows for leases that are not recognised as rental expenses |

24.5 |

(0.7) |

|

(3.7) |

(3.3) |

-11.8% |

|

Adjusted free cash

flow |

58.3 |

49.9 |

|

162.4 |

191.7 |

18.0% |

|

|

|

|

|

|

|

|

| Change working

capital requirements * |

9.6 |

19.9 |

108.1% |

(6.6) |

25.1 |

- |

| Income tax

paid |

(3.5) |

(4.1) |

18.4% |

(14.5) |

(25.2) |

74.1% |

|

Adjusted Operating free cash flow |

64.4 |

65.7 |

2.1% |

141.4 |

191.6 |

35.5% |

*Excluding LTIP and exceptional items payment

Table 3: Consolidated

statement of cash flows

|

In € million |

31-Dec-2021 |

31-Dec-2022 |

|

Profit/(loss) |

(73.4) |

(81.1) |

|

Adjustments: |

656.5 |

706.4 |

| Share of

profit/(loss) of associates and joint ventures |

1.2 |

2.2 |

| Amortization,

depreciation, impairment losses and provisions, net of

reversals |

168.3 |

150.5 |

| Employee benefits

LTIP & employment-related earn-out and option expenses |

308.0 |

147.5 |

| Change in fair

value of financial instruments |

(7.4) |

105.4 |

| Income tax

expenses |

49.2 |

76.9 |

| Other

adjustments(1) |

(1.2) |

76.8 |

| Cost of financial

debt, lease liabilities and current accounts |

138.3 |

147.2 |

|

Gross cash provided by operating activities |

583.0 |

625.3 |

| Changes in

working capital |

(136.9) |

(92.3) |

| Income tax

paid |

(42.7) |

(74.5) |

|

Net cash flows provided by operating

activities |

403.5 |

458.6 |

| Purchase of

property, plant and equipment and intangible assets |

(66.5) |

(68.1) |

| Purchases of

consolidated companies, net of acquired cash |

(26.6) |

(46.1) |

| Increase in

financial assets |

(13.3) |

(43.1) |

| Proceeds from

sales of consolidated companies, after divested cash |

8.7 |

(9.1) |

| Cash received

through merger with Pegasus (including FPA capital increase) |

|

162.6 |

| Decrease in

financial assets |

0.5 |

2.7 |

|

Net cash provided

by/(used for) investing

activities |

(97.1) |

(1.1) |

| Change in

capital |

|

363.6 |

| Change in other

securities |

|

114.4 |

| Dividends

paid |

(95.0) |

(1.6) |

| Dividends paid by

consolidated companies to their non-controlling interests |

(115.8) |

(4.3) |

| Transactions with

non-controling interests |

53.7 |

(392.1) |

| Proceeds from

borrowings and other financial liabilities |

159.8 |

20.7 |

| Repayment of

borrowings and other financial liabilities |

(134.8) |

(399.0) |

| Interest

paid |

(125.9) |

(131.3) |

|

Net cash flows from/(used

in) financing activities |

(258.0) |

(429.6) |

| Impact of changes

in foreign exchange rates |

(4.4) |

19.1 |

|

Net increase/(decrease) of cash and cash

equivalents |

43.9 |

47.0 |

|

|

|

|

| Cash and cash

equivalents at the beginning of the period |

388.5 |

432.4 |

| Cash and cash

equivalents at end of the period |

432.4 |

479.4 |

(1) Other adjustments include notably unrealized foreign

exchange gains on disposal and liquidation of subsidiaries

Table 4:

Consolidated balance

sheet

|

In € million |

31-Dec-21 |

31-Dec-22 |

|

ASSETS |

|

|

| Goodwill |

2 493.9 |

2 570.2 |

| Intangible

assets |

236.7 |

194.8 |

| Right-of-use

assets |

171.1 |

160.8 |

| Property, plant

and equipment |

55.3 |

59.2 |

| Investments in

associates and joint ventures |

11.1 |

14.0 |

| Non-current

financial assets |

83.0 |

161.7 |

| Other

non-current assets |

29.6 |

35.9 |

| Deferred tax

assets |

47.6 |

51.9 |

|

Non-current

assets |

3 128.3 |

3 248.6 |

| Production of

audiovisual programs - work in progress |

676.7 |

705.2 |

| Trade

receivables |

463.6 |

496.5 |

| Other current

assets |

264.2 |

288.3 |

| Current

financial assets |

75.2 |

24.7 |

| Cash and cash

equivalents |

434.1 |

479.4 |

|

Current assets |

1 913.7 |

1 994.1 |

| TOTAL

ASSETS |

5 042.0 |

5 242.6 |

|

|

|

|

| EQUITY

AND LIABILITIES |

|

|

| Share

capital |

- |

8.0 |

| Share premium

and retained earnings |

73.6 |

91.7 |

| Net

income/(loss) - attributable to shareholders |

(43.0) |

(88.0) |

|

Shareholders'

equity |

30.6 |

11.7 |

| Non-controlling

interests |

(36.7) |

6.3 |

|

Total equity |

(6.2) |

18.0 |

|

|

|

|

| Other

securities |

- |

130.5 |

| Long-term

borrowings and other financial liabilities |

2 457.8 |

2 290.3 |

| Long-term lease

liabilities |

143.2 |

131.2 |

| Non-current

provisions |

22.0 |

27.7 |

| Other

non-current liabilities |

291.7 |

441.3 |

| Deferred tax

liabilities |

3.2 |

7.4 |

|

Non-current

liabilities |

2 917.9 |

3 028.4 |

|

|

|

|

| Short-term

borrowings and bank overdrafts |

306.2 |

349.4 |

| Short-term lease

liabilities |

40.2 |

40.4 |

| Trade

payables |

580.8 |

663.5 |

| Current

provisions |

39.1 |

23.0 |

| Customer

contract liabilities |

707.2 |

693.3 |

| Other current

liabilities |

456.8 |

426.6 |

|

Current liabilities |

2 130.3 |

2 196.2 |

| TOTAL

EQUITY AND LIABILITIES |

5 042.0 |

5 242.6 |

Table 5: IFRS consolidated net

financial debt

|

In € million |

31-Dec-2021 |

31-Dec-2022 |

| Bonds |

1 461.5 |

1 330.8 |

| Bank

borrowings |

1 232.5 |

1 140.1 |

| Bank

overdrafts |

1.7 |

- |

| Accrued

interests on bonds and bank borrowings |

32.7 |

29.6 |

| Vendor

loans |

- |

138.4 |

| |

|

|

|

Total bank

indebtedness |

2 728.4 |

2 638.9 |

| Cash and cash

equivalents |

(434.1) |

(479.4) |

| Trade

receivables on providers |

(24.8) |

(13.1) |

| Players'

liabilities |

41.7 |

50.6 |

|

Cash in trusts and restricted cash |

(22.4) |

(31.6) |

|

Net cash and cash equivalents |

(439.5) |

(473.6) |

|

|

|

|

|

Net debt before derivatives effects |

2 288.8 |

2 165.3 |

| Derivatives -

liabilities |

6.1 |

- |

| Derivatives -

assets |

(26.2) |

(74.5) |

|

Net debt |

2 268.8 |

2 090.8 |

Table 6:

Cash flow statement

|

|

31-Dec-2022 |

|

In € million |

Content production & distribution |

Online sports betting & gaming |

Holding |

Total Group |

|

Net cash flow from operating activities |

378.8 |

107.4 |

(27.7) |

458.6 |

|

Cash flow (used in)/from investing activities |

(147.4) |

(16.3) |

162.6 |

(1.1) |

|

Cash flow (used in)/from financing activities |

(196.7) |

(106.9) |

(125.9) |

(429.6) |

|

Impact of changes in foreign exchange rates |

19.1 |

- |

- |

19.1 |

|

Net increase/(decrease) in cash and cash

equivalents |

53.7 |

(15.8) |

9.0 |

47.0 |

|

Cash and cash equivalents as of 1 January |

343.1 |

87.9 |

1.5 |

432.4 |

|

Cash and cash equivalents as of 31 December |

396.8 |

72.1 |

10.5 |

479.4 |

|

|

31-Dec-2021 |

|

In € million |

Content production & distribution |

Online sports betting & gaming |

Holding |

Total Group |

|

Net cash flow from operating activities |

323.6 |

81.4 |

(1.6) |

403.5 |

|

Cash flow (used in)/from investing activities |

(89.3) |

(7.8) |

- |

(97.1) |

|

Cash flow (used in)/from financing activities |

(158.7) |

(101.0) |

1.7 |

(258.0) |

|

Impact of changes in foreign exchange rates |

(4.4) |

- |

- |

(4.4) |

|

Net increase/(decrease) in cash and cash

equivalents |

71.2 |

(27.4) |

0.1 |

43.9 |

|

Cash and cash equivalents as of 1 January |

271.9 |

115.2 |

1.4 |

388.5 |

|

Cash and cash equivalents as of 31 December |

343.1 |

87.9 |

1.5 |

432.4 |

Table 7:

Content production &

distribution: Net

financial debt as of

31 December

2022

|

At Banijay

level: |

|

|

| In

€ million |

31-Dec-2021 |

31-Dec-2022 |

| |

|

|

| Total

Secured Debt (OM definition) |

1 805 |

1 847 |

| Other debt |

296 |

339 |

|

SUN |

409 |

409 |

|

Total Debt |

2 510 |

2 595 |

| Net Cash |

(342) |

(396) |

|

Total net financial debt (excl.

Earn-out & PUT) |

2 168 |

2 199 |

| EO & PUT |

100 |

124 |

|

Total net financial debt (incl.

Earn-out &

PUT) |

2 268 |

2 323 |

|

|

|

|

| Ratios at

Banijay level: |

|

|

| Leverage

Ratio |

4.85 |

4.46 |

| Adjusted Leverage

Ratio |

5.07 |

4.71 |

| Senior secured

net leverage ratio |

3.50 |

3.20 |

|

|

|

|

|

Banijay contribution at FL Entertainment

level: |

|

|

| In

€ million |

31-Dec-2021 |

31-Dec-2022 |

|

|

|

|

| Total net

financial debt (excl. Earn-out

& PUT) |

2 168 |

2 199 |

| Transaction costs

amortization |

(54) |

(39) |

| Lease debt (IFRS

16) |

(164) |

(160) |

|

Total Net financial debt

at FL Entertainment level |

1 949 |

1 999 |

|

Derivatives |

2 |

(69) |

|

Total Net financial debt

at FL Entertainment level |

1 950 |

1 930 |

Leverage ratio: total Net financial debt / (Adj

EBITDA + shareholder fees + proforma impact from acquisitions)

Adjusted leverage ratio: total Net financial

debt including earn-out and PUTS / (Adjusted EBITDA + shareholder

fees + proforma impact from acquisitions)

Senior secured net leverage ratio: total Senior

Secure Notes + earn-out – Cash / (Adjusted EBITDA + shareholder

fees + proforma impact from acquisitions)

1 +13.2% at constant currency2 Adjusted EBITDA, Adjusted net

income and Adjusted free cash flow: refer to the Appendix for

definition3 Leverage calculated on Net debt pre-IFRS 16 / Adjusted

EBITDA4 Content production & distribution5 Of which Influence

Vision in Austria (influence media adnetwork)6 Including Beyond

acquisition7 Including the discontinued Bet-at-home activities

- FL Entertainment_PR_2022 Results

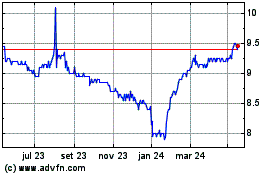

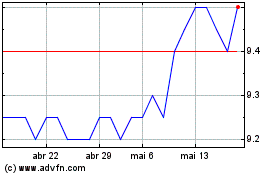

FL Entertainment NV (EU:FLE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

FL Entertainment NV (EU:FLE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024