FL Entertainment: Q1 2023 results

Press Release

Paris – 30

May 2023

First quarter

2023 results

SOLID GROUP

FINANCIAL PERFORMANCE

DOUBLE-DIGIT REVENUE GROWTH IN

ONLINE SPORTS BETTING & GAMINGRETURN

TO NORMAL SEASONALITYIN CONTENT PRODUCTION &

DISTRIBUTION AS EXPECTED

SUCCESSFUL REFINANCING OF

BANIJAY BRINGING

FURTHER FINANCIAL FLEXIBILITY

Q1 2023

HIGHLIGHTS

-

Revenue up +1.1%1 to €900m

- Content production &

distribution: -3.1% reflecting the return to normal seasonality

after post-Covid catch-up in Content production in Q1 2022

- Online sports betting & gaming:

+14.5% revenue growth due to significant increase in Unique Active

Players, partially offset by unfavorable football results in

February 2023

- Adjusted

EBITDA2 stable at €145m in Q1 2023,

resulting in an EBITDA margin of 16.1%

- Adjusted net

income2 up +5.3% to €70m versus Q1 2022,

net income at €8.4m (Q1 2022: €42.0m) mainly

driven by non-cash expenses related to changes in financial

instruments

- Adjusted

free cash flow conversion2 of

83%

- Net

financial debt of €2,084m at 31 March

2023; stable leverage3 ratio of 3.1x compared to 31 December

2022 and strong liquidity position of €452m

- Successful

refinancing of

Banijay debt

(~€875m) with

3-year extension of maturity and ~€200m of new

financing

- Continued

M&A strategy: bolt-on M&A

of leading Brazilian content studio A Fábrica

- 2023 guidance and

mid-term objectives

confirmed

François Riahi, CEO of FL Entertainment,

said:

“FL Entertainment enjoyed a positive start to

2023, with solid financial results and strong business

momentum.

Our Online sports betting & gaming business

continued to perform well, carried by the increase in Unique Active

Players secured during the 2022 FIFA World Cup, which resulted in

double-digit revenue growth across all activities. On the Content

production & distribution side, we registered a strong

Distribution performance while content production activity

normalized compared to the elevated post-covid catch-up effect seen

in Q1 2022. We continued to nurture our future growth by

strengthening our collaboration with major streaming platforms as

they recognize our unrivalled multi-format, geographic and language

capabilities, notably when it comes to non-scripted formats well

suited to the current macroeconomic climate.

During the quarter, we also reinforced our

financial strength and flexibility by refinancing the business and

issuing new debt – securing support from high-quality institutional

lenders.

We are well positioned to build on our

leadership positions, continue to seize M&A opportunities in

structurally growing markets and deliver continued profitable

growth in 2023 and beyond.”

*****

FL Entertainment invites you to its Q1 2023 results conference

call on:

Tuesday,

30 May

2023, at 6:00pm CET

Webcast live:You can watch the

presentation on the following

link:https://edge.media-server.com/mmc/p/gi7xwjvd

Dial-in access telephone

numbers:You need to register to the following

link:https://register.vevent.com/register/BIdddbadef07194aa78d47410acc6b597a

Slides related to Q1 2023 results are available

on the Group’s website, in the “Investor relations” section:

https://www.flentertainment.com/

KEY FINANCIALS IN

Q1 2023

|

€m |

Q1 2022 |

Q1 2023 |

% change |

% constant currency |

|

|

|

|

|

|

| Group

revenue |

890.4 |

900.2 |

1.1% |

1.6% |

| Adjusted

EBITDA |

144.8 |

144.6 |

-0.1% |

|

| Adjusted EBITDA

margin |

16.3% |

16.1% |

|

|

|

|

|

|

|

|

| Net income |

39.6 |

8.4 |

-78.7% |

|

| Adjusted net

income* |

66.7 |

70.2 |

5.3% |

|

|

|

|

|

|

|

| Adjusted

free cash-flow |

118.7 |

119.4 |

0.6% |

|

| Free cash flow

conversion rate |

82% |

83% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the twelve-month period ended |

31 December 2022 |

31 March 2023 |

% change |

|

|

|

|

|

|

|

| Net financial

debt (reported) |

2 091 |

2 084 |

-0.3% |

|

|

Net financial debt / Adjusted EBITDA |

3.1x |

3.1x |

|

|

* Refer to the Appendix for definitionQ1 2022 figures are

adjusted to include holding costs of -€2.4m for comparison

purposes.

Q1 2023

AND POST Q1 2023

– KEY EVENTS

A

Fábrica: Bolt-on in

Brazil

FL Entertainment has a proven ability to execute

and create value through bolt-on acquisitions, with a focus on

broadening the Group’s offer and profitable businesses with

leadership positions in structurally growing international markets

that offer consolidation opportunities.

In that context, Banijay has acquired a majority

stake in leading Brazilian studio A Fábrica based in Rio de

Janeiro. It is behind many of the nation’s top scripted series and

films and its content can currently be found on major networks and

platforms such as Netflix, Amazon Prime Video, Turner, HBO Max,

Globo, Globoplay, Canal GNT and Multishow.

Successful refinancing of Banijay’s Term

Loans B due March

2025

On 6 April 2023, Banijay successfully completed

the refinancing of its two Term Loans B (TLB) in Euros and in US

Dollars for an amount equivalent to ~€875m (including a €453m

tranche and US$460m tranche), resulting in a three-year extension

of their maturities until March 2028. The transaction was

over-subscribed by two times and placed with high-quality

institutional lenders.

Banijay raised an additional TLB financing in

Euros and in US Dollars to strengthen its balance sheet and finance

its future growth for a total amount equivalent to €200m, which

splits into €102m and $110m.

The Term Loans B carry a floating interest at

EURIBOR +450 bps for the Euro-denominated tranche, and at SOFR +375

bps for the US Dollar-denominated tranche, both of which benefit

from the existing hedges until March 2025. The additional amounts

and the extended maturities are also hedged against floating

interest rate risks.

In total, Banijay has refinanced and raised an

amount close to €1,100m. In parallel, Banijay extended the maturity

of its €170m RCF by 3 years to September 2027 at EURIBOR +

3.75%4.

OUTLOOK -

DELIVERING CONTINUED PROFITABLE GROWH IN

2023 AND BEYOND

With a solid Q1 2023 performance, FL

Entertainment is on track to deliver continued profitable growth in

2023 and beyond, thanks to the positive momentum experienced across

both businesses.

Content production & distribution

performance is expected to benefit from strengthened activity with

streaming platforms. In Online sports betting & gaming, the

focus remains on driving growth and retaining the high level of

Unique Active Players gained in the last year.

Leveraging its strategy and know-how, FL

Entertainment will continue to focus on operational excellence

while actively pursuing and seizing growth opportunities.

In this context, the Group re-confirms all its

financial objectives, both in the short and medium term.

PROFIT & LOSS – Q1 2023

Q1 2022 figures are adjusted to include holding costs of -€2.4m

for comparison purposes.

|

In € million |

Q1 2022 |

Q1 2023 |

% change |

|

|

|

|

|

|

Revenue |

890.4 |

900.2 |

1.1% |

| External

expenses |

(467.2) |

(488.9) |

4.7% |

| Personnel

expenses excluding LTIP & employment-related earn-out &

option expenses |

(274.2) |

(260.9) |

-4.8% |

| Other operating

income (loss) excl. restructuring costs & other non-recurring

items |

(4.1) |

(5.8) |

41.0% |

| Depreciation and

amortization expenses related to D&A fiction |

(0.1) |

0.0 |

|

|

Adjusted EBITDA |

144.8 |

144.6 |

-0.1% |

| Adjusted EBITDA

margin |

16.3% |

16.1% |

|

| |

|

|

|

| Restructuring

costs and other non-recurring items |

(3.3) |

(5.7) |

|

| LTIP &

employment-related earn-out and option expenses |

(22.4) |

(30.8) |

|

|

Depreciation and amortization (excl. D&A fiction) |

(26.7) |

(28.8) |

|

| Operating

profit/(loss) |

92.4 |

79.3 |

-14.2% |

| |

|

|

|

| Cost of net

debt |

(36.1) |

(34.3) |

|

|

Other finance income/(costs) |

(1.3) |

(25.3) |

|

| Net

financial income/(expense) |

(37.4) |

(59.5) |

-65.0% |

| Share of net

income from associates & joint ventures |

(1.2) |

(0.9) |

|

|

Earnings before provision for income taxes |

53.8 |

18.8 |

-65.0% |

| |

|

|

|

| Income tax

expenses |

(14.2) |

(10.4) |

|

|

Profit/(loss) from continuing operations |

39.6 |

8.4 |

|

|

Net income/(loss) for the period |

39.6 |

8.4 |

-78.7% |

|

Attributable to: |

|

|

|

| Non-controlling

interests |

23.3 |

3.8 |

|

| Shareholders |

16.3 |

4.6 |

|

|

Restructuring costs and other non-recurring items |

3.3 |

5.7 |

|

| LTIP &

employment-related earn-out and option expenses |

22.4 |

30.8 |

|

|

Other financial income |

1.3 |

25.3 |

|

| Adjusted

net income |

66.7 |

70.2 |

5.3% |

CONSOLIDATED REVENUE IN

Q1 2023

In Q1 2023, Group revenue increased by +1.6% at

constant currency to €900.2m and by +1.1% in absolute terms. This

represents a strong performance given the impact of post-Covid

catch-up in Content production & distribution in Q1 2022. This

is reflected as follows by business:

|

€m |

Q1 2022 |

Q1 2023 |

% change |

% constant currency |

|

|

|

|

|

|

|

Production |

586.4 |

553.0 |

-5.7% |

|

|

Distribution |

57.1 |

67.9 |

18.9% |

|

| Other |

34.0 |

35.5 |

4.5% |

|

|

Content production & distribution |

677.5 |

656.4 |

-3.1% |

-2.5% |

|

|

|

|

|

|

|

Sportsbook |

175.0 |

194.8 |

11.3% |

|

| Casino |

23.3 |

30.6 |

31.6% |

|

| Poker |

12.3 |

15.2 |

23.8% |

|

| Other |

2.4 |

3.1 |

32.8% |

|

|

Online sports betting & gaming |

212.9 |

243.8 |

14.5% |

14.6% |

|

|

|

|

|

|

|

TOTAL REVENUE |

890.4 |

900.2 |

1.1% |

1.6% |

Content

production &

distribution:

Revenue totaled €656.4m, down -3.1% in absolute

terms and -2.5% at constant currency in Q1 2023 compared to Q1

2022.

Activity remained solid driven by a continued

comprehensive and well-adapted offering with firm demand from both

linear TV and streaming platforms for key non-scripted and scripted

content.

Content production revenue was

down -5.7% to €553m in Q1 2023, reflecting a return to normal

seasonality compared to Q1 2022, where higher activity reflected

the catch-up effect after the Covid period.

The Group delivered a number of successful

returning and new shows, with firm demand from global and local

streaming platforms. These included non-scripted show “LoL” on

Amazon in France and premium scripted series “Lidia Poët” on

Netflix. For linear TV broadcasters, non-scripted content such as

“Starstruck” or “Young Masterchef” were commissioned in the UK; in

Northern Europe, production included “Celebrity Island” in Denmark

and the “Write Offs” in Germany.

Content

distribution revenue increased by

+18.9% to €68m, reflecting a strong demand from both linear TV and

streaming platforms for key non-scripted and scripted content. The

first quarter was marked by delivery of new scripted series such as

“Stonehouse” and premium factual series “Wild Isles” (narrated by

David Attenborough). Banijay also relaunched local format

adaptations of superbrand IP including Big Brother in Argentina and

Survivor in Colombia, which have not been on air for several

years.

Overall, the number of content hours at the end

of March 2023 increased further by +4% compared to December 2022 to

~167,000 hours, following 8,000 additional hours acquired through

Beyond in December 2022.

Online sports

betting &

gaming:

Revenue grew by a solid +14.5% to €244m on a

reported basis5 in Q1 2023 compared to Q1 2022 (+14.6% at constant

currency) with a high level of New Unique Active Players (up +55%)

and total Unique Active Players (up +42%), driven by the positive

impact of the 2022 FIFA World Cup and the successful cross-selling

strategies on the other products, namely casino, poker and horse

racing.

All divisions recorded double-digit growth:

revenue rose by +11.3% in sportsbook in Q1 2023, online casino by

+31.6%, and online poker by +23.8%, with all lines benefitting from

gamification and constant product improvement.

At constant exchange rates and excluding

Bet-at-home operations discontinued in certain jurisdictions,

revenue was up +15% in Q1 2023, driven by the solid continued

performance of Betclic entity (+16%). Bet-at-home recorded stable

revenue (-0.7% over the quarter). On 1 February 2023, Bet-at-home

group rolled out its new betting and gaming platform, which is

expected to benefit all countries from Q2 2023 onwards.

As part of its commitment towards responsible

gaming standards, the proportion of revenue generated in locally

regulated markets increased to 98.4% in Q1 2023 revenue (compared

to 96.5% in Q1 2022), partly due to the increase of Bet-at-home in

regulated markets.

ADJUSTED EBITDA IN Q1

2023

Adjusted

EBITDA6 amounted to €144.6m in Q1

2023, stable compared to Q1 2022, reflecting the Group’s good

performance despite the offsetting effect of the return of normal

seasonality in Content production & distribution in Q1 2023 and

unfavorable football results, notably in countries where taxes are

paid on stakes placed.

|

Adjusted EBITDA

(€m) |

Q1 2022 |

Q1 2023 |

% change |

|

|

|

|

|

| Content

production & distribution |

89.0 |

84.2 |

-5.4% |

| Online sports

betting & gaming |

58.2 |

62.8 |

8.0% |

| Holding |

(2.4) |

(2.4) |

|

|

Adjusted EBITDA |

144.8 |

144.6 |

-0.1% |

|

|

|

|

|

| Content

production & distribution |

13.1% |

12.8% |

|

| Online sports

betting & gaming |

27.3% |

25.8% |

|

|

Adjusted EBITDA margin |

16.3% |

16.1% |

|

At a Group level, external expenses rose by

+4.7% to €488.9m reflecting higher betting taxes for Online sports

betting & gaming. The -4.8% decrease in personnel expenses

(excluding LTIP and employment-related earn-out & option

expenses) to €260.9m related to the flexible cost structure of

Content production & distribution.

FROM ADJUSTED EBITDA TO ADJUSTED NET

INCOME

Restructuring and other non-recurring

items: -€5.7m in Q1 2023 compared to -€3.3m in Q1

2022.

LTIP &

employment-related earn-out and option

expenses: -€30.8m (-€22.4m in Q1 2022)

reflecting the vesting of the incentive plan.

Net financial result

Net financial result amounted to -€59.5m in Q1

2023 compared to -€37.4m in Q1 2022. Of this amount:

- Cost of

net debt totaled -€34.3m in Q1 2023 compared to -€36.1m in

Q1 2022, attributable to decrease in interest charges related to

Betclic loan issued in December 2021 and reimbursed in July

2022.

- Other financial income and

expenses amounted to -€25.3m in Q1 2023, compared to

-€1.3m in Q1 2022, mainly explained by the change in fair value of

the Put/Earn-out debt, hedging instruments and foreign exchange

losses.

Income tax expenses

The tax charge amounted to -€10.4m in Q1 2023

compared to -€14.2m in Q1 2022.

Adjusted net income

As a result of the above, Adjusted net income

rose by +5.3% to €70.2m in Q1 2023 compared to €66.7m in Q1

2022.

FREE CASH FLOW AND NET FINANCIAL

DEBT IN Q1

2023

Adjusted free cash flow (after lease payments)

reached €119m in Q1 2023, stable compared to Q1 2022, driven

by the business performance as well as disciplined control of cash

expenses and capital expenditures.

The change in working capital in Q1 2023 is due

to the come back of a normal seasonality for Content production

& distribution, following high show deliveries in Q1 2022.

Adjusted free cash flow conversion after capex

and leases payment amounted to 83%.

The rise in income taxes paid was mainly

attributable to advanced tax payment on higher 2022

performance.

Adjusted operating free cash flow stood at €68m

in Q1 2023.

|

€m |

Q1 2022 |

Q1 2023 |

% change |

|

Adjusted EBITDA |

144.8 |

144.6 |

-1.8% |

| Capex |

(14.8) |

(13.7) |

|

| Disposals of

property, plant & equipment & intangible assets |

|

0.2 |

|

| Total cash

outflows for leases that are not recognised as rental expenses |

(11.3) |

(11.6) |

|

|

Adjusted free

cash flow |

118.7 |

119.4 |

0.6% |

|

|

|

|

|

| Change in

working capital* |

(17.2) |

(44.0) |

|

| Income tax

paid |

(2.3) |

(7.9) |

|

|

Adjusted operating free cash flow |

99.1 |

67.4 |

-31.9% |

*Excludes LTIP paid and exceptional items

cash-out

The Group’s Net financial debt remained stable

at €2,084m as of 31 March 2023 compared to €2,091m as of 31

December 2022.

Change in net financial debt came mainly from an

increase in Adjusted free cash flow of +€67m, partly offset by LTIP

paid & exceptional items for €13m, net acquisitions for €10m

and €34m interests recognized during Q1 2023.

The financial leverage ratio remained stable at

3.1x as of 31 March 2023, compared to

31 December 2022.

Agenda

H1 2023 results: 2 August 2023

General Shareholders’ Meeting: 15 June 2023

Investor Relations

Caroline Cohen – Phone: +33 1 44 95 23 34 –

c.cohen@flentertainment.com

Press Relations

flentertainment@brunswickgroup.com

Hugues Boëton – Phone: +33 6 79 99 27 15

Nicolas Grange – Phone: +33 6 29 56 20 19

About FL Entertainment

Founded by Stéphane Courbit, a 30-year

entertainment industry pioneer and entrepreneur, FL Entertainment

Group is a global leader in multimedia content and gaming,

combining the strengths of Banijay, the world’s largest independent

producer distributor, with Betclic Everest Group, the

fastest-growing online sports betting platform in Europe. In 2022,

FL Entertainment recorded through Banijay and Betclic Everest

Group, a combined revenue, and Adjusted EBITDA, of €4,047m and

€670m respectively. FL Entertainment listed on Euronext Amsterdam

in July 2022.ISIN: NL0015000X07 - Bloomberg: FLE NA - Reuters:

FLE.AS

Forward-looking statementsThis

communication contains information that qualifies as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

Forward Looking StatementsSome

statements in this press release may be considered “forward-looking

statements”. By their nature, forward-looking statements involve

risk and uncertainty because they relate to events and depend on

circumstances that may occur in the future. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors that are outside of our control and impossible to predict

and may cause actual results to differ materially from any future

results expressed or implied. These forward-looking statements are

based on current expectations, estimates, forecasts, analyses and

projections about the industry in which we operate and management's

beliefs and assumptions about possible future events. You are

cautioned not to put undue reliance on these forward-looking

statements, which only express views as at the date of this press

release and are neither predictions nor guarantees of possible

future events or circumstances. We do not undertake any obligation

to release publicly any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this press release or to reflect the occurrence of unanticipated

events, except as may be required under applicable securities

law.

Alternative performance

measuresThe financial information in this release includes

non-IFRS financial measures and ratios (e.g. non-IFRS metrics, such

as adjusted EBITDA) that are not recognized as measures of

financial performance or liquidity under IFRS. The non-IFRS

financial measures presented are measures used by management to

monitor the underlying performance of the business and operations

and, have therefore not been audited or reviewed. Furthermore, they

may not be indicative of the historical operating results, nor are

they meant to be predictive of future results. These non-IFRS

measures are presented because they are considered important

supplementary measurements of FL Entertainment N.V.'s (the

"Company") performance, and we believe that these and similar

measures are widely used in the industry in which the Company

operates as a way to evaluate a company’s operating performance and

liquidity. Not all companies calculate non-IFRS financial measures

in the same manner or on a consistent basis. As a result, these

measures and ratios may not be comparable to measures used by other

companies under the same or similar names.

Regulated information related to this

press release is available on the

website:https://www.flentertainment.com/results-center/https://www.flentertainment.com/

APPENDIX

Glossary

Transaction: business combination with Pegasus

Entrepreneurial Acquisition Company Europe B.V., a special purpose

acquisition company to become a listed company on Euronext

Amsterdam as well as the Group’s reorganization

Adjusted EBITDA: for a period

is defined as the operating profit for that period excluding

restructuring costs and other non-core items, costs associated with

the long-term incentive plan within the Group (the "LTIP") and

employment related earn-out and option expenses, and depreciation

and amortization (excluding D&A fiction). D&A fiction are

costs related to the amortization of fiction production, which the

Group considers to be operating costs. As a result of the D&A

fiction, the depreciation and amortization line item in the Group's

combined statement of income deviates from the depreciation and

amortization costs in this line item.

Adjusted net income: defined as

net income (loss) adjusted for restructuring costs and other

non-core items, costs associated with the LTIP and employment

related earn-out and option expenses and other financial

income.

Adjusted free cash flow:

defined as Adjusted EBITDA adjusted for purchase and disposal of

property plant and equipment and of intangible assets and cash

outflows for leases that are not recognized as rental expenses.

Adjusted

operating free cash flow: defined

as adjusted EBITDA adjusted for purchase and disposal of property

plant and equipment and of intangible assets, cash outflows for

leases that are not recognized as rental expenses, change in

working capital requirements, and income tax paid.

Net financial debt: defined as

the sum of bonds, bank borrowings, bank overdrafts, vendor loans,

accrued interests on bonds and bank borrowings minus cash and cash

equivalents, trade receivables on providers, cash in trusts, plus

players liabilities and escrow accounts plus (or minus) the fair

value of net derivatives liabilities (or assets) for that period.

Net financial debt is pre-IFRS 16.

Leverage: Adjusted net

financial debt / Adjusted EBITDA.

Number of Unique Active

Players: average number of unique players playing at least

once a month in a defined period.

Table 1: Content

production &

distribution: Key

indicators

|

Key indicators - In €m |

Q1 2022 |

Q1 2023 |

% change |

| Production |

586.4 |

553.0 |

-5.7% |

|

Distribution |

57.1 |

67.9 |

18.9% |

| Other |

34.0 |

35.5 |

4.5% |

|

REVENUE |

677.5 |

656.4 |

-3.1% |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

89.0 |

84.2 |

-5.4% |

| Adjusted EBITDA

margin (%) |

13.1% |

12.8% |

|

|

|

|

|

|

| Capex |

(12.4) |

(11.6) |

|

| Total cash

outflows for leases that are not recognised as rental expenses |

(10.4) |

(10.7) |

|

|

Adjusted free-cash

flow |

66.2 |

61.9 |

-6.5% |

|

|

|

|

|

| Change in

WC |

(20.6) |

(40.5) |

|

| Income tax

paid |

(1.8) |

(4.9) |

|

|

Adjusted operating free

cash flow |

43.9 |

16.5 |

-62.4% |

Table 2: Online sports betting & gaming: Key

indicators

|

Key indicators - €m |

Q1 2022 |

Q1 2023 |

% change |

| Sportsbook |

175.0 |

194.8 |

11.3% |

| Casino |

23.3 |

30.6 |

31.6% |

| Poker |

12.3 |

15.2 |

23.8% |

| Other |

2.4 |

3.1 |

32.8% |

|

REVENUE |

212.9 |

243.8 |

14.5% |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

58.2 |

62.8 |

8.0% |

| Adjusted EBITDA

margin (%) |

27.3% |

25.8% |

|

|

|

|

|

|

| Capex |

(2.4) |

(2.0) |

|

| Total cash

outflows for leases that are not recognised as rental expenses |

(0.9) |

(1.0) |

|

|

Adjusted free cash flow |

54.8 |

59.9 |

9.2% |

|

|

|

|

|

| Change in

WC |

3.1 |

0.8 |

|

| Income tax

paid |

(0.6) |

(3.0) |

|

|

Adjusted operating free

cash flow |

57.3 |

57.7 |

0.6% |

*Excluding LTIP payment and exceptional items

Table 3: Consolidated

statement of cash flows

|

In € million |

31 March 2022 |

31 March 2023 |

|

Profit/(loss) |

42.0 |

8.4 |

|

Adjustments: |

95.8 |

131.6 |

| Share of

profit/(loss) of associates and joint ventures |

1.2 |

0.9 |

| Amortization,

depreciation, impairment losses and provisions, net of

reversals |

26.9 |

27.9 |

| Employee

benefits LTIP & employment-related earn-out and option

expenses |

22.4 |

30.8 |

| Change in fair

value of financial instruments |

(3.2) |

16.0 |

| Income tax

expenses |

14.2 |

10.4 |

| Other

adjustments (1) |

(2.3) |

9.4 |

| Cost of

financial debt and current accounts |

36.7 |

36.1 |

|

Gross cash provided by operating activities |

137.8 |

140.0 |

| Changes in

working capital |

(19.6) |

(52.8) |

| Income tax

paid |

(2.3) |

(7.9) |

|

Net cash flows provided by operating

activities |

115.9 |

79.2 |

| Purchase of

property, plant and equipment and intangible assets |

(14.8) |

(13.7) |

| Purchases of

consolidated companies, net of acquired cash |

(17.6) |

(3.0) |

| Increase in

financial assets |

(1.8) |

(6.4) |

| Disposals of

property, plant and equipment and intangible assets |

|

0.2 |

| Proceeds from

sales of consolidated companies, after divested cash |

0.9 |

0.1 |

| Decrease in

financial assets |

0.5 |

1.8 |

| Dividends

received |

0.2 |

0.1 |

|

Net cash provided by/(used for) investing

activities |

(32.6) |

(21.0) |

| Change in

capital |

(0.0) |

|

| Dividends paid

by consolidated companies to their non-controlling interests |

(1.0) |

(4.1) |

| Proceeds from

borrowings and other financial liabilities |

1.6 |

3.3 |

| Repayment of

borrowings and other financial liabilities |

(15.1) |

(25.3) |

| Other cash items

related to financial activities |

|

0.2 |

| Interest

paid |

(48.2) |

(49.8) |

|

Net cash flows from/(used in) financing

activities |

(62.7) |

(75.7) |

| Impact of

changes in foreign exchange rates |

4.5 |

(11.0) |

|

Net increase/(decrease) of cash and cash

equivalents |

25.0 |

(28.5) |

|

|

|

|

| Net cash and

cash equivalents at the beginning of the period |

432.4 |

479.4 |

| Net cash and

cash equivalents at the end of the period |

457.5 |

450.9 |

(1) Other adjustments include notably unrealized foreign

exchange gains on disposal and liquidation of subsidiaries

Table 4:

Consolidated balance

sheet

|

In € million |

31 December 2022 |

31 March 2023 |

|

ASSETS |

|

|

| Goodwill |

2 570.2 |

2 595.0 |

| Intangible

assets |

194.8 |

201.6 |

| Right-of-use

assets |

160.8 |

163.3 |

| Property, plant

and equipment |

59.2 |

60.6 |

| Investments in

associates and joint ventures |

14.0 |

13.7 |

| Non-current

financial assets |

161.7 |

124.2 |

| Other

non-current assets |

35.9 |

28.4 |

| Deferred tax

assets |

51.9 |

53.4 |

|

Non-current assets |

3 248.6 |

3 240.2 |

|

|

|

|

| Inventories and

work in progress |

705.2 |

736.5 |

| Trade

receivables |

496.5 |

532.4 |

| Other current

assets |

288.3 |

283.7 |

| Current

financial assets |

24.7 |

18.9 |

| Cash and cash

equivalents |

479.4 |

452.1 |

|

Current assets |

1 994.0 |

2 023.7 |

| TOTAL

ASSETS |

5 242.6 |

5 263.8 |

|

|

|

|

| EQUITY

AND LIABILITIES |

|

|

| Share

capital |

8.0 |

8.0 |

| Share

premiums |

91.7 |

2.3 |

| Net

income/(loss) - attributable to shareholders |

(88.0) |

4.6 |

|

Shareholders' equity |

11.7 |

14.8 |

| Non-controlling

interests |

6.3 |

10.6 |

|

Total equity |

18.0 |

25.4 |

|

|

|

|

| Other

securities |

130.5 |

130.5 |

| Long-term

borrowings and other financial liabilities |

2 290.3 |

2 309.8 |

| Long-term lease

liabilities |

131.2 |

135.0 |

| Non-current

provisions |

27.7 |

30.8 |

| Other

non-current liabilities |

441.3 |

476.7 |

| Deferred tax

liabilities |

7.4 |

10.0 |

|

Non-current liabilities |

3 028.4 |

3

092.6 |

|

|

|

|

| Short-term

borrowings and bank overdrafts |

349.4 |

287.4 |

| Short-term lease

liabilities |

40.4 |

40.0 |

| Trade

payables |

663.6 |

651.9 |

| Current

provisions |

23.0 |

15.2 |

| Customer

contract liabilities |

693.3 |

741.9 |

|

Other current liabilities |

426.5 |

409.5 |

|

Current liabilities |

2 196.2 |

2 151.3 |

| TOTAL

EQUITY AND LIABILITIES |

5 242.6 |

5 263.8 |

Table 5: IFRS consolidated net

financial debt

|

In € million |

31 December 2022 |

31 March 2023 |

| Bonds |

1 330.8 |

1 324.3 |

| Bank

borrowings |

1 140.0 |

1 119.0 |

| Bank

overdrafts |

0.0 |

1.4 |

| Accrued

interests on bonds and bank borrowings |

29.6 |

12.9 |

| Vendor

loans |

138.4 |

139.6 |

|

Total bank indebtedness |

2 638.9 |

2 597.1 |

| Cash and cash

equivalents |

(479.4) |

(452.1) |

| Trade

receivables on providers |

(13.1) |

(13.7) |

| Players'

liabilities |

50.6 |

45.9 |

| Cash in

trusts |

(31.6) |

(32.5) |

|

Net cash and cash equivalents |

(473.6) |

(452.4) |

|

|

|

|

|

Net debt before intercompany loan and derivatives

effects |

2 165.3 |

2 144.7 |

|

|

|

|

|

Net debt before derivatives effects |

2 165.3 |

2 144.7 |

| Derivatives -

liabilities |

- |

- |

| Derivatives -

assets |

(74.5) |

(60.8) |

|

Net debt |

2 090.8 |

2 084.0 |

Table 6:

Cash flow statement

|

|

31 March 2023 |

|

In € million |

Content production & distribution |

Online sports betting & gaming |

Holding |

Total Group |

|

Net cash flow from operating activities |

25.4 |

60.6 |

(6.7) |

79.2 |

|

Cash flow (used in)/from investing activities |

(18.2) |

(2.8) |

- |

(21.0) |

|

Cash flow (used in)/from financing activities |

(123.8) |

(23.0) |

71.0 |

(75.7) |

|

Other |

(11.0) |

- |

- |

(11.0) |

|

Net increase/(decrease) in cash and cash

equivalents |

(127.6) |

34.9 |

64.3 |

(28.5) |

|

Cash and cash equivalents as of 1 January |

396.8 |

72.1 |

10.5 |

479.4 |

|

Cash and cash equivalents as of 30 September |

269.2 |

106.9 |

74.8 |

450.9 |

|

|

31 March 2022 |

|

In € million |

Content production & distribution |

Sports Betting & Online Gaming |

Holding |

Total Group |

|

Net cash flow from operating activities |

54.9 |

60.7 |

0.3 |

115.9 |

|

Cash flow (used in)/from investing activities |

(30.1) |

(2.5) |

0.0 |

(32.6) |

|

Cash flow (used in)/from financing activities |

(59.3) |

(3.4) |

- |

(62.7) |

|

Other |

4.5 |

- |

- |

4.5 |

|

Net increase/(decrease) in cash and cash

equivalents |

(30.1) |

54.8 |

0.3 |

25.0 |

|

Cash and cash equivalents as of 1 January |

343.1 |

87.9 |

1.5 |

432.4 |

|

Cash and cash equivalents as of 30 September |

313.0 |

142.7 |

1.8 |

457.5 |

Table 7:

Content production & distribution:

Net financial debt as

of 31

March 2023

|

At Banijay level: |

|

|

| In

€ million |

31-Dec-2022 |

31 March 2023 |

| |

|

|

| Total

Secured Debt (OM definition) |

1 847 |

1 820 |

| Other debt |

339 |

325 |

|

SUN |

409 |

402 |

|

Total Debt |

2 595 |

2 548 |

| Net Cash |

(396) |

(300) |

|

Total net financial debt (excl.

earn-out &

PUT) |

2 199 |

2 248 |

| EO & PUT |

124 |

130 |

|

Total net financial debt (incl.

earn-out &

PUT) |

2 323 |

2 378 |

|

|

|

|

| Ratios at

Banijay level: |

|

|

| Leverage

ratio |

4.46 |

4.54 |

| Adjusted Leverage

ratio |

4.71 |

4.81 |

| Senior secured

net leverage ratio |

3.20 |

3.34 |

|

|

|

|

|

Banijay contribution at FL Entertainment

level: |

|

|

| In

€ million |

31-Dec-2022 |

31 March 2023 |

|

|

|

|

| Total net

financial debt (excl.

earn-out &

PUT) |

2 199 |

2 248 |

| Transaction costs

amortization |

(39) |

(36) |

| Lease debt (IFRS

16) |

(160) |

(163) |

|

Total Net financial debt

at FL Entertainment level |

1 999 |

2 048 |

|

Derivatives |

(69) |

(56) |

|

Total Net financial debt

at FL Entertainment level |

1 930 |

1 992 |

Leverage ratio: total Net financial debt / (Adj

EBITDA + shareholder fees + proforma impact from acquisitions)

Adjusted leverage ratio: total Net financial

debt including earn-out and PUTS / (Adjusted EBITDA + shareholder

fees + proforma impact from acquisitions)

Senior secured net leverage ratio: total Senior

Secure Notes + earn-out – Cash / (Adjusted EBITDA + shareholder

fees + proforma impact from acquisitions)

1 +1.6% at constant currency2 Adjusted EBITDA, Adjusted net

income and Adjusted free cash flow conversion: figures in Q1 2022

are adjusted to include holding costs of -€2.4m for comparison

purposes. 3 Leverage calculated on Net debt pre-IFRS 16 / Adjusted

EBITDA For definition, refer to the Appendix4 Euribor + 3.75%

for base currency and SOFR / SONIA + 4.00% USD/GBP additional

facility margin5 Including the discontinued Bet-at-home activities6

Figures in Q1 2022 are adjusted to take into account holding costs

of -€2.4m for comparison purposes

- FL Entertainment_PR_Q1 2023 Results

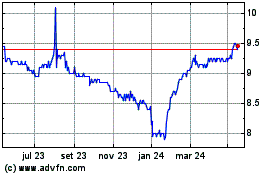

FL Entertainment NV (EU:FLE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

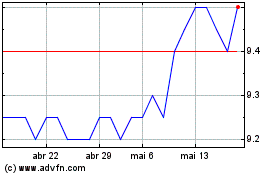

FL Entertainment NV (EU:FLE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024