Swiss Franc Rises Against U.S. Dollar, Euro

10 Junho 2024 - 10:11AM

RTTF2

The Swiss franc climbed against the U.S. dollar and the euro in

the New York session on Monday, as investors became cautious ahead

of the Federal Reserve's interest rate decision and U.S. inflation

data due this week.

The Fed is due to announce its latest monetary policy decision

on Wednesday, when the central bank is widely expected to leave

interest rates unchanged.

Since the decision is largely seen as a foregone conclusion,

traders are likely to pay closer attention to Fed officials' latest

projections for the economy and rates.

Consumer and producer inflation data are set to be published

this week.

Traders trimmed their expectations for rate cut by the Fed in

September after Friday's data, with pricing indicating a

probability of under 50 percent.

The franc recovered to 0.8954 against the greenback, from an

early 1-week low of 0.8982. The franc is poised to challenge

resistance around the 0.87 level.

The franc touched 0.9625 against the euro, its highest level

since April 19. Next key resistance for the currency is seen around

the 0.95 level.

Meanwhile, the franc eased against the yen and was trading at

175.04. The currency is likely to face support around the 140.00

region, if it falls again.

The franc retreated to 1.1422 against the pound. This may be

compared to a previous 4-day low of 1.1430. The currency is seen

finding support around the 1.17 level.

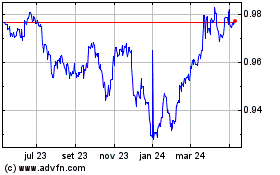

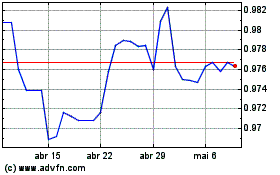

Euro vs CHF (FX:EURCHF)

Gráfico Histórico de Câmbio

De Mai 2024 até Jun 2024

Euro vs CHF (FX:EURCHF)

Gráfico Histórico de Câmbio

De Jun 2023 até Jun 2024