Helios Underwriting Plc Quarterly Syndicate Mid-Point Forecasts (7221K)

30 Agosto 2023 - 3:00AM

UK Regulatory

TIDMHUW

RNS Number : 7221K

Helios Underwriting Plc

30 August 2023

30(th) August 2023

Helios Underwriting plc

('Helios' or 'the Company')

Quarterly Syndicate Mid-Point Forecasts

Indicative underwriting profits of 22p per share to be

recognised over the next two years

Potential NTA per share of 174p

Helios, the investment vehicle which builds shareholder value

through exposure to Lloyd's, announces the current mid-point

forecasts in respect of its portfolio of syndicate capacity for the

2021 and 2022 years of account based on 2(nd) quarter 2023

mid-point estimates.

Martin Reith, Chief Executive, commented :

"Helios' proposition as the investment vehicle which builds

shareholder value through exposure to Lloyd's continues to go from

strength to strength. We have built and curated an outstanding

portfolio of the better performing syndicates, based on stringent

underwriting discipline and judicious capital deployment. During

the period, we have acquired four further LLVs, and taken GBP6m

capacity on a new syndicate.

"Market conditions at Lloyd's are strong, as reflected in our

second published mid-point profit forecast for 2022 of 5.7% of

capacity. This, compounded by Helios' increased retained capacity,

GBP184m for the 2022 year of account, leads us to be confident in

our expectation of achieving underwriting profits of 22p per share

over the next two years."

2021 2022 2023

GBPm GBPm GBPm

Total capacity as at 30(th) May

2023

Retained 99.3 177.6 238.4

Reinsured 51.5 60.8 58.3

------ ------ ------

150.8 238.4 296.7

------ ------ ------

Changes since 30(th) May

Acquisition of LLV's 6.4 6.8 8.1

New Syndicate Participation - - 6.0

Increase in capacity reinsured - - (8.0)

------ ------ ------

Total change in retained 6.4 6.8 6.1

Reinsured - - 8.0

------ ------ ------

Total increase in capacity 6.4 6.8 14.1

------ ------ ------

Total capacity as at 30(th) August

2023

Retained 105.7 184.4 244.5

Reinsured 51.5 60.8 66.3

------ ------ ------

157.2 245.2 310.8

------ ------ ------

Mid-point forecast at 31st March

2023 3.9% 5.7%

Current mid-point forecast 4.9% 5.7%

Impact on Net Asset Value per GBPm

share

After tax retained underwriting

losses earned to 31/12/2022 for

2021 & 2022 underwriting years (4.8)

Indicative after tax retained

underwriting profits from mid-point

estimates 11.6

After tax retained underwriting

profits to be earned 16.4

------

Potential increase in Net Tangible

Asset Value per share - pence 22p

Current Net Tangible Asset Value

per share 152p

Potential Net Asset Value per

share 174p

Activity During the Period

Four LLV acquisitions have been completed, for a total

consideration of GBP7.4m, adding capacity to all three open years

of account.

We have taken GBP6m capacity on a new syndicate, commencing

underwriting on 1(st) July 2023. Syndicate 1996 - managed by Wild

fire Defence Systems - underwrites property in the USA that is

susceptible to fire risk.

The capacity ceded to reinsurers was increased by GBP8m with

effect from 1(st) January 2023 releasing Helios Funds at Lloyds' of

GBP3.6m to be used for corporate purposes.

The 2021 mid-point estimate continues to improve to 4.9% (3.9%

as at Q1 2023) in line with expectations.

The 2022 mid-point forecast at 5.7% profit on capacity (5.7% as

at Q1 2023), after the impact of the loss from Hurricane Ian, will

make a significant contribution to the earned underwriting profits

in the future as this underwriting year recognised a loss in the

first 12 months of 4.0%.

The future retained after tax underwriting profits that are

currently expected to be recognised over the next two years could

increase the NTA per share by 22p to 174p per share.

Notes

1) The table above shows the capacity as at 30(th) August 2023,

splitting the capacity retained by Helios and the capacity that is

ceded to quota share reinsurers.

2) The mid-point forecasts for 2021 and 2022 years of account as

at 2(nd) quarter 2023 have been aggregated at syndicate level from

estimates supplied by Managing Agents.

3) The potential increase in net tangible asset value per share

could be impacted by future underwriting losses, operating and

reinsurance costs.

4) The impact on Helios will be as follows:

a. The underwriting profits to be recognised after 1 January

2023 on the retained capacity from the indications provided by the

mid-point forecasts will be earned in calendar years 2023 and

2024.

b. The overall change in the syndicate results will be

recognised by Helios in cash at the close of the year of

account.

For further information, please contact:

Helios Underwriting plc

Helios Underwriting plc

Martin Reith - Chief Executive +44(0)7720 292 505

Nigel Hanbury - Executive Deputy Chairman +44(0)7787 530 404

Arthur Manners - Chief Financial Officer +44(0)7754 965 917

Numis (Nomad and Broker)

Giles Rolls / Charles Farquhar +44 (0)20 7260 1000

Buchanan (PR)

Helen Tarbet / George Beale +44 (0)7872 604 453

+44 (0)20 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP311m of capacity

for the 2023 account. The portfolio provides a good spread of

business being concentrated in property & casualty insurance

and reinsurance. For further information please visit

www.huwplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUQPRUPWGBB

(END) Dow Jones Newswires

August 30, 2023 02:00 ET (06:00 GMT)

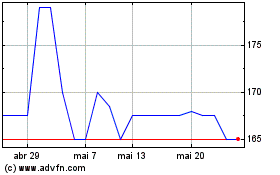

Helios Underwriting (LSE:HUW)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Helios Underwriting (LSE:HUW)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024