TIDMSHI

RNS Number : 1600M

SIG PLC

10 January 2023

10 January 2023

SIG plc: 2022 Full Year Trading Update

SIG plc ("SIG", or "the Group"), a leading supplier of

specialist insulation and building products across Europe, today

issues a trading update for the year ended 31 December 2022

("FY22").

Highlights

-- FY22 results reflect the continuing successful delivery of

the Return to Growth strategy and the resilience of the Group's

diversified business model

-- Full year like-for-like(1) ("LFL") sales growth of 17%, with revenues of GBP2.74bn

-- Substantial increase in underlying operating profit (2) ;

expected to be at cGBP80m, in line with market expectations, up

from GBP41m in 2021

-- Positive free cash flow (3) for the year

-- New CEO Gavin Slark (formerly CEO of Grafton Group plc) will

join the Group on 1 Februar y 2023

Summary

The Return to Growth Strategy, initiated in 2020, continued to

deliver significant progress in the year, with strong growth in

revenue and profitability, underpinned by continued improvement in

operational performance and superior customer service. As

anticipated, market demand softened in most geographies in H2, but

we continued to benefit from solid execution of our commercial

strategy, strengthening our positions in the markets in which we

operate. Input price inflation eased in H2, as expected, but

remained a strong tailwind to year-on-year revenue growth.

As a result of the above, and subject to audit, the Board

expects to report FY22 revenues of cGBP2,743m , together with a

substantial improvement in underlying operating profit to cGBP80m,

up from the GBP41.4m reported in 2021.

This performance was achieved despite a one-off loss of cGBP5m

in H2 resulting from the administration of Avonside, a major UK

roofing contractor and one of the Group's largest customers. Whilst

disappointing, the Group believes that this situation arose from

company-specific factors. Customer bad debt metrics more broadly

remain in line with management's expectations.

The improved operating performance and profitability, allied

with good working capital management, means that the Group expects

to report positive free cash flow for the year of cGBP12m, and

year-end gross cash balances of GBP131m (2021: GBP145m). The

movement in cash balances in the year reflects previously reported

cash outflows on M&A, as well as the positive free cash flow.

The Group's revolving credit facility ("RCF") was increased in

November 2022 from GBP50m to GBP90m and remained undrawn as at 31

December 2022.

The Group expects to report net debt as at 31 December 2022 of

cGBP440m on a post IFRS 16 basis (2021: GBP365m), and cGBP159m on a

pre IFRS 16 basis (2021: GBP129m). The movement in post IFRS 16 net

debt is due mainly to increase in lease liabilities of cGBP45m,

driven by timing of lease renewals and investments in new branches,

and a currency movement of cGBP17m on bond debt. Leverage continued

to come down towards the Group's medium-term targets, and finished

the year at 2.8x and 1.8x on post and pre IFRS 16 bases

respectively. The Group's pre IFRS 16 debt consists almost wholly

of a EUR 300m bond at a fixed rate of 5.25%. The bond, and the

currently undrawn RCF, both mature in 2026.

Trading performance

The Group continues to benefit from a balanced geographic spread

of country revenues, with 58% of revenues derived from the EU in

FY22, and 42% from the UK.

FY22 LFL revenues grew 17% compared to prior year. Reported

Group revenues were 20% higher in the year, including c4% from

acquisitions, slightly offset by c1% adverse currency

movements.

Group revenue growth rates across most geographies moderated in

H2 compared to H1 primarily due to the impact of lower rates of

input cost inflation, following the annualisation of significant

rises in H2 21, and some broadly based softening in market demand.

Pass through of input cost inflation added to the top line in all

geographies. We estimate the impact on revenue for the full year to

be around 17-18%.

LFL sales

growth

2022 vs 2021 H1 H2 FY FY 2022 sales

GBPm

UK Interiors 24% 22% 23% 701

UK Exteriors 13% 1% 7% 446

UK 19% 12% 15% 1,147

------------------ ---- ---- ---- --------------

France Interiors 13% 12% 12% 218

France Exteriors 18% 11% 15% 465

Germany 17% 15% 16% 458

Poland 44% 16% 28% 231

Benelux 20% 31% 25% 116

Ireland 55% 2% 24% 108

------------------ ---- ---- ---- --------------

EU 23% 14% 18% 1,596

------------------ ---- ---- ---- --------------

Group 21% 13% 17% 2,743

------------------ ---- ---- ---- --------------

In the UK Interiors business, the strategic and operational

changes made since mid-2020 continue to drive the business's return

towards its previous market position and performance. In UK

Exteriors, volumes were down, more notably in H2, in line with

weaker market conditions and against particularly strong 2021

comparators. Recent UK acquisitions, including Miers Construction

Products acquired in July 2022, are performing well.

In the EU, FY growth of 18% reflected solid trading across all

our businesses, including some incremental market share gains, and

H2 growth remained robust at 14%. Performance remains strong in our

French businesses. Our German business is benefiting from the new,

experienced leadership put in place in the second half of 2021.

Benelux's performance is improving, with progress to date on the

top line. Poland's growth normalised in H2 after the exceptional

growth seen in H1, and sales in Ireland reflected some weaker

market conditions in H2.

CEO Transition

As previously announced, Gavin Slark will join as Group CEO on 1

February 2023. Gavin joins SIG with a long track record of success

in the pan-European construction distribution industry, including

most recently as CEO of Grafton Group plc for 11 years. Steve

Francis steps down as CEO following the Group's successful

turnaround and return to profitability.

Steve Francis, CEO, commented:

"SIG's performance in 2022 demonstrated the resilience,

flexibility and diversity of its pan-European business. Thanks to

strong employee and customer engagement, the Group has continued to

drive strong profit growth, even as market conditions became

increasingly challenging as the year progressed. SIG now has strong

foundations for the future , and the Group remains well-positioned

to benefit from the need for governments and end-customers to

increase the sustainability and energy efficiency of buildings over

time. Gavin and I are now completing a very smooth leadership

handover, and I am confident that Gavin and the team will build on

the progress made in the last three years."

FY 22 Results date, and Outlook

We will publish our full FY22 results on 8 March 2023, and will

hold a presentation and conference call for analysts and investors

at 10.00am (GMT) on that date. We will provide a more detailed

outlook on 2023 at that time.

The numbers in this update remain subject to final close

procedures and to audit.

1. Like-for-like is defined as sales per working day in constant

currency, excluding completed acquisitions and disposals

2. Underlying represents the results before Other items. Other

items relate to the amortisation of acquired intangibles,

impairment charges, profits and losses on agreed sale or closure of

non-core businesses and associated impairment charges, net

operating profits and losses attributable to businesses identified

as non-core, net restructuring costs, and other non-underlying

profits or losses.

3. Free cash flow is defined as all cash flows excluding M&A

transactions, dividend payments, and financing transactions.

Contacts

SIG plc +44 (0) 114 285 6300

Ian Ashton Chief Financial Officer

Sarah Ogilvie Head of Investor Relations

FTI Consulting +44 (0) 20 3727 1340

Richard Mountain

Peel Hunt LLP - Joint broker to SIG +44 (0) 20 7418 8900

Mike Bell / Charles Batten

Investec Bank plc - Joint broker

to SIG +44 (0) 20 7597 5970

Bruce Garrow / David Anderson

LEI: 213800VDC1BKJEZ8PV53

Cautionary Statement

This document contains certain forward-looking statements

concerning the Group's business, financial condition, results of

operations and certain Group's plans, objectives, assumptions,

projections, expectations or beliefs with respect to these items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'potential',

'targets', 'goal', 'forecasts' or 'estimates' or similar

expressions or negatives thereof.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause the Group's actual

financial condition, performance and results to differ materially

from the plans, goals, objectives and expectations set out in the

forward-looking statements included in this document.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to the Group

or any persons acting on its behalf are expressly qualified in

their entirety by the factors referred to above. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements. No assurance can be given that the

forward-looking statements in this document will be realised;

actual events or results may differ materially as a result of risks

and uncertainties facing the Group. Subject to compliance with

applicable law and regulation, the Group does not intend to update

the forward-looking statements in this document to reflect events

or circumstances after the date of this document and does not

undertake any obligation to do so.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBCGDBUBGDGXC

(END) Dow Jones Newswires

January 10, 2023 02:00 ET (07:00 GMT)

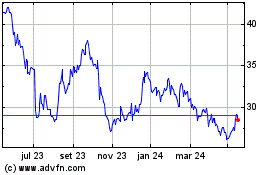

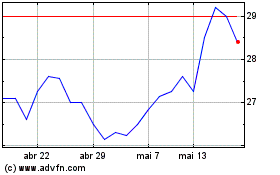

Sig (LSE:SHI)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Sig (LSE:SHI)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024