Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-271054

PROSPECTUS

Up

to 85,175 Shares of Common Stock Offered by the Selling Stockholders

This

prospectus relates to the offer and resale, from time to time, by the selling stockholders named under the heading “Selling Stockholders”

in this prospectus (the “Selling Stockholders”), and their donees, pledgees, transferees or other successors-in-interest,

of up to 85,175 shares (the “Shares”) of the common stock, par value $0.0001 per share (the “Common Stock”),

of BioVie Inc. (the “Company”), consisting of (i) 35,175 shares of Common Stock issuable upon the exercise of the Underwriter

Warrants (as defined below) and (ii) 50,000 shares of Common Stock issuable upon the exercise of the Lender Warrants (as defined below,

and together with the Underwriter Warrants, the “Warrants”) held by the Selling Stockholders. We are registering the offer

and sale of the Shares issuable upon exercise of the Warrants held by the Selling Stockholders to satisfy the registration rights they

were granted by the Company pursuant to the underwriting agreement entered into on September 17, 2020 with ThinkEquity, a division of

Fordham Financial Management, Inc., and Kingswood Capital Markets, Division of Benchmark Investments, Inc. (the “Representatives”)

and the Loan and Security Agreement and the Supplement to the Loan and Security Agreement, each entered into on November 30, 2021 with

Avenue Venture Opportunities Fund II, L.P. (“AVOPII”) and Avenue Venture Opportunities Fund, L.P. (“AVOPI” and,

together with AVOPII, the “Lenders”).

We

will not receive any proceeds from the sales of Shares by the Selling Stockholders. Upon any exercise of the Warrants by payment of cash,

we will receive the nominal cash exercise price paid by the holders of the Warrants. We intend to use those proceeds, if any, for working

capital and general corporate purposes.

The

Selling Stockholders may sell or otherwise dispose of the Shares covered by this prospectus in a number

of different ways and at varying prices. We provide more information on how the Selling Stockholders may sell or otherwise dispose of

the Shares covered by this prospectus in the section entitled “Plan of Distribution” on page 11. Discounts, concessions, commissions

and similar selling expenses attributable to the sale of Shares covered by this prospectus will be borne by the Selling Stockholders.

We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of

the Shares with the Securities and Exchange Commission.

Our Common Stock is traded on The Nasdaq Capital Market

under the symbol “BIVI.” On April 5, 2023, the closing price for our Common Stock, as reported on The Nasdaq Capital Market

was $6.95 per share.

Investing

in these securities involves certain risks. See “Risk Factors” on page 5 of this prospectus.

See also “Risk Factors” in the documents incorporated by reference in this prospectus for a discussion of the factors you

should carefully consider before deciding to purchase these securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is April 10, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3, which we have filed with the Securities and Exchange Commission (the “SEC”),

using a “shelf” registration process. Under this shelf registration process, the Selling Stockholders may from time to time

sell the Shares described in this prospectus in one or more offerings or otherwise as described under “Plan of Distribution.”

This

prospectus may be supplemented from time to time by one or more prospectus supplements. Such prospectus supplements may also add, update

or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the

applicable prospectus supplement, you must rely on the information in the prospectus supplement. You should carefully read both this

prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You

Can Find More Information” before deciding to invest in the Shares being offered.

Neither

we nor the Selling Stockholders have authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus or in any applicable prospectus supplement or any applicable free writing prospectus that we have authorized. We take

no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. The Shares

are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information contained in or

incorporated by reference in this prospectus is accurate as of any date other than the respective dates of such document. Our business,

financial condition, results of operations and prospects may have changed since those dates.

Unless

the context otherwise indicates, references in this prospectus to, “BioVie,” “the Company,” “we,”

“our,” or “us” mean BioVie, Inc., a Nevada corporation. The term “Selling Stockholders” refers, collectively,

to the selling stockholders named under the heading “Selling Stockholders” in this prospectus and their donees, pledgees,

transferees or other successors-in-interest.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about us and certain information contained elsewhere in or incorporated by

reference into this prospectus. This prospectus summary is not complete and does not contain all of the information that you should

consider before making an investment decision. For a more complete understanding of the Company, you should read and consider

carefully the more detailed information included or incorporated by reference in this prospectus and any applicable prospectus

supplement or amendment, including the factors described under the heading “Risk Factors,” on page 5 of this prospectus,

as well as the information incorporated herein by reference, before making an investment decision.

Overview

of the Company

We

are a clinical-stage company developing innovative drug therapies to overcome unmet medical needs in chronic debilitating conditions.

In

neurodegenerative disease, we acquired the biopharmaceutical assets of NeurMedix, Inc. (“NeurMedix”), a related party

privately held clinical-stage pharmaceutical company and related party affiliate, in June 2021. The acquired assets include NE3107, a

potentially selective inhibitor of inflammatory ERK signaling that, based on animal studies, it may reduce neuroinflammation. NE3107

is a novel, orally administered small molecule that is thought to inhibit inflammation-driven insulin resistance and major pathological

inflammatory cascades with a novel mechanism of action. There is emerging scientific consensus that both inflammation and insulin resistance

may play fundamental roles in the development of Alzheimer’s and Parkinson’s disease, and NE3107 could, if approved, represent

an entirely new medical approach to treating these devastating conditions affecting an estimated 6 million Americans suffering from Alzheimer’s

and 1 million from Parkinson’s. The FDA has authorized a potentially pivotal Phase 3 randomized, double-blind, placebo-controlled,

parallel group, multicenter study to evaluate NE3107 in subjects who have mild to moderate Alzheimer’s disease (NCT04669028). We initiated this trial on August

5, 2021 and are targeting primary completion in Q3 of the 2023 calendar year.

On

January 20, 2022, the Company initiated a study by treating the first patient, in its Phase 2 study assessing NE3107’s safety and

tolerability and potential pro-motoric impact in Parkinson’s disease patients (the “PD Trial”). The NM201 study (NCT05083260)

is a double-blind, placebo-controlled, safety, tolerability, and pharmacokinetics study in Parkinson’s disease (PD). Participants

will be treated with carbidopa/levodopa and NE3107 or placebo. Forty patients with a defined PD medication “off state” will

be randomized 1:1 placebo to active NE3107 20 mg twice daily for 28 days. Safety assessments will look at standard measures of patient

health and potential for drug-drug interactions affecting L-dopa pharmacokinetics and activity. Exploratory efficacy assessments will

use the Motor Disease Society Unified Parkinson’s Disease Rating (MDS-UPDRS) parts 1-3, ON/OFF Diary, and Non-Motor Symptom Scale.

The

NM201 study (NCT05083260) is a double-blind, placebo-controlled, safety, tolerability, and pharmacokinetics study in Parkinson’s disease

(PD) participants treated with carbidopa/levodopa and NE3107. 45 patients with a defined L-dopa “off state” were randomized

1:1 to placebo:NE3107 20 mg twice daily for 28 days. This trial was launched with two design objectives: 1) the primary objectives are

safety and a drug-drug interaction study as requested by the FDA to demonstrate the absence of adverse interactions of NE3107 with levodopa;

and 2) the secondary objective is to determine if preclinical indications of promotoric activity and apparent enhancement of levodopa

activity can be seen in humans. Both objectives were met.

In

liver disease, our Orphan Drug candidate BIV201 (continuous infusion terlipressin) is being developed as a future treatment option

for patients suffering from ascites and other life-threatening complications of advanced liver cirrhosis caused by NASH, hepatitis, and

alcoholism. The initial target for BIV201 therapy is refractory ascites. These patients suffer from frequent life-threatening complications,

generate more than $5 billion in annual treatment costs, and have an estimated 50% mortality rate within 6 to 12 months. The US Food

and Drug Administration (FDA) has not approved any drug to treat refractory ascites. The Company’s Orphan drug candidate BIV201

(continuous infusion terlipressin), with FDA Fast Track status, is being evaluated in a US Phase 2b study for the treatment of refractory

ascites due to liver cirrhosis. BIV201 is administered as a patent-pending liquid formulation. The active agent is approved in the U.S.

and in about 40 countries for related complications of advanced liver cirrhosis. For more information, visit http://www.bioviepharma.com/.

The

BIV201 development program was initiated by LAT Pharma LLC. On April 11, 2016, the Company acquired LAT Pharma LLC and the rights to

its BIV201 development program. The Company currently owns all development and marketing rights to its drug candidate. Pursuant to the

Agreement and Plan of Merger entered into on April 11, 2016, between our predecessor entities, LAT Pharma LLC and NanoAntibiotics, Inc.,

BioVie is obligated to pay a low single digit royalty on net sales of BIV201 (continuous infusion terlipressin) to be shared among LAT

Pharma Members, PharmaIn Corporation, and The Barrett Edge, Inc.

Underwriter

Warrants Issued in Connection with Registered Public Offering

On

September 22, 2020, we closed a registered public offering (the “Offering”) issuing 1,799,980 of Class A common stock, par

value $0.0001 per share (the “Common Stock”) at $10.00 per share, resulting in net proceeds of approximately $15.6 million,

net of issuance costs of approximately $2.4 million; and of which approximately $1.8 million was used to satisfy all amounts owing in

respect of a 10% OID Convertible Delayed Draw Debenture due September 24, 2020 held by the Company’s controlling stockholder, Acuitas

Group Holdings, LLC. In connection with the closing of the Offering of registered Common Stock, we issued warrants (the “Underwriter

Warrants”) to purchase 89,998 shares of Common Stock (the “Underwriter Warrant Shares”) to the underwriters of the

Offering.

We

entered into an underwriting agreement (the “Underwriting Agreement”) with ThinkEquity, a division of Fordham Financial Management,

Inc., and Kingswood Capital Markets, Division of Benchmark Investments, Inc. (the “Representatives”) in connection with the

Offering. Pursuant to the Underwriting Agreement, we agreed to (i) pay the underwriters a cash fee equal to seven percent (7%) of the

aggregate gross proceeds raised in this offering plus a one percent (1%) nonaccountable expense; and (ii) grant the Representatives warrants

to purchase that number of shares of our common stock equal to an aggregate of up to five percent (5%) of the shares of Common Stock

sold in the Offering (or 89,999 shares given the underwriters fully exercised the overallotment option). Such Underwriter Warrants have

an exercise price equal to $12.50 per share, which is 125% of the public offering price, and terminate on September 17, 2025 (i.e., the

five-year anniversary of the issuance date of the Underwriter Warrants). The Warrants are not subject to redemption by us.

Neither

the Underwriter Warrants nor the Underwriter Warrant Shares issuable upon exercise of the Underwriter Warrants issued and sold in the

Offering were registered under the Securities Act of 1933, as amended (the “Securities Act”), or applicable state securities

laws, and were issued and sold pursuant to Section 4(a)(2) of the Securities Act, based on representations made by the Selling Stockholders.

Pursuant

to the terms of the Underwriting Agreement, we agreed to provide the holders of the Underwriter Warrants with certain registration rights,

which require us to prepare and file this registration statement with the SEC covering the resale of the Underwriter Warrant Shares issuable

upon exercise of the Underwriter Warrants sold in the Offering within sixty (60) days after receipt of a demand notice of the holders

of at least 51% of the Underwriter Warrants and/or the underlying Underwriter Warrant Shares.

Lender

Warrants Issued in Connection with Loan Agreement

On

November 30, 2021 (the “Loan Closing Date”), the Company entered into a Loan and Security Agreement and the Supplement to

the Loan and Security Agreement (together, the “Loan Agreement”) with Avenue Venture Opportunities Fund II, L.P. (“AVOPII”)

and Avenue Venture Opportunities Fund, L.P. (“AVOPI” and, together with AVOPII, the “Lenders,”) for growth capital

loans in an aggregate principal amount of up to $20,000,000 (the “Loan”), with (i) $15,000,000 funded on the Loan Closing

Date (“Tranche 1”) and (ii) up to $5,000,000 to be made available to the Company on or prior to September 15, 2022, subject

to the Company’s achievement of certain milestones with respect to certain of its ongoing clinical trials (“Tranche 2”).

The Loan bears interest at an annual rate equal to the greater of (a) the sum of 7.00% plus the prime rate as reported in The Wall Street

Journal and (b) 10.75%. The Loan is secured by a lien upon and security interest in all of the Company’s assets, including intellectual

property, subject to agreed exceptions. The maturity date of the Loan is December 1, 2024. Up to $5,000,000 of the principal amount of

the Loan outstanding may be converted, at the option of the Lenders, into shares of the Company’s common stock at a conversion

price of $6.98 per share.

In

connection with the Loan, pursuant to the funding of Tranche 1 on the Loan Closing Date, the Company issued to the Lenders warrants

to purchase 361,002 shares of common stock of the Company at an exercise price per share equal to $5.82 (the “Lender

Warrants”). The Lender Warrants, which are exercisable until November 30, 2026, were offered and sold by the Company in

reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

The

Lenders may exercise the Lender Warrants at any time, or from time to time up to and including the Expiration Date, by making a cash

payment equal to the exercise price multiplied by the quantity of shares. The Lenders may also exercise the Lender Warrants on a cashless

or “net issuance” basis by receiving a net number of shares calculated pursuant to the formula set forth in the Lender Warrants.

The Lender Warrants are subject to anti-dilution adjustments for stock dividends, stock splits, and reverse stock splits. Pursuant to

the terms of the Lender Warrants, the holders of the Lender Warrants are entitled to piggyback registration rights if the Company proposes

to file a new registration statement under the Securities Act for purposes of effecting an underwritten offering of its equity securities,

subject to certain limitations.

Corporate

Information

Our

principal executive office is located at 680 W. Nye Lane, Suite 201, Carson City, Nevada 89703, and our phone number is (775) 888-3162.

THE

OFFERING

This

prospectus relates to the resale from time to time by the Selling Stockholders identified in this prospectus of up to 85,175 Shares,

consisting of 85,175 Shares issuable upon the exercise of the Warrants held by the Selling Stockholders. We are registering the offer

and sale of the Shares to satisfy the registration rights they were granted by the Company pursuant to the Underwriting Agreement.

|

| Issuer |

BioVie

Inc. |

| |

|

| Common

Stock offered by the Selling Stockholders |

A

total 85,175 Shares issuable upon the exercise of the Warrants. |

| |

|

| Common

Stock currently outstanding |

36,070,534 (as of March 29, 2023) |

| |

|

| Common

Stock to be outstanding assuming the full exercise of the Warrants |

36,155,709 |

| |

|

| The

Warrants |

The

exercise price of the 35,175 Underwriter Warrants is $12.50 per Underwriter Warrant. The

Underwriter Warrants are exercisable at any time from date of issuance until September 17,

2025.

The

exercise price of the 50,000 Lender Warrants is $5.82 per Lender Warrant. The Lender Warrants are exercisable until November 30,

2026.

|

| Use

of Proceeds |

We

will not receive any proceeds from the sales of Shares by the Selling Stockholders. Upon any exercise of the Warrants by payment

of cash, we will receive the nominal cash exercise price paid by the holders of the Warrants. We intend to use those proceeds, if

any, for working capital and general corporate purposes. See the section of this prospectus titled “Use of Proceeds.”

|

| |

|

| Trading

Market and Ticker Symbol for Common Stock |

Our

Common Stock is listed on The Nasdaq Capital Market under the symbol “BIVI.” |

| |

|

| Risk

Factors |

Investing

in our securities involves a high degree of risk. For a discussion of factors to consider before deciding to invest in our Common

Stock, you should carefully review and consider the “Risk Factors” section of this prospectus, as well as the risk factors

described or referred to in any documents incorporated by reference in this prospectus, and in any applicable prospectus supplement

or amendment. |

RISK

FACTORS

Investing

in shares of our Common Stock involves a high degree of risk. Before deciding whether to invest in shares of our Common Stock, you should

consider carefully the risks and uncertainties discussed under the sections titled “Risk Factors” contained in our most recent

Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto reflected in our subsequent

filings with the SEC, which are incorporated by reference into this prospectus, together with other information in this prospectus, the

documents incorporated by reference herein, and any prospectus supplement and any free writing prospectus that we may authorize. Please

also read carefully the section titled “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference into this prospectus contain “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels

of activity, performance or achievements expressed or implied by these forward-looking statements. Such forward-looking statements concern

our anticipated results and progress of our operations in future periods, planned exploration and, if warranted, development of our properties,

plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information

that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. All statements

contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,”

“expect,” “estimate,” “may,” “will,” “could,” “leading,” “intend,”

“contemplate,” “shall” and similar expressions are generally intended to identify forward-looking statements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual

events or results to differ from those expressed or implied by the forward-looking statements. The section in this prospectus entitled

“Risk Factors” and the sections in our periodic reports, including our Annual Report on Form 10-Q for the fiscal year ended

June 30, 2022 (the “2022 Form 10-K”) entitled “Business,” and in the 2022 Form 10-K and the Quarterly Report

on Form 10-Q for the fiscal quarter ended December 31, 2022 entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” as well as other sections in this prospectus and the documents or reports incorporated by reference

into this prospectus, discuss some of the factors that could contribute to these differences. Forward-looking statements in this prospectus

and the documents incorporated by reference herein include, but are not limited to, statements with respect to:

| |

- |

our

limited operating history and experience in developing and manufacturing drugs; |

| |

- |

none

of our products are approved for commercial sale; |

| |

- |

our

substantial capital needs; |

| |

- |

product

development risks; |

| |

- |

our

lack of sales and marketing personnel; |

| |

- |

regulatory,

competitive and contractual risks; |

| |

- |

no

assurance that our product candidates will obtain regulatory approval or that the results of clinical studies will be favorable; |

| |

- |

risks

related to our intellectual property rights; |

| |

- |

the

volatility of the market price and trading volume in our common stock; |

| |

- |

the

absence of liquidity in our common stock; |

| |

- |

the

risk of substantial dilution from future issuances of our equity securities; and |

| |

- |

the

other risks set forth herein and in the documents incorporated by reference herein under the caption “Risk Factors.” |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with. The factors set forth above under “Risk Factors” and other cautionary statements made

in this prospectus should be read and understood as being applicable to all related forward-looking statements wherever they appear in

this prospectus. The forward-looking statements contained in this prospectus represent our judgment as of the date of this prospectus.

We caution readers not to place undue reliance on such statements. You should read this prospectus and the documents that we have filed

as exhibits to this prospectus and incorporated by reference herein completely and with the understanding that our actual future results

may be materially different from the plans, intentions and expectations disclosed in the forward-looking statements we make. Except as

required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information

becomes available or other events occur in the future. All subsequent written and oral forward-looking statements attributable to us

or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout

this prospectus.

USE

OF PROCEEDS

We

will not receive any proceeds from the sales of Shares by the Selling Stockholders.

Upon

any exercise of the Warrants by payment of cash, we will receive the nominal cash exercise price paid by the holders of the Warrants.

We cannot assure you that any of the Warrants will be exercised, or if exercised, of the quantity that will be exercised or the period

in which such Warrants will be exercised. We intend to use the proceeds, if any, for working capital and general corporate purposes.

SELLING

STOCKHOLDERS

On

September 17, 2020, we entered into an Underwriting Agreement pursuant to which we issued and sold to certain

of the Selling Stockholders Underwriter Warrants to purchase an aggregate of 89,998 shares of Common Stock. On November 30, 2021, we entered

into a Loan and Security Agreement pursuant to which we issued and sold to certain of the Selling Stockholders Lender Warrants to purchase

361,002 shares of Common Stock. This prospectus covers the sale or other disposition by the Selling Stockholders and their respective

donees, pledgees or other successors-in-interest of up to the total number of Shares registered on behalf of the Selling Stockholders

in the manner contemplated under “Plan of Distribution” below. Throughout this prospectus, when we refer to the Shares being

registered on behalf of the Selling Stockholders, we are referring to the Shares issuable upon the exercise of the Warrants issued to

the Selling Stockholders in the Offering and the Loan, and when we refer to the Selling Stockholders in this prospectus, we are referring

to those investors set forth in the table below.

In

connection with the Underwriting Agreement and the Loan and Security Agreement, we granted certain registration rights to the Selling

Stockholders. The Underwriting Agreement and the Loan and Security Agreement also provide, among other things, certain indemnification

rights and reimbursement by the Company of certain fees and expenses.

We

have agreed with the Selling Stockholders to keep the registration statement of which this prospectus constitutes a part effective for

a period of at least twelve (12) months after the date that the Selling Stockholders are first given the opportunity to sell all of the

Shares.

Except

as otherwise disclosed herein and in the footnotes below with respect to the Selling Stockholders, the Selling Stockholders do not, and

within the past three years, have not had, any position, office or other material relationship with us.

The

following table sets forth the name of the Selling Stockholders, the number of shares of Common Stock beneficially owned by the Selling

Stockholders, the number of Shares that may be offered under this prospectus and the number of shares of our Common Stock that will be

owned by the Selling Stockholders assuming all of the Shares covered hereby are sold. The number of Shares in the column “Number

of Shares Being Offered” represents all of the Shares that the Selling Stockholders may offer under this prospectus. Pursuant to

Rules 13d-3 and 13d-5 of the Exchange Act (“Rule 13(d)”), beneficial ownership includes all shares of our Common Stock as

to which a Selling Stockholder has sole or shared voting power or investment power, and also any shares of our Common Stock which the

Selling Stockholder has the right to acquire within 60 days of March 29, 2023, but without regard to the Beneficial Ownership Limitation

included in the Warrants (described below). The actual beneficial ownership of certain Selling Stockholders (determined in accordance

with Rule 13d) does not necessarily correspond to the number of Shares reflected below in the column “Number of Shares Being Offered.”

Notwithstanding

the presentation of Share ownership in the table below, pursuant to the terms of the Warrants, a holder of a Warrant does not have the

right to exercise any portion of the Warrant held by such holder to the extent (but only to the extent) that after giving effect to such

issuance after exercise, the holder (together with the holder’s affiliates, and any other persons acting as a group together with

the holder or any of the holder’s affiliates), would beneficially own in excess of 9.99% of the number of shares of Common Stock

outstanding immediately after giving effect to the issuance of shares of Common Stock issued upon exercise of the Warrants (the “Beneficial

Ownership Limitation”). The holder of a Warrant may, upon notice to the Company, increase or decrease the Beneficial Ownership

Limitation of its Warrant, provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the number of shares of the

Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon exercise of the Warrant held

by the holder. Any increase in the Beneficial Ownership Limitation will not be effective until the 61st day after such notice

is delivered to the Company. No such increase notice has been provided to the Company as of the date of this prospectus.

The

information set forth below is based upon information obtained from the Selling Stockholders

and upon information in our possession regarding the issuance of the Shares issuable upon the exercise of the Warrants to the Selling

Stockholders. The percentages of shares of Common Stock beneficially owned before this offering are based on 36,070,534 shares of Common

Stock outstanding as of March 29, 2023. The percentages of shares of our Common Stock owned after the offering are based on 36,155,709

shares of our Common Stock outstanding after this offering, including the 36,070,534 shares of Common Stock outstanding as of March 29,

2023 plus 85,175 Shares issuable upon the exercise of the Warrants covered hereby.

The

Shares covered hereby may be offered from time to time by the Selling Stockholders. The Selling Stockholders may sell some, all or none

of their respective Shares. We do not know how long the Selling Stockholders will hold their Shares before selling them, and we currently

have no agreements, arrangements or understandings with the Selling Stockholders regarding the sale or other disposition of any of the

Shares.

| |

|

Shares

of Common Stock

Beneficially Owned

Prior To The

Offering |

|

|

Maximum

Number of

Shares

Being Offered |

|

|

Shares

of Common Stock

Beneficially Owned

After The

Offering(1) |

|

| Name

of Selling Stockholder |

|

Number |

|

Percentage |

|

|

Number |

|

|

Percent |

|

| Richard

Adams(2) |

|

200 |

|

* |

|

|

200 |

|

|

0 |

|

|

- |

|

| Avenue

Venture Opportunities Fund, LP(3) |

|

180,501 |

|

* |

|

|

25,000 |

|

|

155,501 |

|

|

- |

|

| Avenue

Venture Opportunities Fund II, LP(4) |

|

180,501 |

|

* |

|

|

25,000 |

|

|

155,501 |

|

|

- |

|

| Nelson

Baquet(5) |

|

135 |

|

* |

|

|

135 |

|

|

0 |

|

|

- |

|

| William

Baquet(6) |

|

2,902 |

|

* |

|

|

2,902 |

|

|

0 |

|

|

- |

|

| Premchand

Beharry(7) |

|

1,305 |

|

* |

|

|

1,305 |

|

|

0 |

|

|

- |

|

|

| William

Bongiorno(8) |

|

1,080 |

|

* |

|

|

1,080 |

|

|

0 |

|

|

- |

|

|

| Vincent

Campitiello(9) |

|

730 |

|

* |

|

|

720 |

|

|

0 |

|

|

- |

|

|

| David

Cherry(10) |

|

270 |

|

* |

|

|

270 |

|

|

0 |

|

|

- |

|

|

| Chirag

Choudhary(11) |

|

3,000 |

|

* |

|

|

3,000 |

|

|

0 |

|

|

- |

|

|

| Jangiz

Demirkan(12) |

|

45 |

|

* |

|

|

45 |

|

|

0 |

|

|

- |

|

|

| Charles

Giordano(13) |

|

378 |

|

* |

|

|

378 |

|

|

0 |

|

|

- |

|

|

| Phyllis

Henderson(14) |

|

200 |

|

* |

|

|

200 |

|

|

0 |

|

|

- |

|

|

| Bruce

P. Inglis and Nancy M. Ingles, JTWROS(15) |

|

810 |

|

* |

|

|

810 |

|

|

0 |

|

|

- |

|

|

| Kingswood

Capital Partners, LLC(16) |

|

4,499 |

|

* |

|

|

4,499 |

|

|

0 |

|

|

- |

|

|

| Eric

Lord(17) |

|

6,075 |

|

* |

|

|

6,075 |

|

|

0 |

|

|

- |

|

|

| Priyanka

Mahajan(18) |

|

4,680 |

|

* |

|

|

4,680 |

|

|

0 |

|

|

- |

|

|

| Kevin

Mangan(19) |

|

5,265 |

|

* |

|

|

5,265 |

|

|

0 |

|

|

- |

|

|

| Peter

Mazzone(20) |

|

90 |

|

* |

|

|

90 |

|

|

0 |

|

|

- |

|

|

| Redstone

Group(21) |

|

90 |

|

* |

|

|

90 |

|

|

0 |

|

|

- |

|

|

| Maria

Robles(22) |

|

68 |

|

* |

|

|

68 |

|

|

0 |

|

|

- |

|

|

| Robert

Sagarino(23) |

|

720 |

|

* |

|

|

720 |

|

|

0 |

|

|

- |

|

|

| Jeffrey

Singer(24) |

|

44,718 |

|

* |

|

|

44,718 |

|

|

0 |

|

|

- |

|

|

| Craig

Skop(25) |

|

2,318 |

|

* |

|

|

2,318 |

|

|

0 |

|

|

- |

|

|

| Kolinda

Tomasic(26) |

|

100 |

|

* |

|

|

100 |

|

|

0 |

|

|

- |

|

|

| Tom

Tully(27) |

|

90 |

|

* |

|

|

90 |

|

|

0 |

|

|

- |

|

|

Percentages

denoted by * are less than 1%.

| (1) | Assumes

that all Shares being registered in this prospectus are resold to third parties and that

the Selling Stockholders sell all Shares registered under this prospectus held by them. |

| (2) | The

business address of Richard Adams is 61 Morley Lane, Bloomfield, NJ, 07003. Richard Adams

is an affiliate of a broker-dealer. Richard

Adams purchased the shares in the ordinary course of business, and at

the time of the purchase of the shares to be resold, Richard Adams did not have any

agreements or understandings, directly or indirectly, with any person to distribute the securities. |

| (3) | The

business address for Avenue Venture Opportunities Fund, LP is 11 West 42nd St.

9th Floor, New York, NY, 10036. |

| (4) | The

business address for Avenue Venture Opportunities Fund II, LP is 11 West 42nd

St. 9th Floor, New York, NY, 10036 |

| (5) | The business address of Nelson Baquet is 17 State St., 41st Fl., New York, NY 10004. Nelson Baquet is an affiliate of a broker-dealer. Nelson Baquet purchased the shares in the ordinary course of business, and at the time of the purchase of the shares to be resold, Nelson Baquet did not have any agreements or understandings, directly or indirectly, with any person to distribute the securities. |

| (6) | The

business address of William Baquet is 17 State St., 41st Fl., New York, NY 10004. William Baquet is

an affiliate of a broker-dealer. William Baquet

purchased the shares in the ordinary course of business, and at

the time of the purchase of the shares to be resold, William Baquet did not have any

agreements or understandings, directly or indirectly, with any person to distribute the securities. |

| (7) | The

business address for Premchand Beharry is 18-20 Orchid Drive, Endeavour, Chaguanas 501101,

Trinidad, W.I. |

| (8) | The

business address for William Bongiorno is 281 Stephen Ave., Toms River, NJ 08753. William

Bongiorno is an affiliate of a broker-dealer.

William Bongiorno purchased the shares

in the ordinary course of business, and at the

time of the purchase of the shares to be resold, William

Bongiorno did not have any agreements or understandings, directly or indirectly, with

any person to distribute the securities. |

| (9) | The

business address for Vincent Campitiello is 4366 Amboy Road, Staten Island, NY 10312-3820. |

| (10) | The business

address for David Cherry is c/o Cherry Pipes Ltd., 12 Derryhirk Road, Tullyroan, Dungannon, United Kingdom. |

| (11) | The business

address for Chirag Choudhary is 17 State St., 41st Fl., New York, NY 10004. Chirag

Choudhary is an affiliate of a broker-dealer. Chirag

Choudhary purchased the shares in the ordinary course of business, and at the time

of the purchase of the shares to be resold, Chirag Choudhary did not have any agreements

or understandings, directly or indirectly, with any person to distribute the securities. |

| (12) | The business

address for Jangiz Demirkan is 495 W. Veterans HWY., Jackson, NJ 08527. |

| (13) | The business

address for Charles Giordano is 9 Greenhaven Court, Lakewood, NJ 08701. Charles

Giordano is an affiliate of a broker-dealer. Charles

Giordano purchased the shares in the ordinary course of business, and at the

time of the purchase of the shares to be resold, Charles Giordano did not have any

agreements or understandings, directly or indirectly, with any person to distribute the securities. |

| (14) | The business

address of Phyllis Henderson 17 Salem Road, Hicksville, NY 11801. Phyllis Henderson is an affiliate of a broker-dealer. Phyllis

Henderson purchased the shares in the ordinary course of business, and at the time of

the purchase of the shares to be resold, Phyllis Henderson did not have any agreements or understandings, directly or indirectly,

with any person to distribute the securities. |

| (15) | The business

address for Bruce P. Inglis and Nancy M. Inglis, JTWROS is 5587 Dutch St., Dundee, NY 14837. |

| (16) | Consists of

(i) 4,499 Shares originally held by Benchmark Investments, Inc. and assigned to Kingswood Capital Partners, LLC on December 7, 2022.

The business address for Kingwood Capital Partners, LLC is 175 Country Club Dr., Suite 400, Bldg. D, Stockbridge, GA

30281. |

| (17) | The business

address for Eric Lord is 17 State St., 41st Fl., New York, NY 10004. Eric

Lord is an affiliate of a broker-dealer. Eric

Lord purchased the shares in the ordinary course of business, and at the time of

the purchase of the shares to be resold, Eric Lord did not have any agreements or

understandings, directly or indirectly, with any person to distribute the securities. |

| (18) | The business

address for Priyanka Mahajan is 1400 Hudson Street, Apt. 832, Hoboken, NJ 07030. Priyanka Mahajan is an affiliate of a broker-dealer. Priyanka

Mahajan purchased the shares in the ordinary course of business, and at the time of the

purchase of the shares to be resold, Priyanka Mahajan did not have any agreements or understandings, directly or indirectly, with

any person to distribute the securities. |

| (19) | The business

address for Kevin Mangan is 17 State St., 41st Fl., New York, NY 10004.

Kevin Mangan is an affiliate of a broker-dealer. Kevin

Mangan purchased the shares in the ordinary course of business, and at the time of

the purchase of the shares to be resold, Kevin Mangan did not have any agreements or understandings,

directly or indirectly, with any person to distribute the securities. |

| (20) | The business

address of Peter Mazzone is 163 Father Capodanno Blvd., Staten Island, NY 10303. |

| (21) | The business

address for Redstone Group is 1475 N. Highview Ln.. #401, Alexandria, VA 22311, Attn: Michael Schaack. |

| (22) | The business

address for Maria Robles is 17 State St., 41st Fl., New York, NY 10004.

Maria Robles is an affiliate of a broker-dealer. Robles

purchased the shares in the ordinary course of business, and at the time of the purchase

of the shares to be resold, Maria Robles did not have any agreements or understandings, directly

or indirectly, with any person to distribute the securities. |

| (23) | The business

address for Robert Sagarino is 16 Village Dr. W., Dix Hills, NY 11746. |

| (24) | The business

address for Jeffrey Singer is 17 State St., 41st Fl., New York, NY 10004.

Jeffrey Singer is an affiliate of a broker-dealer. Jeffrey

Singer purchased the shares in the ordinary course of business, and at the time of

the purchase of the shares to be resold, Jeffrey Singer did not have any agreements or understandings,

directly or indirectly, with any person to distribute the securities. |

| (25) | The business

address for Craig Skop is 17 State St., 41st Fl., New York, NY 10004. Craig

Skop is an affiliate of a broker-dealer. Craig

Skop purchased the shares in the ordinary course of business, and at the time of the

purchase of the shares to be resold, Craig Skop did not have any agreements or understandings,

directly or indirectly, with any person to distribute the securities. |

| (26) | The

Business address for Kolinda Tomasic is 154-01 20th Avenue, Whitestone, NY 11357.

Kolinda Tomasic is an affiliate of a broker-dealer. Kolinda Tomasic purchased the shares

in the ordinary course of business, and at the time of the purchase of the shares to be resold,

Kolinda Tomasic did not have any agreements or understandings, directly or indirectly, with any person to distribute the securities. |

| (27) | The

business address for Tom Tully is c/o Tully Construction, 127-50 Northern Boulevard, Flushing,

NY 11365. |

PLAN

OF DISTRIBUTION

We

are registering the Shares issuable upon exercise of the Warrants previously issued in the Offering and the Loan to permit the resale

of these Shares by the holders thereof from time to time after the date of this prospectus. We will not receive any of the proceeds,

other than the nominal exercise price of the Warrants if paid in cash, from the sale by the Selling Stockholders of the Shares. We will

bear all fees and expenses incident to our obligation to register the Shares. Discounts, concessions, commissions and similar selling

expenses attributable to the sale of Shares covered by this prospectus will be borne by the Selling Stockholders.

The

Selling Stockholders, which shall include donees, pledgees, transferees or other successors-in-interest selling Shares or interests in

Shares received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer,

may, from time to time, sell, transfer or otherwise dispose of any or all of their Shares or interests in Shares on any stock exchange,

market or trading facility on which the shares of Common Stock of the Company are traded or in private transactions. These dispositions

may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying

prices determined at the time of sale, or at negotiated prices.

The

Selling Stockholders may use any one or more of the following methods when disposing of shares or interests therein:

| |

● |

|

on

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

● |

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

|

block

trades in which the broker-dealer will attempt to sell the Shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

● |

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its own account; |

| |

● |

|

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

|

privately

negotiated transactions; |

| |

● |

|

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

|

through

agreements between broker-dealers and the selling stockholders to sell a specified number of such Shares at a stipulated price per

share; |

| |

● |

|

a

combination of any such methods of sale; and |

| |

● |

|

any

other method permitted by applicable law. |

The

Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the Shares owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Shares, from time to

time, under this prospectus, or under an amendment to the registration statement of which this prospectus forms a part amending the list

of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus.

The Selling Stockholders also may transfer the Shares in other circumstances, in which case the pledgees, transferees or other successors

in interest will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of the Shares or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they

assume. The Selling Stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short

positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may

also enter into options or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative

securities which require the delivery to each such broker-dealer or other financial institution of Shares offered by this prospectus,

which Shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to

reflect such transaction).

The

aggregate proceeds to the Selling Stockholders from the sale of the Shares offered by them will be the purchase price of the Shares less

discounts or commissions, if any. Each of the Selling Stockholders reserves the right to accept and, together with its agents from time

to time, to reject, in whole or in part, any proposed purchase of Shares to be made directly or through agents. We will not receive any

of the proceeds from the sale of Shares by the Selling Stockholders.

The

Selling Stockholders also may resell all or a portion of the Shares in open market transactions in reliance upon Rule 144 under the Securities

Act, provided that they meet the criteria and conform to the requirements of that rule.

There

can be no assurance that any Selling Stockholder will sell any or all of the Shares registered pursuant to the registration statement,

of which this prospectus forms a part.

The

Selling Stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Shares or interests therein may

be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit

they earn on any resale of the Shares may be underwriting discounts and commissions under the Securities Act. Selling Stockholders who

are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements

of the Securities Act.

To

the extent required, the Shares to be sold, the names of the Selling Stockholders, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer

will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the Shares may be sold in these jurisdictions only through registered

or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

To

the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the

Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Stockholders

may indemnify any broker-dealer that participates in transactions involving the sale of the Shares against certain liabilities, including

liabilities arising under the Securities Act.

We

are required to pay all fees and expenses incident to the registration of the Shares. We have agreed to indemnify the Selling Stockholders

against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the Shares

offered by this prospectus. Once sold under the registration statement, of which this prospectus forms a part, the Shares will be freely

tradable in the hands of persons other than our affiliates.

We

have agreed with the Selling Stockholders to keep the registration statement of which this prospectus constitutes a part effective for

a period of at least twelve (12) months after the date that the Selling Stockholders are first given the opportunity to sell all of the

Shares.

LEGAL

MATTERS

The

validity of the Shares to be offered for resale by the Selling Stockholder under this prospectus will be passed upon for us by Sherman

& Howard L.L.C.

EXPERTS

The

balance sheets of BioVie Inc. as of June 30, 2022 and 2021, and the related statements of operations, changes in stockholders’

equity (deficit), and cash flows for each of the years then ended, have been audited by EisnerAmper LLP, independent registered public

accounting firm, as stated in their report which is incorporated by reference, which report includes an explanatory paragraph about the

existence of substantial doubt concerning the Company’s ability to continue as a going concern. Such financial statements have

been incorporated by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all

the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements

or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement

or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement

or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly

and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet

at the SEC’s website at http://www.sec.gov.

You

may also access our SEC filings at our website https://bioviepharma.com/. Our website and the information contained on, or that

can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus.

You should not rely on our website or any such information in making your decision whether to purchase our securities.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to incorporate by reference into this prospectus the information contained in other documents we file with the SEC, which

means that we can disclose important information to you by referring you to those documents. Any statement contained in any document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this prospectus,

to the extent that a statement contained in or omitted from this prospectus, or in any other subsequently filed document that also is

or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate by reference the documents

listed below which have been filed by us:

| |

● |

|

Our

Annual Report on Form 10-K for the year ended June 30, 2022, filed with the SEC on September 27, 2022, including those portions of

the Form 10-K incorporated by reference from our definitive proxy statement filed with the SEC on September 30, 2022, including any

amendments or supplements thereto; |

| |

● |

|

Our

Quarterly Report on Form 10-Q for the period ended September 30, 2022, filed with the SEC on November 4, 2022; and our Quarterly

Report on Form 10-Q for the period ended December 31, 2022, filed with the SEC on February 10, 2023; |

| |

● |

|

Our

Current Reports on Form 8-K, filed with the SEC on July 15, 2022 (as subsequently amended on Form 8-K/A on July 18, 2022), August

31, 2022, September 7, 2022 (as subsequently amended on 8-K/A on September 7, 2022), October 5, 2022, November 10, 2022, December

6, 2022 (both filed on such date), December 7, 2022 December 15, 2022, December 23, 2022, March 6, 2023, March 13,

2023 and April 7, 2023; and |

| |

● |

|

The

description of our Common Stock contained in our registration on Form 8-A (File No. 001-39015) filed with the SEC on August 25, 2020,

including any amendment or report filed for the purpose of updating such description. |

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any report

or documents that is not deemed filed under such provisions, (1) on or after the date of filing of the registration statement containing

this prospectus and prior to the effectiveness of the registration statement and (2) on or after the date of this prospectus until the

earlier of the date on which all of the securities registered hereunder have been sold or the registration statement of which this prospectus

is a part has been withdrawn, shall be deemed incorporated by reference in this prospectus and to be a part of this prospectus from the

date of filing of those documents and will be automatically updated and, to the extent described above, supersede information contained

or incorporated by reference in this prospectus and previously filed documents that are incorporated by reference in this prospectus.

Nothing

in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC pursuant to Item 2.02, 7.01 or 9.01

of Form 8-K. Upon written or oral request, we will provide without charge to each person, including any beneficial owner, to whom a copy

of the prospectus is delivered a copy of any or all of the reports or documents incorporated by reference herein (other than exhibits

to such documents, unless such exhibits are specifically incorporated by reference herein). You may request a copy of these filings,

at no cost, by writing or telephoning us at the following address: BioVie Inc., 680 W Nye Lane, Suite 204, Carson City, NV 89703.

85,175 Shares

BioVie Inc.

Class A Common Stock

April 10, 2023

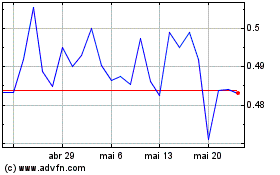

BioVie (NASDAQ:BIVI)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

BioVie (NASDAQ:BIVI)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024