Five9 Reports Third Quarter Total Revenue Growth of 27%

01 Novembro 2016 - 6:05PM

LTM Enterprise Subscription Revenue Growth

Accelerates to 43%

Five9, Inc. (NASDAQ:FIVN), a leading provider of cloud software for

the enterprise contact center market, today reported results for

the third quarter 2016 ended September 30, 2016.

Third Quarter 2016 Financial Results

- Total revenue for the third quarter of 2016 increased 27% to a

record $41.0 million, compared to $32.3 million for the third

quarter of 2015

- GAAP gross margin was 56.6% for the third quarter of 2016,

compared to 54.1% for the third quarter of 2015

- Adjusted gross margin was 61.5% for the third quarter of 2016,

compared to 59.4% for the third quarter of 2015

- GAAP net loss for the third quarter of 2016 was $(3.9) million,

or $(0.07) per share, compared to a GAAP net loss of $(6.0)

million, or $(0.12) per share, for the third quarter of 2015

- Non-GAAP net loss for the third quarter of 2016 was $(0.2)

million, or $(0.00) per share, compared to a non-GAAP net loss of

$(3.9) million, or $(0.08) per share, for the third quarter of

2015

- GAAP operating cash flow for the third quarter of 2016 was $1.7

million, compared to a GAAP operating cash outflow of $(3.2)

million for the third quarter of 2015

- Adjusted EBITDA for the third quarter of 2016 was $2.7 million,

or 6.7% of revenue, compared to a loss of $(1.1) million, or (3.4)%

of revenue, for the third quarter of 2015

“Our third quarter results were once again outstanding.

Our revenue grew 27% year-over-year resulting in record revenue of

$41.0 million. This revenue growth was driven primarily by

the continued acceleration in our enterprise business, which

delivered 43% growth in LTM enterprise subscription revenue and

which drives high marginal profitability. Additionally, Five9

was once again named a leader in this year’s Gartner Magic Quadrant

for Contact Center as a Service, North America, published on

October 24th, and we were positioned highest on ability to execute.

We see this as further validation of our leadership position in the

enterprise market. We believe we are still in the early days of a

massive push towards modernization of customer service and contact

center technologies. Given our leadership position in this

market and the strong momentum in our business, we are again

raising 2016 guidance.”

- Mike Burkland, President and CEO, Five9

Q3 Business Highlights

- Third quarter record for enterprise bookings

- LTM enterprise subscription revenue grew 43% year-over-year, up

from 35% in the year ago period

- LTM enterprise revenue increased to 68% of total revenue, up

from 63% in the year ago period

- Annual dollar-based retention rate was 100%, up from 95% in the

year ago period

Business Outlook

- For the full year 2016, Five9 expects to

report:

- Revenue in the range of $159.2 to $160.2 million, up from the

prior guidance range of $155.8 to $157.8 million that was

previously provided on August 3, 2016

- GAAP net loss in the range of $(15.8) to $(16.8) million,

including a $1.0 million write-off of unamortized fees and

discounts as well as a prepayment penalty from the termination of

our prior term debt facility, or a loss of $(0.30) to $(0.32) per

share, improved from the prior guidance range of $(17.8) to $(19.8)

million, or a loss of $(0.34) to $(0.38) per share, that was

previously provided on August 3, 2016

- Non-GAAP net loss in the range of $(4.5) to $(5.5) million, or

$(0.09) to $(0.11) per share, improved from the prior guidance

range of $(6.5) to $(8.5) million, or $(0.12) to $(0.16) per share,

that was previously provided on August 3, 2016

- For the fourth quarter of 2016, Five9 expects to

report:

- Revenue in the range of $41.3 to $42.3 million

- GAAP net loss in the range of $(3.5) to $(4.5) million, or a

loss of $(0.07) to $(0.09) per share

- Non-GAAP net loss in the range of $(0.8) to $(1.8) million, or

a loss of $(0.02) to $(0.03) per share

Conference Call Details

Five9 will discuss its third quarter 2016 results today,

November 1, 2016, via teleconference at 4:30 p.m. Eastern

Time. To access the call (ID 2120093), please dial:

888-437-9362 or 719-325-2492. An audio replay of the call

will be available through November 15, 2016 by dialing 888-203-1112

or 719-457-0820 and entering access code 2120093. A copy of

this press release will be furnished to the Securities and Exchange

Commission on a Current Report on Form 8-K, and will be posted to

our web site, prior to the conference call.

A webcast of the call will be available on the Investor

Relations section of the Company’s website at

http://investors.five9.com/.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted

gross profit by adding back the following items to gross profit:

depreciation, amortization, and stock-based compensation

expenses. We calculate adjusted EBITDA by adding back the

following items to net loss: depreciation, amortization, interest

expense, income tax expense, stock-based compensation expense, and

interest and other, which consists primarily of interest income and

foreign exchange gains and losses. We calculate non-GAAP

operating income (loss) as operating loss excluding stock-based

compensation, amortization of acquisition intangibles and an

immaterial one time out of period adjustment for sales taxes.

We calculate non-GAAP net loss as net loss excluding stock-based

compensation, amortization of acquisition intangibles,

extinguishment of debt, amortization of debt discount and issuance

costs, and an immaterial one time out of period adjustment for

sales taxes. Non-GAAP financial measures do not have any

standardized meaning and are therefore unlikely to be comparable to

similarly titled measures presented by other companies.

Five9 considers these non-GAAP financial measures to be

important because they provide useful measures of the operating

performance of the Company, exclusive of unusual events, as well as

factors that do not directly affect what we consider to be our core

operating performance. The Company’s management uses these

measures to (i) illustrate underlying trends in the Company’s

business that could otherwise be masked by the effect of income or

expenses that are excluded from non-GAAP measures, and (ii)

establish budgets and operational goals for managing the Company’s

business and evaluating its performance. In addition,

investors often use similar measures to evaluate the operating

performance of a company. Non-GAAP financial measures are

presented only as supplemental information for purposes of

understanding the Company's operating results. The non-GAAP

financial measures should not be considered a substitute for

financial information presented in accordance with GAAP.

Please see the reconciliation of non-GAAP financial measures set

forth herein and attached to this release.

Forward Looking Statements

This news release contains certain forward-looking statements,

including the statements in the quote from our Chief Executive

Officer, including statements regarding Five9’s market position,

customer service and contact center market trends, increasing

demand for Five9’s solutions, and the fourth quarter 2016 and full

year 2016 financial projections set forth under the caption

“Business Outlook,” that are based on our current expectations and

involve numerous risks and uncertainties that may cause these

forward-looking statements to be inaccurate. Risks that may cause

these forward-looking statements to be inaccurate include, among

others: (i) our quarterly and annual results may fluctuate

significantly, may not fully reflect the underlying performance of

our business and may result in decreases in the price of our common

stock; (ii) we may be unable to attract new clients or sell

additional services and functionality to our existing clients or

could experience a reduction in seats or revenues from existing

clients; (iii) our recent rapid growth may not be indicative

of our future growth and we may fail to manage our growth

effectively; (iv) we may not be able to grow our sales

and support staff sufficiently to continue to grow our business;

(v) the markets in which we participate are highly competitive and

we may be unable to compete effectively; (vi) we may be

unable to manage our technical operations infrastructure, which

could cause our existing clients to experience service outages,

cause our new clients to experience delays in the deployment of our

solution and subject us to, among other things, claims for credits

or damages; (vii) a decline in our dollar-based retention

rate could cause our revenues and gross margins to decrease and our

net loss to increase and we may be required to spend more money to

grow our client base to maintain our revenues; (viii) sales of our

solutions to larger organizations may require longer sales and

implementation cycles and we may be unable to offer the

configuration and integration services or customized features and

functions required by larger organizations, which could delay or

prevent sales of our solution to them; (ix) downturns or

upturns in new sales will not be immediately reflected in our

operating results and may be difficult to discern; (x)

third-party telecommunications and internet service providers on

which we rely may fail to provide our clients and their customers

with reliable telecommunication services and connectivity to our

cloud contact center software; (xi) we may be unable to

achieve or sustain profitability; (xii) we may be unable to secure

additional financing on favorable terms, or at all, to meet our

future capital needs; and (xiii) the other risks detailed from

time-to-time under the caption “Risk Factors” and elsewhere in our

Securities and Exchange Commission filings and reports, including,

but not limited to, our most recent quarterly report on Form 10-Q.

Such forward looking statements speak only as of the date hereof

and readers should not unduly rely on such statements. We

undertake no obligation to update the information contained in this

press release, including in any forward-looking statements.

About Five9

Five9 is a leading provider of cloud software for the enterprise

contact center market, bringing the power of the cloud to thousands

of customers and facilitating over three billion customer

interactions annually. Since 2001, Five9 has led the cloud

revolution in contact centers, helping organizations transition

from legacy premise-based solutions to the cloud. Five9 provides

businesses with cloud contact center software that it reliable,

secure, compliant and scalable which is designed to create

exceptional customer experiences, increase agent productivity and

deliver tangible business results. For more information visit

www.five9.com.

| |

| FIVE9, INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (In thousands) |

| |

| |

|

September 30, 2016 |

|

December 31, 2015 |

| |

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

57,333 |

|

|

$ |

58,484 |

|

| Accounts receivable, net |

|

12,899 |

|

|

10,567 |

|

| Prepaid expenses and other current

assets |

|

4,097 |

|

|

2,184 |

|

| Total current

assets |

|

74,329 |

|

|

71,235 |

|

| Property and equipment,

net |

|

13,690 |

|

|

13,225 |

|

| Intangible assets,

net |

|

1,657 |

|

|

2,041 |

|

| Goodwill |

|

11,798 |

|

|

11,798 |

|

| Other assets |

|

1,225 |

|

|

934 |

|

| Total

assets |

|

$ |

102,699 |

|

|

$ |

99,233 |

|

| |

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

3,609 |

|

|

$ |

2,569 |

|

| Accrued and other current

liabilities |

|

10,500 |

|

|

7,911 |

|

| Accrued federal fees |

|

5,873 |

|

|

5,684 |

|

| Sales tax liability |

|

1,307 |

|

|

1,262 |

|

| Revolving line of credit |

|

— |

|

|

12,500 |

|

| Notes payable |

|

1,070 |

|

|

7,212 |

|

| Capital leases |

|

5,634 |

|

|

4,972 |

|

| Deferred revenue |

|

8,838 |

|

|

6,413 |

|

| Total current

liabilities |

|

36,831 |

|

|

48,523 |

|

| Revolving line of

credit — less current portion |

|

32,594 |

|

|

— |

|

| Sales tax liability —

less current portion |

|

1,591 |

|

|

1,915 |

|

| Notes payable — less

current portion |

|

470 |

|

|

17,327 |

|

| Capital leases — less

current portion |

|

4,902 |

|

|

4,606 |

|

| Other long-term

liabilities |

|

532 |

|

|

582 |

|

| Total

liabilities |

|

76,920 |

|

|

72,953 |

|

| Stockholders’

equity: |

|

|

|

|

| Common stock |

|

53 |

|

|

51 |

|

| Additional paid-in

capital |

|

192,415 |

|

|

180,649 |

|

| Accumulated

deficit |

|

(166,689 |

) |

|

(154,420 |

) |

| Total

stockholders’ equity |

|

25,779 |

|

|

26,280 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

102,699 |

|

|

$ |

99,233 |

|

| FIVE9,

INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited, in

thousands, except per share data) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

40,982 |

|

|

$ |

32,287 |

|

|

$ |

117,883 |

|

|

$ |

92,835 |

|

| Cost of revenue |

|

17,790 |

|

|

14,812 |

|

|

51,164 |

|

|

43,860 |

|

| Gross profit |

|

23,192 |

|

|

17,475 |

|

|

66,719 |

|

|

48,975 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research and development |

|

6,041 |

|

|

5,473 |

|

|

17,642 |

|

|

17,079 |

|

| Sales and marketing |

|

12,925 |

|

|

10,797 |

|

|

38,268 |

|

|

31,322 |

|

| General and administrative |

|

6,143 |

|

|

6,087 |

|

|

18,561 |

|

|

19,389 |

|

| Total operating

expenses |

|

25,109 |

|

|

22,357 |

|

|

74,471 |

|

|

67,790 |

|

| Loss from

operations |

|

(1,917 |

) |

|

(4,882 |

) |

|

(7,752 |

) |

|

(18,815 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

| Interest expense |

|

(961 |

) |

|

(1,235 |

) |

|

(3,357 |

) |

|

(3,529 |

) |

| Extinguishment of debt |

|

(1,026 |

) |

|

— |

|

|

(1,026 |

) |

|

— |

|

| Interest income and other |

|

12 |

|

|

119 |

|

|

(66 |

) |

|

72 |

|

| Total other income

(expense), net |

|

(1,975 |

) |

|

(1,116 |

) |

|

(4,449 |

) |

|

(3,457 |

) |

| Loss before income

taxes |

|

(3,892 |

) |

|

(5,998 |

) |

|

(12,201 |

) |

|

(22,272 |

) |

| Provision for (benefit

from) income taxes |

|

(2 |

) |

|

50 |

|

|

68 |

|

|

48 |

|

| Net loss |

|

$ |

(3,890 |

) |

|

$ |

(6,048 |

) |

|

$ |

(12,269 |

) |

|

$ |

(22,320 |

) |

| Net loss per

share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.45 |

) |

| Shares used in

computing net loss per share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

52,708 |

|

|

50,369 |

|

|

52,078 |

|

|

49,931 |

|

| FIVE9,

INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited, in

thousands) |

| |

| |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

| Cash flows from

operating activities: |

|

|

|

|

| Net loss |

|

$ |

(12,269 |

) |

|

$ |

(22,320 |

) |

| Adjustments to

reconcile net loss to net cash provided by (used in) operating

activities: |

|

|

|

|

| Depreciation and amortization |

|

6,302 |

|

|

5,525 |

|

| Provision for doubtful

accounts |

|

58 |

|

|

157 |

|

| Stock-based compensation |

|

6,927 |

|

|

6,010 |

|

| Loss on disposal of property and

equipment |

|

1 |

|

|

10 |

|

| Loss on extinguishment of debt |

|

1,026 |

|

|

— |

|

| Amortization of debt discount and

issuance costs |

|

221 |

|

|

260 |

|

| Accretion of interest |

|

11 |

|

|

— |

|

| Others |

|

(10 |

) |

|

40 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

(2,383 |

) |

|

(1,149 |

) |

| Prepaid expenses and other current

assets |

|

(1,927 |

) |

|

(957 |

) |

| Other assets |

|

(25 |

) |

|

(178 |

) |

| Accounts payable |

|

1,039 |

|

|

(1,329 |

) |

| Accrued and other current

liabilities |

|

2,749 |

|

|

788 |

|

| Accrued federal fees and sales tax

liability |

|

(90 |

) |

|

161 |

|

| Deferred revenue |

|

2,449 |

|

|

192 |

|

| Other liabilities |

|

(75 |

) |

|

(83 |

) |

| Net cash provided by

(used in) operating activities |

|

4,004 |

|

|

(12,873 |

) |

| Cash flows from

investing activities: |

|

|

|

|

| Purchases of property

and equipment |

|

(973 |

) |

|

(689 |

) |

| (Increase) Decrease in

restricted cash |

|

(60 |

) |

|

806 |

|

| Purchase of short-term

investments |

|

— |

|

|

(20,000 |

) |

| Proceeds from maturity

of short-term investments |

|

— |

|

|

40,000 |

|

| Net cash (used in)

provided by investing activities |

|

(1,033 |

) |

|

20,117 |

|

| Cash flows from

financing activities: |

|

|

|

|

| Proceeds from exercise

of common stock options |

|

4,050 |

|

|

419 |

|

| Proceeds from sale of

common stock under ESPP |

|

792 |

|

|

680 |

|

| Repayments of notes

payable |

|

(23,866 |

) |

|

(2,622 |

) |

| Proceeds from revolving

line of credit |

|

32,594 |

|

|

— |

|

| Payment of prepayment

penalty and related fees |

|

(368 |

) |

|

— |

|

| Payments for debt

issuance costs |

|

(206 |

) |

|

— |

|

| Payments of capital

leases |

|

(4,618 |

) |

|

(4,509 |

) |

| Repayments on revolving

line of credit |

|

(12,500 |

) |

|

— |

|

| Net cash used in

financing activities |

|

(4,122 |

) |

|

(6,032 |

) |

| Net (decrease) increase

in cash and cash equivalents |

|

(1,151 |

) |

|

1,212 |

|

| Cash and cash

equivalents: |

|

|

|

|

| Beginning of period |

|

58,484 |

|

|

58,289 |

|

| End of period |

|

$ |

57,333 |

|

|

$ |

59,501 |

|

| FIVE9,

INC. |

| RECONCILIATION

OF GAAP GROSS PROFIT TO ADJUSTED GROSS PROFIT |

| (Unaudited, in

thousands, except percentages) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

23,192 |

|

|

$ |

17,475 |

|

|

$ |

66,719 |

|

|

$ |

48,975 |

|

| GAAP gross margin |

|

56.6 |

% |

|

54.1 |

% |

|

56.6 |

% |

|

52.8 |

% |

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

| Depreciation |

|

1,580 |

|

|

1,382 |

|

|

4,700 |

|

|

4,203 |

|

| Intangibles amortization |

|

88 |

|

|

88 |

|

|

264 |

|

|

264 |

|

| Stock-based compensation |

|

357 |

|

|

233 |

|

|

951 |

|

|

639 |

|

| Adjusted gross

profit |

|

$ |

25,217 |

|

|

$ |

19,178 |

|

|

$ |

72,634 |

|

|

$ |

54,081 |

|

| Adjusted gross

margin |

|

61.5 |

% |

|

59.4 |

% |

|

61.6 |

% |

|

58.3 |

% |

| RECONCILIATION

OF GAAP NET LOSS TO ADJUSTED EBITDA |

| (Unaudited, in

thousands) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

|

|

|

|

|

|

|

| GAAP net loss |

|

$ |

(3,890 |

) |

|

$ |

(6,048 |

) |

|

$ |

(12,269 |

) |

|

$ |

(22,320 |

) |

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

2,140 |

|

|

1,840 |

|

|

6,302 |

|

|

5,525 |

|

| Stock-based compensation |

|

2,519 |

|

|

1,945 |

|

|

6,927 |

|

|

6,010 |

|

| Interest expense |

|

961 |

|

|

1,235 |

|

|

3,357 |

|

|

3,529 |

|

| Extinguishment of debt |

|

1,026 |

|

|

— |

|

|

1,026 |

|

|

— |

|

| Interest income and other |

|

(12 |

) |

|

(119 |

) |

|

66 |

|

|

(72 |

) |

| Provision for (benefit from) income

taxes |

|

(2 |

) |

|

50 |

|

|

68 |

|

|

48 |

|

| Out of period adjustment for sales

tax liability (G&A) |

|

— |

|

|

— |

|

|

— |

|

|

765 |

|

| Adjusted EBITDA |

|

$ |

2,742 |

|

|

$ |

(1,097 |

) |

|

$ |

5,477 |

|

|

$ |

(6,515 |

) |

| FIVE9,

INC. |

| RECONCILIATION

OF GAAP OPERATING LOSS TO NON-GAAP OPERATING INCOME

(LOSS) |

| (Unaudited, in

thousands) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

$ |

(1,917 |

) |

|

$ |

(4,882 |

) |

|

$ |

(7,752 |

) |

|

$ |

(18,815 |

) |

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

| Stock-based

compensation |

|

2,519 |

|

|

1,945 |

|

|

6,927 |

|

|

6,010 |

|

| Intangibles

amortization |

|

129 |

|

|

128 |

|

|

384 |

|

|

$ |

384 |

|

| Out of period

adjustment for sales tax liability (G&A) |

|

— |

|

|

— |

|

|

— |

|

|

765 |

|

| Non-GAAP operating

income (loss) |

|

$ |

731 |

|

|

$ |

(2,809 |

) |

|

$ |

(441 |

) |

|

$ |

(11,656 |

) |

| RECONCILIATION

OF GAAP NET LOSS TO NON-GAAP NET LOSS |

| (Unaudited, in

thousands, except per share data) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

|

|

|

|

|

|

|

| GAAP net loss |

|

$ |

(3,890 |

) |

|

$ |

(6,048 |

) |

|

$ |

(12,269 |

) |

|

$ |

(22,320 |

) |

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

2,519 |

|

|

1,945 |

|

|

6,927 |

|

|

6,010 |

|

| Intangibles amortization |

|

129 |

|

|

128 |

|

|

384 |

|

|

384 |

|

| Amortization of debt discount and

issuance costs |

|

43 |

|

|

89 |

|

|

221 |

|

|

260 |

|

| Extinguishment of debt |

|

1,026 |

|

|

— |

|

|

1,026 |

|

|

— |

|

| Out of period adjustment for sales

tax liability (G&A) |

|

— |

|

|

— |

|

|

— |

|

|

765 |

|

| Non-GAAP net loss |

|

$ |

(173 |

) |

|

$ |

(3,886 |

) |

|

$ |

(3,711 |

) |

|

$ |

(14,901 |

) |

| |

|

|

|

|

|

|

|

|

| GAAP net loss per

share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.45 |

) |

| Non-GAAP net loss per

share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

— |

|

|

$ |

(0.08 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.30 |

) |

| Shares used in

computing GAAP and non-GAAP net loss per share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

52,708 |

|

|

50,369 |

|

|

52,078 |

|

|

49,931 |

|

| SUMMARY OF

STOCK-BASED COMPENSATION, DEPRECIATION AND INTANGIBLES

AMORTIZATION |

| (Unaudited, in

thousands) |

|

|

| |

|

Three Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

Stock-Based Compensation |

|

Depreciation |

|

Intangibles Amortization |

|

Stock-Based Compensation |

|

Depreciation |

|

Intangibles Amortization |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

$ |

357 |

|

|

$ |

1,580 |

|

|

$ |

88 |

|

|

$ |

233 |

|

|

$ |

1,382 |

|

|

$ |

88 |

|

| Research and

development |

|

547 |

|

|

204 |

|

|

— |

|

|

475 |

|

|

126 |

|

|

— |

|

| Sales and

marketing |

|

626 |

|

|

27 |

|

|

29 |

|

|

448 |

|

|

23 |

|

|

29 |

|

| General and

administrative |

|

989 |

|

|

200 |

|

|

12 |

|

|

789 |

|

|

181 |

|

|

11 |

|

| Total |

|

$ |

2,519 |

|

|

$ |

2,011 |

|

|

$ |

129 |

|

|

$ |

1,945 |

|

|

$ |

1,712 |

|

|

$ |

128 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

| |

|

September 30, 2016 |

|

September 30, 2015 |

| |

|

Stock-Based Compensation |

|

Depreciation |

|

Intangibles Amortization |

|

Stock-Based Compensation |

|

Depreciation |

|

Intangibles Amortization |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

$ |

951 |

|

|

$ |

4,700 |

|

|

$ |

264 |

|

|

$ |

639 |

|

|

$ |

4,203 |

|

|

$ |

264 |

|

| Research and

development |

|

1,510 |

|

|

513 |

|

|

— |

|

|

1,389 |

|

|

315 |

|

|

— |

|

| Sales and

marketing |

|

1,604 |

|

|

78 |

|

|

85 |

|

|

1,430 |

|

|

67 |

|

|

85 |

|

| General and

administrative |

|

2,862 |

|

|

627 |

|

|

35 |

|

|

2,552 |

|

|

556 |

|

|

35 |

|

| Total |

|

$ |

6,927 |

|

|

$ |

5,918 |

|

|

$ |

384 |

|

|

$ |

6,010 |

|

|

$ |

5,141 |

|

|

$ |

384 |

|

| FIVE9,

INC. |

| RECONCILIATION

OF GAAP NET LOSS TO NON-GAAP NET LOSS – GUIDANCE |

| (Unaudited, in

thousands, except per share data) |

|

|

| |

|

Three Months Ending |

|

Year Ending |

| |

|

December 31, 2016 |

|

December 31, 2016 |

| |

|

Low |

|

High |

|

Low |

|

High |

| |

|

|

|

|

|

|

|

|

| GAAP net loss |

|

$ |

(3,520 |

) |

|

$ |

(4,520 |

) |

|

$ |

(15,789 |

) |

|

$ |

(16,789 |

) |

| Non-GAAP

adjustments: |

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

2,579 |

|

|

2,579 |

|

|

9,506 |

|

|

9,506 |

|

| Intangibles amortization |

|

116 |

|

|

116 |

|

|

500 |

|

|

500 |

|

| Amortization of debt discount and

issuance costs |

|

25 |

|

|

25 |

|

|

247 |

|

|

247 |

|

| Extinguishment of debt |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,026 |

|

|

$ |

1,026 |

|

| Non-GAAP net loss |

|

$ |

(800 |

) |

|

$ |

(1,800 |

) |

|

$ |

(4,510 |

) |

|

$ |

(5,510 |

) |

| GAAP net loss per

share, basic and diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.32 |

) |

| Non-GAAP net loss per

share, basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.11 |

) |

| Shares used in

computing GAAP and non-GAAP net loss per share: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

53,000 |

|

|

53,000 |

|

|

52,300 |

|

|

52,300 |

|

Investor Relations Contact:

Five9, Inc.

Barry Zwarenstein

Chief Financial Officer

925-201-2000 ext. 5959

IR@five9.com

The Blueshirt Group for Five9, Inc.

Lisa Laukkanen

415-217-4967

Lisa@blueshirtgroup.com

Tony Righetti

415-489-2186

Tony@blueshirtgroup.com

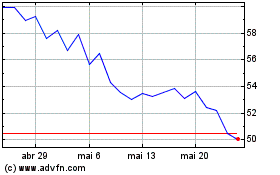

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024