37% Growth in LTM Enterprise Subscription

Revenue

Tenth Consecutive Quarter of Positive Operating

Cash Flow at $5.7 Million

Five9, Inc. (NASDAQ:FIVN), a leading provider of cloud contact

center software for the digital enterprise, today reported results1

for the second quarter ended June 30, 2018.

Second Quarter 2018 Financial Results

- Revenue for the second quarter of 2018

increased 28% to a record $61.1 million, compared to

$47.7 million for the second quarter of 2017.

- GAAP gross margin was 59.4% for the

second quarter of 2018, compared to 57.5% for the second quarter of

2017.

- Adjusted gross margin was 63.8% for the

second quarter of 2018, compared to 62.3% for the second quarter of

2017.

- GAAP net loss for the second quarter of

2018 was $(2.0) million, or $(0.04) per basic share, compared to

GAAP net loss of $(4.0) million, or $(0.07) per basic share, for

the second quarter of 2017. GAAP net loss for the second quarter of

2018 included $1.7 million in amortization of discount and issuance

costs on our 0.125% convertible senior notes issued in May

2018.

- Non-GAAP net income for the second

quarter of 2018 was $6.9 million, or $0.11 per diluted share,

compared to non-GAAP net loss of $(0.1) million, or $(0.00) per

basic share, for the second quarter of 2017.

- Adjusted EBITDA for the second quarter

of 2018 was $9.7 million, or a record 15.8% of revenue, compared to

$3.0 million, or 6.2% of revenue, for the second quarter of

2017.

- GAAP operating cash flow for the second

quarter of 2018 was $5.7 million, compared to GAAP operating cash

flow of $0.1 million for the second quarter of 2017.

“Our second quarter results significantly exceeded our

expectations on both the top and bottom line. Revenue growth

accelerated in Q2, up 28% year-over-year to $61.1 million, and

continued to be driven by our Enterprise business, which delivered

37% growth in LTM Enterprise subscription revenue. I am excited to

be taking the helm at Five9 as contact centers undergo a massive

technology-enabled transformation driven by the move to the cloud

and the rise of artificial intelligence (AI). Our vision is to

create a self-learning, intelligent contact center delivered

through the cloud and powered by AI. Our recently announced Five9

Genius and partnership with Google, which brings practical AI

enhancements to the contact center, is the first step in this

direction. As Five9 continues to disrupt this massive market, we

are also laser-focused on near-term execution.”

- Rowan Trollope, CEO, Five9

Business Outlook

The guidance below includes the expected impact of the adoption

of ASC 606.

- For the full year 2018, Five9

expects to report:

- Revenue in the range of $244.5 to

$246.5 million, up from the prior guidance range

of $235.8 to $238.8 million that was previously

provided on May 1, 2018.

- GAAP net loss in the range of $(14.0)

to $(12.0) million, or $(0.24) to $(0.20) per basic share, compared

to the prior guidance range of $(13.0) to

$(10.0) million, or $(0.22) to $(0.17) per

basic share, that was previously provided on May 1, 2018. GAAP

net loss guidance includes $7.9 million in amortization of discount

and issuance costs on our convertible senior notes, offset by $2.5

million net interest savings from the use of our convertible

proceeds.

- Non-GAAP net income in the range of

$24.0 to $26.0 million, or $0.39 to $0.42 per diluted share,

improved from the prior guidance range of $15.4 to

$18.4 million, or $0.25 to $0.30 per diluted share,

that was previously provided on May 1, 2018. Non-GAAP net

income guidance includes $2.5 million net interest savings from the

use of our convertible proceeds.

- For the third quarter of 2018, Five9

expects to report:

- Revenue in the range of $61.0 to $62.0

million.

- GAAP net loss in the range of $(8.1) to

$(7.1) million, or a loss of $(0.14) to $(0.12) per basic share.

GAAP net loss guidance includes $3.0 million in amortization of

discount and issuance costs on our convertible senior notes, offset

by $1.0 million net interest savings from the use of our

convertible proceeds.

- Non-GAAP net income in the range of

$5.1 to $6.1 million, or $0.08 to $0.10 per diluted share. Non-GAAP

net income guidance includes $1.0 million net interest savings from

the use of our convertible proceeds.

1On January 1, 2018, Five9 adopted Accounting Standards

Codification (ASC) 606 “Revenue from Contracts with Customers”

using the modified retrospective transition method. While the

financial results for the second quarter of 2018 are presented

under ASC 606, financial results for the second quarter of 2017 are

presented under ASC 605. A reconciliation of the financial results

for the second quarter of 2018 under ASC 606 and ASC 605 is

presented in the “Reconciliation of ASC 605 to ASC 606” table

included in this release.

Conference Call Details

Five9 will discuss its second quarter 2018 results today,

August 6, 2018, via teleconference at 4:30 p.m. Eastern Time.

To access the call (ID 6113370), please dial: 888-204-4368 or

323-794-2423. An audio replay of the call will be available through

August 20, 2018 by dialing 888-203-1112 or 719-457-0820 and

entering access code 6113370. A copy of this press release will be

furnished to the Securities and Exchange Commission on a Current

Report on Form 8-K, and will be posted to our web site, prior to

the conference call.

A webcast of the call will be available on the Investor

Relations section of the Company’s website at

http://investors.five9.com/.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted gross

profit by adding back or removing the following items to gross

profit: depreciation, intangibles amortization and stock-based

compensation expense. We calculate adjusted EBITDA by adding back

or removing the following items to or from GAAP net loss:

depreciation, amortization, interest expense, provision for income

taxes, stock-based compensation expense, non-recurring litigation

settlement costs and interest income and other, which consists

primarily of a non-cash adjustment on investment, interest income

and foreign exchange gains and losses. We calculate non-GAAP

operating income (loss) as operating income (loss) excluding

stock-based compensation expense, intangibles amortization and

non-recurring litigation settlement costs. We calculate non-GAAP

net income (loss) as GAAP net loss excluding stock-based

compensation expense, intangibles amortization, amortization of

debt discount and issuance costs, amortization of discount and

issuance costs on convertible senior notes, non-recurring

litigation settlement costs, and non-cash adjustments on

investment. Non-GAAP financial measures do not have any

standardized meaning and are therefore unlikely to be comparable to

similarly titled measures presented by other

companies. Five9 considers these non-GAAP financial

measures to be important because they provide useful measures of

the operating performance of the Company, exclusive of factors that

do not directly affect what we consider to be our core operating

performance, as well as unusual events. The Company’s management

uses these measures to (i) illustrate underlying trends in the

Company’s business that could otherwise be masked by the effect of

income or expenses that are excluded from non-GAAP measures, and

(ii) establish budgets and operational goals for managing the

Company’s business and evaluating its performance. In addition,

investors often use similar measures to evaluate the operating

performance of a company. Non-GAAP financial measures are presented

only as supplemental information for purposes of understanding the

Company's operating results. The non-GAAP financial measures should

not be considered a substitute for financial information presented

in accordance with GAAP. Please see the reconciliation of non-GAAP

financial measures set forth herein and attached to this

release.

Forward-Looking Statements

This news release contains certain forward-looking statements,

including the statements in the quote from our Chief Executive

Officer, including statements regarding Five9’s market position,

business momentum, product positioning and company vision, the

state of the cloud customer experience market, the industry shift

to the cloud, and the third quarter 2018 and full year 2018

financial projections set forth under the caption “Business

Outlook,” that are based on our current expectations and involve

numerous risks and uncertainties that may cause these

forward-looking statements to be inaccurate. Risks that may cause

these forward-looking statements to be inaccurate include, among

others: (i) our quarterly and annual results may fluctuate

significantly, may not fully reflect the underlying performance of

our business and may result in decreases in the price of our common

stock; (ii) if we are unable to attract new clients or sell

additional services and functionality to our existing clients, our

revenue and revenue growth will be harmed; (iii) our recent rapid

growth may not be indicative of our future growth, and even if we

continue to grow rapidly, we may fail to manage our growth

effectively; (iv) failure to adequately expand our sales force

could impede our growth; (v) if we fail to manage our technical

operations infrastructure, our existing clients may experience

service outages, our new clients may experience delays in the

deployment of our solution and we could be subject to, among other

things, claims for credits or damages; (vi) security breaches and

improper access to or disclosure of our data or our clients’ data,

or other cyber attacks on our systems, could result in litigation

and regulatory risk, harm our reputation and adversely affect our

business; (vii) the markets in which we participate are highly

competitive, and if we do not compete effectively, our operating

results could be harmed; (viii) if our existing clients terminate

their subscriptions or reduce their subscriptions and related

usage, our revenues and gross margins will be harmed and we will be

required to spend more money to grow our client base; (ix) our

growth depends in part on the success of our strategic

relationships with third parties and our failure to successfully

grow and manage these relationships could harm our business; (x) we

are establishing a network of master agents and resellers to sell

our solution; our failure to effectively develop, manage, and

maintain this network could materially harm our revenues; (xi) we

sell our solution to larger organizations that require longer sales

and implementation cycles and often demand more configuration and

integration services or customized features and functions that we

may not offer, any of which could delay or prevent these sales and

harm our growth rates, business and operating results; (xii)

because a significant percentage of our revenue is derived from

existing clients, downturns or upturns in new sales will not be

immediately reflected in our operating results and may be difficult

to discern; (xiii) we rely on third-party telecommunications and

internet service providers to provide our clients and their

customers with telecommunication services and connectivity to our

cloud contact center software, any increase in the cost thereof,

reduction in efficacy or any failure by these service providers to

provide reliable services could cause us to lose customers,

increase our customers’ cost of using our solution and subject us

to, among other things, claims for credits or damages; (xiv) we

have a history of losses and we may be unable to achieve or sustain

profitability; (xv) we may not be able to secure additional

financing on favorable terms, or at all, to meet our future capital

needs; (xvi) failure to comply with laws and regulations could harm

our business and our reputation; and (xvii) the other risks

detailed from time-to-time under the caption “Risk Factors” and

elsewhere in our Securities and Exchange Commission filings and

reports, including, but not limited to, our most recent quarterly

report on Form 10-Q. Such forward-looking statements speak only as

of the date hereof and readers should not unduly rely on such

statements. We undertake no obligation to update the information

contained in this press release, including in any forward-looking

statements.

About Five9

Five9 is a leading provider of cloud contact center software for

the digital enterprise, bringing the power of cloud innovation to

customers and facilitating more than three billion customer

interactions annually. Five9 provides end-to-end

solutions with omnichannel routing, analytics, WFO, and AI to

increase agent productivity and deliver tangible

business results. The Five9 platform is reliable, secure,

compliant, and scalable; designed to create exceptional

personalized customer experiences. For more information, visit

www.five9.com.

FIVE9, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30, 2018 December 31, 2017

ASSETS Current assets: Cash and cash equivalents $

166,162 $ 68,947 Marketable investments 108,140 — Accounts

receivable, net 20,167 19,048 Prepaid expenses and other current

assets 8,437 4,840 Deferred contract acquisition costs 8,083

— Total current assets 310,989 92,835 Property and

equipment, net 22,019 19,888 Intangible assets, net 841 1,073

Goodwill 11,798 11,798 Other assets 1,026 2,602 Deferred contract

acquisition costs — less current portion 18,393 —

Total assets $ 365,066 $ 128,196

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 6,035 $ 4,292 Accrued and other

current liabilities 13,615 11,787 Accrued federal fees 1,638 1,151

Sales tax liability 1,201 1,326 Notes payable 31 336 Capital leases

7,442 6,651 Deferred revenue 14,750 13,975 Total

current liabilities 44,712 39,518 Convertible senior notes 190,615

— Revolving line of credit — 32,594 Sales tax liability — less

current portion 928 1,044 Capital leases — less current portion

7,869 7,161 Other long-term liabilities 1,436 1,041

Total liabilities 245,560 81,358

Stockholders’ equity: Common stock 58 57 Additional paid-in

capital 273,373 222,202 Accumulated deficit (153,925 ) (175,421 )

Total stockholders’ equity 119,506 46,838

Total liabilities and stockholders’ equity $ 365,066

$ 128,196

FIVE9, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share data)

(Unaudited)

Three Months Ended Six Months

Ended

June 30,2018

June 30,2017

June 30,2018

June 30,2017

Revenue $ 61,120 $ 47,727 $ 120,025 $ 94,741 Cost of revenue

24,814 20,273 49,516 40,244 Gross

profit 36,306 27,454 70,509 54,497 Operating expenses: Research and

development 8,367 6,836 16,139 13,683 Sales and marketing 17,912

16,932 35,390 32,710 General and administrative 9,833 6,845

18,936 15,705 Total operating expenses 36,112

30,613 70,465 62,098 Income (loss) from

operations 194 (3,159 ) 44 (7,601 ) Other income (expense), net:

Interest expense (2,378 ) (888 ) (3,188 ) (1,770 ) Interest income

and other 206 90 604 208 Total other

income (expense), net (2,172 ) (798 ) (2,584 ) (1,562 ) Loss before

income taxes (1,978 ) (3,957 ) (2,540 ) (9,163 ) Provision for

income taxes 64 50 109 99 Net loss $

(2,042 ) $ (4,007 ) $ (2,649 ) $ (9,262 ) Net loss per share: Basic

and diluted $ (0.04 ) $ (0.07 ) $ (0.05 ) $ (0.17 ) Shares used in

computing net loss per share: Basic and diluted 57,903

54,723 57,453 54,208

FIVE9, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June 30, 2018

June 30, 2017 Cash flows from operating activities:

Net loss $ (2,649 ) $ (9,262 ) Adjustments to reconcile net loss to

net cash provided by operating activities: Depreciation and

amortization 4,769 4,365 Amortization of premium on marketable

investments (43 ) — Provision for doubtful accounts 66 45

Stock-based compensation 12,122 6,983 Gain on sale of convertible

note held for investment (312 ) — Non-cash adjustment on investment

(40 ) (161 ) Amortization of debt discount and issuance costs 40 40

Amortization of discount and issuance costs on convertible senior

notes 1,733 — Accretion of interest 44 10 Others (19 ) (14 )

Changes in operating assets and liabilities: Accounts receivable

(1,114 ) (2,426 ) Prepaid expenses and other current assets (3,140

) (4,106 ) Deferred contract acquisition costs (3,338 ) — Other

assets 4 166 Accounts payable 1,493 1,187 Accrued and other current

liabilities 2,415 909 Accrued federal fees and sales tax liability

246 171 Deferred revenue 1,170 2,025 Other liabilities 261

311 Net cash provided by operating activities 13,708

243

Cash flows from investing activities: Purchases

of marketable investments (109,506 ) — Proceeds from maturities of

marketable investments 1,400 — Purchases of property and equipment

(1,092 ) (1,178 ) Proceeds from sale of convertible note held for

investment 1,923 — Net cash used in investing

activities (107,275 ) (1,178 )

Cash flows from financing

activities: Proceeds from issuance of convertible senior notes,

net of issuance costs paid of $7,946 250,804 — Payments for capped

call transactions (31,412 ) — Proceeds from exercise of common

stock options 5,821 2,303 Proceeds from sale of common stock under

ESPP 2,884 1,800 Repayments on revolving line of credit (32,594 ) —

Payments of notes payable (318 ) (400 ) Payments of capital leases

(4,403 ) (3,741 ) Net cash provided by (used in) financing

activities 190,782 (38 ) Net increase (decrease) in cash and

cash equivalents 97,215 (973 )

Cash and cash equivalents:

Beginning of period 68,947 58,122 End of period $

166,162 $ 57,149

FIVE9, INC.

RECONCILIATION OF ASC 605 TO ASC 606

P&L ITEMS - GAAP

(In thousands, except per share data and

percentages)

(Unaudited)

Three Months Ended June 30, 2018 ASC

605 Adjustments ASC 606

Revenue $ 60,772 $ 348 $

61,120 Cost of revenue 24,668 146 24,814

GAAP gross profit 36,104 202

36,306 GAAP gross margin 59.4 %

59.4 % Operating expenses: Research and development

8,367 —

8,367

Sales and marketing 19,588 (1,676 )

17,912 General and administrative 9,833 —

9,833

Total operating expenses 37,788 (1,676 ) 36,112

GAAP income (loss) from operations (1,684

) 1,878 194 GAAP Operating Margin

(2.8 )% 0.3 % Other income (expense),

net (2,172 ) —

(2,172 ) Loss before income taxes (3,856 ) 1,878 (1,978 ) Provision

for income taxes 64 — 64

GAAP net loss

$ (3,920 ) $ 1,878

$ (2,042 ) Net loss per share: Basic and

diluted $ (0.07 ) $ 0.03 $ (0.04 ) Shares used in computing

net loss per share: Basic and diluted 57,903 — 57,903

FIVE9, INC.

RECONCILIATION OF ASC 605 TO ASC 606

P&L ITEMS - NON-GAAP

(In thousands, except per share data and

percentages)

(Unaudited)

Three Months Ended

June 30, 2018

ASC 605 Adjustments ASC 606

Revenue $ 60,772 $ 348 $

61,120 Cost of revenue 21,951 146 22,097

Adjusted gross profit 38,821 202

39,023 Adjusted gross margin 63.9 %

63.8 % Operating expenses: Research and development

7,070 — 7,070 Sales and marketing 17,973 (1,676 ) 16,297 General

and administrative 5,975 — 5,975 Total

operating expenses 31,018 (1,676 ) 29,342

Adjusted

EBITDA 7,803 1,878 9,681 Adjusted

EBITDA margin 12.8 % 15.8 %

Depreciation 2,333 — 2,333

Non-GAAP

operating income 5,470 1,878 7,348

Non-GAAP operating margin 9.0 % 12.0

% Other income (expense), net (419 ) — (419 ) Income

before income taxes 5,051 1,878 6,929 Provision for income taxes 64

— 64

Non-GAAP net income $

4,987 $ 1,878 $

6,865 Non-GAAP net income per share: Basic $

0.09 $ 0.03 $ 0.12 Diluted $ 0.08 $

0.03 $ 0.11 Shares used in computing non-GAAP net

income per share: Basic 57,903 — 57,903

Diluted 61,105 — 61,105

FIVE9, INC.

RECONCILIATION OF GAAP GROSS PROFIT TO

ADJUSTED GROSS PROFIT

(In thousands, except percentages)

(Unaudited)

Three Months Ended Six Months Ended

June 30, 2018 June 30, 2017 June 30,

2018 June 30, 2017 GAAP gross profit $

36,306 $ 27,454 $ 70,509 $ 54,497 GAAP gross margin 59.4 % 57.5 %

58.7 % 57.5 % Non-GAAP adjustments: Depreciation 1,776 1,628 3,482

3,116 Intangibles amortization 88 88 176 176 Stock-based

compensation 853 575 1,531 1,009

Adjusted gross profit $ 39,023 $ 29,745 $ 75,698

$ 58,798 Adjusted gross margin 63.8 % 62.3 % 63.1 %

62.1 %

FIVE9, INC.

RECONCILIATION OF GAAP NET LOSS TO

ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended Six Months

Ended June 30, 2018 June 30, 2017 June

30, 2018 June 30, 2017 GAAP net loss $

(2,042 ) $ (4,007 ) $ (2,649 ) $ (9,262 ) Non-GAAP adjustments:

Depreciation and amortization 2,449 2,270 4,769 4,365 Stock-based

compensation 6,797 3,854 12,122 6,983 Interest expense 2,378 888

3,188 1,770 Interest income and other (206 ) (90 ) (604 ) (208 )

Legal settlement — — — 1,700 Legal and indemnification fees related

to settlement 241 — 241 135 Provision for income taxes 64 50

109 99 Adjusted EBITDA $ 9,681 $ 2,965

$ 17,176 $ 5,582

FIVE9, INC.

RECONCILIATION OF GAAP OPERATING INCOME

(LOSS) TO NON-GAAP OPERATING INCOME

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended

June 30, 2018 June 30, 2017 June 30,

2018 June 30, 2017 Income (loss) from

operations $ 194 $ (3,159 ) $ 44 $ (7,601 ) Non-GAAP adjustments:

Stock-based compensation 6,797 3,854 12,122 6,983 Intangibles

amortization 116 117 232 234 Legal settlement — — — 1,700 Legal and

indemnification fees related to settlement 241 — 241

135 Non-GAAP operating income $ 7,348 $ 812

$ 12,639 $ 1,451

FIVE9, INC.

RECONCILIATION OF GAAP NET LOSS TO

NON-GAAP NET INCOME (LOSS)

(In thousands, except per share data)

(Unaudited)

Three Months Ended Six Months Ended

June 30, 2018 June 30, 2017 June 30,

2018 June 30, 2017 GAAP net loss $ (2,042

) $ (4,007 ) $ (2,649 ) $ (9,262 ) Non-GAAP adjustments:

Stock-based compensation 6,797 3,854 12,122 6,983 Intangibles

amortization 116 117 232 234 Amortization of debt discount and

issuance costs 20 20 40 40 Amortization of discount and issuance

costs on convertible senior notes 1,733 — 1,733 — Legal settlement

— — — 1,700 Legal and indemnification fees related to settlement

241 — 241 135 Non-cash adjustment on investment — (58 ) (352

) (161 ) Non-GAAP net income (loss) $ 6,865 $ (74 ) $ 11,367

$ (331 ) GAAP net loss per share: Basic and diluted $ (0.04

) $ (0.07 ) $ (0.05 ) $ (0.17 ) Non-GAAP net income (loss) per

share: Basic $ 0.12 $ — $ 0.20 $ (0.01 )

Diluted $ 0.11 $ — $ 0.19 $ (0.01 ) Shares

used in computing GAAP net loss per share: Basic and diluted 57,903

54,723 57,453 54,208 Shares used in

computing non-GAAP net income (loss) per share: Basic 57,903

54,723 57,453 54,208 Diluted 61,105

54,723 60,741 54,208

FIVE9, INC.SUMMARY OF

STOCK-BASED COMPENSATION, DEPRECIATION AND INTANGIBLES

AMORTIZATION(In thousands)(Unaudited)

Three Months Ended June 30, 2018

June 30, 2017

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Cost of revenue $ 853 $ 1,776 $ 88 $ 575 $ 1,628 $ 88

Research and development 1,064 233 — 801 237 — Sales and marketing

1,585 2 28 1,224 1 29 General and administrative 3,295 322

— 1,254 287 — Total $ 6,797 $

2,333 $ 116 $ 3,854 $ 2,153 $ 117

Six Months Ended June 30, 2018 June

30, 2017

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Cost of revenue $ 1,531 $ 3,482 $ 176 $ 1,009 $ 3,116 $ 176

Research and development 1,941 427 — 1,438 443 — Sales and

marketing 2,947 3 56 2,152 2 58 General and administrative 5,703

625 — 2,384 570 — Total $ 12,122

$ 4,537 $ 232 $ 6,983 $ 4,131 $

234

FIVE9, INC.RECONCILIATION OF

GAAP NET LOSS TO NON-GAAP NET INCOME – GUIDANCE(In thousands,

except per share data)(Unaudited)

Three Months Ending Year Ending

September 30, 2018 December 31, 2018 Low

High Low High GAAP net

loss $ (8,126 ) $ (7,126 ) $ (13,961 ) $ (11,961 ) Non-GAAP

adjustments: Stock-based compensation 9,966 9,966 29,614 29,614

Intangibles amortization 116 116 442 442 Amortization of discount

and issuance costs on convertible senior notes 3,144 3,144 7,881

7,881 Amortization of debt discount and issuance costs — — 135 135

Legal and indemnification fees related to settlement — — 241 241

Non-cash adjustment on investment — — (352 ) (352 ) Income tax

expense effects (1) — — — — Non-GAAP

net income $ 5,100 $ 6,100 $ 24,000 $ 26,000

GAAP net loss per share, basic and diluted $ (0.14 ) $ (0.12

) $ (0.24 ) $ (0.20 ) Non-GAAP net income per share: Basic $ 0.09

$ 0.10 $ 0.41 $ 0.44 Diluted $ 0.08

$ 0.10 $ 0.39 $ 0.42 Shares used in

computing GAAP net loss per share and non-GAAP net income per

share: Basic 59,000 59,000 58,500 58,500

Diluted 62,500 62,500 62,000 62,000

(1) Non-GAAP adjustments do not have an

impact on our income tax provision due to past non-GAAP losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180806005538/en/

Investor Relations Contacts:Five9, Inc.Barry Zwarenstein,

925-201-2000 ext. 5959Chief Financial OfficerIR@five9.comorThe

Blueshirt Group for Five9, Inc.Lisa Laukkanen,

415-217-4967Lisa@blueshirtgroup.com

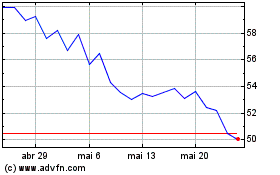

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024