36% Growth in LTM Enterprise Subscription

Revenue

Fourth Quarter GAAP Net Income of $3.7

Million

Fourth Quarter Adjusted EBITDA of $16.4

Million, a Record 22.7% of Revenue

Five9, Inc. (NASDAQ:FIVN), a leading provider of cloud contact

center software for the digital enterprise, today reported results1

for the fourth quarter and full year ended December 31,

2018.

Fourth Quarter 2018 Financial Results

- Revenue for the fourth quarter of 2018

increased 31% to a record $72.3 million, compared to $55.4 million

for the fourth quarter of 2017.

- GAAP gross margin was 60.8% for the

fourth quarter of 2018, compared to 59.6% for the fourth quarter of

2017.

- Adjusted gross margin was 65.1% for the

fourth quarter of 2018, compared to 63.6% for the fourth quarter of

2017.

- GAAP net income for the fourth quarter

of 2018 was $3.7 million, or $0.06 per diluted share, compared to

GAAP net loss of $(0.6) million, or $(0.01) per basic share, for

the fourth quarter of 2017.

- Non-GAAP net income for the fourth

quarter of 2018 was $14.5 million, or $0.23 per diluted share,

compared to non-GAAP net income of $4.0 million, or $0.07 per

diluted share, for the fourth quarter of 2017.

- Adjusted EBITDA for the fourth quarter

of 2018 was $16.4 million, or a record 22.7% of revenue, compared

to $6.9 million, or 12.4% of revenue, for the fourth quarter of

2017.

- GAAP operating cash flow for the fourth

quarter of 2018 was $15.5 million, compared to GAAP operating cash

flow of $2.9 million for the fourth quarter of 2017.

2018 Financial Results

- Total revenue for 2018 increased 29% to

a record $257.7 million, compared to $200.2 million in 2017.

- GAAP gross margin was 59.6% for 2018,

compared to 58.5% in 2017.

- Adjusted gross margin was 63.9% for

2018, compared to 62.7% in 2017.

- GAAP net loss for 2018 was $(0.2)

million, or $(0.00) per basic share, compared to a GAAP net loss of

$(9.0) million, or $(0.16) per basic share, in 2017.

- Non-GAAP net income for 2018 was $37.0

million, or $0.60 per diluted share, compared to a non-GAAP net

income of $6.3 million, or $0.11 per diluted share, in 2017.

- Adjusted EBITDA for 2018 was $46.4

million, or a record 18.0% of revenue, compared to

$17.6 million, or 8.8% of revenue, in 2017.

- GAAP operating cash flow for 2018 was

$38.6 million, compared to GAAP operating cash flow of $11.1

million in 2017.

“We closed 2018 with our strongest quarter ever with fourth

quarter revenue growth accelerating to 31%. This accelerating

revenue growth, combined with our strong execution and expense

discipline, allowed us to deliver 22.7% adjusted EBITDA margin.

These stand-out results are representative of the large market

opportunity we are addressing and continued momentum in our

Enterprise business. As customer experience becomes a strategic

priority and the market shifts towards the cloud, we believe Five9

is extremely well positioned to capitalize on this opportunity. Our

customers view Five9 as a trusted strategic partner who can help

them at every stage of the customer experience journey. We believe

that we are at the nexus of a transformative opportunity, and that

this will enable us to continue to deliver sustained growth and

advance our goal of creating the world’s best intelligent contact

center delivered through the cloud and powered by AI.”

- Rowan Trollope, CEO, Five9

Business Outlook

- For the full year 2019, Five9

expects to report:

- Revenue in the range of $298.5 to

$301.5 million.

- GAAP net loss in the range of $(22.1)

to $(19.1) million, or $(0.36) to $(0.31) per basic share.

- Non-GAAP net income in the range of

$36.8 to $39.8 million, or $0.58 to $0.62 per diluted share.

- For the first quarter of 2019, Five9

expects to report:

- Revenue in the range of $70.0 to $71.0

million.

- GAAP net loss in the range of $(5.7) to

$(4.7) million, or a loss of $(0.10) to $(0.08) per basic

share.

- Non-GAAP net income in the range of

$7.1 to $8.1 million, or $0.11 to $0.13 per diluted share.

1On January 1, 2018, Five9 adopted Accounting Standards

Codification (ASC) 606 “Revenue from Contracts with Customers”

using the modified retrospective transition method. While the

financial results for the fourth quarter and full year 2018 are

presented under ASC 606, financial results for the fourth quarter

and full year 2017 are presented under ASC 605. A reconciliation of

the financial results for the fourth quarter and full year 2018

under ASC 606 and ASC 605 is presented in the “Reconciliation of

ASC 605 to ASC 606 P&L items” table included in this

release.

Conference Call Details

Five9 will discuss its fourth quarter and full year 2018 results

today, February 19, 2019, via teleconference at 4:30 p.m.

Eastern Time. To access the call (ID 2920436), please dial:

800-458-4121 or 323-794-2093. An audio replay of the call will be

available through March 5, 2019 by dialing 888-203-1112 or

719-457-0820 and entering access code 2920436. A copy of this press

release will be furnished to the Securities and Exchange Commission

on a Current Report on Form 8-K, and will be posted to our web

site, prior to the conference call.

A webcast of the call will be available on the Investor

Relations section of the Company’s website at

http://investors.five9.com/.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted gross

profit by adding back the following items to gross profit:

depreciation, intangibles amortization and stock-based

compensation. We calculate adjusted EBITDA by adding back or

removing the following items to or from GAAP net income (loss):

depreciation, amortization, stock-based compensation, interest

expense, interest (income) and other, non-recurring litigation

settlement costs and related indemnification fees, reversal of

interest and penalties on accrued federal fees, and provision for

income taxes. We calculate non-GAAP operating income as operating

income (loss) excluding stock-based compensation, intangibles

amortization, non-recurring litigation settlement costs and related

indemnification fees, and reversal of interest and penalties on

accrued federal fees. We calculate non-GAAP net income as GAAP net

income (loss) excluding stock-based compensation, intangibles

amortization, amortization of debt discount and issuance costs,

amortization of discount and issuance costs on convertible senior

notes, non-recurring litigation settlement costs and related

indemnification fees, reversal of interest and penalties on accrued

federal fees and non-cash adjustment on investment. Non-GAAP

financial measures do not have any standardized meaning and are

therefore unlikely to be comparable to similarly titled measures

presented by other companies. Five9 considers these

non-GAAP financial measures to be important because they provide

useful measures of the operating performance of the Company,

exclusive of factors that do not directly affect what we consider

to be our core operating performance, as well as unusual events.

The Company’s management uses these measures to (i) illustrate

underlying trends in the Company’s business that could otherwise be

masked by the effect of income or expenses that are excluded from

non-GAAP measures, and (ii) establish budgets and operational goals

for managing the Company’s business and evaluating its performance.

In addition, investors often use similar measures to evaluate the

operating performance of a company. Non-GAAP financial measures are

presented only as supplemental information for purposes of

understanding the Company's operating results. The non-GAAP

financial measures should not be considered a substitute for

financial information presented in accordance with GAAP. Please see

the reconciliation of non-GAAP financial measures set forth herein

and attached to this release.

Forward-Looking Statements

This news release contains certain forward-looking statements,

including the statements in the quote from our Chief Executive

Officer, including statements regarding Five9’s market position,

business momentum, expectations for future growth, product

positioning, enterprise customer views of the value of our products

and vision for the future, the Company’s long-term goals, and the

first quarter and full year 2019 financial projections set forth

under the caption “Business Outlook,” that are based on our current

expectations and involve numerous risks and uncertainties that may

cause these forward-looking statements to be inaccurate. Risks that

may cause these forward-looking statements to be inaccurate

include, among others: (i) our quarterly and annual results may

fluctuate significantly, including as a result of the timing and

success of new product and feature introductions by us, may not

fully reflect the underlying performance of our business and may

result in decreases in the price of our common stock; (ii) if we

are unable to attract new clients or sell additional services and

functionality to our existing clients, our revenue and revenue

growth will be harmed; (iii) our recent rapid growth may not be

indicative of our future growth, and even if we continue to grow

rapidly, we may fail to manage our growth effectively; (iv) failure

to adequately expand our sales force could impede our growth; (v)

if we fail to manage our technical operations infrastructure, our

existing clients may experience service outages, our new clients

may experience delays in the deployment of our solution and we

could be subject to, among other things, claims for credits or

damages; (vi) security breaches and improper access to or

disclosure of our data or our clients’ data, or other cyber attacks

on our systems, could result in litigation and regulatory risk,

harm our reputation and adversely affect our business; (vii) the

markets in which we participate involve numerous competitors and

are highly competitive, and if we do not compete effectively, our

operating results could be harmed; (viii) if our existing clients

terminate their subscriptions or reduce their subscriptions and

related usage, our revenues and gross margins will be harmed and we

will be required to spend more money to grow our client base; (ix)

our growth depends in part on the success of our strategic

relationships with third parties and our failure to successfully

grow and manage these relationships could harm our business; (x) we

have established, and are continuing to increase, our network of

master agents and resellers to sell our solution; our failure to

effectively develop, manage, and maintain this network could

materially harm our revenues; (xi) we sell our solution to larger

organizations that require longer sales and implementation cycles

and often demand more configuration and integration services or

customized features and functions that we may not offer, any of

which could delay or prevent these sales and harm our growth rates,

business and operating results; (xii) because a significant

percentage of our revenue is derived from existing clients,

downturns or upturns in new sales will not be immediately reflected

in our operating results and may be difficult to discern; (xiii) we

rely on third-party telecommunications and internet service

providers to provide our clients and their customers with

telecommunication services and connectivity to our cloud contact

center software and any failure by these service providers to

provide reliable services could cause us to lose clients and

subject us to claims for credits or damages, among other things;

(xiv) we have a history of losses and we may be unable to achieve

or sustain profitability; (xv) the contact center software

solutions market is subject to rapid technological change, and we

must develop and sell incremental and new products in order to

maintain and grow our business; (xvi) we may not be able to secure

additional financing on favorable terms, or at all, to meet our

future capital needs; (xvii) failure to comply with laws and

regulations could harm our business and our reputation; (xviii) we

may not have sufficient cash to service our convertible senior

notes and repay such notes, if required; and (xix) the other risks

detailed from time-to-time under the caption “Risk Factors” and

elsewhere in our Securities and Exchange Commission filings and

reports, including, but not limited to, our most recent quarterly

report on Form 10-Q. Such forward-looking statements speak only as

of the date hereof and readers should not unduly rely on such

statements. We undertake no obligation to update the information

contained in this press release, including in any forward-looking

statements.

About Five9

Five9 is a leading provider of cloud contact center software for

the digital enterprise, bringing the power of cloud innovation to

customers and facilitating more than three billion customer

interactions annually. Five9 provides end-to-end

solutions with omnichannel routing, analytics, WFO, and AI to

increase agent productivity and deliver tangible

business results. The Five9 platform is reliable, secure,

compliant, and scalable; designed to create exceptional

personalized customer experiences. For more information, visit

www.five9.com.

FIVE9, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

December 31, 2018 December 31,

2017 ASSETS Current assets: Cash and cash

equivalents $ 81,912 $ 68,947 Marketable investments 209,907 —

Accounts receivable, net 24,797 19,048 Prepaid expenses and other

current assets 8,014 4,840 Deferred contract acquisition costs

9,372 — Total current assets 334,002 92,835 Property

and equipment, net 25,885 19,888 Intangible assets, net 631 1,073

Goodwill 11,798 11,798 Other assets 836 2,602 Deferred contract

acquisition costs — less current portion 21,514 —

Total assets $ 394,666 $ 128,196

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable $ 7,010 $ 4,292 Accrued and other

current liabilities 13,771 11,787 Accrued federal fees 1,434 1,151

Sales tax liability 1,741 1,326 Notes payable — 336 Capital leases

6,647 6,651 Deferred revenue 17,391 13,975 Total

current liabilities 47,994 39,518 Convertible senior notes 196,763

— Revolving line of credit — 32,594 Sales tax liability — less

current portion 841 1,044 Capital leases — less current portion

4,509 7,161 Other long-term liabilities 1,811 1,041

Total liabilities 251,918 81,358

Stockholders’ equity: Common stock 59 57 Additional paid-in

capital 294,279 222,202 Accumulated other comprehensive loss (93 )

— Accumulated deficit (151,497 ) (175,421 )

Total stockholders’

equity 142,748 46,838

Total liabilities and

stockholders’ equity $ 394,666 $ 128,196

FIVE9, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share data)

(Unaudited)

Three Months Ended Twelve Months

Ended

December 31,2018

December 31,2017

December 31,2018

December 31,2017

Revenue $ 72,335 $ 55,403 $ 257,664 $ 200,225 Cost of

revenue 28,339 22,363 104,034 83,104

Gross profit 43,996 33,040 153,630 117,121 Operating expenses:

Research and development 8,451 6,748 34,172 27,120 Sales and

marketing 18,793 17,358 72,001 66,570 General and administrative

10,766 8,767 40,448 29,151 Total

operating expenses 38,010 32,873 146,621

122,841 Income (loss) from operations 5,986 167 7,009 (5,720

) Other income (expense), net: Interest expense (3,462 ) (836 )

(10,245 ) (3,471 ) Interest income and other 1,359 164

3,315 490 Total other income (expense), net

(2,103 ) (672 ) (6,930 ) (2,981 ) Income (loss) before income taxes

3,883 (505 ) 79 (8,701 ) Provision for income taxes 150 126

300 268 Net income (loss) $ 3,733 $

(631 ) $ (221 ) $ (8,969 ) Net income (loss) per share: Basic $

0.06 $ (0.01 ) $ — $ (0.16 ) Diluted $ 0.06 $

(0.01 ) $ — $ (0.16 ) Shares used in computing net income

(loss) per share: Basic 58,926

56,034 58,076 54,946 Diluted 62,071

56,034 58,076 54,946

FIVE9, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Twelve Months Ended December 31, 2018

December 31, 2017 Cash flows from operating

activities: Net loss $ (221 ) $ (8,969 ) Adjustments to

reconcile net loss to net cash provided by operating activities:

Depreciation and amortization 10,274 8,314 Amortization of premium

on marketable investments (670 ) — Provision for doubtful accounts

90 95 Stock-based compensation 28,484 15,343 Amortization of debt

discount and issuance costs 129 80 Amortization of discount and

issuance costs on convertible senior notes 7,881 — Reversal of

interest and penalties on accrued federal fees — (2,133 ) Gain on

sale of convertible note held for investment (312 ) — Non-cash

adjustment on investment (40 ) (366 ) Accretion of interest 44 21

Others 27 (48 ) Changes in operating assets and liabilities:

Accounts receivable (5,829 ) (5,163 ) Prepaid expenses and other

current assets (2,806 ) (1,912 ) Deferred contract acquisition

costs (7,748 ) — Other assets 193 (33 ) Accounts payable 2,418 813

Accrued and other current liabilities 1,865 1,061 Accrued federal

fees and sales tax liability 495 90 Deferred revenue 3,956 3,882

Other liabilities 392 31 Net cash provided by

operating activities 38,622 11,106

Cash flows from

investing activities: Purchases of marketable investments

(220,704 ) — Proceeds from maturities of marketable investments

11,293 — Purchases of property and equipment (9,261 ) (2,650 )

Proceeds from sale of convertible note held for investment 1,923

— Net cash (used in) investing activities (216,749 )

(2,650 )

Cash flows from financing activities: Proceeds from

issuance of convertible senior notes, net of issuance costs paid of

$8,039 250,711 — Payments for capped call transactions (31,412 ) —

Proceeds from exercise of common stock options 7,779 6,035 Proceeds

from sale of common stock under ESPP 5,730 4,101 Payments of

employee taxes related to vested common stock (260 ) — Repayments

on revolving line of credit (32,594 ) — Payments of notes payable

(318 ) (699 ) Payments of capital leases (8,544 ) (7,068 ) Net cash

provided by financing activities 191,092 2,369 Net

increase in cash and cash equivalents 12,965 10,825

Cash and

cash equivalents: Beginning of period 68,947 58,122

End of period $ 81,912 $ 68,947

FIVE9, INC.

RECONCILIATION OF ASC 605 TO ASC 606

P&L ITEMS - GAAP

(In thousands, except per share data and

percentages)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2018 ASC

605 Adjustments ASC 606 ASC

605 Adjustments ASC 606

Revenue $ 72,583 $ (248 )

$ 72,335 $ 256,548 $

1,116 $ 257,664 Cost of revenue 28,360

(21 ) 28,339 103,525 509 104,034

GAAP gross profit 44,223 (227 )

43,996 153,023 607 153,630 GAAP

gross margin 60.9 % 60.8 %

59.6 % 59.6 % Operating expenses:

Research and development 8,451 — 8,451 34,172 — 34,172 Sales and

marketing 21,447 (2,654 ) 18,793 79,749 (7,748 ) 72,001 General and

administrative 10,766 — 10,766 40,448 —

40,448 Total operating expenses 40,664 (2,654

) 38,010 154,369 (7,748 ) 146,621

GAAP

income (loss) from operations 3,559 2,427

5,986 (1,346 ) 8,355 7,009

GAAP Operating Margin 4.9 % 8.3

% (0.5 )% 2.7 % Other income

(expense), net (2,103 ) — (2,103 ) (6,930 ) — (6,930

) Income (loss) before income taxes 1,456 2,427 3,883 (8,276 )

8,355 79 Provision for income taxes 150 — 150

300 — 300

GAAP net income (loss)

$ 1,306 $ 2,427 $

3,733 $ (8,576 ) $

8,355 $ (221 ) Net income (loss)

per share: Basic $ 0.02 $ 0.04 $ 0.06 $ (0.15

) $ 0.15 $ — Diluted $ 0.02 $ 0.04 $

0.06 $ (0.15 ) $ 0.15 $ — Shares used in

computing net income (loss) per share: Basic 58,926 —

58,926 58,076 — 58,076 Diluted 62,071

— 62,071 58,076 — 58,076

FIVE9, INC.

RECONCILIATION OF ASC 605 TO ASC 606

P&L ITEMS - NON-GAAP

(In thousands, except per share data and

percentages)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2018 ASC

605 Adjustments ASC 606 ASC

605 Adjustments ASC 606

Revenue $ 72,583 $ (248 )

$ 72,335 $ 256,548 $

1,116 $ 257,664 Cost of revenue 25,289

(21 ) 25,268 92,384 509 92,893

Adjusted gross profit 47,294 (227 )

47,067 164,164 607 164,771 Adjusted

gross margin 65.2 % 65.1 %

64.0 % 63.9 % Operating expenses:

Research and development 7,110 — 7,110 27,833 — 27,833 Sales and

marketing 19,694 (2,654 ) 17,040 73,347 (7,748 ) 65,599 General and

administrative 6,507 — 6,507 24,980 —

24,980 Total operating expenses 33,311 (2,654

) 30,657 126,160 (7,748 ) 118,412

Adjusted

EBITDA 13,983 2,427 16,410 38,004

8,355 46,359 Adjusted EBITDA margin

19.3 % 22.7 % 14.8 %

18.0 % Depreciation 2,745 — 2,745

9,832 — 9,832

Non-GAAP operating

income 11,238 2,427 13,665 28,172

8,355 36,527 Non-GAAP operating margin

15.5 % 18.9 % 11.0 %

14.2 % Other income (expense), net 996 —

996 728 — 728 Income before

income taxes 12,234 2,427 14,661 28,900 8,355 37,255 Provision for

income taxes 150 — 150 300 — 300

Non-GAAP net income $ 12,084

$ 2,427 $ 14,511 $

28,600 $ 8,355 $

36,955 Non-GAAP net income per share: Basic $

0.21 $ 0.04 $ 0.25 $ 0.49 $ 0.15

$ 0.64 Diluted $ 0.19 $ 0.04 $ 0.23 $

0.47 $ 0.13 $ 0.60 Shares used in computing

non-GAAP net income per share: Basic 58,926 — 58,926

58,076 — 58,076 Diluted 62,071 —

62,071 61,428 — 61,428

FIVE9, INC.

RECONCILIATION OF GAAP GROSS PROFIT TO

ADJUSTED GROSS PROFIT

(In thousands, except percentages)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2017

December 31, 2018 December 31, 2017

GAAP gross profit $ 43,996 $ 33,040 $ 153,630 $ 117,121 GAAP gross

margin 60.8 % 59.6 % 59.6 % 58.5 % Non-GAAP adjustments:

Depreciation 2,041 1,523 7,456 5,949 Intangibles amortization 88 88

352 351 Stock-based compensation 942 594 3,333

2,202 Adjusted gross profit $ 47,067 $ 35,245

$ 164,771 $ 125,623 Adjusted gross margin 65.1 % 63.6

% 63.9 % 62.7 %

FIVE9, INC.

RECONCILIATION OF GAAP NET INCOME

(LOSS) TO ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2017

December 31, 2018 December 31, 2017

GAAP net income (loss) $ 3,733 $ (631 ) $ (221 ) $ (8,969 )

Non-GAAP adjustments: Depreciation and amortization 2,838 2,068

10,274 8,314 Stock-based compensation 7,493 4,640 28,484 15,343

Interest expense 3,462 836 10,245 3,471 Interest (income) and other

(1,359 ) (164 ) (3,315 ) (490 ) Legal settlement — — — 1,700 Legal

and indemnification fees related to settlement 93 — 592 135

Reversal of interest and penalties on accrued federal fees

(G&A) — — — (2,133 ) Provision for income taxes 150 126

300 268 Adjusted EBITDA $ 16,410 $

6,875 $ 46,359 $ 17,639 Adjusted EBITDA as %

of revenue 22.7 % 12.4 % 18.0 % 8.8 %

FIVE9, INC.

RECONCILIATION OF GAAP OPERATING INCOME

(LOSS) TO NON-GAAP OPERATING INCOME

(In thousands)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2017

December 31, 2018 December 31, 2017

GAAP operating income (loss) $ 5,986 $ 167 $ 7,009 $ (5,720 )

Non-GAAP adjustments: Stock-based compensation 7,493 4,640 28,484

15,343 Intangibles amortization 93 116 442 465 Legal settlement — —

— 1,700 Legal and indemnification fees related to settlement 93 —

592 135 Reversal of interest and penalties on accrued federal fees

(G&A) — — — (2,133 ) Non-GAAP operating

income $ 13,665 $ 4,923 $ 36,527 $ 9,790

FIVE9, INC.

RECONCILIATION OF GAAP NET INCOME

(LOSS) TO NON-GAAP NET INCOME

(In thousands, except per share data)

(Unaudited)

Three Months Ended Twelve Months

Ended December 31, 2018 December 31, 2017

December 31, 2018 December 31, 2017

GAAP net income (loss) $ 3,733 $ (631 ) $ (221 ) $ (8,969 )

Non-GAAP adjustments: Stock-based compensation 7,493 4,640 28,484

15,343 Intangibles amortization 93 116 442 465 Amortization of debt

discount and issuance costs — 20 129 80 Amortization of discount

and issuance costs on convertible senior notes 3,099 — 7,881 —

Legal settlement — — — 1,700 Legal and indemnification fees related

to settlement 93 — 592 135 Reversal of interest and penalties on

accrued federal fees (G&A) — — — (2,133 ) Non-cash adjustment

on investment — (133 ) (352 ) (366 ) Non-GAAP net income $

14,511 $ 4,012 $ 36,955 $ 6,255 GAAP

net income (loss) per share: Basic $ 0.06 $ (0.01 ) $ —

$ (0.16 ) Diluted $ 0.06 $ (0.01 ) $ — $ (0.16

) Non-GAAP net income per share: Basic $ 0.25 $ 0.07

$ 0.64 $ 0.11 Diluted $ 0.23 $ 0.07 $

0.60 $ 0.11 Shares used in computing GAAP net income

(loss) per share: Basic 58,926 56,034 58,076

54,946 Diluted 62,071 56,034 58,076

54,946 Shares used in computing non-GAAP net income per

share: Basic 58,926 56,034 58,076 54,946

Diluted 62,071 59,905 61,428 59,073

FIVE9, INC.

SUMMARY OF STOCK-BASED COMPENSATION,

DEPRECIATION AND INTANGIBLES AMORTIZATION

(In thousands)

(Unaudited)

Three Months Ended December 31, 2018

December 31, 2017

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Cost of revenue $ 942 $ 2,041 $ 88 $ 594 $ 1,523 $ 88

Research and development 1,010 331 — 807 170 — Sales and marketing

1,747 1 5 1,128 2 28 General and administrative 3,794 372

— 2,111 257 — Total $ 7,493 $

2,745 $ 93 $ 4,640 $ 1,952 $ 116

Twelve Months Ended December 31, 2018 December 31,

2017

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Stock-BasedCompensation

Depreciation

IntangiblesAmortization

Cost of revenue $ 3,333 $ 7,456 $ 352 $ 2,202 $ 5,949 $ 351

Research and development 5,303 1,036 — 3,042 795 — Sales and

marketing 6,307 5 90 4,364 6 114 General and administrative 13,541

1,335 — 5,735 1,099 — Total $

28,484 $ 9,832 $ 442 $ 15,343 $ 7,849

$ 465

FIVE9, INC.

RECONCILIATION OF GAAP NET LOSS TO

NON-GAAP NET INCOME – GUIDANCE

(In thousands, except per share data)

(Unaudited)

Three Months Ending Year Ending

March 31, 2019 December 31, 2019 Low

High Low High GAAP net loss $

(5,725 ) $ (4,725 ) $ (22,075 ) $ (19,075 ) Non-GAAP adjustments:

Stock-based compensation 9,658 9,658 45,723 45,723 Intangibles

amortization 88 88 351 351 Amortization of discount and issuance

costs on convertible senior notes 3,079 3,079 12,801 12,801 Income

tax expense effects (1) — — — —

Non-GAAP net income $ 7,100 $ 8,100 $ 36,800 $

39,800 GAAP net loss per share, basic and diluted $ (0.10 )

$ (0.08 ) $ (0.36 ) $ (0.31 ) Non-GAAP net income per share: Basic

$ 0.12 $ 0.14 $ 0.60 $ 0.65 Diluted $

0.11 $ 0.13 $ 0.58 $ 0.62 Shares used

in computing GAAP net loss per share and non-GAAP net income per

share: Basic 60,000 60,000 61,000 61,000

Diluted 63,000 63,000 64,000 64,000

(1) Non-GAAP adjustments do not have an impact on our income tax

provision due to past non-GAAP losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190219005927/en/

Investor Relations Contacts:

Five9, Inc.Barry ZwarensteinChief Financial Officer925-201-2000

ext. 5959IR@five9.com

The Blueshirt Group for Five9, Inc.Lisa

Laukkanen415-217-4967Lisa@blueshirtgroup.com

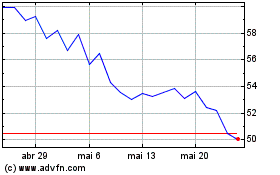

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Five9 (NASDAQ:FIVN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024