ProPetro Holding Corp. ("ProPetro" or "the Company") (NYSE:

PUMP) today announced financial and operational results for the

third quarter of 2024.

Third Quarter 2024 Results and Highlights

- Total revenue of $361 million increased 1% compared to the

prior quarter.

- Net loss was $137 million ($1.32 loss per diluted share) as

compared to a net loss of $4 million in the prior quarter ($0.03

loss per diluted share).

- The net loss in the third quarter included a noncash impairment

expense of $189 million related to the Company's Tier II

diesel-only pumping units and related conventional equipment in our

hydraulic fracturing operating segment which currently represent a

diminishing part of our active fleets.

- Adjusted Net Income in the quarter was $13 million which

excludes the noncash impairment expense.

- Adjusted EBITDA(1) of $71 million was 20% of revenue and

increased 8% compared to the prior quarter.

- Repurchased and retired 1.3 million shares during the quarter

with total repurchases of 12.6 million shares representing

approximately 11% of outstanding shares since plan inception in May

2023.

- Year-to-date net cash provided by operating activities, Free

Cash Flow and Free Cash Flow adjusted for Acquisition

Consideration(2) were $214 million, $84 million, and $105 million,

respectively.

- Three FORCE® electric-powered hydraulic fracturing

fleets are now operating under contract with leading customers with

a fourth expected to be deployed by year-end and a fifth to be

deployed in early 2025.

(1)

Adjusted Net Income (Loss) and

Adjusted EBITDA are non-GAAP financial measures and are described

and reconciled to net income (loss) in the table under “Non-GAAP

Financial Measures.”

(2)

Free Cash Flow and Free Cash Flow adjusted

for Acquisition Consideration are non-GAAP financial measures and

are described and reconciled to net cash from operating activities

in the table under “Non-GAAP Financial Measures."

Management Comments

Sam Sledge, Chief Executive Officer, commented, "ProPetro’s

third quarter results reflect our team’s success in advancing our

strategy, even in a turbulent market environment. Thanks to our

decisive actions and despite moderated customer spending and

activity levels, ProPetro delivered strong financial performance in

the third quarter, while returning capital to shareholders and

capturing additional market share. With three FORCE®

electric fleets in the field, a fourth and fifth on the way, and

plans to order and deploy more electric assets, ProPetro is meeting

the growing demand for our next-generation services and solidifying

our leadership position in the Permian Basin. The Company's strong

financial performance, driven by our investment in industrialized

equipment solutions and services, is supported by our commitment to

operational excellence and financial discipline. In 2024, we have

proven our ability to execute our strategy and are demonstrating

the tremendous potential of ProPetro."

David Schorlemer, Chief Financial Officer, said, "Our third

quarter results are signaling continued reliability of financial

performance in our business. While short-term working capital

headwinds impacted free cash flow, Adjusted EBITDA less our

incurred capital expenditures remained strong. Additionally,

revenues and Adjusted EBITDA were favorably impacted by improved

utilization and cost management despite unfavorable weather delays

during the quarter. Capital spending remained low leading to a

reduction in our full year capital expenditure guidance for the

second time this year. During the quarter, we also recorded a

noncash impairment expense of approximately $189 million on our

Tier II diesel-only hydraulic fracturing equipment. We view this

impairment as validation of our strategy, including our decision

years ago to begin transitioning our fleet towards next generation

gas burning equipment."

Third Quarter 2024 Financial Summary

Revenue was $361 million, compared to $357 million for the

second quarter of 2024. The 1.1% increase in revenue was largely

attributable to a full quarter of AquaPropSM wet sand

solutions partially offset by unfavorable weather impacts in our

hydraulic fracturing and wireline businesses during the

quarter.

Cost of services, excluding depreciation and amortization of

approximately $52 million relating to cost of services, were $268

million during the third quarter of 2024.

General and administrative ("G&A") expense of $28 million

decreased from $31 million in the second quarter of 2024. G&A

expense excluding nonrecurring and noncash items (stock-based

compensation, transaction expense, and other items) of $6 million,

was $22 million, or 6.1% of revenue, a decrease of 12% vs. the

prior quarter.

Net loss totaled $137 million, or $1.32 per diluted share,

compared to net loss of $4 million, or $0.03 per diluted share, for

the second quarter of 2024. During the quarter, the Company

recorded a noncash impairment expense of approximately $189 million

for its conventional Tier II diesel-only pumping units and related

equipment following a comprehensive assessment in compliance with

GAAP standards. The Company is on track to increase its portfolio

of next-generation, lower-emissions hydraulic fracturing equipment

to approximately 75% of its total fleet by the end of 2024,

ensuring alignment with industry trends and customer

preferences.

Adjusted Net Income in the third quarter was $13 million which

excludes the noncash impairment expense compared to an Adjusted Net

Loss of $4 million in the second quarter of 2024.

Adjusted EBITDA increased to $71 million from $66 million in the

second quarter of 2024 primarily related to increased revenues and

improved cost management noted above.

Net cash provided by operating activities was $35 million as

compared to $105 million in the prior quarter, with an investment

in working capital during the third quarter.

Share Repurchase Program

On April 24, 2024, the Company announced a $100 million increase

to its share repurchase program, increasing it to a total of $200

million while extending the plan to May 2025. During the third

quarter, the Company repurchased and retired 1.3 million shares for

$10 million. Since inception, the Company has acquired and retired

12.6 million shares representing approximately 11% of its

outstanding shares.

Liquidity and Capital Spending

As of September 30, 2024, total cash was $47 million and our

borrowings under the ABL Credit Facility were $45 million. Total

liquidity at the end of the third quarter of 2024 was $127 million

including cash and $80 million of available capacity under the ABL

Credit Facility.

Capital expenditures incurred during the third quarter of 2024

were $37 million, which primarily related to maintenance and

support equipment for our FORCE® electric hydraulic

fracturing fleet deployments. Net cash used in investing activities

as shown on the statement of cash flows during the third quarter of

2024 was $40 million.

Guidance

For the second time this year, the Company is reducing its

full-year 2024 capital expenditure guidance to be between $150

million to $175 million, down from prior guidance of $175 million

to $200 million.

During the third quarter, 14 hydraulic fracturing fleets were

active and we expect to run approximately 14 active frac fleets in

the fourth quarter of 2024.

Outlook

Mr. Sledge added, “Looking ahead, while we do expect some

industry softness through normal seasonality and budget exhaustion

in the fourth quarter, demand for our services remains strong. We

believe ProPetro is uniquely positioned to capture the

opportunities ahead and win quality market share. We remain

confident in our ability to deliver strong financial results

through the remainder of this year, in 2025, and beyond. To achieve

this, we are focused on controlling what we can, through decisive

actions that ensure prudent cost management and capital discipline.

With healthy liquidity, a clean balance sheet and the derisking of

future earnings through our next generation equipment and

associated contracts, we believe ProPetro is optimally positioned

to continue transitioning our fleet, strategically pursue organic

and inorganic growth and deliver tangible, sustainable and

increased value to our shareholders."

Conference Call Information

The Company will host a conference call at 8:00 AM Central Time

on Wednesday, October 30, 2024, to discuss financial and operating

results for the third quarter of 2024. The call will also be

webcast on ProPetro’s website at www.propetroservices.com. To access the conference

call, U.S. callers may dial toll free 1-844-340-9046 and

international callers may dial 1-412-858-5205. Please call ten

minutes ahead of the scheduled start time to ensure a proper

connection. A replay of the conference call will be available for

one week following the call and can be accessed toll free by

dialing 1-877-344-7529 for U.S. callers, 1-855-669-9658 for

Canadian callers, as well as 1-412-317-0088 for international

callers. The access code for the replay is 6437367. The Company has

also posted the scripted remarks on its website.

About ProPetro

ProPetro Holding Corp. is a Midland, Texas-based provider of

premium completion services to leading upstream oil and gas

companies engaged in the exploration and production of North

American unconventional oil and natural gas resources. We help

bring reliable energy to the world. For more information visit

www.propetroservices.com.

Forward-Looking Statements

Except for historical information contained herein, the

statements and information in this news release and discussion in

the scripted remarks described above are forward-looking statements

that are made pursuant to the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Statements that are

predictive in nature, that depend upon or refer to future events or

conditions or that include the words “may,” “could,” "confident,"

“plan,” “project,” “budget,” "design," “predict,” “pursue,”

“target,” “seek,” “objective,” “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “will,” “should,” "continue," and other

expressions that are predictions of, or indicate, future events and

trends or that do not relate to historical matters generally

identify forward‑looking statements. Our forward‑looking statements

include, among other matters, statements about the supply of and

demand for hydrocarbons, industry trends and activity levels, our

business strategy, projected financial results and future financial

performance, expected fleet utilization, sustainability efforts,

the future performance of newly improved technology, expected

capital expenditures, the impact of such expenditures on our

performance and capital programs, our fleet conversion strategy and

our share repurchase program. A forward‑looking statement may

include a statement of the assumptions or bases underlying the

forward‑looking statement. We believe that we have chosen these

assumptions or bases in good faith and that they are

reasonable.

Although forward‑looking statements reflect our good faith

beliefs at the time they are made, forward-looking statements are

subject to a number of risks and uncertainties that may cause

actual events and results to differ materially from the

forward-looking statements. Such risks and uncertainties include

the volatility of oil prices, the global macroeconomic uncertainty

related to the conflict in the Israel-Gaza region and continued

hostilities in the Middle East, including rising tensions with

Iran, and the Russia-Ukraine war, general economic conditions,

including the impact of continued inflation and central bank policy

actions, and other factors described in the Company's Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q, particularly the

“Risk Factors” sections of such filings, and other filings with the

Securities and Exchange Commission (the “SEC”). In addition, the

Company may be subject to currently unforeseen risks that may have

a materially adverse impact on it. Accordingly, no assurances can

be given that the actual events and results will not be materially

different than the anticipated results described in the

forward-looking statements. Readers are cautioned not to place

undue reliance on such forward-looking statements and are urged to

carefully review and consider the various disclosures made in the

Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other filings made with the SEC from time to time that

disclose risks and uncertainties that may affect the Company’s

business. The forward-looking statements in this news release are

made as of the date of this news release. ProPetro does not

undertake, and expressly disclaims, any duty to publicly update

these statements, whether as a result of new information, new

developments or otherwise, except to the extent that disclosure is

required by law.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

September 30,

2024

June 30,

2024

September 30,

2023

REVENUE - Service revenue

$

360,868

$

357,021

$

423,804

COSTS AND EXPENSES

Cost of services (exclusive of

depreciation and amortization)

267,555

265,845

292,490

General and administrative (inclusive of

stock-based compensation)

28,356

30,910

28,597

Depreciation and amortization

54,299

57,522

45,361

Impairment expense

188,601

—

—

Loss on disposal of assets

2,149

3,277

12,673

Total costs and expenses

540,960

357,554

379,121

OPERATING (LOSS) INCOME

(180,092

)

(533

)

44,683

OTHER (EXPENSE) INCOME:

Interest expense

(1,939

)

(1,965

)

(1,169

)

Other income (expense), net

3,599

2,403

1,883

Total other (expense) income, net

1,660

438

714

INCOME (LOSS) BEFORE INCOME TAXES

(178,432

)

(95

)

45,397

INCOME TAX BENEFIT (EXPENSE)

41,365

(3,565

)

(10,644

)

NET (LOSS) INCOME

$

(137,067

)

$

(3,660

)

$

34,753

NET (LOSS) INCOME PER COMMON SHARE:

Basic

$

(1.32

)

$

(0.03

)

$

0.31

Diluted

$

(1.32

)

$

(0.03

)

$

0.31

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING:

Basic

104,121

106,303

112,286

Diluted

104,121

106,303

112,698

NOTE:

Certain reclassifications to loss on

disposal of assets and depreciation and amortization have been made

to the statement of operations and the statement of cash flows for

the periods prior to 2024 to conform to the current period

presentation.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

September 30,

2024

December 31,

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

46,566

$

33,354

Accounts receivable - net of allowance for

credit losses of $236 and $236, respectively

225,617

237,012

Inventories

16,743

17,705

Prepaid expenses

9,453

14,640

Short-term investment, net

7,405

7,745

Other current assets

1,037

353

Total current assets

306,821

310,809

PROPERTY AND EQUIPMENT - net of

accumulated depreciation

716,823

967,116

OPERATING LEASE RIGHT-OF-USE ASSETS

127,085

78,583

FINANCE LEASE RIGHT-OF-USE ASSETS

35,562

47,449

OTHER NONCURRENT ASSETS:

Goodwill

26,754

23,624

Intangible assets - net of

amortization

65,155

50,615

Other noncurrent assets

2,010

2,116

Total other noncurrent assets

93,919

76,355

TOTAL ASSETS

$

1,280,210

$

1,480,312

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

128,615

$

161,441

Accrued and other current liabilities

73,738

75,616

Operating lease liabilities

33,532

17,029

Finance lease liabilities

18,967

17,063

Total current liabilities

254,852

271,149

DEFERRED INCOME TAXES

63,882

93,105

LONG-TERM DEBT

45,000

45,000

NONCURRENT OPERATING LEASE LIABILITIES

56,275

38,600

NONCURRENT FINANCE LEASE LIABILITIES

18,145

30,886

OTHER LONG-TERM LIABILITIES

9,100

3,180

Total liabilities

447,254

481,920

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS’ EQUITY:

Preferred stock, $0.001 par value,

30,000,000 shares authorized, none issued, respectively

—

—

Common stock, $0.001 par value,

200,000,000 shares authorized, 103,282,917 and 109,483,281 shares

issued, respectively

103

109

Additional paid-in capital

884,616

929,249

Retained earnings (accumulated

deficit)

(51,763

)

69,034

Total shareholders’ equity

832,956

998,392

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,280,210

$

1,480,312

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Nine Months Ended September

30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net (loss) income

$

(120,797

)

$

102,743

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation and amortization

164,027

124,749

Impairment expense

188,601

—

Deferred income tax (benefit) expense

(29,224

)

28,753

Amortization of deferred debt issuance

costs

327

250

Stock-based compensation

12,975

10,604

Loss on disposal of assets

11,884

62,117

Unrealized loss on short-term

investment

340

2,120

Noncash gain from adjustment of business

acquisition contingent consideration

(1,800

)

—

Changes in operating assets and

liabilities, net of effects of business acquisition:

Accounts receivable

21,876

(44,832

)

Other current assets

(480

)

(2,584

)

Inventories

962

(4,520

)

Prepaid expenses

4,966

(275

)

Accounts payable

(31,933

)

9,584

Accrued and other current liabilities

(7,292

)

16,362

Net cash provided by operating

activities

214,432

305,071

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(112,449

)

(320,747

)

Business acquisition, net of cash

acquired

(21,038

)

—

Proceeds from sale of assets

2,884

7,976

Net cash used in investing activities

(130,603

)

(312,771

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from borrowings

—

30,000

Repayments of borrowings

—

(15,000

)

Payment of debt issuance costs

—

(1,179

)

Payments on finance lease obligations

(13,067

)

(889

)

Tax withholdings paid for net settlement

of equity awards

(1,377

)

(3,506

)

Share repurchases

(55,729

)

(36,258

)

Payment of excise tax on share

repurchases

(444

)

—

Net cash used in financing activities

(70,617

)

(26,832

)

NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS

13,212

(34,532

)

CASH AND CASH EQUIVALENTS - Beginning of

period

33,354

88,862

CASH AND CASH EQUIVALENTS - End of

period

$

46,566

$

54,330

Reportable Segment Information

Three Months Ended September

30, 2024

(in thousands)

Hydraulic Fracturing

Wireline

All Other

Reconciling Items

Total

Service revenue

$

274,138

$

47,958

$

38,920

$

(148

)

$

360,868

Adjusted EBITDA

$

66,166

$

9,194

$

8,989

$

(13,219

)

$

71,130

Depreciation and amortization

$

46,752

$

5,260

$

2,264

$

23

$

54,299

Impairment expense (1)

$

188,601

$

—

$

—

$

—

$

188,601

Operating lease expense on FORCE®

fleets (2)

$

12,516

$

—

$

—

$

—

$

12,516

Capital expenditures incurred

$

33,465

$

1,757

$

1,575

$

38

$

36,835

Three Months Ended June 30,

2024

(in thousands)

Hydraulic Fracturing

Wireline

All Other

Reconciling Items

Total

Service revenue

$

271,628

$

49,202

$

36,277

$

(86

)

$

357,021

Adjusted EBITDA

$

63,623

$

10,793

$

6,583

$

(14,937

)

$

66,062

Depreciation and amortization

$

50,082

$

5,129

$

2,279

$

32

$

57,522

Operating lease expense on FORCE®

fleets (2)

$

11,533

$

—

$

—

$

—

$

11,533

Capital expenditures incurred

$

25,631

$

1,943

$

4,376

$

—

$

31,950

(1)

Represents noncash impairment expense

related to our Tier II diesel-only and related conventional

equipment.

(2)

Represents lease cost related to operating

leases on our FORCE® electric-powered hydraulic fracturing

fleets. This cost is recorded within cost of services in our

condensed consolidated statements of operations.

Non-GAAP Financial Measures

Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash Flow and

Free Cash Flow adjusted for Acquisition Consideration are not

financial measures presented in accordance with GAAP. We define

Adjusted Net Income (Loss) as net income (loss) plus impairment

expense, less income tax benefit. We define EBITDA as net income

(loss) plus (i) interest expense, (ii) income tax expense (benefit)

and (iii) depreciation and amortization. We define Adjusted EBITDA

as EBITDA plus (i) loss (gain) on disposal of assets, (ii)

stock-based compensation, (iii) other expense (income), (iv) other

unusual or nonrecurring (income) expenses such as costs related to

asset acquisitions, insurance recoveries, one-time professional

fees and legal settlements and (v) retention bonus and severance

expense. We define Free Cash Flow as net cash provided by operating

activities less net cash used in investing activities. We define

Free Cash Flow adjusted for Acquisition Consideration as Free Cash

Flow excluding net cash paid as consideration for business

acquisitions.

We believe that the presentation of these non-GAAP financial

measures provide useful information to investors in assessing our

financial condition and results of operations. Net income (loss) is

the GAAP measure most directly comparable to Adjusted Net Income

(Loss), Adjusted EBITDA, and net cash from operating activities is

the GAAP measure most directly comparable to Free Cash Flow and

Free Cash Flow adjusted for Acquisition Consideration. Non-GAAP

financial measures should not be considered as alternatives to the

most directly comparable GAAP financial measures. Non-GAAP

financial measures have important limitations as analytical tools

because they exclude some, but not all, items that affect the most

directly comparable GAAP financial measures. You should not

consider Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash

Flow or Free Cash Flow adjusted for Acquisition Consideration in

isolation or as a substitute for an analysis of our results as

reported under GAAP. Because Adjusted Net Income (Loss), Adjusted

EBITDA, Free Cash Flow and Free Cash Flow adjusted for Acquisition

Consideration may be defined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

Reconciliation of Net Income (Loss) to

Adjusted Net Income (Loss)

Three Months Ended

(in thousands)

September 30, 2024

June 30, 2024

Net loss

$

(137,067

)

$

(3,660

)

Impairment expense (1)

188,601

—

Income tax benefit

(38,230

)

—

Adjusted Net Income (Loss)

$

13,304

$

(3,660

)

(1)

Represents the noncash impairment expense of our conventional

Tier II diesel-only hydraulic fracturing pumps and associated

conventional assets.

Reconciliation of Net Income (Loss) to

Adjusted EBITDA

Three Months Ended

(in thousands)

September 30, 2024

June 30, 2024

Net loss

$

(137,067

)

$

(3,660

)

Depreciation and amortization

54,299

57,522

Impairment expense (1)

188,601

—

Interest expense

1,939

1,965

Income tax (benefit) expense

(41,365

)

3,565

Loss on disposal of assets

2,149

3,277

Stock-based compensation

4,615

4,618

Other income, net (2)

(3,599

)

(2,403

)

Other general and administrative expense,

net

346

1,113

Retention bonus and severance expense

1,212

65

Adjusted EBITDA

$

71,130

$

66,062

(1)

Represents the noncash impairment expense of our conventional

Tier II diesel-only hydraulic fracturing pumps and associated

conventional assets.

(2)

Other income for the three months ended September 30, 2024 is

primarily comprised of tax refunds of $1.8 million and a $1.8

million decrease in the estimated fair value of the contingent

consideration payable on our acquisition of AquaProp LLC. Other

income for the three months ended June 30, 2024 is primarily

comprised of tax refunds of $1.7 million and a $0.7 unrealized gain

on short-term investment.

Reconciliation of Cash Flows from

Operating Activities to Free Cash Flow and Free Cash Flow adjusted

for Acquisition Consideration

Three Months Ended

(in thousands)

September 30, 2024

June 30, 2024

Net Cash provided by Operating

Activities

$

34,669

$

104,941

Net Cash used in Investing Activities

(39,680

)

(57,076

)

Free Cash Flow

(5,011

)

47,865

Acquisition Consideration

—

21,038

Free Cash Flow adjusted for Acquisition

Consideration

$

(5,011

)

$

68,903

Nine Months Ended

(in thousands)

September 30, 2024

September 30, 2023

Net Cash provided by Operating

Activities

$

214,432

$

305,071

Net Cash used in Investing Activities

(130,603

)

(312,771

)

Free Cash Flow

83,829

(7,700

)

Acquisition Consideration

21,038

—

Free Cash Flow adjusted for Acquisition

Consideration

$

104,867

$

(7,700

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030978687/en/

Investor Contacts: David Schorlemer Chief Financial

Officer david.schorlemer@propetroservices.com 432-227-0864 Matt

Augustine Director, Corporate Development and Investor Relations

matt.augustine@propetroservices.com 432-219-7620

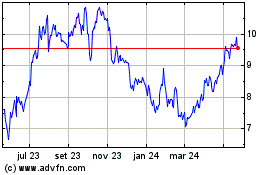

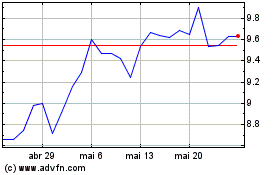

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024