SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Rule 13e-100)

Rule 13e-3 Transaction Statement Under Section 13(e)

of the Securities Exchange Act of 1934

SEQUANS

COMMUNICATIONS S.A.

(Name of the Issuer)

SEQUANS

COMMUNICATIONS S.A.

(Name of Person(s) Filing Statement)

American Depositary Shares, each representing four (4) ordinary shares, nominal value €0.01 per share

Ordinary shares, nominal value €0.01 per share

(Title of Class of Securities)

817323207*

(CUSIP Number

of Class of Securities)

Dr. Georges Karam

Chairman and Chief Executive Officer

Sequans Communications S.A.

15-55 boulevard Charles de Gaulle

92700 Colombes, France

+33 1 70 72 16 00

(Name,

Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With

copies to:

Brett Cooper, Esq.

Richard Vernon Smith, Esq.

Orrick, Herrington & Sutcliffe LLP

The Orrick Building

405

Howard Street

San Francisco, CA 94105

Telephone: (415) 773-5700

| * |

The CUSIP number is assigned to the Filing Company’s American Depositary Shares, each representing four

(4) Ordinary Shares |

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☐ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

|

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☒ |

|

A tender offer. |

|

|

|

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the

transaction: ☐

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS

TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3, together

with the exhibits and annexes attached hereto (this “Schedule 13E-3”), is being filed by Sequans Communications S.A., a société anonyme organized under

the laws of France (the “Company” or “Sequans”), the issuer of the ordinary shares, nominal value €0.01 per share, of the Company (each, an “Ordinary Share” and, collectively, the

“Ordinary Shares”), including American Depositary Shares representing Ordinary Shares (each American Depositary Share represents four Ordinary Shares) (each, an “ADS” and, collectively, the “ADSs”),

and Ordinary Shares issuable upon the exercise, conversion or exchange of any outstanding options, warrants, convertible securities, restricted share awards or rights to purchase, subscribe for, or be allocated Ordinary Shares (collectively, the

“Company Shares”), that are the subject of the Rule 13e-3 transaction described below.

This

Schedule 13E-3 relates to the tender offer by Renesas Electronics Europe GmbH, incorporated as a limited liability company under the laws of Germany (Gesellschaft mit

beschränkter Haftung—GmbH) (“Purchaser”), a direct wholly owned subsidiary of Renesas Electronics Corporation, a Japanese corporation (“Parent” or

“Renesas”), to acquire all of the outstanding Company Shares for U.S. $0.7575 per Ordinary Share and U.S. $3.03 per ADS (each such amount, the “Offer Price”) in each case, payable net to the seller in cash, without

interest, less any withholding taxes that may be applicable, upon the terms and subject to the conditions set forth in the Offer to Purchase dated September 11, 2023 (together with any amendments or supplements thereto, the “Offer to

Purchase”) and in the accompanying Ordinary Share Acceptance Form (together with any amendments or supplements thereto, the “Ordinary Share Acceptance Form”) and American Depositary Share Letter of Transmittal (together

with any amendments or supplements thereto, the “ADS Letter of Transmittal” and, together with the Offer to Purchase, the Ordinary Share Acceptance Form and other related materials, as each may be amended or supplemented from time

to time, the “Offer”). The Offer to Purchase, Ordinary Share Acceptance Form and the ADS Letter of Transmittal are filed as Exhibits (a)(1)(A), (a)(1)(B), (a)(1)(C) hereto, respectively, and are incorporated by reference herein. The

Offer is described in a combined Tender Offer Statement and Rule 13e-3 Transaction Statement filed under cover of Schedule TO with the Securities and Exchange Commission (the “SEC”) on

September 11, 2023, by Parent and Purchaser (as amended or supplemented from time to time, the “Schedule TO”).

The Offer is being made

pursuant to that certain Memorandum of Understanding, dated as of August 4, 2023, as amended by Amendment No. 1 to the Memorandum of Understanding, dated as of September 2, 2023 (as it may be further amended, restated or supplemented

from time to time in accordance with its terms, the “Memorandum of Understanding”), by and between Sequans and Parent. The foregoing summary of the Offer and the Memorandum of Understanding is qualified in its entirety by the

description contained in the Offer to Purchase and ADS Letter of Transmittal and by the Memorandum of Understanding. The Memorandum of Understanding and Amendment No. 1 to the Memorandum of Understanding are filed as Exhibits (e)(1) and (e)(2)

to this Schedule 13E-3 and incorporated by reference herein. The Memorandum of Understanding is summarized under the heading “Special Factors—Memorandum of Understanding; Other Agreements—The

Memorandum of Understanding” in the Offer to Purchase.

In response to the Offer, the Company filed a Solicitation/Recommendation Statement on Schedule 14D-9 on September 11, 2023 (together with any exhibits and annexes attached thereto, the “Schedule 14D-9”). The

information contained in the Schedule 14D-9 and the Schedule TO, including the Offer to Purchase, and including all schedules, annexes and exhibits thereto, copies of which are attached as exhibits

hereto, is expressly incorporated by reference to the extent such information is required in response to the items of this Schedule 13E-3, and is supplemented by the information specifically provided

herein. The responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in the Schedule 14D-9 and the Offer to

Purchase. All information contained in this Schedule 13E-3 concerning the Company, Parent and Purchaser has been provided by such person and not by any other person. All capitalized terms used in this Schedule 13E-3 without definition have the meanings ascribed to them in the Schedule 14D-9.

| ITEM 1. |

SUMMARY TERM SHEET. |

The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

| ITEM 2. |

SUBJECT COMPANY INFORMATION. |

(a) Name and Address

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 1. Subject Company Information—Name and Address”

|

(b) Securities

The information

set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 1. Subject Company Information—Securities” |

(c) Trading Market and Price

The information set forth

in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 6. Price Range of the ADSs”

|

(d) Dividends

The information set

forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 6. Price Range of the ADSs”

|

(e) Prior Public Offerings

On

March 15, 2022 and April 1, 2022, the Company issued and sold an aggregate of 26,666,668 Ordinary Shares (represented by 6,666,667 ADSs) and 4,000,000 Ordinary Shares (represented by 1,000,000 ADSs), respectively, in an underwritten public

offering at a price to the public of U.S. $0.75 per Ordinary Share (U.S. $3.00 per ADS) for total net proceeds, before offering expenses, of U.S.$18.7 million and U.S.$2.8 million, respectively.

On December 14, 2020, the Company issued and sold an aggregate of 1,517,976 Ordinary Shares (represented by 379,494 ADSs) in an underwritten public

offering at a price to the public of U.S. $1.375 per Ordinary Share (U.S. $5.50 per ADS) for total net proceeds, before offering expenses, to the Company of U.S. $2.0 million.

(f) Prior Stock Purchases

The information set forth in

the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements with Directors and

Executive Officers of Sequans—Affiliated Ownership” |

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON. |

(a) Name and Address

The filing person is the subject

company.

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein

by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Name and Address”

|

| |

• |

|

“Annex A—Business and Background of the Company’s Directors and

Executive Officers” (attached to the Schedule 14D-9) |

(b) Business and Background of Entities

Not applicable.

(c) Business and Background of Natural

Persons

The information set forth in the Schedule 14D-9 under the following heading is incorporated

herein by reference:

| |

• |

|

“Annex A—Business and Background of the Company’s Directors and Executive

Officers” (attached to the Schedule 14D-9) |

| ITEM 4. |

TERMS OF THE TRANSACTION. |

(a) Material Terms

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Tender Offer”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Questions and Answers” |

| |

• |

|

“Special Factors—Section 5. Effects of the Offer” |

| |

• |

|

“Special Factors—Section 6. Memorandum of Understanding; Other

Agreements” |

| |

• |

|

“The Tender Offer—Section 1. Terms of the Offer” |

| |

• |

|

“The Tender Offer—Section 2. Acceptance for Payment and Payment”

|

| |

• |

|

“The Tender Offer—Section 3. Procedures for Tendering into the Offer”

|

| |

• |

|

“The Tender Offer—Section 4. Withdrawal Rights” |

| |

• |

|

“The Tender Offer—Section 5. Tax Considerations” |

| |

• |

|

“The Tender Offer—Section 7. Possible Effects of the Offer on the Market for

ADSs; NYSE Listing; Exchange Act Registration; Termination of the ADS Deposit Agreement; The Post-Offer Reorganization; Margin Regulations” |

(c) Different Terms

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements”

|

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Directors and Executive Officers of Sequans—Interests of Certain Persons—Golden Parachute Compensation” |

The information set forth in the Offer to Purchase under the following headings is incorporated herein by

reference:

| |

• |

|

“Special Factors—Section 8. Transactions and Arrangements Concerning the Shares

and Other Securities of Sequans” |

| |

• |

|

“Special Factors—Section 10. Interests of Certain Sequans Directors and Executive

Officers in the Offer” |

(d) Appraisal Rights

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 8. Additional Information—Appraisal Rights” |

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Questions and Answers—Am I entitled to appraisal rights in connection with the Offer?”

|

| |

• |

|

“Special Factors—Section 7. Appraisal Rights; Rule 13e-3” |

(e) Provisions for Unaffiliated Security Holders

The filing person has not made any provision in connection with the transaction to grant unaffiliated security holders access to the corporate files of the

filing person or to obtain counsel or appraisal services at the expense of the filing person.

(f) Eligibility for Listing or Trading

Not applicable.

| ITEM 5. |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. |

(a) Transactions

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 8. Transactions and Arrangements Concerning the Shares

and Other Securities of Sequans” |

| |

• |

|

“Special Factors—Section 9. Certain Agreements between Parent and its Affiliates

and Sequans” |

| |

• |

|

“Special Factors—Section 10. Interests of Certain Sequans Directors and Executive

Officers in the Offer” |

(b) Significant Corporate Events

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements”

|

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by

reference:

| |

• |

|

“Special Factors—Section 1. Background” |

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

(c) Negotiations or Contacts

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 1. Background” |

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

(e) Agreements Involving the Subject Company’s Securities

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Parent, Purchaser and Certain of Their Affiliates” |

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Directors and Executive Officers of Sequans—Interests of Certain Persons—Golden Parachute Compensation” |

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Directors and Executive Officers of Sequans—Affiliated Ownership” |

The information set forth in the Offer to Purchase

under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 9. Certain Agreements between Parent and its Affiliates

and Sequans” |

| |

• |

|

“Special Factors—Section 10. Interests of Certain Sequans Directors and Executive

Officers in the Offer” |

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

(b) Use of Securities Acquired

The information set forth

in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Tender Offer”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 7. Possible Effects of the Offer on the Market for

ADSs; NYSE Listing; Exchange Act Registration; Termination of the ADS Deposit Agreement; The Post-Offer Reorganization; Margin Regulations” |

(c)(1)-(8) Plans

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 2. Identify and Background of the Filing Person—Tender Offer”

|

| |

• |

|

“Item 7. Purposes of the Transaction and Plans or Proposals” |

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

| |

• |

|

“Special Factors—Section 5. Effects of the Offer” |

| |

• |

|

“The Tender Offer—Section 7. Possible Effects of the Offer on the Market for

ADSs; NYSE Listing; Exchange Act Registration; Termination of the ADS Deposit Agreement; The Post-Offer Reorganization; Margin Regulations” |

| ITEM 7. |

PURPOSES, ALTERNATIVES, REASONS AND EFFECTS. |

(a) Purposes

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

| |

• |

|

“Item 7. Purposes of the Transaction and Plans or Proposals”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 1. Background” |

| |

• |

|

“Special Factors— Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

(b) Alternatives

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

(c) Reasons

The information set

forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by

reference:

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

(d) Effects

The

information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Tender Offer”

|

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Directors and Executive Officers of Sequans” |

| |

• |

|

“Item 5. Persons/Assets Retained, Employed, Compensated or Used”

|

| |

• |

|

“Item 8. Additional Information” |

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

| |

• |

|

“Special Factors—Section 5. Effects of the Offer” |

| |

• |

|

“Special Factors—Section 6. Memorandum of Understanding; Other

Agreements” |

| |

• |

|

“Special Factors—Section 7. Appraisal Rights; Rule 13e-3” |

| |

• |

|

“The Tender Offer—Section 5. Tax Considerations” |

| |

• |

|

“The Tender Offer—Section 7. Possible Effects of the Offer on the Market for

ADSs; NYSE Listing; Exchange Act Registration; Termination of the ADS Deposit Agreement; The Post-Offer Reorganization; Margin Regulations” |

| ITEM 8. |

FAIRNESS OF THE TRANSACTION. |

(a) Fairness

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation” |

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

| |

• |

|

“Special Factors—Section 3. The Recommendation by the Board of Directors of

Sequans” |

| |

• |

|

“Special Factors—Section 4. Position of Parent and Purchaser Regarding Fairness

of the Offer” |

(b) Factors Considered in Determining Fairness

The information set forth in the Schedule 14D-9 under the following headings is incorporated by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

| |

• |

|

“Item 4. The Solicitation or Recommendation—Opinion of

Needham & Company, LLC” |

The information set forth in the Offer to Purchase under the following headings

is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 1. Background” |

| |

• |

|

“Special Factors—Section 2. Purpose of and Reasons for the Offer; Plans for

Sequans” |

| |

• |

|

“Special Factors—Section 3. The Recommendation by the Board of Directors of

Sequans” |

| |

• |

|

“Special Factors—Section 4. Position of Parent and Purchaser Regarding Fairness

of the Offer” |

The information set forth in Exhibits (c)(1) – (c)(5) attached hereto is incorporated herein by

reference.

(c) Approval of Security Holders

The

information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Tender Offer”

|

| |

• |

|

“Item 8. Additional Information—Certain Shareholder Approvals Required in

Connection with the Post-Offer Reorganization” |

The information set forth in the Offer to Purchase under the following headings

is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 1. Terms of the Offer” |

| |

• |

|

“Special Factors—Section 6. Memorandum of Understanding; Other

Agreements” |

(d) Unaffiliated Representative

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

No unaffiliated representative has been retained by a majority of directors who are not employees of the subject company to act solely

on behalf of unaffiliated security holders for purposes of negotiating the terms of this transaction and/or preparing a report concerning the fairness of the transaction.

(e) Approval of Directors

The information set forth in

the Schedule 14D-9 under the following heading is incorporated by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Solicitation or

Recommendation—Recommendation of the Board” |

The information set forth in the Offer to Purchase under the following heading is incorporated by reference:

| |

• |

|

“Special Factors—Section 3. The Recommendation by the Board of Directors of

Sequans” |

(f) Other Offers

Not Applicable.

| ITEM 9. |

REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS. |

(a)-(b) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal

The information set forth in Exhibits (c)(1) – (c)(5) attached hereto is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the following headings is incorporated by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

| |

• |

|

“Item 4. The Solicitation or Recommendation—Opinion of

Needham & Company, LLC” |

| |

• |

|

“Item 5. Persons/Assets Retained, Employed, Compensated or Used”

|

(c) Availability of Documents

The

reports, opinions or appraisals referenced in Item 9 of this Schedule 13E-3 are available for inspection and copying at the Company’s principal executive offices located at 15-55 boulevard Charles de Gaulle, 92700 Colombes, France, during regular business hours, by any interested holder of Ordinary Shares or ADSs of the Company or a representative of such interested holder of Ordinary

Shares or ADSs who has been so designated in writing by such interested holder of Ordinary Shares or ADSs and at the expense of the requesting security holder.

| ITEM 10. |

SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION. |

(a)-(b) Source of Funds; Conditions

The information set

forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 2. Identity and Background of Filing Person—Tender Offer”

|

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 10. Source and Amount of Funds”

|

(c) Expenses

The information set

forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 5. Persons/Assets Retained, Employed, Compensated or Used”

|

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 14. Fees and Expenses” |

(d) Borrowed Funds

Not applicable.

| ITEM 11. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY. |

(a) Securities Ownership

The information set forth in Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements”

|

| |

• |

|

“Item 6. Interest in Securities of the Subject Company” |

(b) Securities Transactions

The information set forth in

Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 6. Interest in Securities of the Subject Company”

|

The information set forth in the Offer to Purchase under the follow heading is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 8. Transactions and Arrangements Concerning the

Shares and Other Securities of Sequans” |

| ITEM 12. |

THE SOLICITATION OR RECOMMENDATION. |

(d) Intent to Tender or Vote in a Going-Private Transaction

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Parent, Purchaser and Certain of Their Affiliates” |

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements with Directors and

Executive Officers of Sequans—Affiliated Ownership” |

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons” |

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 6. Memorandum of Understanding; Other

Agreements—Other Agreements—Tender and Support Agreements” |

(e) Recommendations of Others

The information set forth in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 4. The Solicitation or Recommendation—Solicitation or

Recommendation—Recommendation of the Board” |

| |

• |

|

“Item 4. The Solicitation or Recommendation—Reasons”

|

The information set forth in the Offer to Purchase under the following headings is incorporated herein by reference:

| |

• |

|

“Special Factors—Section 4. The Recommendation by the Board of Directors of

Sequans” |

| |

• |

|

“Special Factors—Section 6. Memorandum of Understanding; Other

Agreements—Other Agreements—Tender and Support Agreements” |

| ITEM 13. |

FINANCIAL STATEMENTS. |

(a) Financial Information

The audited financial

statements of the Company as of and for the fiscal years ended December 31, 2021 and December 31, 2022 are incorporated herein by reference to “Part III Item 17. Financial Statements” of the Company’s Annual Report

on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC on March 31, 2023.

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 8. Certain Information Concerning Sequans”

|

(b) Pro Forma Information

Not

applicable.

| ITEM 14. |

PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED. |

(a)-(b) Solicitations or Recommendations; Employees and Corporate Assets

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 5. Persons/Assets Retained, Employed, Compensated or Used”

|

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 14. Fees and Expenses” |

| ITEM 15. |

ADDITIONAL INFORMATION. |

(b) Golden Parachute Payments

The information set forth

in the Schedule 14D-9 under the following headings is incorporated herein by reference:

| |

• |

|

“Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements

with Directors and Executive Officers of Sequans—Interests of Certain Persons—Golden Parachute Compensation” |

| |

• |

|

“Item 8. Additional Information—Golden Parachute Compensation”

|

(c) Other Material Information

The information set forth in the Schedule 14D-9 under the following heading is incorporated herein by reference:

| |

• |

|

“Item 8. Additional Information” |

The information set forth in the Offer to Purchase under the following heading is incorporated herein by reference:

| |

• |

|

“The Tender Offer—Section 15. Miscellaneous” |

The following exhibits are filed herewith:

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated September 11, 2023 (incorporated by reference to Exhibit (a)(1)(A) to the Schedule TO filed by Renesas Electronics Corporation and Renesas Electronics Europe GmbH with the SEC on

September 11, 2023 (the “Schedule TO”)). |

|

|

| (a)(1)(B) |

|

Form of Ordinary Share Acceptance Form (incorporated by reference to Exhibit (a)(1)(B) to the Schedule TO). |

|

|

| (a)(1)(C) |

|

Form of ADS Letter of Transmittal (including Guidelines for Certification of Taxpayer Identification Number on Form W-9) (incorporated by reference to Exhibit (a)(1)(C) to the

Schedule TO). |

|

|

| (a)(1)(D) |

|

ADS Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit (a)(1)(D) to the Schedule TO). |

|

|

| (a)(1)(E) |

|

ADS Form of Letter to Clients for Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit (a)(1)(E) to the Schedule TO). |

|

|

| (a)(1)(F) |

|

Form of Notice of Guaranteed Delivery (incorporated by reference to Exhibit (a)(1)(J) to the Schedule TO). |

|

|

| (a)(1)(G) |

|

Summary Newspaper Advertisement, as published in the New York Times on September 11, 2023 (incorporated by reference to Exhibit (a)(1)(K) to the Schedule TO). |

|

|

| (a)(2)(A) |

|

Solicitation/Recommendation Statement on Schedule 14D-9 (incorporated by reference to the Solicitation/Recommendation Statement on

Schedule 14D-9 filed by the Company with the SEC on September 11, 2023). |

|

|

| (a)(2)(B) |

|

Press Release, issued on August 16, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.1 to the Schedule 14D-9C filed by Sequans Communications S.A.

with the SEC on August 16, 2023). |

|

|

| (a)(2)(C) |

|

Letter to Sequans Employees, first used on August 16, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.2 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 16, 2023). |

|

|

|

| (a)(5)(A)* |

|

Joint Press Release issued by Sequans Communications S.A and Renesas Electronics Corporation on September 11, 2023. |

|

|

| (a)(5)(B) |

|

Joint Press Release issued by Sequans Communications S.A and Renesas Electronics Corporation on August 7, 2023 (incorporated by reference to Exhibit 99.2 of the Form 6-K filed by Sequans

Communications S.A with the SEC on August 7, 2023). |

|

|

| (a)(5)(C) |

|

Press release issued by Sequans Communications S.A on August 16, 2023 (incorporated by reference to Exhibit 99.1 of the Form 6-K filed by Sequans Communications S.A with the SEC on

August 16, 2023). |

|

|

| (a)(5)(D) |

|

Letter to Sequans Employees, first used on August 16, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.2 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 16, 2023). |

|

|

| (a)(5)(E) |

|

Script for Investor Call, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.2 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(F) |

|

Investor Presentation, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.3 to the Schedule 14D-9C filed by Sequans Communications

S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(G) |

|

Letter to Sequans Employees, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.4 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(H) |

|

Employee Slide Presentation, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.5 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(I) |

|

Letter to Partners and Customers, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.6 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(J) |

|

Partners and Customers Slide Presentation, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.7 to the Schedule 14D-9C filed by

Sequans Communications S.A. with the SEC on August 7, 2023). |

|

|

| (a)(5)(K) |

|

Works Council Information Memorandum, first used on August 7, 2023 by Sequans Communications S.A. (incorporated by reference to Exhibit 99.1 to the Schedule 14D-9C filed by Sequans

Communications S.A. with the SEC on August 8, 2023). |

|

|

| (a)(5)(L) |

|

Form of Amendment No. 1 to the Deposit Agreement dated as of May 14, 2018, by and between Sequans Communications S.A. and The Bank of New York Mellon, and all holders from time to time of American depositary receipts

issued thereunder (incorporated by reference to Exhibit B to the Form F-6 filed by Sequans Communications S.A. with the SEC on September 11, 2023). |

|

|

| (c)(1) |

|

Opinion of Needham & Company, LLC dated August 3, 2023 (incorporated by reference to Annex A to the Schedule 14D-9 filed by Sequans Communications S.A. with the SEC on

September 11, 2023). |

|

|

| (c)(2)* |

|

Presentation materials of Needham & Company, LLC provided to management of Sequans Communications S.A. on April 23, 2023. |

|

|

|

| (c)(3)* |

|

Presentation materials of Needham & Company, LLC provided to the Special Committee of the Board of Directors of Sequans Communications S.A. on June 27, 2023. |

|

|

| (c)(4)* |

|

Presentation materials of Needham & Company, LLC provided to the Board of Directors of Sequans Communications S.A. on July 25, 2023. |

|

|

| (c)(5)* |

|

Presentation materials of Needham & Company, LLC provided to the Board of Directors of Sequans Communications S.A. on August 3, 2023. |

|

|

| (d)(1) † |

|

Memorandum of Understanding, dated August 4, 2023 by and between Sequans Communications S.A and Renesas Electronics Corporation (incorporated by reference to Exhibit 99.1 of the Form 6-K

filed by Sequans Communications S.A with the SEC on August 7, 2023). |

|

|

| (d)(2)* |

|

Amendment No. 1 to Memorandum of Understanding, dated September 2, 2023, by and between Sequans Communications S.A. and Renesas Electronics Corporation. |

|

|

| (d)(3) † |

|

Form of Tender and Support Agreement by and between Renesas Electronics and certain shareholders of Sequans Communications S.A. (incorporated by reference to Exhibit 99.3 of the Form 6-K filed

by Sequans Communications S.A with the SEC on August 7, 2023). |

|

|

| (d)(4) † |

|

Securities Purchase Agreement, dated December 22, 2021 (incorporated by reference to Exhibit 4.5 of the Form F-3 filed by Sequans Communications S.A with the Securities and Exchange

Commission on May 5, 2023). |

|

|

| (d)(5) |

|

Registration Rights Agreement, dated January 11, 2022 (incorporated by reference to Exhibit 4.6 of the Form F-3 filed by Sequans Communications S.A with the SEC on May 5,

2023). |

|

|

| (d)(6) |

|

Right of First Notification Agreement, by and between Sequans Communications S.A and Renesas Electronics Corporation, dated January 11, 2022 (incorporated by reference to Exhibit (d)(6) to the Schedule TO filed by Renesas

Electronics Corporation with the SEC on September 11, 2023). |

|

|

| (d)(7) †† |

|

LTE Technology Access and License Agreement, by and between Sequans Communications S.A and Renesas Electronics Corporation, dated September 3, 2022 (incorporated by reference to Exhibit (d)(7) to the Schedule TO filed by

Renesas Electronics Corporation with the SEC on September 11, 2023). |

|

|

| (d)(8) †† |

|

5G Technology Access and License Agreement, by and between Sequans Communications S.A and Renesas Electronics Corporation, dated November 30, 2022 (incorporated by reference to Exhibit (d)(8) to the Schedule TO filed by Renesas

Electronics Corporation with the SEC on September 11, 2023). |

|

|

| (d)(9)†† |

|

IP License Agreement, by and between Sequans Communications S.A and Silicon and Software Systems Limited, a subsidiary of Renesas Electronics Corporation, dated October, 2010 (incorporated by reference to Exhibit (d)(9) to the

Schedule TO filed by Renesas Electronics Corporation with the SEC on September 11, 2023). |

|

|

| (d)(10) |

|

Nondisclosure Agreement, by and between Sequans Communications S.A and Renesas Electronics Corporation, dated March 7, 2023 (incorporated by reference to Exhibit (d)(10) to the Schedule TO filed by Renesas Electronics

Corporation with the SEC on September 11, 2023). |

|

|

| (f) |

|

Section 327(f) AktG (German Stock Corporation Act) and Section 2 SpruchG (German Appraisal Proceedings Act) (incorporated by reference to Schedule III to the Offer to Purchase filed as Exhibit (a)(1)(A) to the Schedule TO

filed by Renesas Electronics Corporation with the SEC on September 11, 2023). |

| † |

Portions of this exhibit have been omitted in accordance with Item 601(b)(10) of Regulation S-K. |

| †† |

Confidential treatment is being requested with respect to portions of this exhibit that have been redacted

pursuant to Rule 24b-2 under the Securities Exchange Act of 1934, as amended. |

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule 13E-3 is true,

complete and correct.

Dated: September 11, 2023

|

|

|

| SEQUANS COMMUNICATIONS S.A. |

|

|

| By: |

|

/s/ Dr. Georges Karam |

| Name: |

|

Dr. Georges Karam |

| Title: |

|

Chief Executive Officer and Chairman |

Exhibit (a)(5)(a)

Renesas Commences Tender Offer

for All Outstanding Shares and ADSs of Sequans

Shareholders to Receive U.S. $0.7575 per Ordinary Share and U.S. $3.03 per ADS in cash

TOKYO, Japan and PARIS, France – September 11, 2023 – Renesas Electronics Corporation (TSE: 6723, “Renesas”) and

Sequans Communications S.A. (NYSE: SQNS, “Sequans”) today announced that Renesas has commenced the previously-announced tender offer to acquire all of the outstanding ordinary shares of Sequans for $0.7575 per ordinary share and American

Depositary Shares (“ADSs”) of Sequans for $3.03 per ADS (each ADS representing four ordinary shares) in cash, without interest and less any applicable withholding taxes.

The tender offer is being made pursuant to the memorandum of understanding between Renesas and Sequans dated August 4, 2023, as amended. As previously

announced on August 16, 2023, the Sequans Board of Directors determined that the Renesas offer is consistent with and will further the business objectives and goals of Sequans, and is in the best interests of Sequans, its employees, and its

shareholders, and recommends that all holders of ordinary shares and ADSs accept Renesas’ offer and tender their outstanding shares and/or ADSs to Renesas.

The tender offer is scheduled to expire at one minute after 11:59 P.M. (New York City time) on October 6, 2023, unless extended or terminated. The closing of

the tender offer is subject to the valid tender of ordinary shares and ADSs of Sequans representing – together with ordinary shares and ADSs of Sequans beneficially owned by Renesas, if any – at least 90% of the fully diluted ordinary

shares and ADSs, as well as confirmation of tax treatment from relevant authorities, regulatory approvals and other customary closing conditions.

About Renesas Electronics Corporation

Renesas

Electronics Corporation (TSE: 6723) empowers a safer, smarter and more sustainable future where technology helps make our lives easier. The leading global provider of microcontrollers, Renesas combines our expertise in embedded processing,

analog, power and connectivity to deliver complete semiconductor solutions. These Winning Combinations accelerate time to market for automotive, industrial, infrastructure and IoT applications, enabling billions of connected, intelligent devices

that enhance the way people work and live. Learn more at renesas.com. Follow us on LinkedIn, Facebook, Twitter, YouTube and Instagram.

About Sequans Communications

Sequans Communications S.A.

(NYSE: SQNS) is a leading developer and supplier of cellular IoT connectivity solutions, providing chips and modules for 5G/4G massive and broadband IoT. For 5G/4G massive IoT applications, Sequans provides a comprehensive

product portfolio based on its flagship Monarch LTE-M/NB-IoT and Calliope Cat 1 chip platforms, featuring industry-leading low power consumption, a large set of integrated functionalities, and global

deployment capability. For 5G/4G broadband IoT applications, Sequans offers a product portfolio based on its Cassiopeia Cat 4/Cat 6 4G and high-end Taurus 5G chip platforms, optimized for low-cost residential, enterprise, and industrial applications. Founded in 2003, Sequans is based in Paris, France with additional offices in the United States, United Kingdom, Israel, Hong Kong, Singapore,

Finland, Taiwan, South Korea, and China. Visit Sequans online at http://www.sequans.com/, and follow us on Facebook, Twitter and LinkedIn.

Advisors

BofA Securities is serving as financial advisor

to Renesas, and Goodwin Procter LLP is serving as legal counsel. Needham & Company is serving as financial advisor to Sequans, and Orrick, Herrington & Sutcliffe LLP is serving as legal counsel.

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Sequans Communications S.A. (“Sequans”) by Renesas Electronics Corporation, a Japanese corporation

(“Parent” or “Renesas”), Parent commenced a tender offer for all of the outstanding ordinary shares, including American Depositary Shares of Sequans, on September 11, 2023. This communication is for informational purposes

only and is neither an offer to purchase nor a solicitation of an offer to sell securities of Sequans. It is also not a substitute for the tender offer materials that Renesas Electronics Europe GmbH, a direct wholly owned subsidiary of Parent

(“Purchaser”) filed with the Securities and Exchange Commission (the “SEC”) or the solicitation/recommendation statement that Sequans filed on Schedule 14D-9 with the SEC upon commencement

of the tender offer. Purchaser filed tender offer materials on Schedule TO with the SEC, and Sequans filed a Solicitation/Recommendation Statement on Schedule 14D-9 and a Schedule 13E-3 transaction statement with respect to the tender offer with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN

OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT AND TRANSACTION STATEMENT CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND BE CONSIDERED BY SEQUANS’ SECURITYHOLDERS BEFORE ANY DECISION IS MADE WITH

RESPECT TO THE TENDER OFFER. Both the tender offer materials and the solicitation/recommendation statement and transaction statement will be made available to Sequans’ investors and security holders free of charge. A free copy of the tender

offer materials and the solicitation/recommendation statement will also be made available to all of Sequans’ investors and security holders by contacting Sequans at ir@sequans.com, or by visiting Sequans’ website (www.sequans.com). In

addition, the tender offer materials and the solicitation/recommendation statement (and all other documents filed by Sequans with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. SEQUANS’

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE TENDER OFFER MATERIALS, THE SOLICITATION/RECOMMENDATION STATEMENT AND THE TRANSACTION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED

BY PARENT OR SEQUANS WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER. THESE MATERIALS CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER, PARENT AND SEQUANS.

Cautionary note regarding forward-looking statements

This announcement may contain certain statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results

of operations and business of Renesas and/or Sequans and/or the combined group following completion of the transaction and certain plans and objectives of Renesas with respect thereto. These forward-looking statements include, but are not limited

to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transaction, the timing and benefits thereof, as well as other statements that are not historical fact.

These forward-looking statements can be identified by the fact that they do not relate to historical or current facts. Forward-looking statements also often use words such as “anticipate,” “target,” ”continue,”

“estimate,” “expect,” ‘‘forecast,” “intend,” “may,” “plan,” “goal,” “believe,” “hope,” “aims,” “continue,” “could,”

“project,” “should,” “will” or other words of similar meaning. These statements are based on assumptions and assessments made by Renesas and/or Sequans (as applicable) in light of their experience and perception of

historical trends, current conditions, future developments and other factors they believe appropriate. By their nature, forward-looking statements involve risk and uncertainty, because they relate to events and depend on circumstances that will

occur in the future and the factors described in the context of such forward-looking statements in this announcement could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking

statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct and you are therefore cautioned not to place undue

reliance on these forward-looking statements which speak only as at the date of this announcement.

Forward-looking statements are not guarantees of

future performance. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Such risks and uncertainties include, but are not

limited to, the potential

failure to satisfy conditions to the completion of the proposed transaction due to the failure to receive a sufficient number of tendered shares in the tender offer; the failure to obtain

necessary regulatory or other approvals; the outcome of legal proceedings that may be instituted against Sequans and/or others relating to the transaction; the possibility that competing offers will be made; potential adverse reactions or changes to

business relationships resulting from the announcement or completion of the proposed transaction; significant or unexpected costs, charges or expenses resulting from the proposed transaction; and negative effects of this announcement or the

consummation of the proposed acquisition on the market price of Sequans’ ADS and ordinary shares. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Among the factors

that could cause actual results to differ materially from those described in the forward-looking statements are changes in the global, political, economic, business and competitive environments, market and regulatory forces, future exchange and

interest rates, changes in tax rates and future business combinations or dispositions. If any one or more of these risks or uncertainties materializes or if any one or more of the assumptions prove incorrect, actual results may differ materially

from those expected, estimated or projected. Such forward looking statements should therefore be construed in the light of such factors. A more complete description of these and other material risks can be found in Sequans’ filings with the

SEC, including its annual report on Form 20-F for the year ended December 31, 2022, subsequent filings on Form 6-K and other documents that may

be filed from time to time with the SEC, as well as, the Schedule TO and related tender offer documents filed by Parent and Purchaser and the Schedule 14D-9 and Schedule 13E-3 filed by Sequans. Due

to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this announcement. Neither Renesas nor Sequans undertakes any obligation to update or revise

any forward-looking statement as a result of new information, future events or otherwise, except as required by applicable law.

No member of the Renesas

group or the Sequans group nor any of their respective associates, directors, officers, employers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking

statements in this announcement will actually occur.

Except as expressly provided in this announcement, no forward-looking or other statements have been

reviewed by the auditors of the Renesas group or the Sequans group. All subsequent oral or written forward-looking statements attributable to any member of the Renesas group or the Sequans group, or any of their respective associates, directors,

officers, employers or advisers, are expressly qualified in their entirety by the cautionary statement above.

###

All names of products or services mentioned in this press release are trademarks or registered trademarks of their respective owners.

|

|

|

| Media Contacts: Renesas Electronics

Corporation Akiko Ishiyama +

1-408-887-9006

pr@renesas.com

Sequans Communications S.A. Kimberly Tassin

+1-425-736-0569

Kimberly@Sequans.com |

|

Investor Relations Contacts:

Renesas Electronics Corporation Yuuki Oka

+81 3-6773-3002

ir@renesas.com

Sequans Communications S.A. Kim Rogers

+1-541-904-5075

Kim@HaydenIR.com |

Exhibit (c)(2) Project Sequoia – Materials for Discussion DRAFT,

PRELIMINARY, AND SUBJECT TO CONFIRMATION & MATERIAL REVISION April 23, 2023 STRICTLY PRIVATE & CONFIDENTIAL

- DRAFT AND SUBJECT TO CHANGE - Presentation Basis ▪ This

presentation was prepared on a confidential basis exclusively for the benefit and use of the Board of Directors of Sting (the “Company”). This presentation is subject to the assumptions, qualifications and limitations set forth herein.

This presentation is for discussion purposes only. It is not a recommendation as to how any Board member should vote, and does not carry any right of publication or disclosure. Neither this presentation nor any of its contents may be used for any

other purpose without the prior written consent of Needham & Company, LLC. ▪ The information contained in this material is based on information obtained from the Company and other sources. Needham & Company, LLC has relied upon the

accuracy and completeness of the foregoing information and has neither attempted to verify independently nor assumed responsibility for verifying any of such information. Any financial estimates and projections contained herein have been prepared by

management or are based upon such estimates and projections, and involve numerous and significant subjective determinations, which may or may not be correct, and we have assumed that such estimates and projections have been reasonably prepared on

bases reflecting the best currently available estimates and judgments of management or represent reasonable estimates. No representation or warranty, expressed or implied, is made as to the accuracy or completeness of such information and nothing

contained herein is, or shall be relied upon as, a promise or representation, whether as to the past or the future. This material was not prepared for use by readers not as familiar with the business and affairs of the Company as the Board of

Directors of the Company and, accordingly, Needham & Company, LLC takes no responsibility for the accompanying material when used by persons other than the Board of Directors. ▪ Nothing contained herein should be construed as tax,

accounting, or legal advice. NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 1

- DRAFT AND SUBJECT TO CHANGE - Table of Contents Section 1 Valuation

Analysis and Considerations Appendix A WACC Analysis NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 2

- DRAFT AND SUBJECT TO CHANGE - Valuation Analysis and Considerations

NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 3

- DRAFT AND SUBJECT TO CHANGE - Sequoia Whole Company Forecast (Chip Only)

Sequoia Pro-Forma Annual Income Statement Sequoia Pro-Forma Quarterly Income Statement (in $000) 2022A 2023E 2024E 2025E Revenue Massive IoT $ 21,986.0 $ 19,204.1 $ 62,012.6 $ 110,519.8 Broadband IoT 987.9 3,091.7 8,824.9 29,483.4 IP & Services

37,577.1 28,943.4 26,010.7 17,535.0 Total Revenue 60,551.0 51,239.2 9 6,848.2 157,538.3 Note: Pre-Chip Conversion Product Revenue Est. 30,674.8 107,247.4 210,185.4 Cost of Revenue Variable Product Cost (13,999.7) (11,574.7) (34,542.1) (63,329.8)

Fixed Cost (1,269.6) (1,144.8) (1,180.4) (1,184.0) Cost of Services (2,222.0) (2,376.0) (2,376.0) (756.0) Total Cost of Revenue (17,491.3) (15,095.5) (38,098.4) (65,269.8) Gross Profit 4 3,059.8 36,143.7 5 8,749.8 92,268.5 Variable Product Gross

Profit Margin 39.1% 48.1% 51.2% 54.8% Product Gross Profit Margin 33.5% 43.0% 49.6% 53.9% Total Gross Profit Margin 71.1% 70.5% 60.7% 58.6% Operating Expenses General & Administrative (6,791.8) (6,415.9) (6,615.9) (6,633.7) Sales & Marketing

(8,406.7) (9,996.1) (10,292.8) (10,347.2) Research & Development (21,286.1) (26,325.7) (30,109.6) (31,078.7) OverHead (5,748.0) (5,786.9) (5,928.5) (5,935.6) Total Operating Expenses (42,232.7) (48,524.6) (52,946.9) (53,995.2) 0 0 0 0 Operating

Profit $ 827.1 $ (12,380.9) $ 5,802.9 $ 38,273.3 Operating Profit Margin 1.4% (24.2%) 6.0% 24.3% Notes: Source: Information provided by management NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 4

- DRAFT AND SUBJECT TO CHANGE - Summary of Valuation Methodologies ▪

In preparing the following preliminary valuation, Needham considered the following ➢ Selected Public Companies: Wireless / Connectivity / IoT-Centric Peers ➢ Selected M&A Transactions: Valuation is capped by applying transaction

multiple to historical financial results; doesn’t represent full value and future potential upside post acquisition (included for illustrative purposes) ➢ Discounted Cash Flow Analysis: intrinsic valuation analysis performed based on

Company’s financial statement estimates; reflects opportunity to unlock long term value NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 5

- DRAFT AND SUBJECT TO CHANGE - Selected Public Companies Enterprise Value

/ % of $ in millions Revenue Gross Profit Revenue Growth Gross Margin 4/21/2023 52-week Equity Enterprise Company Price High Value Value CY'23E CY'24E CY'25E CY'23E CY'24E CY'25E 23E/22A 24E/23E 2023E 2024E Wireless / Connectivity / IoT-Centric

Companies Analog Devices, Inc. $ 186.34 94% $ 94,260.6 $ 99,133.3 7.8x 7.5x NA 10.6x 10.3x NA 5.3% 2.8% 73.5% 73.4% Infineon Technologies 38.01 92% 49,640.9 51,518.2 2.9x 2.7x 2.5x 6.4x 6.1x 5.5x 15.1% 7.4% 45.3% 44.6% Microchip Technology Inc.

76.80 89% 42,070.7 48,370.5 5.6x 5.5x 5.0x 8.3x 8.0x NA 7.4% 1.7% 67.7% 68.9% Nordic Semiconductor 10.89 53% 2,099.0 1,719.9 2.5x 2.0x 1.7x 4.7x 3.9x 3.2x (9.7)% 21.3% 51.7% 51.6% NXP Semiconductors 169.82 87% 44,071.6 51,682.6 4.2x 3.8x 3.6x 7.2x

6.6x 6.1x (6.1)% 8.3% 57.8% 58.0% Qorvo Inc. 92.95 77% 9,284.7 10,389.5 3.1x 2.8x 2.4x 6.9x 5.8x 4.8x (12.6)% 12.1% 45.2% 47.5% Semtech Corporation 20.70 32% 1,322.1 2,426.9 2.4x 2.0x NA 4.9x 4.0x NA 33.2% 20.0% 49.3% 50.2% Silicon Laboratories Inc.

166.50 86% 5,311.2 4,648.8 4.4x 3.8x 3.1x 7.1x 6.5x 5.4x 4.1% 15.4% 61.3% 58.4% Skyworks Solutions Inc. 106.72 87% 16,965.7 18,162.9 3.6x 3.3x NA 7.0x 6.4x NA (4.9)% 9.1% 51.2% 50.7% STMicroelectronics 47.42 89% 43,175.6 41,428.6 2.4x 2.3x 2.1x 5.1x

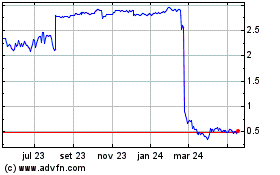

4.9x 4.5x 7.0% 4.8% 46.7% 47.1% Synaptics Inc. 95.13 55% 3,747.7 3,868.7 2.6x 2.3x NA 4.4x 4.1x NA (5.7)% 10.5% 58.9% 57.1% Mean 3.8x 3.5x 2.9x 6.6x 6.1x 4.9x 3.0% 10.3% 55.3% 55.2% Median 3.1x 2.8x 2.5x 6.9x 6.1x 5.1x 4.1% 9.1% 51.7% 51.6% Sequoia

$ 2.47 60% $ 118.4 $ 154.4 2.8x 1.8x 1.9x 4.2x 2.8x 3.6x (10.0)% 61.4% 67.4% 61.8% Aggregate Mean 3.7x 3.3x 2.8x 6.4x 5.8x 4.7x 1.9% 14.6% 56.3% 55.8% Aggregate Median 3.0x 2.7x 2.4x 6.6x 5.9x 4.8x (0.4)% 9.8% 54.7% 54.3% Notes: Source: FactSet

Research Systems, SEC Filings Market statistics reflect closing stock price on April 21, 2023 ‘NM’ for multiples that exceed 75x, ‘NEG’ for multiples that are below zero and ‘NA’ for unavailable or insufficient

information NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 6

- DRAFT AND SUBJECT TO CHANGE - Selected M&A Transactions ($ in

Millions) Announce Enterprise Enterprise Value / Date Target Acquirer Value LTM Revenue 8/2/2022 Sierra Wireless, Inc. Semtech Corporation $ 1,263 2.3x 11/4/2021 Neophotonics Corporation Lumentum Holdings Inc. 858 3.1x 10/28/2021 Celeno

Communications Renesas Electronics Corp. 315 8.5x 8/30/2021 DSP Group, Inc. Synaptics, Inc. 480 3.8x 7/14/2021 Coretex Eroad 133 4.0x 5/25/2021 Telit Communications Limited DBAY Advisors Limited 418 NA 4/22/2021 Silicon Laboratories Inc.

(Infrastructure & Automotive Business) Skyworks Solutions Inc. 2,750 7.1x 4/8/2021 ORBCOMM Inc. GI Partners, L.L.C. 1,089 4.4x 2/7/2021 Dialog Semiconductor Plc Renesas Electronics Corp. 5,461 4.1x 1/14/2021 Acacia Communications, Inc. Cisco

Systems, Inc. 4,190 11.3x 7/17/2020 DisplayLink Corp. Synaptics, Inc. 305 3.2x 7/7/2020 Broadcom, Inc. (Wireless Internet of Things Business) Synaptics, Inc. 250 3.8x 4/1/2020 Thingstream Ltd. u-blox AG 10 NA 2/20/2020 Adesto Technologies Dialog

Semiconductor 433 3.7x 5/29/2019 Marvell Technology Group Ltd. (Wireless Connectivity Business) NXP Semiconductors NV 1,760 5.9x 5/6/2019 Aquantia Corp. Marvell Technology Inc. 450 4.1x 3/27/2019 Quantenna Communications Inc. ON Semiconductor

Corporation 934 4.2x 11/9/2018 Finisar Corporation II-VI Incorporated 4,806 3.7x 10/30/2018 Electro Scientific Industries, Inc. MKS Instruments, Inc. 987 2.4x 9/10/2018 Integrated Device Technology, Inc. Renesas Electronics Corp. 6,686 7.6x

3/12/2018 Oclaro, Inc. Lumentum Holdings Inc. 1,510 2.5x 1/23/2018 Sigma Designs, Inc. (Z-Wave Business) Silicon Laboratories, Inc. 243 NA 12/17/2017 Gemalto N.V. Thales S.A. 6,614 1.9x 9/22/2017 Imagination Technologies Canyon Bridge Capital

Partners 749 4.0x 8/28/2017 IXYS Littelfuse 726 2.2x 3/19/2017 Exar MaxLinear 464 4.2x 2/13/2017 GigPeak Integrated Device Technology 227 3.9x 11/21/2016 Applied Micro Circuits MACOM Technology Solutions 683 4.1x Notes: Source: FactSet Research

Systems, 451 Research, SEC Filings, Company Press Releases ‘NM’ for multiples that exceed 75x, ‘NEG’ for multiples that are below zero and ‘NA’ for unavailable or insufficient information NEEDHAM & COMPANY

STRICTLY PRIVATE & CONFIDENTIAL 7

- DRAFT AND SUBJECT TO CHANGE - Selected M&A Transactions (Cont.) ($

in Millions) Announce Enterprise Enterprise Value / Date Target Acquirer Value LTM Revenue 3/16/2016 ROFIN-SINAR Technologies, Inc. Coherent, Inc. $ 816 1.6x 2/23/2016 Newport Corporation MKS Instruments, Inc. 980 1.6x 9/30/2015 Ezchip Semiconductor

Mellanox Technologies 607 5.8x 9/3/2015 Pericom Semiconductor Diodes 291 2.3x 5/7/2015 Micrel Microchip Technology 743 3.1x 3/18/2015 Vitesse Semiconductor Microsemi 356 3.3x 3/12/2015 Integrated Silicon Solutions Investor Consortium 677 2.1x

2/25/2015 Emulex Avago 577 1.4x 2/3/2015 Entropic Communications MaxLinear 183 1.0x 1/27/2015 Silicon Image Lattice Semiconductor 444 1.7x 11/19/2014 Oplink Communications, Inc. Koch Industries, Inc. 322 1.6x 4/29/2013 Telular Corporation Avista

Capital Partners 253 2.8x 6/5/2012 Miranda Technologies Inc. Belden Inc. 331 1.8x 75th Percentile 4.2x Mean 3.7x Median 3.5x 25th Percentile 2.2x Notes: Source: FactSet Research Systems, 451 Research, SEC Filings, Company Press Releases

‘NM’ for multiples that exceed 75x, ‘NEG’ for multiples that are below zero and ‘NA’ for unavailable or insufficient information NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 8

- DRAFT AND SUBJECT TO CHANGE - Discounted Cash Flow – Revenue

Multiple Discounted Cash Flow Analysis ($ in millions) Fiscal Year Ending December 31, 2022E 2023E 2024E 2025E Operating Profit $ (12.4) $ 5.8 $ 38.3 PRESENT VALUE CALCULATION ($ in millions) Revenue Discount Rate Multiple 15.5% 17.0% 18.5% 20.0%

(1)(2) Present Value of Free Cash Flows $ 19.3 $ 18.4 $ 17.6 $ 16.8 Plus: Present Value of Terminal Value 1.0x $ 106.8 $ 103.1 $ 99.6 $ 96.3 Based on multiple of FY2025 Revenue of $157.5M 1.5x 160.1 154.7 149.5 144.5 2.0x 213.5 206.2 199.3 192.6

2.5x 266.9 257.8 249.1 240.8 3.0x 320.3 309.3 298.9 288.9 Equals: Implied Enterprise Value 1.0x $ 126.0 $ 121.5 $ 117.2 $ 113.1 Based on multiple of FY2025 Revenue of $157.5M 1.5x 179.4 173.1 167.0 161.2 2.0x 232.8 224.6 216.8 209.4 2.5x 286.2 276.2

266.6 257.5 3.0x 339.6 327.7 316.5 305.7 Implied Equity Value 1.0x $ 90.1 $ 85.5 $ 81.2 $ 77.1 Based on $10.7M of Cash & $46.7M of Debt 1.5x 143.4 137.1 131.0 125.2 2.0x 196.8 188.6 180.8 173.4 2.5x 250.2 240.2 230.7 221.5 3.0x 303.6 291.8 280.5

269.7 Notes: Source: Financials provided by management Present value as of April 21, 2023 Based on 2023E – 2025E operating profit NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 9

- DRAFT AND SUBJECT TO CHANGE - Implied Valuation of Sequoia Whole

Company (Chip Only Scenario) 2023E Revenue $ 159 $ 192 (3.1x - 3.8x) LTM Revenue ('24 Multiples) $ 197 $ 246 (2.8x - 3.5x) 2023E Revenue $ 178 $ 189 (3.5x - 3.7x) 2025E Revenue $ 167 $ 276 (1.1x - 1.8x) $50 $100 $150 $200 $250 $300 Notes: Source:

FactSet Research Systems, SEC Filings, Financials Provided by Management Market statistics reflect closing stock price on April 21, 2023 LTM Revenue as of June 30, 2024 NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 10 Discounted Cash

Selected Precedent Selected Wireless / Connectivity / IoT- Flow Analysis Transactions Centric Companies

- DRAFT AND SUBJECT TO CHANGE - Premia Paid Analysis – Technology

Transaction Between $100M and $1B ($ in millions) Selected Technology M&A Transactions Between $100M and $1B, Last Two Years Announce Equity Enterprise Offer Price % Premium Date Acquirer Company Target Company Value Value 1-Day 5-Days 30-Days

60-Days 90-Days a 2/8/23 Wavenet Ltd. AdEPT Technology Group Plc $ 60.4 $ 103.0 74.8% 74.8% 96.1% 78.7% 82.7% 1/3/23 First Brands Group LLC Horizon Global Corp. 48.5 402.5 350.1% 207.0% 236.5% 165.2% (8.9%) Alpha Private Equity; Peninsula Capital

12/7/22 Prima Industrie SpA 108.1 360.8 1.0% 1.0% 1.8% 2.5% 5.0% Advisors; Private Groups 11/9/22 Carlyle Japan Asset Management Uzabase, Inc. 382.2 358.3 74.6% 101.3% 129.7% 110.7% 78.6% 11/8/22 Carlyle Japan Asset Management Totoku Electric Co.

Ltd. 260.6 198.8 157.0% 157.2% 156.5% 152.1% 146.1% 11/1/22 Voya Financial, Inc. Benefitfocus, Inc. 362.0 582.7 48.9% 66.9% 56.3% 54.4% 25.9% Thoma Bravo; Sunstone Partners; Private 10/27/22 UserTesting, Inc. 1,101.4 951.4 94.3% 111.9% 90.8% 68.9%

49.4% Groups 10/26/22 K1 Investment Management LLC ELMO Software Ltd. 309.1 323.5 47.0% 55.9% 61.7% 64.4% 98.8% 9/29/22 Accenture Japan Ltd. Albert, Inc. 283.8 259.8 126.4% 120.9% 108.2% 103.8% 68.7% Insight Venture Management; GTCR; 9/6/22

ChannelAdvisor Corp. 668.0 588.8 57.1% 52.8% 55.6% 60.4% 66.8% Sycamore Partners; CommerceHub, Inc. 8/16/22 Danawa Co., Ltd. KoreaCenter Co., Ltd. 500.8 503.3 (2.0%) 5.0% 18.1% 10.7% (21.5%) 8/15/22 Thoma Bravo LP Nearmap Ltd. 746.2 685.9 39.1%

41.9% 89.2% 101.9% 43.8% 8/8/22 Nordson Corp. CyberOptics Corp. 401.0 383.1 31.4% 34.7% 53.8% 24.9% 24.8% Convey Health Solutions Holdings, 6/21/22 TPG Capital LLC 194.5 1,038.4 143.1% 161.2% 88.5% 75.6% 46.4% Inc. 6/20/22 Aareon AG Momentum

Software Group AB 163.7 154.1 71.4% 61.5% 54.0% 40.9% 25.6% 6/2/22 Apax Partners LLP EcoOnline Holding AS 399.2 404.3 68.5% 64.9% 58.5% 61.3% 23.0% 5/25/22 Thoma Bravo LP Mercell Holding AS 330.2 491.8 109.7% 111.8% 110.0% 104.2% 4.0% Notes: Source:

FactSet Research Systems NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL 11

- DRAFT AND SUBJECT TO CHANGE - Premia Paid Analysis – Technology

Transaction Between $100M and $1B (Cont.) ($ in millions) Selected Technology M&A Transactions Between $100M and $1B, Last Two Years Announce Equity Enterprise Offer Price % Premium Date Acquirer Company Target Company Value Value 1-Day 5-Days

30-Days 60-Days 90-Days a 5/9/22 Concentrix Corp. ServiceSource International, Inc. $ 150.4 $ 159.1 47.1% 37.6% 14.5% 19.0% 52.5% 5/5/22 Latécoère SA Avcorp Industries, Inc. 31.8 109.3 22.2% 22.2% 29.4% 46.7% 69.2% 4/29/22 GI Manager LP

GTY Technology Holdings, Inc. 376.7 395.1 122.6% 138.6% 72.1% 41.9% 8.2% Accel-KKR; Briarwood Chase Management; 4/14/22 Basware Oyj 493.5 554.5 94.7% 93.7% 80.6% 77.4% 30.0% Long Path Partners; Private Groups 4/11/22 Pfizer Australia Holdings Pty

Ltd. ResApp Health Ltd. 133.3 130.9 131.1% 147.6% 210.4% 184.9% 220.0% 4/6/22 Turn/River Management LP Tufin Software Technologies Ltd. 500.4 438.2 44.0% 44.8% 56.8% 48.8% 54.7% 2/14/22 Murata Electronics North America, Inc. Resonant, Inc. 289.9

282.8 262.9% 216.9% 163.2% 144.6% 74.4% 1/31/22 Agrico Acquisition Corp. Kalera AS 191.6 191.6 0.0% 12.5% (28.1%) (36.3%) (72.6%) Alpha Luck Industrial; AKM Meadville 1/14/22 AKM Industrial Co., Ltd. 230.0 380.6 (5.9%) (7.8%) (10.0%) (6.3%) 80.4%

Electronics.; Private Groups Clayton Dubilier & Rice LLC; Vera Whole 1/5/22 Castlight Health, Inc. 335.5 278.7 25.0% 36.7% 21.3% 30.6% 12.6% Health, Inc. 12/16/21 NAT GAMES Co., Ltd. Nexon GT Co., Ltd. 550.7 493.5 2.3% 17.8% 46.3% 81.2% 60.5%

11/8/21 Open Text Corp. Zix Corp. 482.7 789.9 (2.7%) 3.7% 15.2% 14.7% 19.0% 11/4/21 Lumentum Holdings, Inc. NeoPhotonics Corp. 859.0 815.3 38.9% 62.3% 77.0% 64.3% 56.4% 75th Percentile $ 495.2 $ 561.5 112.9% 114.1% 99.1% 102.4% 70.5% Mean 364.8

427.0 75.8% 75.2% 73.8% 66.4% 47.5% Median 332.8 389.1 53.0% 61.9% 60.1% 62.8% 47.9% 25th Percentile 184.6 244.6 24.3% 31.6% 27.4% 29.1% 17.4% Notes: Source: FactSet Research Systems NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL

12

- DRAFT AND SUBJECT TO CHANGE - Appendix A: WACC Analysis NEEDHAM &

COMPANY STRICTLY PRIVATE & CONFIDENTIAL 13

- DRAFT AND SUBJECT TO CHANGE - WACC Analysis Sequoia Levered Beta

Unlevered Beta 0.75 Debt / Equity Ratio 30.4% (1) 21.0% Marginal Tax Rate (2) 0.93 Levered Beta Cost of Capital Calculation (3) 6.00% Equity Market Risk Premium (x) Sequoia Levered Beta 0.93 Adjusted Equity Market Risk Premium 5.58% (4) 3.57% (+)

U.S. Risk Free Rate (5) 6.37% (+) Size Premium Cost of Equity 15.52% Equity % in the Capital Structure 76.7% Debt % in the Capital Structure 23.3% Weighted Average Cost of Capital 15.52% Notes: (1) Assumed capital structure based on industry average

for comparable public companies (2) Assumes tax rate of 21.0% (3) Calculated as Relevered Beta = Unlevered Beta x (1 + ((1 – Tax Rate) x (Debt/Equity))) (4) Source: Kroll (fka Duff & Phelps) as of April 21, 2023 (5) US Treasury; Represents

current yield on 10-year Treasury Bonds as of April 21, 2023 (6) Source: Kroll (fka Duff & Phelps); represents size-related risk premium of companies with market capitalizations between $79M and $124M NEEDHAM & COMPANY STRICTLY PRIVATE &

CONFIDENTIAL 14

Exhibit (c)(3) Project Sequoia – Materials for Discussion DRAFT,

PRELIMINARY, AND SUBJECT TO CONFIRMATION & MATERIAL REVISION June 27, 2023 STRICTLY PRIVATE & CONFIDENTIAL

- DRAFT AND SUBJECT TO CHANGE - Presentation Basis ▪ This

presentation was prepared on a confidential basis exclusively for the benefit and use of the Board of Directors of Sting (the “Company”). This presentation is subject to the assumptions, qualifications and limitations set forth herein.

This presentation is for discussion purposes only. It is not a recommendation as to how any Board member should vote, and does not carry any right of publication or disclosure. Neither this presentation nor any of its contents may be used for any

other purpose without the prior written consent of Needham & Company, LLC. ▪ The information contained in this material is based on information obtained from the Company and other sources. Needham & Company, LLC has relied upon the

accuracy and completeness of the foregoing information and has neither attempted to verify independently nor assumed responsibility for verifying any of such information. Any financial estimates and projections contained herein have been prepared by

management or are based upon such estimates and projections, and involve numerous and significant subjective determinations, which may or may not be correct, and we have assumed that such estimates and projections have been reasonably prepared on

bases reflecting the best currently available estimates and judgments of management or represent reasonable estimates. No representation or warranty, expressed or implied, is made as to the accuracy or completeness of such information and nothing

contained herein is, or shall be relied upon as, a promise or representation, whether as to the past or the future. This material was not prepared for use by readers not as familiar with the business and affairs of the Company as the Board of

Directors of the Company and, accordingly, Needham & Company, LLC takes no responsibility for the accompanying material when used by persons other than the Board of Directors. ▪ Nothing contained herein should be construed as tax,

accounting, or legal advice. NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL

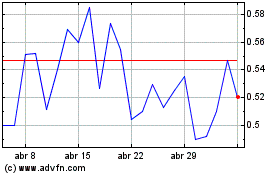

- DRAFT AND SUBJECT TO CHANGE - Sequoia – Premium Analysis 6/23/2023

6/26/2023 Bid / Proposal Volume Weighted Average Price as of June 23, 2023 VWAP Price Company Price Price Price 1-Day 5-Days 10-Days 30-Days 60-Days 90-Days a Sequoia $ 2.15 $ 2.16 $ 3.03 $ 2.21 $ 2.25 $ 2.24 $ 2.22 $ 2.23 $ 2.25 Premium at $3.03

per Share Offer 40.9% 40.3% NA 37.4% 34.7% 35.5% 36.4% 35.8% 34.7% 6/23/2023 6/26/2023 Bid / Proposal Volume Weighted Average Price as of June 26, 2023 VWAP Price Company Price Price Price 1-Day 5-Days 10-Days 30-Days 60-Days 90-Days a Sequoia $

2.15 $ 2.16 $ 3.03 $ 2.19 $ 2.24 $ 2.23 $ 2.22 $ 2.25 $ 2.25 Premium at $3.03 per Share Offer 40.9% 40.3% NA 38.5% 35.4% 35.9% 36.6% 34.7% 34.8% Notes: Source: FactSet Research Systems, SEC Filings Market statistics reflect closing stock price on

June 26, 2023 ‘NM’ for multiples that exceed 75x, ‘NEG’ for multiples that are below zero and ‘NA’ for unavailable or insufficient information NEEDHAM & COMPANY STRICTLY PRIVATE & CONFIDENTIAL

DRAFT Exhibit (c)(4) Project Sting Presentation to the Board of

Directors of Sting July 25, 2023 STRICTLY PRIVATE & CONFIDENTIAL

DRAFT Presentation Basis ▪ This presentation was prepared on a

confidential basis exclusively for the benefit and use of the Board of Directors of Sting (the “Company”). This presentation is subject to the assumptions, qualifications and limitations set forth herein. This presentation is for

discussion purposes only. It is not a recommendation as to how any Board member should vote, and does not carry any right of publication or disclosure. Neither this presentation nor any of its contents may be used for any other purpose without the