- Premiums and deposits1 excluding transactional activity grew

14% compared to the prior year quarter

- Base portfolio income for our insurance operating businesses

grew 19% while base yield expanded 54 basis points compared to the

prior year quarter

- Net loss of $566 million, or $0.87 per share, largely the

result of realized losses on derivatives and foreign exchange

movements

- Adjusted after-tax operating income of $574 million and

operating EPS of $0.88 per share reflects strong base spread income

and favorable mortality experience

- $2.2 billion of normalized distributions from our insurance

companies in 2022

- Paid $876 million in dividends in 2022 ($296 million since the

IPO)

- Declared quarterly cash dividend $0.23 per share of common

stock on February 16, 2023

Corebridge Financial, Inc. ("Corebridge" or the "Company")

(NYSE: CRBG) today reported financial results for the fourth

quarter and full year ended December 31, 2022.

Kevin Hogan, President and Chief Executive Officer of

Corebridge, said, “2022 was a year of significant milestones for

our company. We rebranded as Corebridge Financial early in the year

as our operational separation from AIG began, and in September, we

became a New York Stock Exchange listed company when our initial

public offering closed on September 19. We ended the year with

strong momentum and remain focused on our core mission of helping

individuals plan, save for and achieve secure financial

futures.

"In the fourth quarter and throughout the year, our diversified

business platform and broad reach enabled robust sales and

attractive margins in fixed and fixed index annuities, in addition

to strong performance realized across all our businesses. We

achieved meaningful growth in base spread income and substantial

improvement in underwriting margin, and we benefited from strong

deposit flows. We have made progress with Corebridge Forward, our

modernization initiative, and are benefiting from our partnerships

with Blackstone and BlackRock. We maintained a strong financial

position throughout the year and delivered on our capital

management goals for 2022.

"As we look ahead, the external environment remains uncertain,

but we are steadfastly focused on executing our strategies and

delivering on our financial goals. We have a strong balance sheet

and free cash flow profile, and we will stay disciplined in

deploying capital to create value for our customers, distribution

partners and other stakeholders."

CONSOLIDATED RESULTS

Three Months Ended December

31,

Twelve Months Ended December

31,

($ in millions, except per share data)

2022

2021

2022

2021

Net income (loss) attributable to common

shareholders

$

(566

)

$

3,122

$

8,149

$

7,355

Income (loss) per common share

attributable to common shareholders2

$

(0.87

)

$

5.24

$

12.59

$

11.80

Adjusted after-tax operating income

$

574

$

729

$

1,857

$

2,929

Operating EPS

$

0.88

$

1.13

$

2.87

$

4.54

Book value per common share

$

12.73

$

41.99

$

12.73

$

41.99

Adjusted book value per common share

$

33.10

$

30.31

$

33.10

$

30.31

Pre-tax income (loss)

$

(779

)

$

4,623

$

10,460

$

10,127

Adjusted pre-tax operating income

$

639

$

926

$

2,183

$

3,685

Premiums and deposits

$

8,694

$

8,501

$

31,623

$

30,608

Net investment income

$

2,555

$

2,925

$

9,576

$

11,672

Net investment income (APTOI basis)

$

2,307

$

2,492

$

8,758

$

9,917

Base portfolio income - insurance

operating businesses

$

2,200

$

1,846

$

7,884

$

7,494

Variable investment income - insurance

operating businesses

$

23

$

511

$

442

$

2,029

Corporate and other

$

84

$

135

$

432

$

394

Return on average equity

(28.8

%)

39.3

%

46.2

%

22.9

%

Adjusted return on average equity

10.6

%

12.1

%

9.1

%

12.6

%

Fourth Quarter

Net loss was $0.6 billion, a 118% decrease compared to the prior

year quarter. The change was largely driven by $3.0 billion of

gains recorded in the fourth quarter of 2021 attributed to the sale

of our affordable housing portfolio and $1.2 billion of net

realized losses in the fourth quarter of 2022 related to

derivatives and foreign exchange movements.

Adjusted pre-tax operating income ("APTOI") was $639 million, a

31% decrease compared to the prior year quarter, largely due to

challenging macroeconomic conditions and structural changes in our

business profile, including implementation of the Company's new

capital structure and divestitures. Variable investment income was

lower by $488 million, the largest contributor to the

year-over-year decline. Excluding variable investment income, APTOI

was $616 million, a 48% increase compared to the prior year

quarter, the result of higher base portfolio income, improved

mortality experience and lower expenses, partially offset by lower

fee income.

Premiums and deposits were $8.7 billion, a 2% increase compared

to the prior year quarter. Excluding transactional activity (i.e.,

pension risk transfer, guaranteed investment contracts and Group

Retirement plan acquisitions), premiums and deposits grew 14% when

compared to the prior year quarter. These results mainly reflect

higher fixed and fixed index annuity deposits partially offset by

lower variable annuity deposits in Individual Retirement and Group

Retirement.

Net investment income was $2.6 billion, a 13% decrease compared

to the prior year quarter, while net investment income on an APTOI

basis was $2.3 billion, a 7% decrease compared to the prior year

quarter. This decline largely was due to lower variable investment

income – notably weaker private equity returns, lower bond call and

tender income, and lower commercial mortgage loan prepayment

activity – partially offset by higher base portfolio income. Base

portfolio income grew 19% when compared to fourth quarter of

2021.

Full Year

Net income was $8.1 billion, an 11% increase year-over-year,

primarily the result of higher gains on the Fortitude Re funds

withheld embedded derivative and higher net realized gains,

partially offset by lower net investment income and a gain recorded

in 2021 associated with the sale of our affordable housing

portfolio.

APTOI was $2.2 billion, a 41% decrease compared to the prior

year, largely related to the impact from structural changes in our

business and challenging macroeconomic conditions driving higher

base portfolio income, lower variable investment income, lower fee

income and higher deferred acquisition costs amortization. Improved

mortality experience, as well as a comparatively less adverse

result from the annual actuarial assumption review, also impacted

results. Variable investment income was lower by $1.6 billion, the

largest contributor to the year-over-year decline.

Premiums and deposits were $31.6 billion, a 3% increase compared

to the prior year.3 Excluding transactional activity, premiums and

deposits grew 8% when compared to 2021. These results primarily

reflect higher fixed and fixed index annuity deposits partially

offset by lower variable annuity deposits in Individual Retirement

and Group Retirement.

Net investment income was $9.6 billion, an 18% decrease compared

to the prior year, while net investment income on an APTOI basis

was $8.8 billion, a 12% decrease compared to the prior year. This

decline largely was due to lower variable investment income –

notably weaker private equity returns, lower bond call and tender

income, and lower commercial mortgage loan prepayment activity –

partially offset by higher base portfolio income. Base portfolio

income grew 5% when compared to 2021.

BUSINESS RESULTS

Individual

Retirement

Three Months Ended December

31,

($ in millions)

2022

2021

Premiums and deposits

$

3,827

$

3,308

Spread income

$

587

$

646

Base spread income

$

565

$

420

Variable investment income

$

22

$

226

Fee income

$

304

$

383

Adjusted pre-tax operating income

$

436

$

504

- Premiums and deposits increased $519 million, or 16%, as

compared to the prior year quarter largely driven by growth of

fixed and fixed index annuity deposits, partially offset by lower

variable annuity deposits. Net flows increased $244 million, or

718%, when compared to the fourth quarter of 2021 primarily the

result of stronger fixed annuity flows

- Base net investment spread of 2.21% for the quarter expanded 54

basis points and 27 basis points on a prior year and sequential

quarter basis, respectively

- APTOI decreased $68 million, or 13%, year-over-year primarily

due to lower variable investment income and lower fee income,

partially offset by higher base spread income and lower

expenses

Group

Retirement

Three Months Ended December

31,

($ in millions)

2022

2021

Premiums and deposits

$

2,243

$

1,862

Spread income

$

208

$

316

Base spread income

$

207

$

184

Variable investment income

$

1

$

132

Fee income

$

177

$

222

Adjusted pre-tax operating income

$

177

$

315

- Premiums and deposits increased $381 million, or 20%, as

compared to the prior year quarter due to higher plan acquisitions

and out-of-plan fixed annuity deposits, partially offset by lower

out-of-plan variable annuity deposits. Net flows increased $116

million, or 11%, when compared to the fourth quarter of 2021,

primarily the result of stronger in-plan flows

- Base net investment spread of 1.59% for the quarter expanded 17

basis points on a prior year quarter basis. Results were unchanged

sequentially

- APTOI decreased $138 million, or 44%, year-over-year primarily

due to lower variable investment income and lower fee income,

partially offset by higher base spread income

Life

Insurance

Three Months Ended December

31,

($ in millions)

2022

2021

Premiums and deposits

$

1,073

$

1,098

Underwriting margin

$

375

$

266

Underwriting margin excluding variable

investment income

$

370

$

188

Variable investment income

$

5

$

78

Adjusted pre-tax operating income

$

97

$

6

- APTOI increased $91 million year-over-year primarily due to

higher underwriting margin driven by improved mortality experience

and higher base portfolio income

- COVID mortality experience was in line with the previously

disclosed estimate of exposure sensitivity of $65 million to $75

million per 100,000 population deaths based on the reported fourth

quarter 2022 COVID-related deaths in the United States

Institutional

Markets

Three Months Ended December

31,

($ in millions)

2022

2021

Premiums and deposits

$

1,551

$

2,233

Spread income

$

65

$

139

Base spread income

$

71

$

73

Variable investment income (loss)

$

(6

)

$

66

Fee income

$

16

$

15

Underwriting margin

$

17

$

22

Underwriting margin excluding variable

investment income

$

17

$

15

Variable investment income

$

—

$

7

Adjusted pre-tax operating income

$

64

$

166

- Premiums and deposits decreased $682 million, or 31%, as

compared to the prior year quarter driven by lower volume of new

pension risk transfer activity, partially offset by higher

structured settlement annuities. Pension risk transfer sales were

$1.3 billion for the fourth quarter of 2022

- APTOI decreased $102 million, or 61%, year-over-year primarily

due to lower variable investment income

Corporate and

Other4

Three Months Ended December

31,

($ in millions)

2022

2021

Corporate expenses

$

(46

)

$

(36

)

Interest on financial debt

$

(103

)

$

(25

)

Asset management

$

15

$

—

Consolidated investment entities

$

2

$

(6

)

Other

$

(3

)

$

2

Adjusted pre-tax operating income

(loss)

$

(135

)

$

(65

)

- APTOI decreased $70 million, or 108%, year-over-year primarily

due to higher interest expense on financial debt driven by the

Company’s recapitalization in connection with the IPO

CAPITAL AND LIQUIDITY HIGHLIGHTS

- Life Fleet RBC Ratio estimated to exceed 400% target

- Financial leverage ratio of 29.6%, within our 25% to 30%

targeted range

- Parent liquidity of $1.5 billion as of December 31, 2022

- $200 million of normalized distributions from our insurance

companies during the fourth quarter, with $2.2 billion of

normalized distributions for the full year of 2022

- Adjusted book value grew $1.8 billion, or 9%, year-over-year by

delivering strong earnings while also paying $876 million in

dividends ($296 million since the IPO)

- Declared quarterly dividend of $0.23 per share of common stock

on February 16, 2023, payable on March 31, 2023, to shareholders of

record at the close of business on March 17, 2023

___________________________

1

This release refers to financial measures

not calculated in accordance with generally accepted accounting

principles (non-GAAP); definitions of non-GAAP measures and

reconciliations to their closest GAAP measures, as well as more

information on key operating metrics and key terms, can be found in

"Non-GAAP Financial Measures" or "Key Operating Metrics and Key

Terms" below

2

Prior period results reflect Class A

shares only. Net income per Class B shares was $1.21 and $7.77 in

4Q21 and 2021, respectively. Refer to page 19 for an explanation of

the share class structure in 2021

3

Excludes deposits from the sale of our

retail mutual fund business that were sold to Touchstone on July

16, 2021, or otherwise liquidated in connection with the sale

4

Includes consolidations and

eliminations

CONFERENCE CALL

Corebridge will host a conference call on Friday, February 17,

2023, at 8:30 a.m. EST to review these results. The call is open to

the public and can be accessed via a live listen-only webcast in

the Investors section of corebridgefinancial.com. A replay will be

available after the call at the same location.

Supplemental financial data and our investor presentation are

available in the Investors section of

www.corebridgefinancial.com.

About Corebridge Financial

Corebridge Financial makes it possible for more people to take

action in their financial lives. With more than $355 billion in

assets under management and administration as of December 31, 2022,

Corebridge is one of the largest providers of retirement solutions

and insurance products in the United States. We proudly partner

with financial professionals and institutions to help individuals

plan, save for and achieve secure financial futures. For more

information, visit corebridgefinancial.com and follow us on

LinkedIn, YouTube, Facebook and Twitter. These references with

additional information about Corebridge have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

In the discussion below, “we,” “us” and “our” refer to

Corebridge and its consolidated subsidiaries, unless the context

refers solely to Corebridge as a corporate entity.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This release contains forward-looking statements. Words such as

“expects,” “believes,” “anticipates,” “intends,” “seeks,” “aims,”

“plans,” “assumes,” “estimates,” “projects,” “should,” “would,”

“could,” “may,” “will,” “shall” or variations of such words are

generally part of forward-looking statements. Also, forward-looking

statements include, without limitation, all matters that are not

historical facts. Forward-looking statements are made based on

management’s current expectations and beliefs concerning future

developments and their potential effects upon Corebridge and its

consolidated subsidiaries. There can be no assurance that future

developments affecting Corebridge and its consolidated subsidiaries

will be those anticipated by management.

Any forward-looking statements included herein are not a

guarantee of future performance and involve risks and

uncertainties, and there are certain important factors that could

cause actual results to differ, possibly materially, from

expectations or estimates reflected in such forward-looking

statements, including, among others, risks related to:

- market conditions, including risks related to rapidly

increasing interest rates, declining or negative interest rates,

deterioration of market conditions, geopolitical tensions, equity

market declines or volatility and the COVID-19 pandemic;

- insurance risk and related exposures, including risks related

to insurance liability claims exceeding reserves, reinsurance

becoming unavailable and the occurrence of events causing

acceleration of the amortization of deferred acquisition

costs;

- our investment portfolio and concentration of investments,

including risks related to realization of gross unrealized losses

on fixed maturity securities and changes in investment

valuations;

- liquidity, capital and credit, including risks related to our

access to funds from our subsidiaries being restricted, the

possible incurrence of additional debt, the ability to refinance

existing debt, the illiquidity of some of our investments, a

downgrade in our insurer financial strength ratings and

non-performance by counterparties;

- our business and operations, including risks related to pricing

for our products, guarantees within certain of our products, our

use of derivatives instruments, marketing and distribution of our

products through third parties, our reliance on third parties to

provide business and administrative services, maintaining the

availability of our critical technology systems, our risk

management policies becoming ineffective, significant legal or

regulatory proceedings, our business strategy becoming ineffective,

intense competition, catastrophes, changes in our accounting

principles and financial reporting requirements, our foreign

operations, business or asset acquisitions and dispositions and our

ability to protect our intellectual property;

- the intense regulation of our business;

- estimates and assumptions, including risks related to estimates

or assumptions used in the preparation of our financial statements

differing materially from actual experience, the effectiveness of

our productivity improvement initiatives and impairments of

goodwill;

- competition and employees, including risks related to our

ability to attract and retain key employees and employee error and

misconduct;

- our investment managers, including our reliance on agreements

with Blackstone ISG-1 Advisors L.L.C. which we have a limited

ability to terminate or amend and increased regulation or scrutiny

of investment advisers and investment activities;

- our separation from AIG, including risks related to the

replacement or replication of functions and the loss of benefits

from AIG’s global contracts, our inability to file a single US

consolidated income federal income tax return for a five-year

period, and limitations on our ability to use deferred tax assets

to offset future taxable income;

- our agreements with Fortitude Reinsurance Company Ltd.;

and

- other factors discussed in “Management’s Discussion and

Analysis of Financial Conditions and Results of Operations” and

“Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2022, filed with the U.S. Securities and Exchange

Commission pursuant to Rule 424(b)(4) under the Securities Act of

1933, as amended.

Forward-looking statements should be read in conjunction with

the other cautionary statements, risks, uncertainties and other

factors identified in our filings with the Securities and Exchange

Commission. Further, any forward-looking statement speaks only as

of the date on which it is made, and we undertake no obligation to

update or revise any forward-looking statement to reflect events or

circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events, except as otherwise

may be required by law.

NON-GAAP FINANCIAL MEASURES

Throughout this release, we present our financial condition and

results of operations in the way we believe will be most meaningful

and representative of our business results. Some of the

measurements we use are ‘‘non-GAAP financial measures’’ under

Securities and Exchange Commission rules and regulations. We

believe presentation of these non-GAAP financial measures allows

for a deeper understanding of the profitability drivers of our

business, results of operations, financial condition and liquidity.

These measures should be considered supplementary to our results of

operations and financial condition that are presented in accordance

with GAAP and should not be viewed as a substitute for GAAP

measures. The non-GAAP financial measures we present may not be

comparable to similarly-named measures reported by other

companies.

Adjusted pre-tax operating income (“APTOI”) is

derived by excluding the items set forth below from income from

operations before income tax. These items generally fall into one

or more of the following broad categories: legacy matters having no

relevance to our current businesses or operating performance;

adjustments to enhance transparency to the underlying economics of

transactions; and recording adjustments to APTOI that we believe to

be common in our industry. We believe the adjustments to pre-tax

income are useful for gaining an understanding of our overall

results of operations.

APTOI excludes the impact of the following items:

FORTITUDE RELATED ADJUSTMENTS:

The modco reinsurance agreements with

Fortitude Re transfer the economics of the invested assets

supporting the reinsurance agreements to Fortitude Re. Accordingly,

the net investment income on Fortitude Re funds withheld assets and

the net realized gains (losses) on Fortitude Re funds withheld

assets are excluded from APTOI. Similarly, changes in the Fortitude

Re funds withheld embedded derivative are also excluded from

APTOI.

As a result of entering into the reinsurance

agreements with Fortitude Re we recorded a loss which was primarily

attributed to the write-off of DAC, VOBA and deferred cost of

reinsurance assets. The total loss and the ongoing results

associated with the reinsurance agreement with Fortitude Re have

been excluded from APTOI as these are not indicative of our ongoing

business operations.

INVESTMENT RELATED ADJUSTMENTS:

APTOI excludes “Net realized gains (losses),”

including changes in the allowance for credit losses on

available-for-sale securities and loans, as well as gains or losses

from sales of securities, except for gains (losses) related to the

disposition of real estate investments. Net realized gains

(losses), except for gains (losses) related to the disposition of

real estate investments, are excluded as the timing of sales on

invested assets or changes in allowances depend largely on market

credit cycles and can vary considerably across periods. In

addition, changes in interest rates may create opportunistic

scenarios to buy or sell invested assets. Our derivative results,

including those used to economically hedge insurance liabilities,

also included in Net realized gains (losses) are similarly excluded

from APTOI except earned income (periodic settlements and changes

in settlement accruals) on derivative instruments used for

non-qualifying (economic) hedges or for asset replication. Earned

income on such economic hedges is reclassified from Net realized

gains and losses to specific APTOI line items based on the economic

risk being hedged (e.g., Net investment income and Interest

credited to policyholder account balances).

Our investment-oriented contracts, such as

universal life insurance, and fixed, fixed index and variable

annuities, are also impacted by net realized gains (losses), and

these secondary impacts are also excluded from APTOI. Specifically,

the changes in benefit reserves and DAC, VOBA and DSI assets

related to net realized gains (losses) are excluded from APTOI.

VARIABLE, FIXED INDEX ANNUITIES AND INDEX

UNIVERSAL LIFE INSURANCE PRODUCTS ADJUSTMENTS:

Certain of our variable annuity contracts

contain guaranteed minimum withdrawal benefits (“GMWBs”) and are

accounted for as embedded derivatives. Additionally, certain fixed

index annuity contracts contain GMWB or indexed interest credits

which are accounted for as embedded derivatives, and our index

universal life insurance products also contain embedded

derivatives. Changes in the fair value of these embedded

derivatives, including rider fees attributed to the embedded

derivatives, are recorded through “Net realized gains (losses)” and

are excluded from APTOI.

Changes in the fair value of securities used

to hedge guaranteed living benefits are excluded from APTOI.

OTHER ADJUSTMENTS:

Other adjustments represent all other adjustments that are

excluded from APTOI and includes the net pre-tax operating income

(losses) from noncontrolling interests related to consolidated

investment entities. The excluded adjustments include, as

applicable:

- restructuring and other costs related to initiatives designed

to reduce operating expenses, improve efficiency and simplify our

organization;

- non-recurring costs associated with the implementation of

non-ordinary course legal or regulatory changes or changes to

accounting principles;

- separation costs;

- non-operating litigation reserves and settlements;

- loss (gain) on extinguishment of debt;

- losses from the impairment of goodwill; and

- income and loss from divested or run-off business.

Adjusted after-tax operating income attributable to our

common shareholders (“Adjusted After-tax Operating Income”

or “AATOI”) is derived by excluding the tax effected APTOI

adjustments described above, as well as the following tax items

from net income attributable to us:

- changes in uncertain tax positions and other tax items related

to legacy matters having no relevance to our current businesses or

operating performance; and

- deferred income tax valuation allowance releases and

charges.

Book value, excluding AOCI, adjusted for the cumulative

unrealized gains and losses related to Fortitude Re’s funds

withheld assets (“Adjusted Book Value”) is used to

eliminate the asymmetrical impact resulting from changes in fair

value of our available-for-sale securities portfolio where there is

largely no offsetting impact for certain related insurance

liabilities that are not recorded at fair value. In addition, we

adjust for the cumulative unrealized gains and losses related to

Fortitude Re’s funds withheld assets since these fair value

movements are economically transferred to Fortitude Re.

Adjusted Book Value per Common Share is computed as

adjusted book value divided by total common shares outstanding.

Adjusted Return on Average Equity (“Adjusted

ROAE”) is derived by dividing AATOI by average Adjusted Book

Value and is used by management to evaluate our recurring

profitability and evaluate trends in our business. We believe this

measure is useful to investors because it eliminates items that can

fluctuate significantly from period to period, including changes in

fair value of our available-for-sale securities portfolio and

foreign currency translation adjustments. This measure also

eliminates the asymmetrical impact resulting from changes in fair

value of our available-for-sale securities portfolio for which

there is largely no offsetting impact for certain related insurance

liabilities. In addition, we adjust for the cumulative unrealized

gains and losses related to Fortitude Re funds withheld assets

since these fair value movements are economically transferred to

Fortitude Re.

Adjusted revenues exclude Net realized gains (losses)

except for gains (losses) related to the disposition of real estate

investments, income from non-operating litigation settlements

(included in Other income for GAAP purposes) and changes in fair

value of securities used to hedge guaranteed living benefits

(included in Net investment income for GAAP purposes).

Net investment income (APTOI basis) is the sum of

base portfolio income and variable investment income.

Normalized distributions are defined as dividends paid by

the Life Fleet subsidiaries as well as the international insurance

subsidiaries, less non-recurring dividends, plus dividend capacity

that would have been available to Corebridge absent strategies that

resulted in utilization of tax attributes. We believe that

presenting normalized distributions is useful in understanding a

significant component of our liquidity as a stand-alone

company.

Operating EPS is calculated by dividing AATOI by weighted

average diluted shares.

Premiums and deposits is a non-GAAP financial measure

that includes direct and assumed premiums received and earned on

traditional life insurance policies, group benefit policies and

life-contingent payout annuities, as well as deposits received on

universal life insurance, investment-type annuity contracts and

GICs. We believe the measure of premiums and deposits is useful in

understanding customer demand for our products, evolving product

trends and our sales performance period over period.

KEY OPERATING METRICS AND KEY TERMS

Assets Under Management and Administration

- Assets Under Management (“AUM”) include assets in

the general and separate accounts of our subsidiaries that support

liabilities and surplus related to our life and annuity insurance

products.

- Assets Under Administration (“AUA”) include Group

Retirement mutual fund assets and other third-party assets that we

sell or administer and the notional value of SVW contracts.

- Assets Under Management and Administration

(“AUMA”) is the cumulative amount of AUM and AUA.

Net Investment Income

- Base portfolio income includes interest, dividends and

foreclosed real estate income, net of investment expenses and

non-qualifying (economic) hedges.

- Variable investment income includes call and tender

income, commercial mortgage loan prepayments, changes in market

value of investments accounted for under the fair value option,

interest received on defaulted investments (other than foreclosed

real estate), income from alternative investments, affordable

housing investments and other miscellaneous investment income,

including income of certain partnership entities that are required

to be consolidated. Alternative investments include private equity

funds which are generally reported on a one-quarter lag.

Base spread income means base portfolio income less

interest credited to policyholder account balances, excluding the

amortization of deferred sales inducements assets.

Base net investment spread means base yield less cost of

funds, excluding the amortization of deferred sales

inducements.

Base yield means the returns from base portfolio income

including accretion and impacts from holding cash and short-term

investments.

Cost of funds means the interest credited to

policyholders excluding the amortization deferred of sales

inducement assets.

Fee and Spread Income and Underwriting Margin

- Fee income is defined as policy fees plus advisory fees

plus other fee income.

- Spread income is defined as net investment income less

interest credited to policyholder account balances, exclusive of

amortization of deferred sales inducement assets. Spread income is

comprised of both base spread income and variable investment

income.

- Underwriting margin for our Life Insurance segment

includes premiums, policy fees, advisory fee income, net investment

income, less interest credited to policyholder account balances and

policyholder benefits and excludes the annual assumption update.

For our Institutional Markets segment, select products utilize

underwriting margin, which includes premiums, net investment

income, non-SVW fee and advisory fee income, less interest credited

and policyholder benefits and excludes the annual assumption

update.

Life Fleet RBC Ratio

- Life Fleet includes our three primary risk-bearing

entities, American General Life Insurance Company (“AGL”), The

United States Life Insurance Company in the City of New York

(“USL”) and The Variable Annuity Life Insurance Company (“VALIC”).

AGL, USL and VALIC are domestic insurance entities with a statutory

surplus greater than $500 million on an individual basis. The Life

Fleet does not include AGC Life Insurance Company, as it has no

operations outside of internal reinsurance.

- Life Fleet RBC Ratio is the risk-based capital (“RBC”)

ratio for the Life Fleet. RBC ratios are quoted using the Company

Action Level.

RECONCILIATIONS

The following tables present a reconciliation of pre-tax income

(loss)/net income (loss) attributable to Corebridge to adjusted

pre-tax operating income (loss)/adjusted after-tax operating income

(loss) attributable to Corebridge:

Three Months Ended December 31,

2022

2021

(in millions)

Pre-tax

Total Tax (Benefit)

Charge

Non- controlling

Interests

After Tax

Pre-tax

Total Tax (Benefit) Charge

Non- controlling Interests

After Tax

Pre-tax income/net income, including

noncontrolling interests

$

(779

)

$

(252

)

$

—

$

(527

)

$

4,623

$

884

$

—

$

3,739

Noncontrolling interests

—

—

(39

)

(39

)

—

—

(617

)

(617

)

Pre-tax income/net income attributable

to Corebridge

(779

)

(252

)

(39

)

(566

)

4,623

884

(617

)

3,122

Fortitude Re related items

Net investment income on Fortitude Re

funds withheld assets

(274

)

(57

)

—

(217

)

(439

)

(92

)

—

(347

)

Net realized (gains) losses on Fortitude

Re funds withheld assets

125

26

—

99

(442

)

(93

)

—

(349

)

Net realized losses on Fortitude Re funds

withheld embedded derivative

347

69

—

278

658

138

—

520

Net realized losses on Fortitude

transactions

—

—

—

—

(26

)

(5

)

—

(21

)

Subtotal Fortitude Re related

items

198

38

—

160

(249

)

(52

)

—

(197

)

Other reconciling Items:

Changes in uncertain tax positions and

other tax adjustments

—

5

—

(5

)

—

16

—

(16

)

Deferred income tax valuation allowance

(releases) charges

—

(6

)

—

6

—

9

—

(9

)

Changes in fair value of securities used

to hedge guaranteed living benefits

(1

)

—

—

(1

)

1

—

—

1

Changes in benefit reserves and DAC, VOBA

and DSI related to net realized gains (losses)

(120

)

(25

)

—

(95

)

(13

)

(3

)

—

(10

)

Loss on extinguishment of debt

—

—

—

—

(10

)

(2

)

—

(8

)

Net realized (gains) losses(a)

1,297

272

—

1,025

113

23

15

105

Separation costs

54

26

—

28

—

—

—

—

Restructuring and other costs

22

5

—

17

24

5

—

19

Non-recurring costs related to regulatory

or accounting changes

7

2

—

5

5

2

—

3

Net (gain) loss on divestiture

—

—

—

—

(2,978

)

(688

)

—

(2,290

)

Pension expense - non operating

—

—

—

—

12

3

—

9

Noncontrolling interests

(39

)

—

39

—

(602

)

—

602

—

Subtotal: Non-Fortitude Re reconciling

items

1,220

279

39

980

(3,448

)

(635

)

617

(2,196

)

Total adjustments

1,418

317

39

1,140

(3,697

)

(687

)

617

(2,393

)

Adjusted pre-tax income(loss)/Adjusted

after-tax income (loss) attributable to Corebridge common

shareholders

$

639

$

65

$

—

$

574

$

926

$

197

$

—

$

729

Twelve Months Ended December

31,

2022

2021

(in millions)

Pre-tax

Total Tax (Benefit)

Charge

Non- controlling

Interests

After Tax

Pre-tax

Total Tax (Benefit) Charge

Non- controlling Interests

After Tax

Pre-tax income/net income, including

noncontrolling interests

$

10,460

$

1,991

$

—

$

8,469

$

10,127

$

1,843

$

—

$

8,284

Noncontrolling interests

—

—

(320

)

(320

)

—

—

(929

)

(929

)

Pre-tax income/net income attributable

to Corebridge

10,460

1,991

(320

)

8,149

10,127

1,843

(929

)

7,355

Fortitude Re related items

Net investment income on Fortitude Re

funds withheld assets

(891

)

(187

)

—

(704

)

(1,775

)

(373

)

—

(1,402

)

Net realized (gains) losses on Fortitude

Re funds withheld assets

397

83

—

314

(924

)

(194

)

—

(730

)

Net realized losses on Fortitude Re funds

withheld embedded derivative

(6,347

)

(1,370

)

—

(4,977

)

687

144

—

543

Net realized losses on Fortitude

transactions

—

—

—

—

(26

)

(5

)

—

(21

)

Subtotal Fortitude Re related

items

(6,841

)

(1,474

)

—

(5,367

)

(2,038

)

(428

)

—

(1,610

)

Other reconciling Items:

Changes in uncertain tax positions and

other tax adjustments

—

95

—

(95

)

—

174

—

(174

)

Deferred income tax valuation allowance

(releases) charges

—

(157

)

—

157

—

(26

)

—

26

Changes in fair value of securities used

to hedge guaranteed living benefits

(30

)

(6

)

—

(24

)

(56

)

(12

)

—

(44

)

Changes in benefit reserves and DAC, VOBA

and DSI related to net realized gains (losses)

308

65

—

243

101

21

—

80

Loss on extinguishment of debt

—

—

—

—

219

46

—

173

Net realized (gains) losses(a)

(1,710

)

(359

)

—

(1,351

)

(813

)

(171

)

68

(574

)

Non-operating litigation reserves and

settlements

(25

)

(5

)

—

(20

)

—

—

—

—

Separation costs

180

142

—

38

—

—

—

—

Restructuring and other costs

147

31

—

116

44

9

—

35

Non-recurring costs related to regulatory

or accounting changes

12

3

—

9

31

7

—

24

Net (gain) loss on divestiture

1

—

—

1

(3,081

)

(710

)

—

(2,371

)

Pension expense - non operating

1

—

—

1

12

3

—

9

Noncontrolling interests

(320

)

—

320

—

(861

)

—

861

—

Subtotal: Non-Fortitude Re reconciling

items

(1,436

)

(191

)

320

(925

)

(4,404

)

(659

)

929

(2,816

)

Total adjustments

(8,277

)

(1,665

)

320

(6,292

)

(6,442

)

(1,087

)

929

(4,426

)

Adjusted pre-tax income(loss)/Adjusted

after-tax income (loss) attributable to Corebridge common

shareholders

$

2,183

$

326

$

—

$

1,857

$

3,685

$

756

$

—

$

2,929

(a) Includes all net realized gains and

losses except earned income (periodic settlements and changes in

settlement accruals) on derivative instruments used for

non-qualifying (economic) hedging or for asset replication.

Additionally, gains (losses) related to the disposition of real

estate investments are also excluded from this adjustment

The following table presents Corebridge’s adjusted pre-tax

operating income by segment:

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Three Months Ended December 31,

2022

Premiums

$

62

$

3

$

587

$

1,375

$

20

$

—

$

2,047

Policy fees

199

104

382

49

—

—

734

Net investment income(a)

1,064

494

376

289

112

(28

)

2,307

Net realized gains (losses)(a)(b)

—

—

—

—

27

—

27

Advisory fee and other income

105

73

27

1

20

—

226

Total adjusted revenues

1,430

674

1,372

1,714

179

(28

)

5,341

Policyholder benefits

132

19

911

1,518

—

—

2,580

Interest credited to policyholder account

balance(c)(d)

485

289

86

105

—

—

965

Amortization of deferred policy

acquisition costs

148

11

73

1

—

—

233

Non-deferrable insurance commissions

86

34

27

8

—

—

155

Advisory fee expenses

35

29

1

—

—

—

65

General operating expenses

108

115

177

18

87

(4

)

501

Interest expense

—

—

—

—

186

(22

)

164

Total benefits and expenses

994

497

1,275

1,650

273

(26

)

4,663

Noncontrolling interests

—

—

—

—

(39

)

—

(39

)

Adjusted pre-tax operating income

(loss)

$

436

$

177

$

97

$

64

$

(133

)

$

(2

)

$

639

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Three Months Ended December 31,

2021

Premiums

$

66

$

7

$

402

$

2,150

$

21

$

—

$

2,646

Policy fees

245

133

357

47

—

—

782

Net investment income(a)

1,080

603

380

294

139

(4

)

2,492

Net realized gains (losses)(a)(b)

—

—

—

—

503

—

503

Advisory fee and other income

138

89

30

—

31

—

288

Total adjusted revenues

1,529

832

1,169

2,491

694

(4

)

6,711

Policyholder benefits

162

18

814

2,245

—

—

3,239

Interest credited to policyholder account

balance(c)(d)

445

291

89

53

—

—

878

Amortization of deferred policy

acquisition costs

124

16

54

2

—

—

196

Non-deferrable insurance commissions

126

32

32

8

1

—

199

Advisory fee expenses

40

37

—

—

—

—

77

General operating expenses

118

116

168

15

85

5

507

Interest expense

10

7

6

2

70

(8

)

87

Total benefits and expenses

1,025

517

1,163

2,325

156

(3

)

5,183

Noncontrolling interests

—

—

—

—

(602

)

—

(602

)

Adjusted pre-tax operating income

(loss)

$

504

$

315

$

6

$

166

$

(64

)

$

(1

)

$

926

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Twelve Months Ended December 31,

2022

Premiums

$

230

$

19

$

1,871

$

2,913

$

82

$

—

$

5,115

Policy fees

836

451

1,491

194

—

—

2,972

Net investment income(a)

3,888

2,000

1,389

1,049

473

(41

)

8,758

Net realized gains (losses)(a)(b)

—

—

—

—

170

—

170

Advisory fee and other income

451

305

121

2

121

—

1,000

Total adjusted revenues

5,405

2,775

4,872

4,158

846

(41

)

18,015

Policyholder benefits

626

97

3,229

3,381

—

—

7,333

Interest credited to policyholder account

balance(c)(d)

1,877

1,142

342

320

—

—

3,681

Amortization of deferred policy

acquisition costs

761

96

265

6

—

—

1,128

Non-deferrable insurance commissions

351

123

131

29

2

—

636

Advisory fee expenses

141

124

1

—

—

—

266

General operating expenses

426

447

656

73

384

(2

)

1,984

Interest expense

—

—

—

—

535

(51

)

484

Total benefits and expenses

4,182

2,029

4,624

3,809

921

(53

)

15,512

Noncontrolling interests

—

—

—

—

(320

)

—

(320

)

Adjusted pre-tax operating income

(loss)

$

1,223

$

746

$

248

$

349

$

(395

)

$

12

$

2,183

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Twelve Months Ended December 31,

2021

Premiums

$

191

$

22

$

1,573

$

3,774

$

86

$

—

$

5,646

Policy fees

962

522

1,380

187

—

—

3,051

Net investment income(a)

4,334

2,413

1,621

1,155

443

(49

)

9,917

Net realized gains (losses)(a)(b)

—

—

—

—

701

—

701

Advisory fee and other income(e)

592

337

110

2

134

—

1,175

Total adjusted revenues

6,079

3,294

4,684

5,118

1,364

(49

)

20,490

Policyholder benefits

580

76

3,231

4,141

—

—

8,028

Interest credited to policyholder account

balance(c)(d)

1,791

1,150

354

274

—

—

3,569

Amortization of deferred policy

acquisition costs

744

61

164

6

—

—

975

Non-deferrable insurance commissions

397

121

132

27

3

—

680

Advisory fee expenses

189

133

—

—

—

—

322

General operating expenses

437

445

682

77

375

—

2,016

Interest expense

46

35

25

9

286

(47

)

354

Total benefits and expenses

4,184

2,021

4,588

4,534

664

(47

)

15,944

Noncontrolling interests

—

—

—

—

(861

)

—

(861

)

Adjusted pre-tax operating income

(loss)

$

1,895

$

1,273

$

96

$

584

$

(161

)

$

(2

)

$

3,685

(a) Adjustments include Fortitude Re

activity of $(198) million and $419 million for the three months

ended December 31, 2022 and 2021, respectively, as well as $6,841

million and $2,012 million for the twelve months ended December 31,

2022 and 2021, respectively

(b) Net realized gains (losses) includes

the gains (losses) related to the disposition of real estate

investments

(c) Includes deferred sales inducement in

Individual Retirement of $8 million and $11 million for the three

months ended December 31, 2022 and 2021, respectively, as well as

$74 million and $107 million for the twelve months ended December

31, 2022 and 2021, respectively

(d) Includes deferred sales inducement in

Group Retirement of $3 million and $4 million for the three months

ended December 31, 2022 and 2021, respectively, as well as $13

million and $12 million for the twelve months ended December 31,

2022 and 2021, respectively

(e) Individual Retirement includes

advisory fee income of $54 million for the twelve months ended

December 31, 2021, related to the assets of the retail mutual funds

business that were sold to Touchstone on July 16, 2021, or

otherwise liquidated, in connection with the sale

The following table presents a summary of Corebridge's spread

income, fee income and underwriting margin:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Individual Retirement

Spread income

$

587

$

646

$

2,085

$

2,650

Fee income(a)

304

383

1,287

1,500

Total Individual Retirement(a)

891

1,029

3,372

4,150

Group Retirement

Spread income

208

316

871

1,275

Fee income

177

222

756

859

Total Group Retirement

385

538

1,627

2,134

Life Insurance

Underwriting margin

375

266

1,284

1,067

Total Life Insurance

375

266

1,284

1,067

Institutional Markets(b)

Spread income

65

139

295

478

Fee income

16

15

63

61

Underwriting margin

17

22

77

102

Total Institutional Markets

98

176

435

641

Total

Spread income

860

1,101

3,251

4,403

Fee income

497

620

2,106

2,420

Underwriting margin

392

288

1,361

1,169

Total

$

1,749

$

2,009

$

6,718

$

7,992

(a) Excludes fee income of $54 million for

the twelve months ended December 31, 2021, related to the assets of

the retail mutual funds business that were sold to Touchstone on

July 16, 2021, or otherwise liquidated, in connection with the

sale

(b) Fee income for Institutional Markets

includes only Stable Value Wrap fee income, while underwriting

margin includes fee and advisory income on products other than

Stable Value Wrap

The following table presents Life Insurance underwriting

margin:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Premiums

$

587

$

402

$

1,871

$

1,573

Policy fees

382

357

1,491

1,380

Net investment income

376

380

1,389

1,621

Other income

27

30

121

110

Policyholder benefits

(911

)

(814

)

(3,229

)

(3,231

)

Interest credited to policyholder account

balances

(86

)

(89

)

(342

)

(354

)

Less: Impact of annual actuarial

assumption update

—

—

(17

)

(32

)

Underwriting margin

$

375

$

266

$

1,284

$

1,067

The following table presents Institutional Markets spread

income, fee income and underwriting margin:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Net investment income

$

253

$

252

$

901

$

969

Interest credited to policyholder account

balances

(78

)

(26

)

(213

)

(166

)

Policyholder benefits

(110

)

(87

)

(393

)

(325

)

Total spread income(a)

$

65

$

139

$

295

$

478

Policy fees

16

15

63

61

Total fee income(b)

$

16

$

15

$

63

$

61

Premiums

(9

)

(8

)

(37

)

(35

)

Policy fees (excluding SVW)

33

32

131

126

Net investment income

35

39

143

175

Other income

1

—

2

1

Policyholder benefits

(16

)

(14

)

(52

)

(57

)

Interest credited to policyholder account

balances

(27

)

(27

)

(107

)

(108

)

Less: Impact of annual actuarial

assumption update

—

—

(3

)

—

Total underwriting margin(c)

$

17

$

22

$

77

$

102

(a) Represents spread income from Pension

Risk Transfer, Guaranteed Investment Contracts and Structured

Settlement products

(b) Represents fee income from Stable

Value Wrap

(c) Represents underwriting margin from

Corporate Markets products, including private placement variable

universal life insurance and private placement variable annuity

products

The following table presents the Operating EPS:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions, except per common share

data)

2022

2021

2022

2021

GAAP

Basis

Numerator for

EPS

Net income (loss)

$

(527

)

$

3,739

$

8,469

$

8,284

Less: Net income (loss) attributable to

noncontrolling interests

39

617

320

929

Net income (loss) attributable to

Corebridge common shareholders

$

(566

)

$

3,122

$

8,149

$

7,355

Net income attributable to Class A

shareholders

N/A

$

3,045

N/A

$

6,859

Net income attributable to Class B

shareholders

N/A

$

77

N/A

$

496

Denominator for

EPS(a)

Weighted average common shares outstanding

- basic

648.7

N/A

646.1

N/A

Dilutive common shares(b)

—

N/A

1.3

N/A

Weighted average common shares outstanding

- diluted

648.7

N/A

647.4

N/A

Common stock Class A - basic and

diluted

N/A

581.1

N/A

581.1

Common stock Class B - basic and

diluted

N/A

63.9

N/A

63.9

Income per common

share attributable to Corebridge common

shareholders(a)

Basic

Common stock

$

(0.87

)

N/A

$

12.61

N/A

Common stock Class A

N/A

$

5.24

N/A

$

11.80

Common stock Class B

N/A

$

1.21

N/A

$

7.77

Diluted

Common stock

$

(0.87

)

N/A

$

12.59

N/A

Common stock Class A

N/A

$

5.24

N/A

$

11.80

Common stock Class B

N/A

$

1.21

N/A

$

7.77

Operating

Basis(a)

Adjusted after-tax operating income

attributable to Corebridge shareholders

$

574

$

729

$

1,857

$

2,929

Weighted average common shares outstanding

- diluted

653.1

645.0

647.4

645.0

Operating earnings per common share

$

0.88

$

1.13

$

2.87

$

4.54

(a) The results of the September 6, 2022

stock split have been applied retroactively for all periods prior

to September 6, 2022. Operating earnings per share is the same for

Common stock Class A and B

(b) Potential dilutive common shares

include our share-based employee compensation plans

Note: On September 6, 2022, Corebridge

Financial, Inc. effectuated a stock split and recapitalization of

its 100,000 shares of common stock, of which 90,100 shares were

Class A Common Stock and 9,900 shares were Class B Common Stock.

Subsequent to September 6, 2022, there is a single class of Common

Stock. Accordingly, the two-class method for allocating net income

will no longer be applicable. Corebridge Financial, Inc. split its

100,000 shares of Class A shares and Class B shares in a 6,450 to 1

stock split for a total of 645,000,000 shares of a single class of

Common Stock.

The results of the stock split have been

applied retroactively to the weighted average common shares

outstanding for all periods prior to September 6, 2022. After

closing the sale of a 9.9% equity stake in Corebridge to Blackstone

on November 2, 2021, Blackstone owned 63,855,000 shares of Class B

Common Stock. Prior to the sale of the Class B shares to Blackstone

on November 2, 2021, Class B shares did not exist. The Class B

Common Stock was pari passu to the Class A Common Stock except for

distributions associated with the sale of the affordable housing

portfolio.

Prior to September 6, 2022, we used the

two-class method for allocating net income to each class of our

common stock. Prior to November 1, 2021, the EPS calculation

allocates all net income ratably to Class A and Class B shares.

After November 2, 2021, income was allocated ratably to the Class A

and B shares, except for distributions associated with the sale of

the affordable housing portfolio in 2021 in which the Class B

shareholder did not participate.

The following table presents a reconciliation of dividends to

normalized distributions:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Subsidiary dividends paid

$

200

$

641

$

1,821

$

1,564

Less: Non-recurring dividends

—

(295

)

—

(295

)

Tax sharing payments related to

utilization of tax attributes

—

132

401

902

Normalized distributions

$

200

$

478

$

2,222

$

2,171

The following table presents the reconciliation of Adjusted Book

Value:

At Period End

December 31, 2022

December 31, 2021

(in millions, except per share data)

Total Corebridge shareholders' equity

(a)

$

8,210

$

27,086

Less: Accumulated other comprehensive

income (AOCI)

(15,947

)

10,167

Add: Cumulative unrealized gains and

losses related to Fortitude Re funds withheld assets

(2,806

)

2,629

Total adjusted book value (b)

21,351

19,548

Total common shares outstanding (c)

645.0

645.0

Book value per common share (a/c)

$

12.73

$

41.99

Adjusted book value per common share

(b/c)

$

33.10

$

30.31

The following table presents the reconciliation of Adjusted

ROAE:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions, unless otherwise noted)

2022

2021

2022

2021

Actual or annualized net income (loss)

attributable to Corebridge shareholders (a)

$

(2,264

)

$

12,488

$

8,149

$

7,355

Actual or annualized adjusted after-tax

operating income attributable to Corebridge shareholders (b)

2,296

2,916

1,857

2,929

Average Corebridge shareholders’ equity

(c)

7,870

31,798

17,648

32,159

Less: Average AOCI

(16,619

)

10,382

(2,890

)

12,410

Add: Average cumulative unrealized gains

and losses related to Fortitude Re funds withheld assets

(2,879

)

2,727

(89

)

3,427

Average Adjusted Book Value (d)

$

21,610

$

24,143

$

20,449

$

23,176

Return on Average Equity (a/c)

(28.8

)%

39.3

%

46.2

%

22.9

%

Adjusted ROAE (b/d)

10.6

%

12.1

%

9.1

%

12.6

%

The following table presents a reconciliation of net investment

income (net income basis) to net investment income (APTOI)

basis:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Net investment income (net income

basis)

$

2,555

$

2,925

$

9,576

$

11,672

Net investment (income) on Fortitude Re

funds withheld assets

(274

)

(439

)

(891

)

(1,775

)

Change in fair value of securities used to

hedge guaranteed living benefits

(16

)

(14

)

(56

)

(60

)

Other adjustments

(13

)

(10

)

(50

)

(30

)

Derivative income recorded in net realized

investment gains (losses)

55

30

179

110

Total adjustments

(248

)

(433

)

(818

)

(1,755

)

Net investment income (APTOI

basis)(a)

$

2,307

$

2,492

$

8,758

$

9,917

(a) Includes net investment income (loss)

from Corporate and Other of $112 million and $139 million for the

three months ended December 31, 2022 and 2021, respectively, as

well as $473 million and $443 million for the twelve months ended

December 31, 2022 and 2021, respectively

The following table presents the premiums and deposits:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2022

2021

2022

2021

Individual Retirement

Premiums

$

62

$

66

$

230

$

191

Deposits(a)

3,764

3,244

14,900

13,473

Other(b)

1

(2

)

(10

)

(7

)

Premiums and deposits

3,827

3,308

15,120

13,657

Group Retirement

Premiums

3

7

19

22

Deposits

2,240

1,855

7,923

7,744

Premiums and deposits(c)

2,243

1,862

7,942

7,766

Life Insurance

Premiums

587

402

1,871

1,573

Deposits

411

426

1,601

1,635

Other(b)

75

270

764

1,020

Premiums and deposits

1,073

1,098

4,236

4,228

Institutional Markets

Premiums

1,375

2,150

2,913

3,774

Deposits

169

77

1,382

1,158

Other(b)

7

6

30

25

Premiums and deposits

1,551

2,233

4,325

4,957

Total

Premiums

2,027

2,625

5,033

5,560

Deposits

6,584

5,602

25,806

24,010

Other(b)

83

274

784

1,038

Premiums and deposits

$

8,694

$

8,501

$

31,623

$

30,608

(a) Excludes deposits from the assets of

our retail mutual funds business that were sold to Touchstone on

July 16, 2021, or otherwise liquidated in connection with the sale.

Deposits from these retail mutual funds were $259 million for the

twelve months ended December 31, 2021

(b) Other principally consists of ceded

premiums, in order to reflect gross premiums and deposits

(c) Excludes client deposits into advisory

and brokerage accounts of $414 million and $629 million for the

three months ended December 31, 2022 and 2021, respectively, as

well as $2,058 million and $2,502 million for the twelve months

ended December 31, 2022 and 2021

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230216005927/en/

Josh Smith (Investors):

investorrelations@corebridgefinancial.com Dana Ripley (Media):

dana.ripley@aig.com

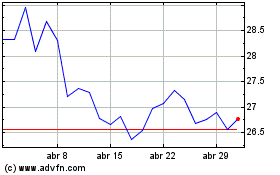

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024