Advanced Outcomes Annuity’s New Hedged Equity

Funds Create Structured Outcome Investments with an Active

Approach

Corebridge Financial today announced that its Advanced Outcomes

Annuity®, a variable annuity featuring structured outcome

investments, now includes hedged equity funds managed by Milliman

Financial Risk Management (Milliman FRM) and sub-advised by Capital

Group, home of the American Funds®.

“Our Advanced Outcomes Annuity helps financial professionals

take action for their clients as they seek to target higher growth

than many traditional structured annuities, provide strong downside

protection and deliver a valuable level of flexibility,” said Bryan

Pinsky, President of Individual Retirement at Corebridge Financial.

“We are excited to partner with renowned investor Capital Group to

bring active management to Advanced Outcomes Annuity with two new

structured outcome funds managed by Milliman FRM.”

A recent Greenwald Research survey commissioned by Corebridge

revealed that financial professionals want to invest in protection

with the potential for upside growth. Amid stock market volatility

and interest rate increases, 4 in 10 financial professionals

reported they are increasingly using structured solutions that

offer targeted downside protection.

The new hedged equity funds, Milliman-Capital Group Hedged

U.S. Growth Fund and Milliman-Capital Group Hedged U.S.

Income and Growth Fund, are structured outcome funds that take

an active approach in pursuing attractive returns while seeking to

limit downside market exposure. Capital Group first identifies a

select list of securities using its distinct investment process.

Milliman FRM then constructs the portfolio with an options overlay

designed for quarterly resets. The Capture-Reset-Reinvest

capability is part of every Advanced Outcomes Annuity investment

strategy and gives financial professionals and their clients the

opportunity to capture investment gains, refresh upside potential

and downside protection, and reinvest in a new strategy with a

different targeted outcome.

“We are thrilled to join with Corebridge Financial and Capital

Group to take the next step forward with the Advanced Outcomes

Annuity,” said Adam Schenck, Principal, Managing Director and Head

of Fund Services, Milliman Financial Risk Management. “In this

challenging investment environment, financial professionals want to

capture growth through equities but are wary of market declines.

Variable annuities featuring structured outcome investments can

become an important part of a portfolio that emphasizes long-term

growth while seeking to protect against a prolonged period of

market decline.”

“We are excited to partner with Corebridge Financial and

Milliman FRM to bring our proven track record of active management

to Advanced Outcomes Annuity and the structured investing space,”

said Steve Joyce, Insurance Business Segment Leader, Capital

Group.

In addition to the new hedged equity funds, Advanced Outcomes

Annuity recently added a trigger strategy to the structured outcome

funds managed by Milliman FRM. The trigger strategy targets

predefined growth when the referenced index performance is either

flat or positive and provides targeted downside protection using a

buffer against market losses over the six-month fund term.

For more information on Corebridge’s variable annuity featuring

structured outcome investments, please visit the Advanced Outcomes

Annuity website.

Advanced Outcomes Annuity offers structured outcome

investment strategies with underlying funds that have

characteristics unlike many other traditional investment products

and may not be suitable for all investors. There is no guarantee

that the outcomes for a specific fund term will be realized. An

investment in Advanced Outcomes Annuity involves investment risk,

including possible loss of principal. For more information

regarding whether an investment in these funds is right for you,

please see the product and fund prospectuses.

Hedged equity funds – Equity exposure is subject to an Extended

Buffer rate in down markets and a Cap rate in up markets.

Structured outcome funds – Equity exposure is subject to a Par

Down, Floor or Buffer rate in down markets and a Par Up, Cap,

Spread or Trigger rate in up markets.

Investment strategies terms pertain only to the fund term itself

and not the annuity. Advanced Outcomes Annuity features a 6-year

declining withdrawal charge schedule.

There is no assurance that a variable portfolio’s strategy or

investment process will achieve its specific investment

objectives.

Underlying Funds may employ Strategies which seek to provide a

‘structured outcome’ investment experience. The upside capture

parameters could limit the upside participation of these Underlying

Funds. Conversely, downside protection parameters provide limited

protection in the event of decreasing referenced index performance.

There is no guarantee that these Underlying Funds will completely

protect against referenced index price decreases. The parameters of

the Underlying Funds are designed to attempt to achieve their

objectives over the entirety of the Underlying Fund’s outcome

period. If you invest in these Underlying Funds after its specified

outcome period has already started, you risk your investment not

experiencing the full effect of the parameters. The specified

outcomes of these Underlying Funds may not be realized, and a

degree of under or over performance is likely. For more

information, please see the Underlying Funds’ prospectuses.

Variable annuities are long-term investments designed for

retirement. Early withdrawals may be subject to withdrawal charges.

Partial withdrawals may reduce benefits available under the

contract, as well as the amount available upon a full surrender.

Withdrawals of taxable amounts are subject to ordinary income tax

and if taken prior to age 59½, an additional 10% federal tax may

apply.

An investment in Advanced Outcomes Annuity involves investment

risk, including possible loss of principal. The contract, when

redeemed, may be worth more or less than the total amount invested.

Products and features may vary by state and may not be available in

all states or firms. We reserve the right to change fees for

features described in this material; however, once a contract is

issued, the fees will not change. The purchase of Advanced Outcomes

Annuity is not required for, and is not a term of, the provision of

any banking service or activity.

This material is general in nature, was developed for

educational use only, and is not intended to provide financial,

legal, fiduciary, accounting or tax advice, nor is it intended to

make any recommendations. Applicable laws and regulations are

complex and subject to change. Please consult with your financial

professional regarding your situation. For legal, accounting or tax

advice consult the appropriate professional.

All contract and optional benefit guarantees are backed by the

claims-paying ability of the issuing insurance company. They are

not backed by the broker/dealer from which this annuity is

purchased.

Advanced Outcomes Annuity is sold by prospectus only. The

prospectus contains the investment objectives, risks, fees,

charges, expenses and other information regarding the contract and

underlying funds, which should be considered carefully before

investing. A prospectus may be obtained by calling 1-877-445-1262.

Investors should read the prospectus carefully before

investing.

Advanced Outcomes Annuity is issued by American General Life

Insurance Company (AGL), Houston, TX, in all states except New

York. AGL does not solicit, issue or deliver policies or contracts

in the state of New York. Distributed by AIG Capital Services,

Inc. (ACS), member FINRA. All companies above are subsidiaries

of Corebridge Financial, Inc. Corebridge Financial and Corebridge

are marketing names used by subsidiaries of Corebridge Financial,

Inc.

Policy form number: AG-807 (06/21)

About Corebridge Financial

Corebridge Financial (NYSE: CRBG) makes it possible for more

people to take action in their financial lives. With more than $355

billion in assets under management and administration as of

December 31, 2022, Corebridge is one of the largest providers of

retirement solutions and insurance products in the United States.

We proudly partner with financial professionals and institutions to

help individuals plan, save for and achieve secure financial

futures. For more information, visit corebridgefinancial.com and

follow us on LinkedIn, YouTube, Facebook and Twitter.

About Milliman Financial Risk Management

Milliman Financial Risk Management LLC is a global leader in

financial risk management to the retirement savings industry.

Milliman FRM provides investment advisory, hedging, and consulting

services on approximately $161 billion in global assets (as of

December 31, 2022). Established in 1998, the practice includes more

than 200 professionals operating from four trading platforms around

the world (Chicago, London, Amsterdam and Sydney). Milliman FRM is

a subsidiary of Milliman, Inc. Milliman is among the world’s

largest providers of actuarial and related products and services.

The firm has consulting practices in healthcare, property &

casualty insurance, life insurance and financial services, and

employee benefits. Founded in 1947, Milliman is an independent firm

with offices in major cities around the globe. For more

information, visit milliman.com/FRM.

About Capital Group

Capital Group, home of American Funds, has been singularly

focused on delivering superior results for long-term investors

using high-conviction portfolios, rigorous research, and individual

accountability since 1931.

As of December 31, 2022, Capital Group manages approximately

$2.2 trillion in equity and fixed-income assets for millions of

individuals and institutional investors around the world. Capital

Group manages equity assets through three investment groups. These

groups make investment and proxy voting decisions independently.

Fixed-income investment professionals provide fixed-income research

and investment management across the Capital organization; however,

for securities with equity characteristics, they act solely on

behalf of one of the three equity investment groups.

For more information, visit capitalgroup.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230306005738/en/

Josh Smith (Investors):

investorrelations@corebridgefinancial.com Matt Burkhard (Media):

media.contact@corebridgefinancial.com

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

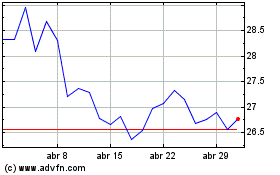

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024