Report on Carbios’ Liquidity Contract with Natixis ODDO BHF

06 Julho 2023 - 1:00PM

Business Wire

- Shares concerned: Carbios (ISIN code:

FR0011648716)

- Market concerned: Euronext Growth

Paris

Regulatory News:

Carbios (Euronext Growth Paris: ALCRB), a pioneer in the

development and industrialization of biological technologies to

reinvent the life cycle of plastics and textiles, reports today

about the liquidity contract entrusted to Natixis ODDO BHF.

As of June 30, 2023, the following assets appeared on the

liquidity account:

- 5,171 shares

- € 514,893.59

- Number of executions on buy side during the semester:

3,593

- Number of executions on sell side during the semester:

3,622

- Traded volume on buy side during the semester: 171,327 shares

for € 6,190,402.48

- Traded volume on sell side during the semester: 169,885 shares

for € 6,142,236.81

For the record, as of the half-year statement on December 31,

2022, the following assets appeared on the liquidity account:

- 3,729 shares

- € 563,058.69

- Number of executions on buy side during the semester:

3,611

- Number of executions on sell side during the semester:

3,795

- Traded volume on buy side during the semester: 121,664 shares

for € 3,628,198.45

- Traded volume on sell side during the semester: 120,735 shares

for € 3,565,927.25

At the implementation of this contract, the following assets

appeared on the liquidity account1:

- 2,048 shares

- € 151,529.34

The implementation of this liquidity contract is carried out in

accordance with the decision of the French Financial Market

Authority (Autorité des Marchés Financiers or AMF) N° 2021-01 dated

June 22, 2021, applicable since July 1, 2021, establishing

liquidity contracts on equity securities as an accepted market

practice.

About Carbios

Established in 2011 by Truffle Capital, Carbios is a green

chemistry company, developing biological and innovative processes.

Through its unique approach of combining enzymes and plastics,

Carbios aims to address new consumer expectations and the

challenges of a broad ecological transition by taking up a major

challenge of our time: plastic and textile pollution. Carbios

deconstructs any type of PET (the dominant polymer in bottles,

trays, textiles made of polyester) into its basic components which

can then be reused to produce new PET plastics with equivalent

quality to virgin ones. This PET innovation, the first of its kind

in the world, was recently recognized in a scientific paper

published in front cover of the prestigious journal Nature. Carbios

successfully started up its demonstration plant in Clermont-Ferrand

in 2021. It has now taken another key step towards the

industrialization of its process with the construction of a

first-of-a-kind unit in partnership with Indorama Ventures.

In 2017, Carbios and L’Oréal co-founded a consortium to

contribute to the industrialization of its proprietary recycling

technology. Committed to developing innovative solutions for

sustainable development, Nestlé Waters, PepsiCo and Suntory

Beverage & Food Europe joined this consortium in April 2019. In

2022, Carbios signed an agreement with On, Patagonia, PUMA, and

Salomon, to develop solutions promoting the recyclability and

circularity of their products.

The Company has also developed an enzymatic biodegradation

technology for PLA-based (a bio sourced polymer) single-use

plastics. This technology can create a new generation of plastics

that are 100% compostable in domestic conditions, integrating

enzymes at the heart of the plastic product.

For more information, please visit www.carbios.com/en / Twitter:

Carbios LinkedIn: Carbios Instagram: insidecarbios

Carbios (ISIN FR0011648716/ALCRB) is eligible for the PEA-PME, a

government program allowing French residents investing in SMEs to

benefit from income tax rebates.

This press release does not constitute and

cannot be regarded as constituting an offer to the public, an offer

to sell or a subscription offer or as a solicitation to solicit a

buy or sell order in any country. Translation is for information

purposes only. In case of discrepancy between the French and the

English version of this press release, the French version shall

prevail

APPENDIX

Number of transactions on buy

side and sell side for each trading day during the six-month period

starting January 1, 2023 and ending June 30, 2023

Traded volume on buy side and

sell side, in number of shares and capital aggregated for each day

of negotiation during the six-month period starting January 1, 2023

and ending June 30, 2023

PURCHASES

SALES

Date

Number of transactions

Number of shares

Equity purchased in

euros

Date

Number of transactions

Number of shares

Equity sold in euros

Total

3 593

171 327

6 190 402,48

Total

3 622

169 885

6 142 236,81

02/01/2023

12

270

9 420,70

02/01/2023

34

1 081

37 811,26

03/01/2023

18

614

22 262,90

03/01/2023

18

400

14 530,82

04/01/2023

23

355

13 026,44

04/01/2023

25

527

19 357,46

05/01/2023

26

1 129

41 421,06

05/01/2023

22

482

17 750,26

06/01/2023

21

669

24 535,24

06/01/2023

16

526

19 372,58

09/01/2023

48

1 182

42 338,06

09/01/2023

25

851

30 473,24

10/01/2023

19

561

19 850,94

10/01/2023

8

366

12 979,94

11/01/2023

38

878

31 380,32

11/01/2023

35

1 188

42 486,06

12/01/2023

60

2 334

86 076,70

12/01/2023

83

3 256

120 099,74

13/01/2023

51

1 568

62 123,78

13/01/2023

73

2 235

88 035,88

16/01/2023

28

828

33 223,78

16/01/2023

35

843

33 929,74

17/01/2023

62

1 499

59 152,16

17/01/2023

25

762

30 214,18

18/01/2023

25

972

38 009,10

18/01/2023

44

1 453

56 912,92

19/01/2023

32

1 514

60 154,30

19/01/2023

25

1 082

43 153,04

20/01/2023

10

238

9 438,86

20/01/2023

11

240

9 527,94

23/01/2023

30

1 049

42 287,46

23/01/2023

32

1 092

44 125,92

24/01/2023

59

2 519

96 970,66

24/01/2023

88

2 516

96 823,18

25/01/2023

35

967

36 895,54

25/01/2023

16

547

20 835,48

26/01/2023

27

721

27 338,18

26/01/2023

39

1 036

39 327,78

27/01/2023

18

616

23 387,10

27/01/2023

9

359

13 642,06

30/01/2023

23

875

32 832,56

30/01/2023

11

602

22 574,44

31/01/2023

14

454

16 835,00

31/01/2023

17

513

19 105,74

01/02/2023

62

1 946

73 748,82

01/02/2023

60

1 828

69 673,52

02/02/2023

36

1 615

60 462,32

02/02/2023

49

2 320

87 031,66

03/02/2023

34

1 420

53 288,40

03/02/2023

31

1 436

54 026,64

06/02/2023

25

1 320

49 821,54

06/02/2023

42

1 667

63 175,02

07/02/2023

41

1 370

52 408,10

07/02/2023

31

930

35 570,22

08/02/2023

41

1 476

57 843,30

08/02/2023

47

1 672

65 497,34

09/02/2023

35

1 183

46 588,60

09/02/2023

33

1 066

42 105,28

10/02/2023

23

766

30 027,04

10/02/2023

24

947

37 208,66

13/02/2023

28

1 379

53 830,88

13/02/2023

25

849

33 165,06

14/02/2023

17

931

35 479,28

14/02/2023

11

244

9 326,80

15/02/2023

40

2 474

91 179,78

15/02/2023

51

2 203

81 196,50

16/02/2023

25

1 407

51 686,08

16/02/2023

17

1 274

46 869,76

17/02/2023

25

1 100

40 870,40

17/02/2023

32

1 131

42 235,94

20/02/2023

31

1 166

44 759,60

20/02/2023

53

1 767

67 905,64

21/02/2023

34

1 370

53 152,00

21/02/2023

44

1 485

57 776,74

22/02/2023

46

2 400

91 269,62

22/02/2023

21

756

28 604,28

23/02/2023

46

1 791

69 642,80

23/02/2023

78

3 107

120 617,96

24/02/2023

36

1 349

52 513,04

24/02/2023

37

1 230

47 995,52

27/02/2023

20

841

33 003,12

27/02/2023

28

912

35 857,04

28/02/2023

21

1 197

46 276,62

28/02/2023

14

652

25 181,94

01/03/2023

49

2 830

109 979,22

01/03/2023

55

2 951

114 949,94

02/03/2023

45

1 982

77 745,50

02/03/2023

50

2 621

103 334,76

03/03/2023

55

2 610

103 096,10

03/03/2023

54

2 153

85 051,08

06/03/2023

74

4 468

168 871,92

06/03/2023

49

2 988

112 207,24

07/03/2023

36

2 518

93 015,88

07/03/2023

22

1 547

57 219,28

08/03/2023

18

641

23 566,30

08/03/2023

14

928

34 127,90

09/03/2023

44

1 469

53 330,68

09/03/2023

21

1 123

40 804,00

10/03/2023

31

1 543

54 537,76

10/03/2023

18

985

34 717,08

13/03/2023

48

2 390

82 836,72

13/03/2023

34

1 684

58 434,90

14/03/2023

26

1 401

49 575,76

14/03/2023

73

2 772

98 233,68

15/03/2023

24

1 260

44 885,26

15/03/2023

14

705

25 134,78

16/03/2023

44

2 008

70 155,14

16/03/2023

26

1 477

51 761,28

17/03/2023

64

3 199

108 032,32

17/03/2023

37

2 524

85 311,36

20/03/2023

49

3 175

103 260,00

20/03/2023

48

2 958

96 254,06

21/03/2023

21

1 116

38 168,12

21/03/2023

42

2 553

86 589,40

22/03/2023

15

797

27 794,32

22/03/2023

24

996

34 773,70

23/03/2023

23

1 319

45 376,70

23/03/2023

21

1 120

38 644,80

24/03/2023

41

2 228

75 706,26

24/03/2023

26

1 182

40 166,12

27/03/2023

24

1 305

44 573,44

27/03/2023

40

2 364

81 082,80

28/03/2023

24

1 375

48 112,06

28/03/2023

37

1 341

46 993,80

29/03/2023

10

356

12 781,86

29/03/2023

20

781

27 963,34

30/03/2023

24

924

34 162,70

30/03/2023

37

1 262

46 630,84

31/03/2023

35

1 372

50 101,28

31/03/2023

13

557

20 220,64

03/04/2023

9

217

7 800,90

03/04/2023

8

224

8 107,90

04/04/2023

44

2 120

77 420,05

04/04/2023

30

1 774

65 127,85

05/04/2023

25

1 470

51 889,15

05/04/2023

26

985

34 857,05

06/04/2023

44

1 838

62 932,75

06/04/2023

36

1 017

34 972,35

11/04/2023

21

1 231

42 382,60

11/04/2023

20

1 098

37 901,30

12/04/2023

37

1 605

53 813,85

12/04/2023

13

1 161

39 393,60

13/04/2023

23

1 468

48 540,50

13/04/2023

30

1 613

53 407,85

14/04/2023

33

1 839

61 101,55

14/04/2023

14

1 306

43 520,60

17/04/2023

31

1 337

44 606,10

17/04/2023

33

1 471

49 185,50

18/04/2023

34

1 629

54 337,20

18/04/2023

18

1 796

60 113,85

19/04/2023

14

649

21 285,20

19/04/2023

2

282

9 235,50

20/04/2023

17

855

27 846,85

20/04/2023

9

813

26 514,25

21/04/2023

32

1 575

50 617,05

21/04/2023

14

1 067

34 343,95

24/04/2023

29

1 372

43 215,40

24/04/2023

11

806

25 450,50

25/04/2023

40

2 639

80 675,30

25/04/2023

43

2 638

80 846,10

26/04/2023

30

1 155

35 450,90

26/04/2023

15

845

25 930,50

27/04/2023

28

1 856

56 567,20

27/04/2023

42

2 047

62 552,60

28/04/2023

7

451

14 038,10

28/04/2023

36

1 703

53 094,20

02/05/2023

34

2 182

70 351,50

02/05/2023

49

3 171

102 262,65

03/05/2023

82

4 620

142 207,05

03/05/2023

39

2 424

74 390,20

04/05/2023

39

2 744

81 506,90

04/05/2023

27

2 335

69 479,25

05/05/2023

0

0

0,00

05/05/2023

24

1 350

40 740,65

08/05/2023

12

500

15 150,00

08/05/2023

2

200

6 150,00

09/05/2023

5

150

4 497,50

09/05/2023

9

199

6 011,40

10/05/2023

6

350

10 527,50

10/05/2023

4

104

3 171,40

11/05/2023

8

200

5 990,00

11/05/2023

5

196

5 938,60

12/05/2023

5

109

3 300,35

12/05/2023

4

46

1 396,10

15/05/2023

4

121

3 654,20

15/05/2023

13

701

21 627,70

16/05/2023

25

1 800

55 730,00

16/05/2023

12

750

24 022,50

17/05/2023

9

317

9 579,25

17/05/2023

7

301

9 125,70

18/05/2023

4

150

4 642,50

18/05/2023

15

599

18 679,20

19/05/2023

0

0

0,00

19/05/2023

14

469

14 787,65

22/05/2023

3

108

3 417,15

22/05/2023

13

701

22 582,00

23/05/2023

22

940

30 444,55

23/05/2023

26

996

32 392,25

24/05/2023

42

2 315

74 683,05

24/05/2023

14

1 392

45 284,00

25/05/2023

24

1 039

32 603,40

25/05/2023

18

936

29 426,20

26/05/2023

32

1 679

52 588,35

26/05/2023

18

1 323

41 633,95

29/05/2023

3

112

3 500,15

29/05/2023

3

120

3 770,00

30/05/2023

23

1 546

50 554,30

30/05/2023

52

3 940

128 560,75

31/05/2023

37

2 389

76 003,75

31/05/2023

44

2 088

66 360,25

01/06/2023

26

1 318

45 599,30

01/06/2023

67

4 294

150 063,50

02/06/2023

46

2 493

95 553,05

02/06/2023

72

4 725

179 577,35

05/06/2023

38

1 752

67 804,35

05/06/2023

38

2 053

79 958,30

06/06/2023

14

583

23 815,80

06/06/2023

31

1 402

58 562,40

07/06/2023

49

2 730

110 114,65

07/06/2023

28

947

38 286,15

08/06/2023

29

1 302

53 372,00

08/06/2023

27

964

39 967,05

09/06/2023

50

3 905

154 403,25

09/06/2023

46

3 003

118 588,15

12/06/2023

48

2 382

92 724,15

12/06/2023

29

1 847

71 888,10

13/06/2023

43

3 409

132 491,40

13/06/2023

71

5 162

202 026,20

14/06/2023

19

746

30 151,05

14/06/2023

30

1 128

45 858,10

15/06/2023

25

1 905

77 939,00

15/06/2023

25

1 513

62 224,00

16/06/2023

32

1 775

73 308,60

16/06/2023

32

1 563

64 800,50

19/06/2023

33

1 295

52 779,90

19/06/2023

24

815

33 364,80

20/06/2023

40

3 460

138 362,50

20/06/2023

41

1 692

67 472,10

21/06/2023

15

996

40 053,90

21/06/2023

55

2 785

112 554,30

1 it is reminded that on October 11, 2022, Carbios has

increased, by € 500,000 (five hundred thousand), the resources

allocated to its liquidity agreement with Natixis Oddo BHF - Cf.

October 12, 2022 press release

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230706519672/en/

CARBIOS Melissa Flauraud Press Relations

melissa.flauraud@carbios.com Benjamin Audebert Investor

Relations contact@carbios.com +33 (0)4 73 86 51 76

Press Relations (Europe) Iconic Marie-Virginie

Klein mvk@iconic-conseil.com +33 (0)1

44 14 99 96

Press Relations (U.S.) Rooney Partners Kate L.

Barrette kbarrette@rooneyco.com +1 212 223 0561

Press Relations (DACH) MC Services Anne Hennecke

carbios@mc-services.eu +49 (0)211 529 252 22

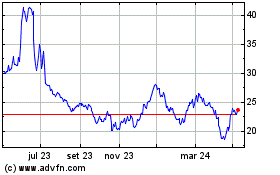

Carbios (EU:ALCRB)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

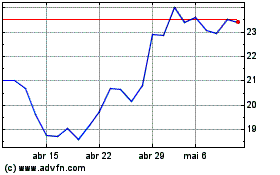

Carbios (EU:ALCRB)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024