Press Release Relating to the Availability

of the Draft Offer Document Prepared by SVF II Strategic

Investments AIV LLC

Regulatory News:

BALYO (Paris:BALYO)

PRICE OF THE OFFER:

EUR 0.85 per Balyo ordinary

share

EUR 0.01 per Balyo preferred

share

EUR 0.07 per Balyo warrant

DURATION OF THE OFFER:

25 trading days

The timetable of the tender offer

will be set out by the Autorité des marchés financiers (the

“AMF”) in accordance with provisions of its General

Regulation.

This press release (the “Press

Release”) was prepared by SVF II Strategic Investments AIV LLC

and made available to the public pursuant to Article 231-16 of the

AMF’s General Regulation.

This Offer (as

defined below) and the Draft Offer Document remain subject to

review by the AMF.

IMPORTANT NOTICE

In accordance with Articles L. 433-4 II of

the French Monetary and Financial Code and 237-1 and seq. of the

General Regulation of the AMF, SVF II Strategic Investments AIV LLC

intends to file a request with the AMF to carry out, within ten

(10) trading days from the publication of the notice of result of

the Offer, or, as the case may be, in the event of a reopening of

the Offer, within three (3) months from the closing of the Reopened

Offer (as defined below), a squeeze-out procedure for Balyo’s

Ordinary Shares and Preferred Shares for a unitary indemnity equal

to the price of the Offer, if the number of Balyo’s Ordinary Shares

and Preferred Shares not tendered in the Offer by the minority

shareholders of Balyo (other than the Treasury Shares, the Ordinary

Shares that could be issued pursuant to the exercise of the BSPCE,

the Unavailable Shares that would be subject to the liquidity

mechanism) does not represent, at the end of the Offer (or, as the

case may be, the Reopened Offer), more than 10% of the capital and

voting rights of Balyo.

SVF II Strategic Investments AIV LLC also

intends to file a request with the AMF to carry out, within ten

(10) trading days from the publication of the notice of result of

the Offer, or, as the case may be, in the event of a reopening of

the Offer, within three (3) months from the closing of the Reopened

Offer, a squeeze-out procedure for the Company Warrants for a

unitary indemnity equal to the price of the Offer, if the number of

the Company Warrants shares that could be created through exercise

of the Company Warrants not presented to the Offer, once added to

the existing shares of Balyo not tendered in the Offer by the

minority shareholders of Balyo (other than the Treasury Shares, the

Ordinary Shares likely to be issued pursuant to the exercise of the

BSPCE, the Unavailable Shares that would be subject to the

liquidity mechanism) does not represent more than 10% of the sum of

the equity securities of Balyo that exist and that could be

created.

The Offer is not being and will not be

launched in any jurisdiction where it would not be permitted under

applicable law. The acceptance of the Offer by persons residing in

countries other than France may be subject to specific obligations

or restrictions imposed by legal or regulatory provisions.

Recipients of the Offer are solely responsible for complying with

such laws and, therefore, before accepting the Offer, they are

responsible for determining whether such laws exist and are

applicable, by relying on their own consultants.

This Press Release should be read in conjunction with all other

documents published in connection with the Offer. The draft offer

document prepared by SVF II Strategic Investments AIV LLC (the

“Draft Offer Document”) is available on the websites of the

AMF (www.amf-france.org) and Balyo (www.balyo.com) and may be

obtained free of charge from:

Alantra

7 rue Jacques Bingen

75017 Paris

Pursuant to Article 231-28 of the AMF’s General Regulations, a

description of the legal, financial and accounting characteristics

of SVF II Strategic Investments AIV LLC will be made available to

the public no later than the day before the opening of the Offer. A

press release will be published to inform the public of the manner

in which this information will be made available.

1. OVERVIEW OF THE OFFER

In accordance with Title III of Book II and more specifically

Articles 232-1 and seq. of the General Regulation of the AMF

(“AMF’s General Regulation”), SVF II Strategic Investments

AIV LLC, a Limited Liability Company organized under the laws of

Delaware, in the United States of America, having its registered

office at Corporation Service Company, 251 Little Falls Drive,

Wilmington, Delaware 19808, United States and registered under

number 6207806 (hereafter, “SVF AIV” or the

“Offeror”), makes an irrevocable offer to the shareholders

and warrant holder of Balyo, a French public limited company with a

board of directors (société anonyme à conseil d'administration),

having its registered office at 74 Avenue Vladimir Illitch Lenine,

94110 Arcueil, registered with the Créteil Trade and Companies

Register under number 483 563 029 (the “Company” or

“Balyo” and together with its direct or indirect

subsidiaries, the “Balyo Group”), and whose shares

are listed on compartment C of the Euronext Paris regulated market

under ISIN code FR0013258399, mnemonic “BALYO” to acquire in cash

(i) all of their Ordinary Shares (as defined below and subject to

the exceptions below) at a price of EUR 0.85 per Ordinary Share

(the “Ordinary Share Offer Price”), (ii) all of their

Preferred Shares (as defined below and subject to the exceptions

below) at a price of EUR 0.01 per Preferred Share (the

“Preferred Share Offer Price”), and (iii) all of their

Company Warrants (as such defined below) at a price of EUR 0.07

(the “Warrant Offer Price”, together with the Ordinary Share

Offer Price and the Preferred Share Offer Price, the “Offer

Price”) through a public tender offer (offre publique d’achat),

the terms of which are described below (the “Offer”).

As of the date of this Press Release, the Offeror does not hold

any Ordinary Share, Preferred Share or Company Warrant.

The Offer targets:

- the ordinary shares already issued, other

than the Excluded Shares (as defined below), i.e., as of 16 August

2023, and to the knowledge of the Offeror, a number of 34,141,873

ordinary shares;

- the ordinary shares likely to be issued

before the closing of the Offer or the Reopened Offer as a result

of the exercise of the 830,000 BSPCE which have not been waived by

their holder (it being specified that such BSPCE are out of the

money as their exercise price is higher than the Ordinary Share

Offer Price and will lapse following the closing of the Offer (if

successful)), which to the knowledge of the Offeror represent at

the date of this Draft Offer Document a maximum of 830,000 ordinary

shares i.e., 2,42% of the share capital and voting rights (together

with the ordinary shares already issued by the Company, the

“Ordinary Shares”);

- 6,270 preferred shares issued by the

Company, i.e., as of 16 August 2023, and to the knowledge of the

Offeror, 2,090 ADP T3, 2,090 ADP T4 and 2,090 ADP T5 (the

“Preferred Shares”)1; and

- all the warrants issued by the Company on

22 February 2019 to Amazon, i.e., 11,753,581 warrants as of 16

August 2023 (the “Company Warrants”);

(together the “Targeted Securities”).

____________________________

1

It being specified that the Ordinary Shares that could result from

the conversion of the 2,090 ADP T3, 2,090 ADP T4 and 2,090 ADP T5

are not targeted by the Offer as the 6,270 Preferred Shares are (i)

not convertible prior to the closing of the Offer, or as the case

may be, the Reopened Offer and (ii) are all subject to undertakings

to tenders by their holders.

It is specified that the Offer does not target:

- the Ordinary Shares held in treasury by the

Company, representing 34,894 Ordinary Shares as of 16 August 2023

(the “Treasury Shares”);

- the 180,000 Ordinary Shares, the 900 ADP

T3, the 900 ADP T4 and the 900 ADP T5 held by Mr. Pascal Rialland

subject to the constraints provided for by article L. 225-197-1. II

§4 of the French Commercial Code, pursuant to which (i) Balyo’s

Board of Directors imposed to Mr. Pascal Rialland, an obligation to

retain a percentage of his shares and (ii) such shares which are

subject to retention obligation are covered by a liquidity

mechanism (the “Unavailable Shares” and together with the

Treasury Shares, the “Excluded Shares”); and

- the 830,000 BSPCE issued by the Company

which are not transferable pursuant to the provisions of article

163bis G of the French Code general des impôts).

The Ordinary Shares already issued are listed on compartment C

of the Euronext Paris regulated market under ISIN code FR0013258399

(mnemonic “BALYO”). The Preferred Shares and Company Warrants are

not listed on any market.

As of the date of this Press Release, to the knowledge of the

Offeror, there are no other equity securities or other financial

instruments issued by the Company or rights granted by the Company

that may give access, immediately or in the future, to the

Company’s share capital or voting rights subject to the issuance

and, if any, conversion of the Bonds as described in section 1.3.2

below.

The Offer will be carried out in accordance with the normal

procedure, in accordance with the provisions of Articles 232-1 et

seq. of the AMF’s General Regulation and will be open for a period

of 25 trading days.

The Offer is subject to the Acceptance Threshold and the Waiver

Threshold described in sections 2.5.1 and 2.5.2 of this Press

Release.

The Offer will be, if the required conditions are met, followed

by a squeeze-out procedure pursuant to Articles L. 433-4, II of the

French Monetary and Financial Code and 237-1 and seq. of the AMF’s

General Regulation.

The Offer is presented by ALANTRA CAPITAL MARKETS (the

“Presenting Institution” or “Alantra”) who guarantees

the content and the irrevocable nature of the commitments made by

the Offeror in connection with the Offer, in accordance with the

provisions of Article 231-13 of the AMF’s General Regulation.

1.1. Background of the Offer

1.1.1. Background and reasons for the Offer

Balyo’s activities consist of research and development

(R&D), the design of robotic forklift technologies enabling

standard forklifts for horizontal or vertical pallet transport to

be automated, and the marketing and sale of these robots and

related services. With a strong product offering of lift trucks

with both vertical and horizontal transport applications

long-standing relationships with its partners (warehouse operators

and suppliers) and experience in this sector, the Offeror considers

the Balyo Group as being one of the best in this robotics

sector.

The Offeror, SVF AIV, is a wholly owned direct subsidiary of the

Japanese company SoftBank Group Corp. (hereinafter “SBG”),

which was founded in 1981 by Mr. Masayoshi Son. The SoftBank Group

invests in breakthrough technology to improve the quality of life

for people around the world. The SoftBank Group is comprised of SBG

(TOKYO: 9984) an investment holding company that includes stakes in

AI, smart robotics, IoT, telecommunications, internet services, and

clean energy technology providers, the SoftBank Vision Funds and

SoftBank Latin America Funds, which are investing more than US$160

billion to help entrepreneurs transform industries and shape new

ones.

Through its portfolio of automated robotic forklift

technologies, Balyo is complementary to SBG’s existing investments

in the Transportation and Logistics industries.

In addition, this acquisition will also provide Balyo with

access to SoftBank’s group global network of 470+ technology-led

companies with scope to develop new commercial relationships for

mutual benefit. Through this partnership, Balyo will benefit

substantially from SBG’s technological and commercial expertise

while also securing the necessary financial resources to reach its

full potential which SBG intends to support.

The Company’s Board of Directors (the “Board of

Directors”) which met on 13 June 2023, welcomed unanimously the

proposed transaction and authorized the conclusion of a tender

offer agreement between the Company and the Offeror (the “Tender

Offer Agreement”).

On 13 June 2023, the Board of Director set up an ad hoc

committee (the “Ad Hoc Committee”), comprised of three

members, a majority of which are independent directors to examine,

the terms and conditions of the envisaged Offer, monitor the work

of the independent expert and prepare a draft reasoned opinion to

be submitted to the Board of Directors.

On 13 June 2023, the Board of Directors appointed, upon

recommendation of the Ad Hoc Committee, Eight Advisory, represented

by Mr. Geoffroy Bizard, as independent expert pursuant to articles

261-1, I 2°, 4° and 5°, and 261-1, II of the AMF’s General

Regulation (as defined below) to prepare and deliver to the Board

of Directors a report regarding the financial terms of the Offer,

including, should the independent expert so conclude, its opinion

that the price of the Offer is fair (équitable) from a financial

point of view for the Company’s securityholders.

On 13 June 2023, the Offeror entered into agreements with FPCI

FSN PME - Ambition Numérique represented by Bpifrance

Investissement, Hyster-Yale UK Limited, SSUG PIPE Fund SCSp,

SICAVRAIF, Linde Material Handling, GmbH, Financière Arbevel, and

Thomas Duval, and on 14 June 2023 with Invus Public Equities, L.P.,

each of which is a shareholder of the Company, pursuant to which

each such shareholder undertakes to tender the Targeted Securities

held by it to the Offer pursuant to the terms and conditions of

such agreement described in section 1.3.3 of this Press

Release.

On 14 June 2023, the Company and the Offeror entered into the

Tender Offer Agreement under which the Offeror undertook to file

the Offer, and the Company undertook to cooperate with the Offeror

in the context of the Offer. The main terms of the Tender Offer

Agreement are described in section 1.3.1 of this Presse

Release.

On 14 June 2023, the Company and the Offeror announced, through

a joint press release, the signature of the above mentioned Tender

Offer Agreement, the intention of SBG to file a tender offer

through a wholly owned subsidiary to acquire the Targeted

Securities, the provision of the interim financing described in

section 1.3.2 of this Press Release, the signature of the

undertakings to tender by shareholders described in section 1.3.3

of this Press Release and the fact that the Company signed an

agreement with its senior lenders on 13 June 2023 regarding the

extension of its existing senior financing arrangements.

If conditions are met, the Offeror also intends to implement a

squeeze-out procedure, pursuant to Articles L. 433- 4, II of the

French Monetary and Financial Code and 237-1 to 237-10 of the AMF’s

General Regulation, in order to obtain the transfer of the Targeted

Securities not tendered to the Offer in return for a payment

(indemnisation) equal to the Offer Price.

On 15 June 2023, the Company initiated its works council’s

consultation process and a first meeting was held on June 16, 2023.

On 21 June 2023, the works council proceeded to an initial hearing

of the Offeror, followed by a second discussion on 5 July 2023, in

accordance with Article 2312-42 paragraph 3 of the French

Employment Code. On 5 July 2023, the works council has issued a

favorable opinion on the Offer.

On 4 August 2023, the Board of Directors, after having reviewed

the independent expert’s report and the works council favorable

opinion, considered that the Offer is in the interests of the

Company, its employees and securityholders. Consequently, the Board

of Directors issued a favorable reasoned opinion recommending the

holders of the Targeted Securities tender their securities to the

Offer.

1.1.2. Breakdown of the Company’s capital and voting rights

as of 16 August 2023

Share capital of Balyo

To the knowledge of the Offeror, and as reflected in article 7

of the Company’s bylaws as updated on 17 July 2023, the share

capital of the Company amounts to EUR 2,749,258.96, divided into

34,356,767 Ordinary Shares with a par value of EUR 0.08 each and

8,970 preference shares divided in three tranches (ADP T3 to ADP

T5) with a par value of EUR 0.08 each.

Composition of Balyo’s shareholding

structure as of 16 August 2023

To the knowledge of the Offeror, the share capital and voting

rights of the Company as of 16 August 2023 are as follows2:

Shareholders

Number of shares and theoretical voting

rights

Percentage of share capital and voting

rights

Ordinary Shares

FPCI FSN PME – Ambition Numérique3

5,053,950

14.71%

SSUG PIPE Funds SCS SICAV RAIF

2,000,000

5.82%

Linde Material Handling, GmbH

1,809,976

5.27%

Seventure Partners

1,624,791

4.73%

Invus Public Equities, L.P.

1,600,000

4.66%

Oddo BHF AIF

1,600,000

4.66%

Financière Arbevel

1,334,404

3.88%

Jean-Luc Barma

1,269,396

3.69%

Hyster-Yale UK Limited

1,216,545

3.54%

Thomas Duval

851,200

2.48%

Pascal Rialland

361,000

1.05%

Fabien Bardinet

74,392

0.22%

Other employees

241,180

0.70%

Treasury Shares

34,894

0.10%

Public

15,285,039

44.48%

Total

34,356,767

/

Preferred shares

Individuals (including Pascal

Rialland)

2,990 ADP T3 with no voting

rights

0.01% of the share capital/ 0% of

voting rights

2,990 ADP T4 with no voting

rights

0.01% of the share capital/ 0% of

voting rights

2,990 ADP T5 with no voting

rights

0.01% of the share capital/ 0% of

voting rights

Total

34,365,737

100%

___________________________

2

On the basis of a capital

composed of 34,365,737 shares (34,356,767 Ordinary Shares and 8,970

preferred shares) representing 34,356,767 theoretical voting rights

as of 16 August 2023, in accordance with the provisions of Article

223-11 of the AMF’s General Regulation.

3

Investment fund managed by

Bpifrance Investissement.

As of the date of this Press Release, the Offeror does not hold

any Ordinary Shares, Preferred Shares and Company Warrants.

1.1.3. Securities giving access to the share capital of

Balyo

As of 16 August 2023, and to the knowledge of the Offeror,

11,753,581 Company Warrants and 830,000 BSPCEs issued by the

Company are outstanding, giving respectively the right to subscribe

to a maximum of 11,753,581 and 830,000 new ordinary shares.

Prior to the filing of the Draft Offer Document, the Offeror

received a letter from Company Warrants’ holder expressing its

intention to tender all its Company Warrants to the Offer and

received waivers from the holders of 527,000 BSPCE which lapsed as

from the date of such waivers as further described in section 2.3.2

of the Press Release.

The Offeror does not hold any BSPCE or Company Warrants.

1.1.4. Acquisition of Balyo’s securities over the last twelve

months

The Offeror did not purchase any Balyo Ordinary Shares,

Preferred Shares or Company Warrants during the (12) months

preceding the filing of the Draft Offer Document.

As of 20 July 2023, the Offeror subscribed to 150 bonds

convertible into ordinary shares for an amount of EUR 1,500,000

pursuant to the terms and conditions described in section 1.3.2 of

the Press Release.

1.2. Intentions of the Offeror for the next twelve

months

1.2.1. Industrial, commercial and financial strategy

Through the Offer initiated by SVF AIV, SBG is keen to expand

its investments in the robotics sector and take part in the

artificial intelligence "revolution".

SBG focuses its investments on companies that help improve the

way we live, work and play.

In this sense, SBG considers the Balyo Group to be among the

best in the robotics sector, with a strong product offering of lift

trucks with both vertical and horizontal transport

applications.

SBG is particularly attracted to the experience of the Balyo

Group and all its employees, as well as its long-standing

relationships with its partners (warehouse operators and

suppliers).

SBG’s tender offer to the Company is the result of SBG’s

conviction that major development and growth opportunities are

available to the Balyo Group, but also that the growth of the Balyo

Group can be accelerated thanks, in particular, to its network of

expertise in robotics and artificial intelligence.

1.2.2. Intentions regarding employment

From an employment standpoint, the completion of the Offer

consists of a change of control and would have no foreseeable

social consequences for Balyo’s employees, who would remain

employees of their current employer under the same conditions,

except for certain key employees amendment of their current

employment agreement to be agreed between such key employees, the

Company and the Offeror. In addition, the Offeror intends, after

the closing of the Offer and subject to its success, to put in

place a retention plan, on terms to be defined, for the benefit of

the corporate officers and employees of Balyo.

The completion of the Offer would have no impact on the location

of the Balyo business sites and decision-making centres. In this

respect, the Offeror undertook in the context of the Offer for a

period of 12 months from the closing of the initial period of the

Offer, to procure that:

- the Company maintains its headquarters in France;

- the Company and its subsidiaries retain existing key employees,

subject to voluntary departures of employees, terminations for

cause or individual layoffs in the ordinary course of business;

and

- the Company maintains its and its subsidiaries’ research &

development functions and IT assets in France.

It is not anticipated that the completion of the Offer will

generate an increase in tasks or workload for employees.

As far as labor relations are concerned, the works council will

not be affected in any way by the completion of the Offer, and its

members will be able to continue exercising their representative

functions under the usual conditions.

1.2.3. Intentions regarding a potential merger or legal

reorganization

On the date of the Draft Offer Document, the Offeror does not

contemplate any merger between the Offeror and the Company, nor any

other corporate reorganization of the Company.

1.2.4. Composition of the Company’s corporate bodies and

management

The Offeror’s objective is to take control of the Company. Thus,

if the Offer is successful, the Offeror will have reached the

Acceptance Threshold and the Waiver Threshold described in sections

2.5.1 and 2.5.2 of the Press Release and will therefore hold at

least a number of shares representing at least 66.67% of the

capital and voting rights of the Company.

Consequently, subject to the success of the Offer, the Offeror

will modify the composition of the corporate bodies of the Company

to reflect its new shareholding structure, so that at least the

majority of the members of the Board of Directors of the Company

shall be appointed upon the proposal of the Offeror.

The Company’s governance will remain consistent with the

governance rules of the Middlenext governance code as long as the

Company remains listed on Euronext. In particular, upon closing of

the Offer, the Board of Directors of the Company will be composed

of at least one third of independent directors appointed amongst

the independent directors in office prior to the Offer, in

accordance with recommendations of the Middlenext governance

code.

1.2.5. Synergies – Economic gains

The Offeror expects the transaction to be a standalone

investment and accordingly does not expect to realize any synergies

of costs or revenues after completion of the Offer.

1.2.6. Interest of the Offer for the Offeror, the Company and

the Targeted Securities holders

The Offeror is offering the Targeted Securities holders who

tender their Ordinary Shares, Preferred Shares and Company Warrants

the opportunity to obtain immediate liquidity at:

- a price per Ordinary Share of EUR 0.85, representing a premium

of 57.4% compared to the last closing price before the announcement

of the Offer (as at 12 June 2023), of 54.3% compared to the

weighted average price of the last 30 trading days before this

date, of 48% compared to the weighted average price of the last 60

trading days before this date;

- a price per Preferred Share of EUR 0.01; and

- a price per Company Warrant of EUR 0.07.

A summary of the elements of assessment of the Offer Price is

presented in section 3 of the Press Release.

1.2.7. Intentions regarding the squeeze-out

In accordance with Articles L. 433-4 II of the French Monetary

and Financial Code, 237-1 and seq. of the AMF’s General Regulation,

the Offeror intends to file a request with the AMF to carry out,

within ten (10) trading days from the publication of the notice of

result of the Offer, or, as the case may be, in the event of a

reopening of the Offer, within three (3) months from the closing of

the Reopened Offer, a squeeze-out procedure for the Ordinary

Shares, the Preferred Shares and the Company Warrants that were not

tendered in the Offer (other than the Excluded Shares) to the

extent the thresholds provided for by article 237-1 and seq. of the

AMF’s General Regulation are met.

It is specified that, prior to the closing of the Offer, or as

the case may be, the Reopened Offer, or the implementation of the

squeeze-out as from its closing, as the case may be, the Offeror

does not intend to convert the Bonds subscribed by the Offeror (see

description in section 1.3.2 below).

In the event that the Offeror is unable to carry out a

squeeze-out following the Offer or the Reopened Offer, the Offeror

reserves the right to file, within the framework of the applicable

regulations, a public offer, followed, if applicable, by a

squeeze-out in respect of the Targeted Securities that it does not

hold directly or indirectly, alone or in concert, at that date.

In the event that the Offer is followed by a squeeze-out, it

will result in the delisting of the Ordinary Shares from the

Euronext Paris regulated market.

1.2.8. Company’s dividend distribution policy

The Offeror reserves the right to change the Company’s dividend

policy following the closing of the Offer.

Following the closing of the Offer, the Company’s dividend

policy and any change thereto will continue to be determined by its

corporate bodies in accordance with the law and the Company’s

articles of association, and based on the Company’s distributive

capacity, financial situation and financial needs.

1.3. Agreements that may have a material impact on the

assessment or outcome of the Offer

1.3.1. Tender Offer Agreement with the Company

On 14 June 2023, the Company and the Offeror entered into a

tender offer agreement in English which is further described in

section 1.3.1 of the Draft Offer Document.

1.3.2. Interim Financing

On 13 June 2023, the Board of Directors authorized the issuance

by the Company of bonds convertible into fully paid-up ordinary

shares to be subscribed by the Offeror for an aggregate principal

amount of up to EUR 5,000,000 (the “Bonds”) which will allow

Balyo to meet its on-going working capital requirements

(“Financing”).

On 14 June 2023, the Offeror and the Company entered into a

subscription agreement providing for the terms and conditions of

the issuance of the Bonds and regulate the relations of the Company

and the Offeror as for the subscription of the Bonds (the

“Subscription Agreement”). The main terms and conditions of

such Subscription Agreement are summarized in section 1.3.2 of the

Draft Offer Document.

On 20 July 2023, the Offeror subscribed to 150 Bonds of EUR

10,000 par value each for a total amount of EUR 1,500,000.

1.3.3. Undertakings to tender

Undertakings to tender entered into with

shareholders

On 13 June 2023, the Offeror entered into undertakings to tender

with the following shareholders:

- FPCI FSN PME – Ambition numérique represented by Bpifrance

Investissement who undertakes to tender 5,053,950 shares

representing approximatively 14.96% of the share capital and voting

rights of the Company as of the date of this undertaking to

tender;

- SSUG PIPE Fund SCSp, SICAVRAIF, who undertakes to tender

2,000,000 shares representing approximatively 5.92% of the share

capital and voting rights of the Company as of the date of this

undertaking to tender;

- Linde Material Handling, GmbH who undertakes to tender

1,809,976 shares representing approximatively 5.37% of the share

capital and voting rights of the Company as of the date of this

undertaking to tender;

- Financière ARBEVEL, who undertakes to tender any Targeted

Securities held by it at the of opening of the Offer to the Offer,

and which as at 13 June 2023 correspond to 1,334,404 shares

representing approximatively 3.95% of the share capital and voting

rights of the Company as of the date of this undertaking to

tender;

- Hyster-Yale UK Limited, who undertakes to tender 1,216,545

shares representing approximatively 3.6% of the share capital and

voting rights of the Company as of the date of this undertaking to

tender; and

- Mr. Thomas Duval, who undertakes to tender 851,200 shares

representing approximatively 2.52% of the share capital and voting

rights of the Company as of the date of this undertaking to

tender.

On 14 June 2023, the Offeror entered into an undertaking to

tender with Invus Public Equities, L.P. who undertakes to tender

1,600,000 shares representing approximatively 4.74% of the share

capital and the voting rights of the Company as of the date of this

undertaking to tender.

The Ordinary Shares held by the above-mentioned shareholders,

representing together approximately 41.08% of the share capital and

voting rights of the Company, as of the date of execution of such

undertakings to tender (and 40.36 % of the share capital as of 17

July 2023), will be tendered to the Offer at the Ordinary Share

Offer Price, less any Ordinary Shares disposed by Financière

ARBEVEL prior to the opening of the Offer, without any additional

consideration payable by the Offeror.

Such undertakings to tender are further described in section

1.3.3 of the Draft Offer Document.

Undertakings to tender entered into with

holders of Preferred Shares

As further described in the section 1.3.3 of the Draft Offer

Document, on 6, 7, 9, 10 and 12 July 2023, the Offeror entered into

undertakings to tender with undertakings to tender with holders of

Preferred Shares and Ordinary Shares providing for an undertaking

from such holders to:

- convert all of their 2,090 ADP T1 and 2,090 ADP T2 as soon as

possible following the Board of Director’s decision in relation to

the conversion of the ADP T2 and tender 418.000 Ordinary Shares

resulting from the conversion of the ADP T1 and ADP T2 to the

Offer; and

- tender all of their 2,090 ADP T3, 2,090 ADP T4 and 2,090 ADP T5

to the Offer.

Intention to tender of the Company Warrant

holder

On 10 July 2023, the holder of the 11,753,581 Company Warrants,

Amazon.com NV Investment Holdings LLC, addressed a letter to Balyo

expressing its intention to tender all of the Company Warrants to

the Offer and terminate the Transaction Agreement entered into

between Amazon and the Company, the main terms and conditions of

such letter are described in section 1.3.3 of the Draft Offer

Document.

1.3.4. Liquidity Agreement

On 13 July 2023, the Offeror entered into a liquidity agreement

with Mr. Pascal Rialland for his Ordinary Shares resulting from the

conversion of his ADP T1, ADP T2, ADP T3, ADP T4 and ADP T5 which

are subject to the constraints provided for by article L.

225-197-1. II §4 of the French Commercial Code, pursuant to which

Balyo’s Board of Directors has imposed on corporate officers an

obligation to retain a percentage of their shares (the

“Unavailable Shares” and the “Liquidity Agreement”).

The main terms and conditions of the Liquidity Agreement are

further described in section 1.3.4 of the Draft Offer Document.

1.3.5. Other agreements of which the Offeror is aware

With the exception of the agreements described in sections 1.3.1

to 1.3.4 of the Press Release, there are, to the knowledge of the

Offeror, no other agreements likely to have an impact on the

assessment or outcome of the Offer.

2. CHARACTERISTICS OF THE OFFER

2.1. Terms of the Offer

In accordance with Article 231-13 of the AMF’s General

Regulation, Alantra, acting on behalf of the Offeror, filed the

draft Offer with the AMF on 16 August 2023, in the form of a

voluntary public tender offer for all Targeted Securities.

Under the Offer, which will take place according to the normal

procedure governed by Articles 232-1 and seq. of the AMF’s General

Regulation, the Offeror irrevocably undertakes to acquire from the

Company’s securityholders, at a price of (i) EUR 0.85 per Ordinary

Share, dividend attached, (ii) EUR 0.01 per Preferred Share,

dividend attached and (iii) EUR 0.07 per Company Warrant, subject

to the adjustments described in section 2.2 of the Press Release,

all the Targeted Securities tendered to the Offer.

Alantra guarantees the content and irrevocable nature of the

undertakings made by the Offeror as part of the Offer, in

accordance with the provisions of Article 231-13 of the AMF’s

General Regulation.

2.2. Adjustment of the terms of the Offer

In the event that between the date of the Draft Offer Document

and the date of settlement-delivery of the Offer or of the Reopened

Offer (included), the Company proceeds in any form whatsoever with

(i) a distribution of dividends, interim dividends, reserves,

premiums or any other distribution (in cash or in kind), or (ii) a

redemption or reduction of its share capital and in both cases, in

which the detachment date or the reference date on which it is

necessary to be a shareholder in order to be entitled thereto is

set before the date of the settlement-delivery of the Offer or of

the Reopened Offer, the Ordinary Share Offer Price, the Preferred

Share Offer Price and the Company Warrants, will be reduced to take

into account this transaction, it being specified that in the event

that the transaction takes place between the date of

settlement-delivery of the Offer (excluded) and the date of

settlement-delivery of the Reopened Offer (included), only the

price of the Reopened Offer will be adjusted.

Likewise, in the event that the terms and conditions of the

Company Warrants are modified between the date of the Draft Offer

Document and the date of settlement-delivery of the Offer or the

Reopened Offer (inclusive), the price per Company Warrant will be

adjusted.

Any adjustment of the Offer Price will be subject to the prior

approval of the AMF and will be the subject to the publication of a

press release.

2.3. Number and nature of the Targeted Securities

As of the date of this Press Release, neither SBG nor the

Offeror holds any Targeted Securities.

The Offer targets:

- all the Ordinary Shares already issued, other than the Excluded

Shares, i.e., as of 16 August 2023, and to the knowledge of the

Offeror, a number of 34,141,873 Ordinary Shares;

- the Ordinary Shares likely to be issued before the closing of

the Offer or the Reopened Offer as a result of the exercise of the

830,000 BSPCE which have not been waived by their holder (it being

specified that such BSPCE are out of the money as their exercise

price is higher than the Ordinary Share Offer Price and will lapse

following the closing of the Offer (if successful)) which to the

knowledge of the Offeror represent at the date of this Draft Offer

Document 830,000 ordinary shares i.e., 2.42% of the share capital

and voting rights;

- 6,270 preferred shares issued by the Company, i.e., as of 16

August 2023, and to the knowledge of the Offeror, 2,090 ADP T3,

2,090 ADP T4 and 2,090ADP T54;

- all the Company Warrants issued by the Company on 22 February

2019 to Amazon, i.e., 11,753,581 warrants as of 16 August

2023.

It is specified that the Offer does not target:

- the Treasury Shares;

- the 180,000 Ordinary Shares, 900 ADP T3, 900 ADP T4 and 900 ADP

T5 held by Mr. Pascal Rialland subject to the constraints provided

for by article L. 225-197-1. II §4 of the French Commercial Code,

pursuant to which Balyo’s Board of Directors has imposed on

corporate officers an obligation to retain a percentage of their

shares, which are subject to a liquidity mechanism described in

section 1.3.4 above; and

- the 430,000 BSPCE issued by the Company which are not

transferable pursuant to the provisions of article 163bis G of the

French Code general des impôts).

As of the date of this Press Release, to the knowledge of the

Offeror, there are no other equity securities or other financial

instruments issued by the Company or rights granted by the Company

that may give access, immediately or in the future, to the

Company’s share capital or voting rights subject to the issuance

and, if any, conversion of the Bonds as described in section 1.3.2

above.

2.3.1. Situation of the holders of Preferred Shares

As of 31 December 2022, the share capital of the Company

included 16,150 preferred shares divided into five tranches:

- 3,230 ADP T1;

- 3,230 ADP T2;

- 3,230 ADP T3;

- 3,230 ADP T4; and

- 3,230 ADP T5 (together the “ADP”).

____________________________

4

It being specified that the

Ordinary Shares resulting from the conversion of the 2,090 ADP T3,

2,090 ADP T4 and 2,090 ADP T5 are not targeted by the Offer as the

6,270 Preferred Shares are (i) not convertible prior to the closing

of the Offer, or as the case may be, the Reopened Offer and (ii)

are all subject to undertakings to tenders by their holders.

These ADP were issued to their holders in the context of a free

share plans put in place by the Company which acquisition and

conservation periods expired. The ADP are subject to the following

cumulative conditions, based on aggregate performance over the

period from 1st January 2020 up to the 31 December 2024:

- Tranche 1: consolidated turnover exceeding EUR 35 million and

gross margin exceeding EUR 14 million.

- Tranche 2: consolidated turnover exceeding EUR 85 million and

gross margin exceeding EUR 35 million.

- Tranche 3: consolidated turnover exceeding EUR 165 million and

gross margin exceeding EUR 70 million.

- Tranche 4: consolidated turnover exceeding EUR 295 million and

gross margin exceeding EUR 130 million.

- Tranche 5: consolidated turnover exceeding EUR 500 million and

gross margin exceeding EUR 235 million.

Provided that the performance conditions of each Tranche are

met, each ADP of the relevant Tranche will be converted into 100

Ordinary Shares of the Company.

Prior to the date of the Draft Offer Document, the performance

conditions of the ADP T1 were met, as acknowledged by a decision of

the Board of Directors dated 27 March 2023.

On 22 June 2023, in accordance with the terms and conditions of

the ADP, the Board of Directors, after having received the

favorable opinion of the appointment and remuneration committee,

acknowledged in advance the fulfilment of the performance

conditions of Tranche 2 based on the high probability of reaching

the conditions of consolidated turnover and gross margin by the end

of the year 2023. In accordance with the terms and conditions of

the ADP, the Board of Directors has all powers to determine, to a

certain extent, specific conversion ratio and cases notably in the

context of a tender offer. Consequently, on 22 June 2023 the Board

of Directors, decided that the conversion ratio applicable to the

ADP T2 was 1 ADP T2 for 100 Ordinary Shares.

On the 6, 7, 9, 10 and 12 July 2023, the holders of the ADP

entered into undertakings to tender with the Offeror, described in

section 1.3.3 above, pursuant to which they undertook to (i)

convert all their ADP T1 and ADP T2 and tender the Ordinary Shares

resulting from such conversion to the Offer at the Ordinary Share

Offer Price and (ii) tender all their ADP T3, ADP T4 and ADP T5 to

the Offer at the Preferred Share Offer Price.

In accordance with the terms and conditions of the ADP, on 17

July 2023, the Board of Directors acknowledged the automatic

conversion of 1,200 ADP into 3,180 Ordinary Shares as a result of

the departure of six holders from Balyo (it being specified that

the departure of one of the holders occurred after 27 March 2023

and his 20 T1 ADP were converted into 2,000 Ordinary Shares, the

other ADP have been converted into one (1) Ordinary Share each).

After such conversions, 14,950 ADP (2,990 ADP of each Tranche)

remained outstanding.

On 17 July 2023, all the 2,990 ADP T1 and 2,990 ADP T2 have been

converted into 598,000 Ordinary Shares at their holders’

request.

Pursuant to their terms and conditions the ADP T3, ADP T4 and

ADP T5 are transferrable. Following such transfer, they will each

be converted into one Ordinary Share in the hands of the

Offeror.

Mr. Pascal Rialland entered into a liquidity agreement with the

Offeror covering the Ordinary Shares resulting from the conversion

of his unavailable ADP T1 and ADP T2 as well as part of his ADP T3,

ADP T4 and ADP T5 also unavailable as described in section 1.3.4

above.

2.3.2. Situation of the holders of the BSPCE

As of 31 December 2022, the Company issued 1,375,000 BSPCE.

Prior to the date of this Draft Offer Document, (i) 18,000 BSPCE

lapsed as a result of the departure of their holders from the

Company (the exercise of the BSPCE being subject to a presence

condition), (ii) the holders of 527,000 BSPCE irrevocably waived

their rights to their BSPCE, which lapsed immediately upon signing

of such waiver agreements.

The 830,000 BSPCE still in circulation are held by Mr. Fabien

Bardinet. These BSPCE are out of the money as their exercise price

is EUR 1.60 per Ordinary Shares for 430,000 BSCPCE and EUR 4.11 per

Ordinary Share for 400.000 other BSPCE, such amounts being superior

to the Ordinary Share Offer Price.

In addition, by a decision of the Board of Directors dated 9 May

2022, the exercise period of the BSPCE has been extended until 90

days following the date of the annual shareholders’ meeting

approving the financial statements for FY22 (i.e., as from 15 June

2023). In addition, if the Offer is successful, the BSPCE not

exercised will lapsed following completion of the Offer. Indeed,

the allocation letter relating to such BSPCE provides that in the

event of a transfer of more than 50% of the Company’s shares (an

“Operation”), the BSPCE not exercised immediately before the

completion of the Operation will lapse.

2.4. Modalities of the Offer

In accordance with Article 231-13 of the AMF’s General

Regulation, the Presenting Institution, acting on behalf of the

Offeror, filed the draft Offer and the Draft Offer Document with

the AMF on 16 August 2023. The AMF will publish a notice of filing

relating to the Offer on its website (www.amf-france.org).

In accordance with Article 231-16 of the AMF’s General

Regulation, the Draft Offer Document, as filed with the AMF, is

available to the public free of charge from the Presenting

Institution, as well as online on the websites of the AMF

(www.amf-france.org) and the Company (www.balyo.com).

The Offer and the Draft Offer Document remain subject to review

by the AMF.

The AMF will publish on its website a reasoned clearance

decision with respect to the draft Offer after verifying that the

draft Offer complies with applicable laws and regulations. In

accordance with Article 231-23 of the AMF’s General Regulation, the

clearance decision will constitute approval of the Offeror’s offer

document.

The offer document approved by the AMF as well as the other

information relating in particular to the legal, financial and

accounting characteristics of the Offeror, will be available to the

public free of charge, in accordance with Article 231-28 of the

AMF’s General Regulation, at the Presenting Institution’s address

mentioned above, no later than the day preceding the opening of the

Offer. Such documents will also be available on the websites of the

AMF (www.amf-france.org) and the Company (www.balyo.com ).

In accordance with Articles 231-27 and 231-28 of the AMF’s

General Regulation, a press release indicating how such documents

are made available by the Offeror will be published no later than

the day preceding the opening of the Offer including on the

Company’s website.

Prior to the opening of the Offer, the AMF will publish a notice

announcing the opening of the Offer and Euronext Paris will publish

a notice recalling the content of the Offer and specifying the

terms of its completion.

2.5. Conditions of the Offer

2.5.1. Acceptance Threshold

Pursuant to the provisions of article 231-9, I of the AMF’s

General Regulations, the Offer will lapse if, at its closing date,

the Offeror does not hold, directly or indirectly, a number of

shares representing a fraction of the Company’s share capital or

voting rights higher than 50% (this threshold being hereinafter

referred to as the “Acceptance Threshold”).

The determination of this threshold follows the rules set forth

in Article 234-1 of the AMF’s General Regulation.

The reaching the Acceptance Threshold will not be known before

the publication by the AMF of the final result of the Offer, which

will take place after the closing of the Offer.

If the Acceptance Threshold is not reached, the Offer will not

be successful and the Targeted Securities tendered in the Offer

will be returned to their owners after the publication of the

notice of result informing of the lapse of the Offer, without any

interest, indemnity or other payment of any kind being due to such

owners.

2.5.2. Waiver Threshold

In addition to the Acceptance Threshold, pursuant to the

provisions of Article 231-9, II of the AMF’s General Regulation,

the Offer will lapse if, at the closing date of the Offer, the

Offeror does not hold, alone or in concert, directly or indirectly,

a number of shares representing a fraction of the share capital and

theoretical voting rights of the Company in excess of 66.67% on a

diluted basis and on a fully diluted basis (the “Waiver

Threshold”).

On a non-diluted basis, the Waiver Threshold will be calculated

as follows:

(a) in the numerator, will be included (i) all the Ordinary

Shares and Preferred Shares held by the Offeror alone or in

concert, directly or indirectly, on the date of the closing of the

Offer, pursuant to acquisitions on the market as well as all the

Ordinary Shares assimilated to those of the Offeror in accordance

with Article L. 233-9 of the French Commercial Code including the

34,894 Treasury Shares and the 180,000 Ordinary Shares and the 900

ADP T3, 900 ADP T4, 900 ADP T5 held by Mr. Pascal Rialland, subject

to the liquidity agreement and (ii) all the Ordinary Shares and

Preferred Shares of the Company validly tendered in the Offer as at

the date of the closing of the Offer; and (b) in the

denominator, all the existing Ordinary Shares and Preferred Shares

issued by the Company making up the share capital on the date of

the closing of the Offer.

On a fully diluted basis, the Waiver Threshold will be

calculated as follows:

(a) in the numerator, will be included (i) the Ordinary

Shares and Preferred Shares held by the Offeror alone or in

concert, directly or indirectly, on the date of the closing of the

Offer, pursuant to acquisitions on the market as well as all the

Ordinary Shares assimilated to those of the Offeror in accordance

with Article L. 233-9 of the French Commercial Code including the

34,894 Treasury Shares and the 180,000 Ordinary Shares, and the 900

ADP T3, 900 ADP T4, 900 ADP T5 held by Mr. Pascal Rialland subject

to the liquidity agreement (ii) all the Ordinary Shares and

Preferred Shares of the Company validly tendered in the Offer as at

the date of the closing of the Offer and (iii) all the Ordinary

Shares of the Company likely to be issued by exercise of the

Company Warrants validly tendered in the Offer as at the date of

the closing of the Offer - excluding any shares which may be

subscribed or held by the Offeror pursuant to the conversion of the

Bonds; (b) in the denominator, (i) all the existing Ordinary

Shares and Preferred Shares issued by the Company making up the

capital on the date of the closing of the Offer, (ii) all the

Ordinary Shares of the Company likely to be issued by exercise of

the Company Warrants on the date of the closing of the Offer and

(iii) all the Ordinary Shares likely to be issued by the Company on

the date of the closing of the Offer (excluding all Ordinary Shares

likely to be subscribed or held by the Offeror pursuant to the

conversion of the Bonds).

The reaching of the Waiver Threshold will not be known before

the publication by the AMF of the final result of the Offer, which

will take place at the end of the Offer.

In accordance with article 231-9, II of the AMF’s General

Regulations, if the Waiver Threshold (calculated as indicated

above) is not reached, and unless the Offeror has decided to waive

the Waiver Threshold in accordance with the conditions set out in

the following paragraphs, the Targeted Securities tendered in the

Offer (excluding shares acquired on the market) will be returned to

their owners without any interest, indemnity or other payment of

any kind being due to the said owners.

However, the Offeror reserves the right to waive the Waiver

Threshold until the date of publication by the AMF of the result of

the Offer.

In addition, the Offeror also reserves the right to remove or

lower the Waiver Threshold by filing an improved offer at the

latest five (5) trading days before the closing of the Offer, in

accordance with the provisions of articles 232-6 and 232-7 of the

AMF’s General Regulations.

2.5.3. Regulatory authorizations

The Offer is not subject to any regulatory authorization, it

being specified that prior to this Draft Offer Document, the Offer

gave rise to a decision by the Ministry of the Economy, Finance and

Industrial and Digital Sovereignty, in accordance with Article

L.151-3 of the French Monetary and Financial Code relating to

foreign investments made in France, dated 1 August 2023, pursuant

to which the Offer was considered outside the scope of the

provisions of Article L.151-3 of the Monetary and Financial

Code.

2.6. Procedure for tendering in the Offer

The Offer will be open for a minimum period of 25 trading days,

except if re-opened by the AMF in accordance with article 232-4 of

the AMF’s General Regulation.

The Targeted Securities tendered in the Offer (including, as the

case may be, in the Reopened Offer) must be freely negotiable and

free from any lien, pledge, collateral or other security interest

or restriction of any kind restricting the free transfer of their

ownership. The Offeror reserves the right to reject, in its sole

discretion, any Targeted Securities tendered in the Offer that do

not comply with this condition.

The Draft Offer Document and all related agreements are subject

to French law. Any dispute or litigation, regardless of the subject

matter or basis, relating to this proposed Offer shall be brought

before the competent courts.

(a)

Process for tendering the Ordinary

Shares The Ordinary Shares shareholders

holding their Ordinary Shares in registered or in bearer form shall

notify their decision to tender to their account holders in order

to tender them in the Offer. The Offeror draws the attention of the

holders of Ordinary Shares to the fact that those of them who would

expressly request the conversion into bearer form would lose the

advantages of holding the Ordinary Shares in registered form.

Holders of Ordinary Shares whose Ordinary Shares are

held in an account managed by a financial intermediary and who wish

to tender their Targeted Securities in the Offer must deliver an

order to tender their Ordinary Shares to their financial

intermediary, in accordance with the standard forms provided by

their financial intermediary, no later than the last business day

of the Offer and in sufficient time for their order to be executed.

Holders of Ordinary Shares are invited to contact their financial

intermediaries to verify whether a shorter period is applicable to

them. (b)

Process for tendering

the Preferred Shares and Company Warrants

Holders of Preferred Shares and Company Warrants willing to tender

their Preferred Shares or Company Warrants to the Offer shall

notify their decision to Uptevia, 89 – 91 rue Gabriel Péri – 92120

Montrouge in accordance with the standard forms provided by their

financial intermediary, no later than the last business day of the

Offer.

In accordance with Article 232-2 of the AMF’s General

Regulation, orders to tender the Targeted Securities in the Offer

may be revoked at any time up to the closing date of the Offer

(included). After this date, such orders to tender in the Reopened

Offer will become irrevocable.

Negotiation costs (including brokerage fees and corresponding

taxes) will not be borne by the Offeror.

No interest will be paid by the Offeror for the period between

the date on which the Targeted Securities are tendered to the Offer

and the date on which settlement of the Offer occurs. This

settlement date will be indicated in the notice of result to be

published by Euronext Paris. The settlement and delivery will take

place after the centralization operations.

2.7. Orders centralization

The centralization of the orders to tender Ordinary Shares in

the Offer will be carried out by Euronext Paris, it being specified

that the orders relating to Preferred Shares and Company Warrants

will be centralized by Uptevia.

Each financial intermediary and the institution holding the

registered accounts of the Company’s Targeted Securities must, on

the date indicated in the Euronext Paris notice, transfer to

Euronext Paris the Targeted Securities for which they will have

received a tender order in the Offer.

After receipt by Euronext Paris of all orders to tender in the

Offer under the conditions described above, Euronext Paris will

centralize all of these orders, determine the results of the Offer

and communicate them to the AMF.

As the case may be, all the operations described above will be

repeated in an identical sequence and under the conditions, in

particular the timeframe, which will be specified in a notice

published by Euronext Paris, in the context of the Reopened

Offer.

2.8. Publication of the results and settlement of the

Offer

Pursuant to the provisions of Article 232-3 of its General

Regulations, the AMF will announce the final result of the Offer at

the latest nine (9) trading days after the closing of the Offer. If

the AMF determines that the Offer is successful, Euronext Paris

will indicate in a notice the date and terms of delivery of the

Targeted Securities and payment of the funds.

On the date of settlement-delivery of the Offer (and, if

applicable, of the Reopened Offer), the Offeror will credit

Euronext Paris with the funds corresponding to the settlement of

the Offer (and, if applicable, of the Reopened Offer). On such

date, the tendered Targeted Securities of the Company and all

rights attached thereto will be transferred to the Offeror.

Euronext Paris will make the cash payment to the intermediaries on

behalf of their clients who have tendered their Targeted Securities

in the Offer (or, as the case may be, in the Reopened Offer) as of

the date of settlement-delivery of the Offer (or, as the case may

be, of the Reopened Offer).

As the case may be, all of the operations described above will

be repeated in an identical sequence and under conditions, in

particular as regards the timeframe, which will be specified in a

notice published by Euronext Paris, in the context of the Reopened

Offer.

It is reminded, as the case may be, that any amount due in

connection with the contribution of the Targeted Securities to the

Offer (or, as the case may be, the Reopened Offer) will not bear

interest and will be paid on the date of settlement-delivery of the

Offer (or, as the case may be, of the Reopened Offer).

2.9. Indicative timetable of the Offer

Prior to the opening of the Offer, the AMF will publish a notice

of opening and Euronext Paris will publish a notice announcing the

terms and opening of the Offer.

An indicative timetable is proposed below:

Date

Main steps of the

Offer

16 August 2023

- Filing of the draft Offer and the Draft

Offer Document of the Offeror with the AMF.

- Offeror’s Draft Offer Document made

available to the public and posted to the websites of the AMF

(www.amf-france.org) and the Company (www.balyo.com).

- Publication by the Offeror of a press

release announcing the filing of the Offer and availability of the

Draft Offer Document.

16 August 2023

- Company’s draft reply document filed

with the AMF, including the reasoned opinion of the Company’s Board

of Directors and the independent expert’s report.

- Company’s draft reply document made

available to the public and posted to the websites of the AMF

(www.amf-france.org) and the Company (www.balyo.com).

- Publication by the Company of a press

release announcing the filing of the Offer and availability of

Company’s draft reply document.

5 September 2023

- Publication of the clearance decision of

the AMF relating to the Offer.

- Availability of the offer document and

the reply document to the public and on the websites of the Company

(www.balyo.com) and the AMF (www.amf-france.org).

6 September 2023

- Availability to the public at the

address of the Presenting Institution mentioned above and posting

on the Company’s website (www.balyo.com) and on the AMF’s website

(www.amf-france.org) of information relating to the legal,

financial and accounting characteristics of the Offeror.

- Availability of the information relating

to the legal, financial and accounting characteristics of the

Company to the public at the Company’s registered office and on the

Company’s website (www.balyo.com) and the AMF website

(www.amf-france.org).

6 September 2023

- Publication by the Offeror of the press

release making available the offer document and the information

relating to the legal, financial and accounting characteristics of

the Offeror.

- Publication by the Company of the press

release making available the note in response and the information

relating to the legal, financial and accounting characteristics of

the Company.

6 September 2023

- Publication by the AMF of the opening of

the Offer

- Publication by Euronext Paris of the

opening statement in relation to the Offer and its modalities

7 September 2023

- Opening of the Offer.

11 October 2023

- Closing of the Offer.

Week of 16 October 2023

- Publication of the notice of result of

the Offer by the AMF.

Week of 16 October 2023

- In case of success of the Offer,

publication of the reopening notice of the Offer by Euronext, or,

implementation of the squeeze-out if the conditions are met.

Week of 16 October 2023

- In case of success of the Offer,

reopening of the Offer and settlement-delivery of the Offer.

Week of 30 October 2023

- Closing of the Reopened Offer.

Week of 30 October 2023

- Publication by the AMF of the notice of

result of the Reopened Offer.

Week of 9 November 2023

- Settlement-delivery of the Reopened

Offer.

As from beginning of November

2023

- Implementation of the squeeze-out, if

the conditions are met.

2.10. Possibility of withdrawing from the Offer

In accordance with the provisions of Article 232-11 of the AMF’s

General Regulation, the Offeror may withdraw its Offer within five

(5) trading days following the publication of the timetable of a

competing offer or a superior offer (surenchère). It shall inform

the AMF of its decision, which shall be published.

The Offeror may also withdraw its Offer if it becomes

purposeless, or if the Company, due to the measures it has taken,

sees its substance modified during the Offer or in the event of

success of the Offer or if the measures taken by the Company result

in an increase in the cost of the Offer for the Offeror. The

Offeror may only use this option with the prior authorization of

the AMF, which shall rule in accordance with the principles set

forth in Article 231-3 of the AMF’s General Regulation.

The Offeror may also waive his Offer if the Waiver Threshold is

not reached, as specified in section 2.5.2 “Waiver Threshold”

above.

In the event of a waiver, the shares tendered in the Offer will

be restituted to their owners without any interest, indemnity or

other payment of any kind being due to such owners.

2.11. Reopening of the Offer

In accordance with the provisions of Article 232-4 of the AMF’s

General Regulation, if the Offer is successful, the Offer will be

automatically reopened at the latest within ten trading days

following the publication of the final result of the Offer, on the

same terms as the Offer (the “Reopened Offer”). In such

case, the AMF will publish the timetable for the Reopened Offer,

which will, in principle, last at least ten trading days.

In the event of a reopening of the Offer, the procedure for

tendering the Targeted Securities in the Reopened Offer and the

procedure for the Reopened Offer will be identical to that of the

initial Offer, it being specified, however, that orders to tender

to the Reopened Offer will be irrevocable.

However, the Offeror reserves the right, in the event that it

would be in a position and would decide to implement a squeeze-out

directly at the end of the Offer in accordance with the conditions

provided for by articles 237-1 et seq. of the RGAMF, to request the

AMF to implement such a squeeze-out within ten trading days from

the publication of the notice of the result of the Offer. In such a

case, the Offer would not be reopened.

2.12. Costs of the Offer

The overall amount of the fees, costs and external expenses

incurred by the Offeror in connection with the Offer, including, in

particular, fees and other expenses relating to its various legal,

financial and accounting advisors and any other experts and

consultants, as well as publicity costs, is estimated at

approximately EUR 3,600,000 (taxes excluded).

2.13. Financing of the Offer

In the event where all Targeted Securities are tendered to the

Offer based on the Offer Price (i.e., EUR 0.85 per Ordinary Share,

EUR 0.01 per Preferred Share and EUR 0.07 per Company Warrant and

excluding fees, expenses and costs relating to the operation), the

Offer would amount to c. EUR 30,548,905.42.

The Offeror will finance the Offer through its own funds and

resources.

2.14. Brokerage fees and compensation of

intermediaries

No fee or commission will be refunded or paid by the Offeror to

a holder who tendered Targeted Securities to the Offer, or to any

intermediary or person soliciting the tendering of Targeted

Securities to the Offer.

2.15. Offer restrictions abroad

The Offer is made exclusively in France. The Draft Offer

Document is not distributed in countries other than France.

The Offer will not be registered or approved outside of France

and no action will be taken to register or approve it abroad. This

Press Release, the Draft Offer Document and the other documents

relating to the Offer do not constitute an offer to sell or

purchase transferable securities or a solicitation of such an offer

in any other country in which such an offer or solicitation is

illegal or to any person to whom such an offer or solicitation

could not be duly made.

The holders of the shares of the Company located outside of

France can only participate in the Offer if permitted by the local

laws to which they are subject, without the Offeror having to carry

out additional formalities. Participation in the Offer and the

distribution of the Press Release, the Draft Offer Document may be

subject to particular restrictions applicable in accordance with

laws in effect outside France. The Offer will not be made to

persons subject to such restrictions, whether directly or

indirectly, and cannot be accepted in any way in a country in which

the Offer would be subject to such restrictions.

Accordingly, persons in possession of this Press Release, the

Draft Offer Document are required to obtain information on any

applicable local restrictions and to comply therewith. Failure to

comply with these restrictions could constitute a violation of

applicable securities and/or stock market laws and regulations in

one of these countries. The Offeror will not accept any liability

in case of a violation by any person of the local rules and

restrictions that are applicable to it.

United States

In the specific case of the United States of America, it is

stipulated that the Offer will not be made, directly or indirectly,

in the United States of America, or by the use of postal services,

or by any other means of communication or instrument (including by

fax, telephone or email) concerning trade between States of the

United States of America or between other States, or by a stock

market or a trading system of the United States of America or to

persons having residence in the United States of America or "US

persons" (as defined in and in accordance with Regulation S of the

US Securities Act of 1933, as amended). No acceptance of the Offer

may come from the United States of America. Any acceptance of the

Offer that could be assumed as resulting from a violation of these

restrictions shall be deemed void.

The subject of this Press Release is limited to the Offer and no

copy of this Draft Offer Document and no other document concerning

the Press Release, the Offer or the Draft Offer Document may be

sent, communicated, distributed or submitted directly or indirectly

in the United States of America other than in the conditions

permitted by the laws and regulations in effect in the United

States of America.

No holder of the shares of the Company who will be able to

tender its shares into the Offer if such holder cannot represent

that (i) it has not received a copy of the draft offer document or

any other document relating to the Offer into the United States of

America and it has not sent or otherwise transmitted any such

document into the United States of America, (ii) it is not a person

having residence in the United States of America and not being a

"US person" (as defined in Regulation S of the US Securities Act of

1933, as amended) and that it is not issuing a tender order for the

Offer from the United States of America, (iii) it was not located

in the United States of America when it has accepted the terms of

the Offer or its tender order for the Offer, and (iv) it is acting

on a non-discretionary basis for a principal located outside the

United States of America that is not giving an order to participate

in the Offer from the United States of America.

For the purposes of this section, "United States of America"

means the United States of America, its territories and

possessions, any one of these States, and the District of

Columbia.

2.16. Tax treatment of the Offer

The tax treatment of the Offer is described in section 2.16 “Tax

treatment of the Offer” of the Draft Offer Document.

3. SUMMARY OF THE INFORMATION USED TO ASSESS THE OFFER

PRICE

(a) Ordinary Shares Offer Price:

The below table summarizes the valuations derived from the

valuation methods used and the premiums implied by the Ordinary

Shares Offer Price:

[Financial Tables Not Included]

(b)

Preferred Shares Offer Price:

The offer price for these performance shares has been set at EUR

0.01 per instrument, as this corresponds to the minimum amount

technically payable.

Management do not anticipate the performance threshold to be met

for the relevant tranches by 31 December 2024. Hence, these

instruments will not be converted and their implied intrinsic value

will be EUR 0.00.

(c)

Company Warrant Offer Price:

The Black & Scholes method was used to calculate a

theoretical Warrant value using the following parameters:

- Reference price of EUR 0.85 per Ordinary Share, in line with

the Offer;

- Maturity date of 22 February 2026. Although the Company

Warrants can be exercised at any time before the maturity date, the

maturity date can be considered as the exercise date in the absence

of distribution of Company dividends;

- Risk-free rate (as of 12 June 2023 (“The Company Warrants

Valuation Date”), for France 3-Year Government Bonds, based on a

maturity in line with that of the Company Warrants): 2.982%;

- Volatility of the stock of 56.3%, taking into account the level

of volatility of the Balyo shares over 141 weeks leading to the

Company Warrants Valuation Date, respectively from 5 October 2020

to 12 June 2023. 141 weeks is equivalent to the number of weeks

outstanding in the 2.7 years between the Company Warrants Valuation

Date and the Company Warrants Expiration Date. Two periods with

abnormally high volatility were disregarded:

- the period around the announcement of the 2023 financial

results (respectively from 20 March 2023 to 3 April 2023);

- the period around the second Covid lockdown in France

(respectively from 12 October 2020 to 7 December 2020).

The valuation approach using the Black & Scholes method

leads to a theoretical valuation of EUR 0.07 per Company

Warrant.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230815604583/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Financial Communication and Investor Relations Thomas

Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

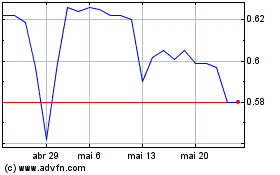

Balyo (EU:BALYO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Balyo (EU:BALYO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024