Upcoming Student Loan Repayments Likely to Test Many Retirement Dreams

26 Setembro 2023 - 10:00AM

Business Wire

New Corebridge Financial-Morning Consult study

finds three in four Americans with student loan debt expect

upcoming repayments to impact retirement savings

Three out of four (75%) borrowers surveyed said that resuming

student debt payments will impact their ability to save for

retirement, according to new insight released by Corebridge

Financial and Morning Consult. The poll also showed that in order

to make these payments beginning in October of this year, more than

one in five borrowers expect to reduce savings overall (29%), for

emergencies (29%) and retirement (22%).

“Many Americans are likely to feel increased pressure on their

personal budgets once student loan payments resume,” said Terri

Fiedler, President of Retirement Services at Corebridge Financial.

“Even with the new financial stress, borrowers can still take

action to save for retirement and a financial professional can

help. Whether it’s evaluating your monthly expenses to streamline

charges or exploring student loan forgiveness, every dollar matters

when it comes to saving for the retirement you want.”

The new Corebridge survey also shows how student loan debt could

impact the financial security of women with 60% saying they do not

expect to be able to afford making payments in October compared to

39% of student loan borrowers who are men. Women (5%) were also

three times less likely compared to men (16%) to have put their

disposable income from paused payments toward retirement, only

compounding the situation.

Additionally, while four in five borrowers expect higher overall

stress, financial stress and impacts on financial security,

borrowers earning less than $50,000 expect the most challenging

road ahead:

- 77% say that payments will affect retirement savings

- 67% say they will probably or definitely not be able to afford

to make payments toward student loans

- 53% expect to miss one or more payments and 38% expect to

default on the loan

Methodology

This poll was conducted between August 16-24, 2023, among a

national sample of 2,112 adults with federal student loans. Results

from the full survey have a margin of error of +/- 2 percentage

points and were weighted to approximate Americans ages 18+ with

student loan debt.

About Corebridge Financial

Corebridge Financial, Inc. (NYSE: CRBG) makes it possible for

more people to take action in their financial lives. With more than

$370 billion in assets under management and administration as of

June 30, 2023, Corebridge Financial is one of the largest providers

of retirement solutions and insurance products in the United

States. We proudly partner with financial professionals and

institutions to help individuals plan, save for and achieve secure

financial futures. For more information, visit

corebridgefinancial.com and follow us on LinkedIn and YouTube.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230926915967/en/

Işıl Müderrisoğlu (Investors):

investorrelations@corebridgefinancial.com Matt Ward (Media):

media.contact@corebridgefinancial.com

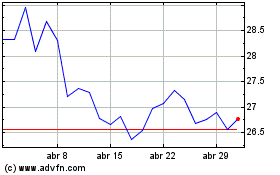

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024