X-Energy Reactor Company, LLC (“X-energy”), a leading developer

of advanced small modular nuclear reactors and fuel technology for

clean energy generation, and Ares Acquisition Corporation (NYSE:

AAC) (“AAC”), a publicly-traded special purpose acquisition

company, announced today that they have mutually agreed to

terminate their previously announced business combination agreement

(the “Business Combination Agreement”), effective immediately. As a

result, the extraordinary general meeting of AAC shareholders

scheduled for October 31, 2023 to approve the proposed transaction

will be convened and then adjourned indefinitely. Additionally, the

extraordinary general meeting of AAC shareholders scheduled for

November 2, 2023 to vote on a proposal to extend the date by which

AAC must consummate a business combination will be convened and

then adjourned indefinitely.

Over the course of 2023, X-energy received strong interest from

potential investors. However, given challenging market conditions,

peer-company trading performance and a balancing of the benefits

and drawbacks of becoming a publicly traded company under current

circumstances, X-energy and AAC jointly determined that it was the

best course of action at this time not to proceed with their

previously announced transaction.

“I am deeply proud of the remarkable business that the X-energy

team has built, and I am confident in the company’s future as a

global clean energy leader,” said Kam Ghaffarian, Ph. D., Founder

and Executive Chairman of X-energy. “Both X-energy and AAC

recognize the challenges presented by the current financial market

environment and the opportunity for X-energy to continue forward as

a private company. I remain confident in X-energy’s attractive

value proposition, and I appreciate the support we have received

from AAC and other investors. X-energy is as committed as ever to

delivering clean, safe and secure energy solutions that can meet

the demand from communities around the world.”

“The X-energy team will continue to make critical progress

toward our long-term objectives,” said J. Clay Sell, Chief

Executive Officer of X-energy. “Among our notable accomplishments

in the last year, we have advanced the initial deployment of four

Xe-100 units with Dow on the Texas Gulf Coast, signed a joint

development agreement with Energy Northwest for up to 12 Xe-100

units in central Washington, progressed the Xe-100 from basic

design to the Final Design Readiness Review phase and signed a

cooperative agreements with both the U.S. Department of Defense and

U.S. Department of Energy to further advance the development of a

mobile microreactor design. Looking ahead, we will continue to

execute against our strategy that capitalizes on our proprietary

clean energy technology, competitive advantages and strategic

relationships to the benefit of our customers and stakeholders

around the world.”

“While the persistently volatile public market conditions over

the course of 2023 have led to this mutual decision, we remain

steadfast in our belief in X-energy’s exceptional talent,

differentiated nuclear technology and mission to deliver

affordable, zero-carbon energy on a global scale,” said David

Kaplan, Co-Chairman and Chief Executive Officer of AAC and

Co-Founder, Director and Partner of Ares Management Corporation.

“We remain unwavering in our belief in the significant market

opportunity for X-energy, and we look forward to supporting the

company through its successes ahead.”

An investment vehicle affiliated with Ares Management

Corporation (NYSE: ARES) has agreed to make a private investment

into X-energy in order to support X-energy’s continued growth as a

private company.

Neither party will be required to pay the other a termination

fee as a result of the mutual decision to terminate the business

combination agreement. Pursuant to the terms of the termination

agreement between AAC and X-energy, X-energy assumed from AAC and

agreed to pay, perform and discharge the liabilities of AAC with

respect to the payment in cash of certain fees, costs and expenses

of AAC and its affiliates.

In view of the termination of the Business Combination

Agreement, AAC determined that it will not be able to consummate an

initial business combination within the time period required by its

amended and restated memorandum and articles of association (as

amended, the “Articles”). As such, AAC intends to dissolve and

liquidate in accordance with the provisions of the Articles and

will redeem all of the outstanding Class A Ordinary Shares, par

value $0.0001 per share (the “Public Shares”), on or about November

7, 2023.

AAC anticipates that the last day of trading in the Public

Shares will be November 6, 2023 and that, as of the open of

business on November 7, 2023, the Public Shares, including those

that were not submitted for redemption, will be suspended from

trading, will be deemed cancelled and will represent only the right

to receive the per-share redemption price for the Public Shares of

approximately $10.79 (the “Per-Share Redemption Amount”), based on

the amount in the Trust Account as of October 27, 2023. In

accordance with the terms of the Articles, AAC expects to retain

$100,000 of the interest earned on the Trust Account to pay

dissolution expenses.

The Per-Share Redemption Amount will be payable to the holders

of the Public Shares upon presentation of their respective share or

unit certificates or other delivery of their shares or units to

AAC’s transfer agent, Continental Stock Transfer & Trust

Company. Beneficial owners of Public Shares held in “street name,”

however, will not need to take any action in order to receive the

Per-Share Redemption Amount.

There will be no redemption rights or liquidating distributions

with respect to AAC’s warrants. AAC’s initial shareholders have

waived their redemption rights with respect to the outstanding

Class B ordinary shares, par value $0.0001 per share, issued prior

to AAC’s initial public offering. As of November 6, 2023, AAC will

cease all operations except those required to wind up AAC’s

business.

AAC expects that The New York Stock Exchange will file a Form 25

with the U.S. Securities and Exchange Commission to delist its

securities.

About X-Energy Reactor Company, LLC

X-Energy Reactor Company, LLC, is a leading developer of

advanced small modular nuclear reactors and fuel technology for

clean energy generation that is redefining the nuclear energy

industry through its development of safer and more efficient

reactors and proprietary fuel to deliver reliable, zero-carbon and

affordable energy to people around the world. X-energy’s

simplified, modular, and intrinsically safe SMR design expands

applications and markets for deployment of nuclear technology and

drives enhanced safety, lower cost and faster construction

timelines when compared with conventional nuclear. For more

information, visit X-energy.com or connect with us on Twitter or

LinkedIn.

About Ares Acquisition Corporation

AAC is a special purpose acquisition company (SPAC) affiliated

with Ares Management Corporation, formed for the purpose of

effecting a merger, share exchange, asset acquisition, share

purchase, reorganization or similar business combination. For more

information about AAC, please visit

www.aresacquisitioncorporation.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995, including statements

relating to the termination of the Business Combination Agreement,

any private investment in X-Energy and the anticipated timing of

AAC’s delisting, liquidation and dissolution. Certain of these

forward-looking statements can be identified by the use of words

such as “believes,” “expects,” “intends,” “plans,” “estimates,”

“assumes,” “may,” “should,” “will,” “seeks,” or other similar

expressions. These statements are based on current expectations on

the date of this press release and involve a number of risks and

uncertainties that may cause actual results to differ

significantly. Readers are cautioned not to put undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date they are made, and AAC assumes no obligation and

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise, except as required by securities and other applicable

laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231030099212/en/

X-energy

Media: Robert McEntyre media@x-energy.com

Ares Acquisition Corporation

Investors: Carl Drake and Greg Mason +1-888-818-5298

IR@AresAcquisitionCorporation.com

Media: Jacob Silber +1-212-301-0376 media@aresmgmt.com

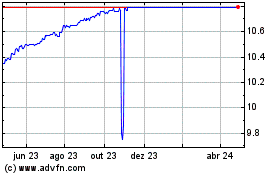

Ares Acquisition (NYSE:AAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ares Acquisition (NYSE:AAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024