Acquisition Will Further Enhance and

Differentiate Tradeweb Intelligent Execution Capabilities in Fixed

Income and Futures

Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today announced that it has entered into a definitive

agreement to acquire r8fin, a technology provider that specializes

in algorithmic-based execution for U.S. Treasuries and interest

rate futures.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231115213638/en/

Tradeweb CEO Billy Hult (Photo: Business

Wire)

Founded in 2016 in Chicago, r8fin provides a suite of

algorithmic-based tools as well as a thin-client execution

management system (EMS) trading application to facilitate futures

and cash trades. The solutions complement Tradeweb’s existing

Dealerweb Active Streams, Dealerweb Central Limit Order Book

(CLOB), Tradeweb Request-for-Quote (RFQ) and Tradeweb AiEX

(Automated Intelligent Execution) offerings, creating a valuable

and broad-based approach to trading U.S. Treasuries and related

futures trading.

Tradeweb expects the acquisition to modestly enhance revenue

growth, operating margins and be accretive to 2024 earnings per

share. The acquisition is expected to close in the first quarter of

2024 subject to customary closing conditions and receipt of

regulatory approvals.

Tradeweb CEO Billy Hult commented: “r8fin technology will help

Tradeweb reach a new and differentiated level of intelligent

execution through a powerful combination of algorithmic technology

and cross-market connectivity. This marks another step forward in

the execution of our vision to deliver an integrated product suite

for accessing the U.S. Treasury market through multiple liquidity

pools across cash and futures. Beyond that, as we look ahead, we

believe pairing r8fin’s sophisticated technology with our global

network will open up a range of new possibilities for clients

engaged in relative value or macro trades spanning multiple asset

classes.”

r8fin has a client base that includes 65 relative value hedge

funds, systematic hedge funds, professional trading firms and

primary dealers. r8fin technology facilitates algorithmic-based

execution for an average of more than $23 billion notional in U.S.

Treasury bonds and 350,000 futures contracts per day.1

Tradeweb is the leading electronic trading platform for U.S.

Treasuries, with a broad and deep network that spans institutional,

wholesale and retail markets. Tradeweb launched the first

multi-dealer online marketplace for U.S. Treasuries 25 years ago,

and today facilitates an average of $142.7 billion per day in U.S.

Treasury trading.2

r8fin Co-founder Assad Fehmy commented: “Combining with Tradeweb

will further amplify and scale the r8fin technology, providing

customers with broader integrated execution solutions and asset

classes. It has been an incredible experience watching our

technology and network evolve over the last seven years, and I am

confident r8fin will be positioned for continued growth in this new

chapter as part of Tradeweb.” Mr. Fehmy will join Tradeweb upon the

closing of this acquisition.

About Tradeweb Markets

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 40 products to clients in the

institutional, wholesale and retail markets. Advanced technologies

developed by Tradeweb enhance price discovery, order execution and

trade workflows while allowing for greater scale and helping to

reduce risks in client trading operations. Tradeweb serves more

than 2,500 clients in more than 65 countries. On average, Tradeweb

facilitated more than $1.2 trillion in notional value traded per

day over the past four fiscal quarters. For more information,

please go to www.tradeweb.com.

About r8fin

r8fin algorithms and the entire r8fin ecosystem are utilized by

hundreds of institutional risk-taking professionals to help manage

their fixed income trading. The r8fin platform is a long-term

proven, highly scalable and robust technology infrastructure hosted

in multiple global co-located data centres. For more information

please go to www.r8fin.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, our outlook and future performance, the

industry and markets in which we operate, our expectations,

beliefs, plans, strategies, objectives, prospects and assumptions

and future events are forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in documents of Tradeweb Markets Inc. on file with or furnished to

the SEC, may cause our actual results, performance or achievements

to differ materially from those expressed or implied by these

forward-looking statements. Given these risks and uncertainties,

you are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements

contained in this release are not guarantees of future performance

and our actual results of operations, financial condition or

liquidity, and the development of the industry and markets in which

we operate, may differ materially from the forward-looking

statements contained in this release. In addition, even if our

results of operations, financial condition or liquidity, and events

in the industry and markets in which we operate, are consistent

with the forward-looking statements contained in this release, they

may not be predictive of results or developments in future

periods.

Any forward-looking statement that we make in this release

speaks only as of the date of such statement. Except as required by

law, we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

1,2 Year-to-date as of October 31, 2023

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115213638/en/

Media contact: Daniel Noonan, Tradeweb, +1 646 767 4677,

Daniel.Noonan@Tradeweb.com

Investor contacts: Ashley Serrao, Tradeweb, +1 646 430

6027, Ashley.Serrao@Tradeweb.com Sameer Murukutla, Tradeweb, +1 646

767 4864, Sameer.Murukutla@Tradeweb.com

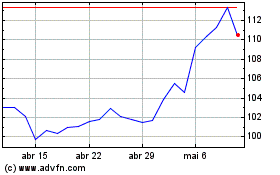

Tradeweb Markets (NASDAQ:TW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Tradeweb Markets (NASDAQ:TW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024