NXP Semiconductors Profit Drops Sharply

27 Outubro 2016 - 12:17AM

Dow Jones News

By Maria Armental

NXP Semiconductors NV's profit dropped sharply as operating

expenses more than doubled, even as acquisitions and continued

strength in its automotive segment drove another revenue surge.

The Dutch company -- best known for designing smartphone chips

used in automotive systems, identification and transit cards -- is

in talks to merge with Qualcomm Inc., the Wall Street Journal

reported, part of a consolidation wave as the chip sector reacts to

slower growth.

A conference call with analysts is scheduled for Thursday

morning.

Shares, up 17% this year, edged down to $98 in after-hours

trading.

NXP started as the semiconductor arm of electronics giant

Philips NV and has expanded into one of the largest computer-chip

companies with more than $6 billion in sales and a market

capitalization of more than $34 billion. Today, it is the No.1

supplier of automotive chips, a fast-growing market.

The company, which is selling its Standard Products business in

a deal expected to close early next year, had reported two straight

quarters of losses, driven by charges from the Freescale

Semiconductor merger.

Over all, third-quarter profit plunged to $91 million, or 26

cents a share.

Revenue surged 62% to $2.47 billion, in line with the company's

projections. However, excluding revenue from Freescale and other

adjustments, NXP said, revenue would have been down about 3%.

Gross profit margin narrowed to 48% from 48.6% a year

earlier.

NXP ended the quarter with about $1.57 billion in cash and $9.4

billion in debt.

For the current quarter, it projects $2.39 billion to $2.49

billion in revenue, compared with analysts' $2.42 billion,

according to Thomson Reuters.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

October 26, 2016 22:02 ET (02:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

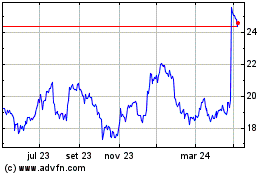

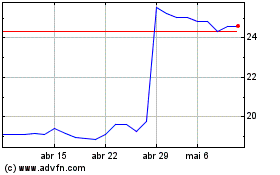

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024