Nokia Cuts Net Sales View, Narrows Margin Guidance for 2023

14 Julho 2023 - 3:35AM

Dow Jones News

By Dominic Chopping

Nokia on Friday lowered its full-year net sales guidance and

narrowed its operating margin outlook amid a weaker demand picture

in its network infrastructure and mobile networks businesses due to

a tougher macroeconomic environment and as customers work through

built-up inventory.

The Finnish telecommunications-equipment company now sees sales

of between 23.2 billion euros and 24.6 billion euros ($26.05

billion-$27.62 billion) from EUR24.6 billion to EUR26.2 billion

previously.

The comparable operating margin is seen at 11.5% to 13% from

11.5% to 14% previously.

"Customer spending plans are increasingly impacted by high

inflation and rising interest rates along with some projects now

slipping to 2024--notably in North America," Nokia said.

"There is also inventory normalization happening at customers

after the supply chain challenges of the past two years."

Ahead of the company's second-quarter earnings on July 20, Nokia

also reported preliminary net sales of around EUR5.7 billion for

the three-month period and a comparable operating margin of around

11%, with operating profit boosted by EUR80 million related to

catch-up payments in its technologies unit.

The company said it will continue to take measures to ensure it

remains on track towards its long-term targets of growing faster

than the market and delivering a comparable operating margin of at

least 14%.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

July 14, 2023 02:20 ET (06:20 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

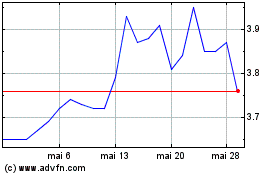

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024