Trending: Nokia, Ericsson Shares Tumble

14 Julho 2023 - 7:41AM

Dow Jones News

1009 GMT - Nokia and Ericsson are among the most mentioned

companies across news items over the past three hours, according to

Factiva data, with both of their shares falling after updates.

Nokia has lowered its full-year sales guidance and narrowed its

operating margin outlook due to weaker demand in its network

infrastructure and mobile networks businesses, given a tougher

macroeconomic environment and as customers work through built-up

inventory. Ericsson said second-quarter sales in North America were

down 50%, and that it expects trends and market mix to continue

into the third quarter. It added that third quarter Ebita margin is

expected to be in line with, or slightly below the second quarter.

Citi analysts wrote that Nokia's warning is directionally similar

to Ericsson's, although the magnitude of change for Nokia is

greater as its full-year guidance had anticipated greater

improvement in 2H. "The telecom equipment market is facing stronger

headwinds than we anticipated, in particular in the key U.S.

market, where inventory digestion and weaker deployments are

leading to greater pressure on near-term revenue." Any fundamental

recovery looks delayed into 2024, Citi says. Nokia shares are

currently down 8.35%, while Ericsson shares are down 7.8%. Dow

Jones & Co. owns Factiva. (ian.walker@wsj.com.)

(END) Dow Jones Newswires

July 14, 2023 06:26 ET (10:26 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

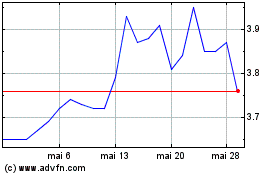

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024