Citi Planning to Sell China Retail-Wealth Unit to HSBC, Source Says

28 Setembro 2023 - 1:47AM

Dow Jones News

By Elaine Yu and Matthew Thomas

Citigroup is in talks to sell its retail-wealth business in

China to British rival HSBC, according to a person familiar with

the matter.

The deal, which is likely to be announced next month, is part of

Citi's broader exit from consumer banking outside of its home

market. The U.S. bank had announced that it was scaling back at

overseas retail banking business in 2021, and said last year that

it would wind down the consumer-banking business in China.

The retail-wealth segment in China includes customers with

assets between $100,000 and $1 million. Citi's China retail wealth

deposits and assets under management are currently between $3

billion and $4 billion, and the sale will affect about 400

employees in China, who are expected to transfer to HSBC, said the

person.

HSBC declined to comment on the potential deal.

HSBC, Hong Kong's biggest lender, had pledged to spend more than

$3.5 billion two years ago to build its Asian wealth business over

the next five years. The bank has since gone on a hiring spree,

including the recruitment of 1,400 wealth managers in mainland

China to sell insurance and advise on investments through its

branchless venture in the country known as Pinnacle.

Citi had earlier this month said that it will simplify its

international structure, removing some regional jobs, as Chief

Executive Jane Fraser shakes up its executive ranks and sheds

overlapping roles.

Write to Elaine Yu at elaine.yu@wsj.com

(END) Dow Jones Newswires

September 28, 2023 00:32 ET (04:32 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

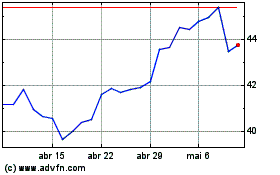

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

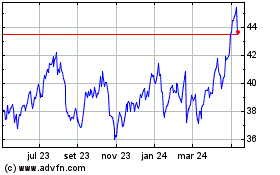

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024