Exxon Buys Pioneer in $60 Billion Deal to Create Shale Giant

11 Outubro 2023 - 8:09AM

Dow Jones News

By Collin Eaton and Benoit Morenne

Exxon Mobil struck a nearly $60 billion agreement Wednesday to

buy Pioneer Natural Resources in the largest oil-and-gas deal in

two decades, tying the energy giant's future to fossil fuels for

decades to come.

The deal, at $253 per share, values Pioneer at an almost 7%

premium to its closing value of about $55.4 billion Tuesday. It

cements Exxon's status as the dominant player in the American

fracking industry, now centered in West Texas where Pioneer has

more places to drill than almost all of its rivals.

Shares in Pioneer rose about 3% in premarket trading on

Wednesday. Exxon's stock dropped less than 1%.

The deal is Exxon's largest since its $75 billion merger with in

the late 1990s and is the largest corporate transaction so far this

year. The Wall Street Journal reported last week that Exxon and

Pioneer were closing in on the tie-up.

Exxon's all-stock transaction leans heavily on its higher share

price relative to its peers over the last year. Several

institutional investment firms have snapped up more of Exxon's

shares following a surge in oil and gas prices, keeping its stock

performing more strongly than that of most other oil companies.

Write to Collin Eaton and Benoit Morenne at Collin.Eaton@wsj.com

and Benoit.Morenne@wsj.com

(END) Dow Jones Newswires

October 11, 2023 06:54 ET (10:54 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

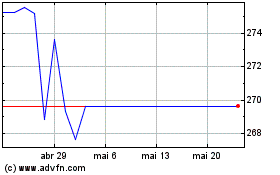

Pioneer Natural Resources (NYSE:PXD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Pioneer Natural Resources (NYSE:PXD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024