Trending: Microsoft's Activision Deal Cleared by UK Regulators

13 Outubro 2023 - 7:22AM

Dow Jones News

0952 GMT - The clearance of Microsoft's $75 billion takeover of

Activision Blizzard by U.K. regulators is among the most mentioned

topics across news items over the past four hours, according to

Factiva data. The U.K.'s Competition and Markets Authority, or CMA,

said Friday its concerns over the threat to competition posed by

the deal were resolved by Microsoft's sale of cloud-streaming

rights for Activision's videogames roster--including hit franchises

"Call of Duty," "Candy Crush" and more--to rival company Ubisoft

Entertainment. The CMA had provisionally cleared the deal last

month. Microsoft said it was "grateful" for the CMA's decision,

while Activision said the official approval was great news for its

future with Microsoft. The U.S. tech giant first announced its plan

to buy Activision in January 2022 and valued the deal at $69

billion after adjusting for the videogame publisher's net cash, and

both companies had set an extended deadline of Oct. 18 for

completing the merger. "If this genuinely protects consumers then

the CMA deserves some credit for holding the line under

considerable pressure from a multi-trillion-dollar business," AJ

Bell investment director Russ Mould says in a market comment. Dow

Jones & Co. owns Factiva. (joseph.hoppe@wsj.com)

(END) Dow Jones Newswires

October 13, 2023 06:07 ET (10:07 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

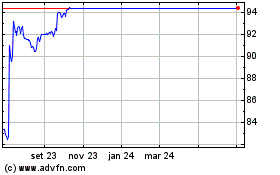

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024