Boosting Venezuelan Output Requires 'Significant Investment,' EIA Says -- OPIS

23 Outubro 2023 - 2:30PM

Dow Jones News

While the Biden administration's easing of sanctions on

Venezuela could increase in the country's crude oil production by

the end of the year, the poor state of its oil infrastructure means

the gains will likely be less than 200,000 b/d over the next year

and any additional increases will take longer and require

significant new investment, the U.S. Energy Information

Administration said Monday.

The administration's Oct. 18 move lifted most sanctions on

Venezuela's energy sector for six months and could lead to the

resumption of U.S. imports of heavy, sour crude. Several refineries

in the U.S. are configured to process the sour crude, which has

seen rising prices following production cuts by OPEC and its allies

that disproportionally impacted heavy crude supplies.

Venezuela has been under U.S. sanctions since early 2019

following a disputed presidential election, which stopped imports

of oil from the country. Those imports had been declining in recent

decades, as Venezuela's oil industry declined.

Venezuelan crude production, which had been about 3.2 million

b/d in 2000, fell to 735,000 b/d in September 2023, according to

EIA. Similarly, U.S. imports from Venezuela fell from 1.3 million

b/d in 2001 to about 510,000 b/d in 2018.

In November, the administration granted waivers allowing Chevron

Corp. to resume exporting crude from its joint venture in

Venezuela. Those exports started in January and totaled about

153,000 b/d in July, EIA said.

Chevron's exports go to Gulf Coast refineries. Any additional

U.S. imports of Venezuelan oil will also likely head to the Gulf.

Citgo Petroleum Corp., which is owned by Venezuela's national oil

company, operates three refineries in the U.S.--Lemont, Ill.; Lake

Charles, La.; and Corpus Christi, Texas. The refineries have a

combined capacity of more than 800,000 b/d and are designed to

process heavy oil, EIA said.

One way lifting of sanctions will lead to an increase in

production is by increasing Venezuela's supply of diluent.

Shortages of the material, necessary to process heavy oil, has

reduced Venezuelan output, EIA said.

Chevron should also be able to ramp up its output in Venezuela

to an average 200,000 b/d by the end of 2024, the agency said.

Similar ventures operated by ENI, Repsol, and Maurel & Prom

could add 50,000 to their output in the short term.

Together, EIA said all the ventures could increase Venezuelan

output to about 900,000 b/d by the end of next year.

After that, increases will be more difficult to come by, the

agency said.

"Years of underinvestment and mismanagement of Venezuela's

energy sector will likely limit crude oil production growth to less

than 200,000 b/d by the end of 2024, requiring more time and

investment for additional growth," EIA said.

This content was created by Oil Price Information Service, which

is operated by Dow Jones & Co. OPIS is run independently from

Dow Jones Newswires and The Wall Street Journal.

--Reporting by Steve Cronin, scronin@opisnet.com; Editing by

Michael Kelly, mkelly@opisnet.com

(END) Dow Jones Newswires

October 23, 2023 13:15 ET (17:15 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

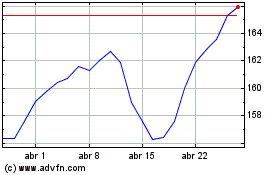

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

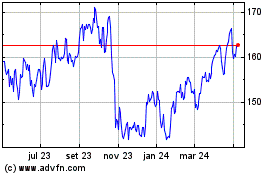

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024