NextEra 3Q Net Down, But Adjusted Earnings, Revenue Growth Top Views

24 Outubro 2023 - 9:40AM

Dow Jones News

By Rob Curran

NextEra Energy posted a 27% drop in third-quarter earnings as

higher operating expenses offset an increase in revenue for the

Florida utility and renewable-energy giant.

The Juno Beach, Fla., power producer said net income declined to

$1.22 billion, or 60 cents a share, for the quarter ended Sept. 30,

from $1.68 billion, or 86 cents a share, a year earlier. Excluding

items such as nonqualified hedges and changes in value of

investments held in a nuclear decommissioning fund, NextEra

registered adjusted earnings of 94 cents a share, surpassing the

average Wall Street target of 89 cents a share, as tallied by

FactSet.

Third-quarter revenue rose 6.7% to $7.17 billion, topping the

average analyst estimate of $7.07 billion, as determined by a

FactSet survey.

Operating expenses rose 6% to $5.34 billion.

Florida Power & Light, NextEra's biggest unit and the

largest U.S. electric utility by customers, had a $2.6 billion

capital-expenditure outlay for the quarter. For the year, Florida

Power & Light anticipates capital expenditure between $9

billion and $9.5 billion.

NextEra Energy Resources, NextEra's renewable-energy arm, added

about 3,245 megawatts of new wind-and-solar and storage capacity to

its backlog.

NextEra Energy reiterated its financial projections for 2023 and

2024. For 2023, NextEra Energy continues to expect adjusted

earnings per share to be in the ranges of $2.98 to $3.13. For 2024,

NextEra is still targeting earnings in a range between $3.23 and

$3.43 a share.

Write to Rob Curran at rob.curran@dowjones.com

(END) Dow Jones Newswires

October 24, 2023 08:25 ET (12:25 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

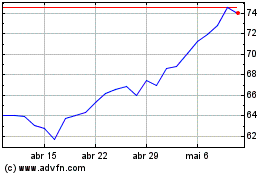

NextEra Energy (NYSE:NEE)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

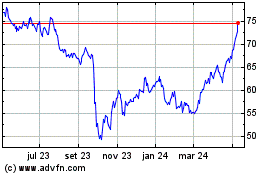

NextEra Energy (NYSE:NEE)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024