Lloyds Banking Backs 2023 Guidance After 3Q Pretax Profit Rose

25 Outubro 2023 - 3:55AM

Dow Jones News

By Elena Vardon

Lloyds Banking Group backed its 2023 guidance as it posted a

better-than-expected rise in pretax profit for the third

quarter.

The British bank reported a pretax profit for the three months

to Sept. 30 of 1.86 billion pounds ($2.26 billion) compared with a

restated GBP576 million for the same period a year earlier and with

GBP1.82 billion expected by a company-compiled consensus.

Net income rose to GBP4.51 billion from GBP4.48 billion, coming

slightly short of consensus' GBP4.56 billion estimate, it said on

Wednesday. Included in the figure are GBP3.44 billion from net

interest income, against expectations of GBP3.48 billion. Its

banking net interest margin was 3.08% for the quarter, below

consensus expectations of 3.10%.

Lloyds's return on tangible equity for the quarter was 16.9%,

beating consensus of 15.7%.

The company said it now sees its asset quality ratio for 2023 of

less than 30 basis points--from around 30 basis points

previously--and reaffirmed its other targets. For the year, it

still expects to report banking net interest margin of over 3.10%,

operating costs around GBP9.1 billion, return on tangible equity of

over 14% and capital generation of around 175 basis points.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

October 25, 2023 02:40 ET (06:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

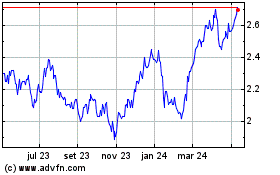

Lloyds Banking (NYSE:LYG)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

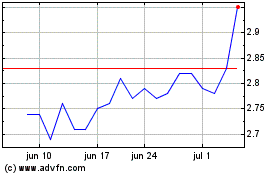

Lloyds Banking (NYSE:LYG)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024