Trending: BP Earnings Fell Below Expectations on Weak Gas Trading

31 Outubro 2023 - 7:57AM

Dow Jones News

1027 GMT - BP is among the most mentioned companies across news

items over the past 4 hours, according to Factiva data, after the

energy major posted third-quarter earnings below consensus

forecasts. Despite producing more oil and gas, seeing higher

realized refining margins and strong oil sales, the London-based

company wasn't able to meet market expectations of $4.01 billion

for underlying replacement cost profit. Offsetting the positives

was a weaker-than-expected gas trading result, leading to an

underlying replacement cost profit of $3.29 billion. Even as

current oil prices remain high, they are still lower than the same

period last year, while gas prices are far from the heights of

2022. "Consequently, it is no surprise to see BP's underlying

profit fall year on year, although the reported figure is also

considerably lower than had been anticipated," Admirals analyst

Roberto Rivero says in a market comment. The FTSE 100-listed energy

group said it plans to launch an additional $1.5 billion share

buyback before its fourth-quarter results, while its dividend

payout was raised to 7.27 U.S. cents a share from 6.006 cents a

share the year prior. Dow Jones & Co. owns Factiva.

(christian.moess@wsj.com)

(END) Dow Jones Newswires

October 31, 2023 06:42 ET (10:42 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

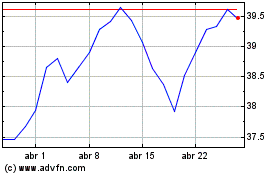

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

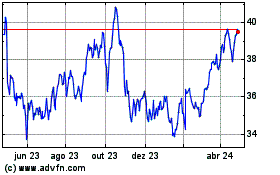

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024