ExxonMobil Sets Plan to Boost Earnings, Cash Flow by $14 Billion Through 2027

06 Dezembro 2023 - 9:53AM

Dow Jones News

By Dean Seal

ExxonMobil updated its corporate plan with a target of doubling

its earnings potential by 2027 compared with 2019.

The oil and gas giant said Wednesday that it is on track to

deliver $14 billion in further earnings and cash flow growth

potential over the next four years.

The company is cutting $6 billion in structural costs by the end

of 2027 and improving its business mix by driving sales for its

high-value performance chemicals, lower-emission fuels, and

performance lubricants.

ExxonMobil expects its capital investments to generate average

returns of 30% and said that more than 90% of its capital

expenditures have payback periods of less than 10 years.

The company also said it will increase capital expenditures in

2025 by growing value-accretive low-carbon solutions opportunities

to reduce emissions.

Once ExxonMobil closes its acquisition of Pioneer Natural

Resources, it intends to increase the pace of its share buyback

program to $20 billion annually through 2025. The company is on

track to complete $17.5 billion in share repurchases this year.

ExxonMobil said it is also developing its position in the

lithium market and has entered the first phase of lithium

production in southwest Arkansas. First production is expected in

2027, with the goal of producing enough lithium to supply the

manufacturing needs of about 1 million electric vehicles a year by

2030.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

December 06, 2023 07:38 ET (12:38 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

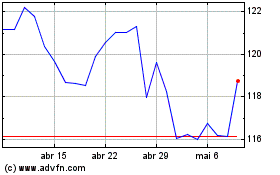

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

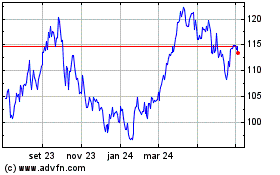

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024