Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

June 2017

Vale S.A.

Avenida das Américas, No. 700 — Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F

x

Form 40-F

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

o

No

x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes

o

No

x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes

o

No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

FREE TRANSLATION FROM PORTUGUESE VERSION

MINUTES OF THE EXTRAORDINARY GENERAL SHAREHOLDERS’

MEETING OF VALE S.A., HELD ON JUNE 27

TH

, 2017.

Publicly-Held Company

Corporate Taxpayer’s ID (CNPJ/MF) # 33,592,510/0001-54

Board of Trade Registration (NIRE) # 33,300,019,766

01 — PLACE, DATE AND TIME:

In the offices of Vale S.A. (“Vale” or the “Company”), at Avenida das Américas, No. 700, 2

nd

floor, room 218 (auditorium), Città America, Barra da Tijuca, in this city, on June 27

th

, 2017, at 11 a.m.

02 - PANEL:

Chairman: Mr. Fernando Jorge Buso Gomes

Secretary: Clovis Torres

03 - ATTENDANCE AND QUORUM:

Attended by shareholders representing 85% of the voting capital, as recorded in the Shareholders’ Attendance Book, and as per information contained in the analytical maps prepared by the bookkeeping agent and by the Company, in accordance with Article 21-W, sections I and II of CVM Instruction #481/2009, thereby confirming the required quorum for the Extraordinary General Shareholders’ Meeting to be properly installed

Also present Mr. Luciano Siani Pires, Vale’s Executive Officer, Mr. Manuel Fernandes Rodrigues de Souza, representative of KPMG Auditores Independente, and Messrs. Ronaldo Valiño and Renato Pereira, representatives of PricewaterhouseCoopers Corporate Finance & Recovery Ltda; and Messrs. Marcus Vinícius Dias Severini and Raphael Manhães Martins, effective members of the Fiscal Council, in accordance with Article 164 of Law #6,404/76.

04 - SUMMONS:

Call Notice of the Extraordinary General Shareholders’ Meeting was duly published in the Rio de Janeiro Official State Gazette on May 15, 16 and 17, 2017, pages 15, 11 and 16; in

Valor Econômico

of São Paulo on May 13, 14 and 15 (sole edition), 16 and 17, 2017, pages E3, E2 and E3, and in

Valor Econômico

of Rio de Janeiro

,

pages E3, E3 and E3, in order to deliberate on the following matters on the Agenda, which are inseparable and interdependent steps of a single transaction to restructure the Company’s corporate governance, with the purposes of transforming Vale into a company without defined control, as described in the Material Facts disclosed on February 20, 2017 and May 11

3

Table of Contents

2017, such that the effectiveness of each step is conditional on the full implementation of the rest:

I.

Voluntary conversion of class “A” preferred shares issued by Vale into common shares at the ratio of 0.9342 common shares to each class “A” preferred share;

II.

Amendment of Vale’s By-Laws to adapt them, as much as possible, to the rules of the “

Novo Mercado

” special listing segment of BM&FBOVESPA S.A. — Bolsa de Valores Mercadorias e Futuro, as well as to implement certain adjustments and improvements, as listed below:

(a)

Update the spelling of the Portuguese words “Assembleia” (“meeting”) or “Assembleias” (“meetings”) appearing, as the case may be, in the following provisions of the By-Laws: Art. 5, §3; Art. 6, §3; title of Chapter III; Art. 8, head paragraph, §1 and §3; Art. 9, head paragraph and Sole paragraph; Art. 11, § 2, §4, §10, §11 and §12; Art. 14, II, XV, XVI and XXXI; Art. 32, XII and §1, Art. 33, II; Art. 35, §2, Art. 36, head paragraph; Art, 37, head paragraph; Art. 39, §3; and Art. 42, head paragraph;

(b)

Update the spelling of the Portuguese word “cinquenta” (“fifty”) in Art. 11, §13, and Art. 43, II;

(c)

Adjust the head paragraph of Art. 6 to set forth the new limit of authorized capital, in the amount of up to 7,000,000,000 (seven billion) common shares, and the Company’s issuance of only the common shares within the limit of authorized capital;

(d)

Adjust Art. 6, §2 and §3, in line with the proposition that the Company may only exclude the right of first refusal of the shareholders in the issuance of bonds convertible into common shares and only grant purchase options for its common shares;

(e)

Modify Art. 11, head paragraph, and §5, to set forth that the number of members of the Board of Directors will change from 11 (eleven) to 12 (twelve);

(f)

Include in Art. 11, a new §6, with the consequent re-numbering of the remaining paragraphs, to establish that at least 20% of the Board of Directors shall be independent members;

(g)

Clarify in Art. 11, §11, that the common shares that elect a member in separate vote do not participate in the multiple vote process;

(h)

Amend Art. 11, §12 and §13, to clarify the election process through the multiple vote regime;

4

Table of Contents

(i)

Include a new item in Art. 14, to set forth the Board of Directors’ ability to express its views about any tender offer to purchase the Company’s shares

(oferta pública de aquisição

- “OPA”);

(j)

Modify Art. 34, IV, to abbreviate the Portuguese word “Artigo” (“Article”) to “Art.”;

(k)

Include Articles 47, 48 and 49 to regulate the holding of an OPA in the case of sale of the Company’s shareholding control;

(l)

Include Art. 50, to establish definitions of terms used in the By-Laws;

(m)

Include Art. 51 to set forth the hypotheses and regulate the holding of an OPA upon reaching equity interest equal to or greater than 25% (twenty-five percent) of the Company’s total common shares or the total capital of the Company;

(n)

Include Art. 52 to establish procedures and sanctions for breach of obligation to hold an OPA;

(o)

Include Art. 53 to address the minimum share price in the event an OPA is held to cancel registration as a publicly held company;

(p)

Include Art. 54 to set forth rules about preparing an appraisal report in the event an OPA is held;

(q)

Include Art. 55 to set forth the prohibition of registering the transfer of shares that do not comply with the provisions of the By-Laws;

(r)

Include Art. 56 to set forth the prohibition of filing a shareholders’ agreement that does not comply with the provisions of the By-Laws;

(s)

Include Art. 57 to set forth the ability of the Shareholders’ Meeting to decide on cases not addressed in the By-Laws; and

(t)

Include Art. 58 to contemplate the use of arbitration to resolve disputes or controversies.

III.

Pursuant to Articles 224, 225, 227 and 264 of Law #6.404/1976, the Instrument of Filing and Justification of Merger of Valepar S.A. (“Valepar”), Vale’s controller, into the Company, including rendering of Valepar’s assets to Vale as a result of the transaction;

IV.

Ratify the appointment of KPMG Auditores Independentes, a specialized company nominated by the boards of Vale and Valepar to appraise Valepar’s shareholders’ equity, for the purposes of its merger into the Company;

5

Table of Contents

V.

Appraisal Report of Valepar’s shareholders’ equity, prepared by the specialized company mentioned above;

VI.

Merger of Valepar into the Company, with an increase of 1,908,980,340 new common shares of Vale to replace the 1,716,435,045 common shares and 20,340,000 preferred shares issued by Vale currently held by Valepar, which will be cancelled as a result of such merger; and

VII.

As a result of item (vi), the consequent amendment of the head paragraph of Art. 5 of the Company’s By-Laws.

All documents required by Law #6.404/1976 and by the rules of

Comissão de Valores Mobiliários -

CVM applicable to the matters on the Agenda were made available to the Company’s shareholders in the Company’s investors relations

website

and through the IPE System of CVM, at the time of the Call Notice.

05 - READING OF DOCUMENTS AND PREVIOUS CLARIFICATIONS:

Pursuant to CVM Instruction #481/2009, the Secretary read out the consolidated synthetic voting map released yesterday to the market, as requested by the Chairman. After the reading, the document remained on the table for consultation by the shareholders.

The following documents were also made available on the table, namely:

(i)

publications of the Call Notice;

(ii)

Proposal submitted by Valepar to Vale on May 5

th

2017;

(iii)

Manual containing information regarding the General Meeting;

(iv)

Instrument of Filing and Justification of Merger of Valepar into Vale, with related exhibits (including the Appraisal Report of the Financial Economic Value of Valepar and Vale, and the Accounting Appraisal Report of Valepar’s Shareholders’ Equity);

(v)

Financial Statements of Vale and Valepar of December 31

st

, 2016;

(vi)

Information required by Article 20-A of CVM Instruction #481/2009 and List of Administrative and Judicial Proceedings involving Valepar;

(vii)

Draft of Vale S.A. Bylaws containing, highlighted, the proposed amendments;

(viii)

Report on the proposed amendments, containing the origin and justification of the amends and analysis of their legal and economic effects, pursuant to article 11 of CVM Instruction #481/2009;

(ix)

Minutes of the Meetings of Vale S.A.’s Executive Board and Board of Directors dated as of May 11, 2017;

(x)

Opinion of the Fiscal Council of Vale S.A. dated May 11, 2017; and

(xi)

Information regarding the Appraiser pursuant to Article 21 of CVM Instruction #481/2009, including a copy of the work proposals;

(xii)

Information required by Article 8 of CVM Instruction #481/2009; and (

xiii

) the Announcement to the Market as of June 05, 2017.

The reading of the aforesaid documents was unanimously waived by the voting shareholders present at the Meeting, as the content of the same was already known, being registered 3.868.948.753 votes in favor, zero dissenting votes, and zero abstention votes.

Therefore, after discussion and comments by the shareholders on the above-mentioned documents, it was pointed that the final binding proposal presented by Valepar, the

6

Table of Contents

controlling shareholder of Vale, at the request of its shareholders Litel Participações S.A., Litela Participações S.A., Bradespar S.A., Mitsui & Co. Ltd. and BNDES Participações S.A. - BNDESPAR, which involves the corporate restructuring of the Company, as well as changes to its corporate governance, with the purpose to transform the Company into a company without defined control and enable the Company to be listed on the “

Novo Mercado

” special listing segment of B3 S.A. - Brasil, Bolsa Balcão (“Proposal” and “B3”, respectively). The Proposal is comprised of a series of inseparable and interdependent events in which the effectiveness of each is conditional on the successful implementation of the rest. The Proposal consists, in addition to the practice of all acts and procedures required by the relevant legal and regulatory provisions, in:

a)

Voluntary conversion of class “A” preferred shares issued by Vale into common shares at the ratio of 0.9342 common share for each class “A” preferred share, which was defined based on the closing price of the common and preferred shares issued by the Company, assessed using the average of the last 30 (thirty) days of trading of B3 prior to February 17

th

, 2017 (inclusive), weighted by the volume of shares traded on the aforementioned trading days ( “Voluntary Conversion”);

b)

Amendment of the Company’s Bylaws to adapt it, as far as possible, to the rules of the Novo Mercado until Vale may be effectively listed in this special segment (“Amendment to the Bylaws”); and

c)

Merger of Valepar into the Company with a replacement ratio that includes an increase in the number of shares held by Valepar’s shareholders of 10% (ten per cent) in relation to Valepar’s current shareholding position in the Company and representing a dilution of around 3% (three per cent) of the stake of the other Vale’s shareholders in its capital stock (“Merger” and together with the Voluntary Conversion and the Amendment to the Bylaws, “Transaction”). Valepar’s shareholders will receive 1,2065 common share issued by the Company for each share issued by Valepar that they own. As a result, the Company will issue an additional amount of 173.543.667 new common shares, all of them nominatives with no par value in favor of Valepar’s shareholders. Therefore, Valepar’s shareholders shall come to hold jointly a total of 1.908.980.340 common shares issued by Vale after the Merger becomes effective.

It was also highlighted that the implementation of the Transaction will only be effective if all stages of the Transaction are approved by the shareholders and if shareholders holding at least 54.09% of class “A” preferred shares issued by Vale (excluded treasury shares) adhere to the Voluntary Conversion (“Minimum Adhesion”), to be manifested within 45 (forty-five) days as from today.

06 - RESOLUTIONS:

Following clarifications above, the following resolutions were approved by voting shareholders, being registered the abstention votes from the shareholders Valepar, Caixa

7

Table of Contents

de Previdência dos Funcionários do Banco do Brasil — Previ (“Previ”) and BNDES Participações S.A. — BNDESPAR (“BNDESPAR”) with respect to items 6.2 and 6.6:

6.1. by the unanimously of the voting shareholders present at the meeting, it was approved to drawn-up the present minutes in summary form and to publish it omitting the signatures of the shareholders present to the meeting, as permitted by Paragraphs First and Second of Article 130 of Law No. 6,404/76.

Were computed 3.868.948.753 votes in favor, zero dissenting votes, and zero abstention votes.

6.2. by the majority of the voting shareholders present at the meeting, it was approved the voluntary conversion of class “A” preferred shares issued by Vale into common shares at the ratio of 0.9342 common share to each class “A” preferred share, which was set based on the closing price of Vale’s common and preferred shares, calculated based on the average of the last 30 (thirty) trading sessions of B3 prior to February 17

th

, 2017 (inclusive), weighted by the volume of shares traded in such sessions, being registered that, as a condition of the Transaction, at least 54.09% of shareholders holding Vale’s class “A” preferred shares (excluded treasury shares) must join the voluntary conversion, to be expressed within 45 (forty five) days from today. Therefore, holders of American Depositary Shares representing Vale class “A” preferred shares (preferred ADSs) may join the voluntary conversion during the same 45 (forty five) days period. Detailed procedures necessary for the Voluntary Conversion, including the measures to be adopted by the shareholders and the ADSs holders to request the conversion will be described in the form of Notice to Shareholders, to be released after this Meeting. After the end of the Conversion Period, if the Minimum Adhesion is confirmed, the effective conversion of class “A” preferred shares into common shares will be informed to the shareholders.

It is highlighted that the shareholders Valepar, Previ and BNDESPAR have abstained from voting this item. Therefore, were computed 1.494.435.660 votes in favor, 418.004.259 dissenting votes, and 2.021.791.334 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.3. by the majority of the voting shareholders present at the meeting, it was approved, pursuant to Articles 224, 225, 227 and 264 of Law #6,404/1976, the Instrument of Filing and Justification of Merger of Valepar (“Filing”), as well as its exhibits and related documents signed by the management of Vale and Valepar, which establishes the terms and conditions of the merger of Valepar into Vale, including the issuance by Vale of 1,2065 new common shares in favor of Valepar’s shareholders for each share issued by Valepar that they own. Therefore, after the Merger of Valepar becomes effective, the current shareholders of Valepar shall come to hold, jointly, 1.908.980.340 common shares issued by the Company.

8

Table of Contents

It is highlighted that the shareholders Valepar, Previ and BNDESPAR have abstained from voting this item. Therefore, were computed 1.487.405.281 votes in favor, 417.384.497 dissenting votes, and 2.029.441.475 abstention votes, including the dissenting vote from Tempo Capital Principal Fundo de Investimento de Ações received by the Panel.

6.4. by the majority of the voting shareholders present at the meeting, it was approved the ratification of appointment of KPMG Auditores Independentes (“KPMG”), a specialized company appointed by the management of Vale and Valepar to proceed to appraise Valepar’s shareholders’ equity for the purposes of its merger into the Company.

It is highlighted that the shareholders Valepar, Previ and BNDESPAR have abstained from voting this item. Therefore, were computed 1.482.637.414 votes in favor, 417.361.310 dissenting votes, and 2.034.232.529 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.5. by the majority of the voting shareholders present at the meeting, it was approved the Appraisal Report of Valepar’s shareholders’ equity, prepared by KPMG.

It is highlighted that the shareholders Valepar, Previ and BNDESPAR have abstained from voting this item. Therefore, were computed 1.484.667.993 votes in favor, 417.496.389 dissenting votes, and 2.032.066.871 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.6. by the majority of the voting shareholders present at the meeting, it was approved the merger of Valepar into Vale, with the issuance of 1.908.980.340 new ordinary shares of Vale to replace 1.716.435.045 common shares and 20.340.000 preferred shares issued by Vale currently held by Valepar, which will be cancelled as a result of such merger. As a result of the Merger, the accounting equity value of Valepar will be merged into Vale, which will succeed Valepar by way of universal title, in all its assets, rights and obligations, so that Valepar will be extinguished, as provided for in Article 227 of Law #6.404/1976, subject to the terms and conditions set out in the Filing, approved in accordance with item 6.3 above. It was also recorded that, as a result of the Merger, the net assets of Valepar, corresponding to R$4.560.806.475.00 (four billion, five hundred and sixty million, eight hundred and six thousand, four hundred and seventy-five reais), of which R$3.072.668.796,21 (three billion, seventy-two million, six hundred and sixty-eight thousand, seven hundred and ninety-six reais and twenty one cents) refer to the balance of the goodwill registered in the financial statements of Valepar, and R$1.488.137.678,79 (one billion, four hundred eighty-eight million, one hundred and thirty-seven thousand, six hundred and seventy-eight reais and

9

Table of Contents

seventy-nine cents) refer to other net assets, will be merged into Vale and allocated to the Company’s capital reserve.

It is highlighted that the shareholders Valepar, Previ and BNDESPAR have abstained from voting this item. Therefore, were computed 1.488.247.899 votes in favor, 417.516.993 dissenting votes, and 2.028.466.361 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.7. by the majority of the voting shareholders present at the meeting, it was approved, due to the provisions of item 6.6 above, the consequent amendment of the head paragraph of Article 5 of the Company’s Bylaws, which, if the conditions for the resolutions adopted by this Meeting becomes effective, shall be effective as the following:

“

Article 5

- The paid-up capital amounts to R$77,300,000,000.00 (seventy-seven billion and three hundred million Reais) corresponding to ) 5.416.521.415 (five billion, four hundred and sixteen million, five hundred and twenty one thousand and four, hundred and fifteen) shares, being R$48.660.827.602,05 (forty-eight billion, six hundred and sixty million, eight hundred and twenty-seven thousand, six hundred and two Reais and five cents), divided into 3.409.733.697 (three billion, four hundred and nine million, seven hundred and thirty-three thousand and six hundred and ninety-seven) common shares and R$28.639.172.397,96 (twenty-eight billion, six hundred and thirty-nine million, one hundred and seventy-two thousand, three hundred and ninety-seven Reais and ninety-six cents), divided into 2.006.787.718 (two billion, six million, seven hundred and eighty-seven thousand, seven hundred and eighteen) preferred Class “A” shares, including 12 (twelve) golden shares, all without nominal value.”

Were computed 3.505.525.667 votes in favor, 417.463.603 dissenting votes, and 11.241.983 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.8. by the absolute majority of the voting shareholders present at the meeting, it was approved, the proposed amendment of Vale’s Bylaws to adapt them as much as possible, to the rules of the “

Novo Mercado

” special listing segment, as well as to implement certain adjustments and improvements. Therefore, if the conditions are satisfied for the resolutions approved in this Meeting become effective, the following statutory provisions shall be effective as follows:

“

Article 5

(…)

§3

- Each common, class A preferred share and special class shares shall confer the right to one vote in decisions made at General Meetings, the provisions of § 4 following being observed.

(...)”

10

Table of Contents

“

Article 6

- The company is authorized to increase its paid-up capital up to the limit of 7,000,000,000 (seven billion) common shares. Within the limit authorized in this article, the Company, as a result of deliberation by the Board of Directors, may increase its paid-up capital independently of reform to its Bylaws, through the issue of common shares.

(...)

§2

- At the option of the Board of Directors the preemptive right in the issuance of shares, bonds convertible into common shares and subscription bonuses, the placement of which on the market may be by sale on the stock exchange or by public subscription as per the prescriptions set forth in Law no. 6.404/76, may be rescinded.

§3

- Provided that the plans approved by the General Meeting are complied with, the company shall be entitled to delegate the option of common share purchase to its administrators and employees, with common shares held in Treasury or by means of the issuance of new shares, the shareholders’ preemptive right being excluded.”

“CHAPTER III - GENERAL MEETING

“

Article 8 -

The ordinary Shareholders’ General Meeting shall be held within the first four months following the end of the fiscal year and, extraordinarily, whenever called by the Board of Directors.

§1

- An extraordinary Shareholders’ General Meeting shall be competent to discuss the subjects specified in Article 7.

(...)

§3

- Should the holder of the special class share be absent from the General Meeting called for this purpose or should it abstain from voting, the subjects specified in Article 7 shall be deemed as having been approved by the holder of the said special class.”

“

Article 9

- At an Ordinary or Extraordinary General Meeting, the chair shall be taken by the Chairman, or in his absence by the Vice-Chairman of the Board of Directors of the company, and the Secretary of the Board of Directors shall act as secretary, as per § 15 of Article 11.

Sole Paragraph

- In the case of temporary absence or impediment of the Chairman or Vice-Chairman of the Board of Directors, the General Meeting of Shareholders shall be chaired by their respective alternates, or in the absence or impediment of such alternates, by an Officer specially appointed by the Chairman of the Board of Directors.”

11

Table of Contents

“

Article 11

- The Board of Directors, a joint decision-making body, shall be elected by the General Meeting and shall be formed of 12 (twelve) effective members and their respective alternates, and one of whom shall be the Chairman of the Board and another shall be the Vice-Chairman.

(...)

§2

-Under the terms of Article 141 of Law No. 6,404/76, 1 (one) member and his alternate of the Board of Directors, may be elected and removed, by means of a separate vote at the general meeting of shareholders, excluding the controlling shareholder, by the majority of holders, respectively, of:

I –

of common shares, representing at least 15% (fifteen percent) of the total shares with voting rights; and

II

- of preferred shares, which represent at least 10% (ten percent) of the share capital.

(…)

§4

- The entitlement set forth in §2 of this Article may only be exercised by those shareholders who are able to prove uninterrupted ownership of the shares required therein for a period of at least 3 (three) months, immediately prior to the general shareholders meeting which elected the members of the Board of Directors.

§5

- From among the 12 (twelve) principal members and their respective alternates of the Board of Directors, 1 (one) member and his alternate shall be elected and/or removed, by means of a separate vote, by the employees of the company.

§6

- At least 20% of the elected principal members of the Board of Directors (and their respective alternates) shall be Independent Directors (as defined below), and expressly designated as such in the Minutes of the General Meeting that elected them. Members of the Board of Directors elected pursuant to the provisions of §§ 2 and 3 of this Article 11 shall also be regarded as Independent Directors. If the application of the percentage referenced above results in a fractional number of members of the Board of Directors, the result shall be rounded to the nearest whole number.

§7

- The Chairman and the Vice-Chairman of the Board of Directors shall be elected among the members thereof during a Meeting of the Board of Directors to be held immediately after the General Meeting which has elected them, subject to Article 10, §3.

§8

- In the case of impediment or temporary absence, the Vice-Chairman shall replace the Chairman, and during the period of such replacement the Vice-Chairman shall have powers identical to those of the Chairman, the alternate of

12

Table of Contents

the Chairman being nevertheless entitled to exercise the right to vote in his capacity as a member of the Board of Directors.

§9

- Should a vacancy occur in the office of Chairman or Vice-Chairman, the Board of Directors shall elect the respective alternates in the first Meeting to be held after the vacancy.

§10

- During their impediments or temporary absences, the members of the Board of Directors shall be replaced by their respective alternates.

§11

- Should a vacancy occur in the office of a member of the Board of Directors or of an alternate, the vacancy shall be filled by nomination by the remaining members of an alternate who shall serve until the next General Meeting, which shall decide on his election. Should vacancies occur in the majority of such offices, a General Meeting shall be convened in order to proceed with a new election.

§12

- If the Board of Directors is elected under the multiple vote regime, as established in Article 141 of Law No. 6,404/19, the Chairman of the shareholders meeting shall inform those shareholders present that the common shares which elected a member of the Board of Directors, by means of a separate vote in accordance with §§2 and 3 of Article 11, may not participate in the multiple vote regime and, evidently, may not participate in the calculation of the respective quorum. Once the separate vote has been held, then the ratio may be definitively defined in order to proceed with the multiple vote.

§13

- With the exception of the principal members and their respective alternates, elected by means of separate vote, respectively, by the employees of the company and by the holders of common and/or preferred shares, under §2 of Article 11, whenever the election for the Board of Directors is held under the multiple vote regime, the removal of any member of the Board of Directors, principal or alternate, elected through the multiple vote system by the general shareholders meeting, shall imply the removal of the other members of the Board of Directors also elected through the multiple vote system, and consequently a new election shall be held; in other cases of vacancy, in the absence of an alternate, the first general shareholders meeting shall elect the whole Board.

§14

- Whenever, cumulatively, the election of the Board of Directors is held under the multiple vote system and the holders of common shares or preferred shares or company employees exercise the right established in §§ 2, 3 and 5 above, the shareholder or group of shareholders under vote agreement who hold over 50% (fifty percent) of common shares with voting rights, shall be ensured the right to elect officers in a number equal to those elected by the other shareholders, plus one, irrespective of the number of officers established in the caption of Article 11.

§15

- The Board of Directors shall have a Secretary, appointed by the Chairman of the Board of Directors, who shall necessarily be an employee or administrator

13

Table of Contents

of the company, in whose absence or impediment shall be replaced by another employee or administrator as designated by the Chairman of the Board of Directors.”

“

Article 14

- The Board of Directors shall be responsible for:

(…)

II.

distributing the remuneration established by the general shareholders meeting among its members and those of the Executive Board;

(...)

XV.

approving the accounts of the Executive Board, substantiated in the Annual Report and the Financial Statements, for subsequent submission to the Ordinary General Meeting;

XVI

. approving the employment of profit for the year, the distribution of dividends and, when necessary, the capital budget, submitted by the Executive Board, to the later direction to the appreciation of the Ordinary Shareholders Meeting;

(...)

XXXI.

expressing its opinion regarding any matter to be submitted to the General Meeting of Shareholders;

(...)

XXXIII.

approving the recommendations submitted by the Fiscal Council of the Company in the exercise of its legal and statutory attributions;

XXXIV.

expressing its views in favor of or against any tender offer to purchase the company’s shares by means of a substantiated opinion disclosed fifteen (15) days before the publication of the tender offer notice, which opinion shall address, at least: (a) the benefit and opportunity of the tender offer with respect to the interest of all shareholders and the liquidity of the securities owned by them; (b) expressing its views in favor of or against any tender offer to purchase the company’s shares by means of a substantiated opinion disclosed fifteen (15) days before the publication of the tender offer notice, which opinion shall address, at least: (a) the benefit and opportunity of the tender offer with respect to the interest of all shareholders and the liquidity of the securities owned by them; (b) the repercussions of the tender offer on the company’s interests; (c) the strategic plans disclosed by the offeror in relation to the company; (iv) other matters that the Board of Directors deems appropriate, as well as any information required by applicable rules of the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários—CVM).

(…)”

14

Table of Contents

“

Article 32

(...)

XII

- preparing in each fiscal year the Annual Report and Financial Statements to be submitted to the Board of Directors and the General Meeting;

(...)

§1

- The Executive Board shall be empowered to lay down voting guidelines to be followed at the General Meetings by its proxies in the companies, foundations and other organizations in which the company participates, directly or indirectly, the investment plans and programs of the company, as well as the respective budgets being complied with, the limit of responsibility being observed as regards, among others, indebtedness, the sale of assets, the waiver of rights and the reduction of corporate equity investments.

(…)”

“

Article 33

(...)

II -

exercise executive direction of the Company, with powers to coordinate and supervise the activities of the other Executive Officers, exerting his best efforts to ensure faithful compliance with the decisions and guidelines laid down by the Board of Directors and the General Meeting;

(...)”

“

Article 34

(...)

IV

- contract the services described in §2º of Article 39, in compliance with determinations of the Fiscal Council.”

“

Article 35

(...)

§2

- The company may, moreover, be represented by a single proxy at the General Meetings of shareholders of the companies, consortia and other organizations in which it participates or for acts arising out the exercise of powers specified in a power of attorney “ad judicia” or: (a) at agencies at any level of government, customs houses and public service concessionaires for specific acts for which a second proxy is not necessary or not permitted; (b) for signing of contract instruments in solemnity or at which the presence of a second proxy is not possible; (c) for signing of documents of any kind which imply in an obligation for the company whose monetary limits shall be established by the Executive Board.

(

…)”

“

Article 36

- The Fiscal Council, a permanently functioning body, shall be formed of 3 (three) to 5 (five) principal members and an equal number of alternates, elected by the General Meeting, which shall fix their remuneration.”

15

Table of Contents

“

Article 37

- The members of the Fiscal Council shall carry out their duties until the first Ordinary General Meeting to be held following their election, their re-election being permitted.”

“

Article 39

(...)

§3

- The members of the Fiscal Council shall provide, within at least 30 (thirty) days before the Annual Shareholders’ Meeting is held, their analysis of the management report and the financial statements.”

“

Article 42

- After the constitution of the legal reserve, the employment of the remaining portion of the net profit verified at the end of each financial year (which shall coincide with the calendar year) shall, on the motion of the Administration, be submitted to the decision of the General Meeting.

(…)”

“

Article 43

(...)

I

- Investments Reserve, in order to ensure the maintenance and development of the main activities which comprise the company’s purpose, in an amount not greater than 50% (fifty percent) of distributable net profit up to a maximum of the company’s share capital.”

“

CHAPTER VIII — SALE OF CONTROL AND CANCELLATION OF THE COMPANY’S REGISTRATION AS A PUBLICLY HELD COMPANY”

“

Article 47

- The Sale of Control of the Company, whether through a single transaction or through a series of transactions, shall be undertaken pursuant to conditions precedent or conditions subsequent that the Purchaser undertakes to make a tender offer to purchase the common shares from the company’s common shareholders, in compliance with the terms and conditions provided for under applicable law, so as to ensure them equal treatment as that given to the Selling Controlling Shareholder.”

“

Article 48

- The tender offer mentioned in the previous article shall also be required:

I -

when there is an remunerated transfer of share subscription rights and other securities or rights related to securities convertible into shares, which may result in the Sale of Control of the Company; or

II -

in case of transfer of the control of a company holding Control over the company, in which case the Selling Controlling Shareholder shall inform BM&FBOVESPA regarding the amount attributed to the company in this transfer and attach the documents evidencing such amount.”

16

Table of Contents

“

Article 49 -

Any person who acquires Control under a private agreement entered into with the Controlling Shareholder for the purchase of any amount of shares shall:

I -

make the tender offer referred to in Article 47 above; and

II -

pay, as indicated below, the amount equivalent to the difference between the tender offer price and the amount paid per any share acquired on a stock exchange in the six (6) months prior to the acquisition of Control, duly adjusted for inflation until the payment date. Such amount shall be distributed among all persons who sold the company’s common shares during the trading sessions in which the Purchaser made the acquisitions, proportionally to the net daily selling balance of each, and BM&FBOVESPA will take measures to make the distribution pursuant to its regulations.”

“

Article 50

- For the purposes of these Bylaws, the following capitalized terms will have the following meanings:

“Administrator(s)” means, when used in the singular, the company’s Officers and members of the Board of Directors referred to individually, or, when used in the plural, the company’s Officers and members of the Board of Directors referred to jointly.

“Control” (as well as its related terms, “Controlling Company”, “Controlled,” or “under Common Control”) means the power effectively used to direct corporate activities and guide the operation of a company’s bodies, directly or indirectly, de facto or de jure, regardless of the equity interest held, as well as to elect the majority of the administrators of a company. There is a rebuttable presumption of control for the person or Group of Shareholders that holds shares assuring it an absolute majority of votes of shareholders attending the last three General Meetings, even if it does not hold shares ensuring the absolute majority of the voting capital.

“Controlling Shareholder” means the shareholder(s) or Group of Shareholders exercising Control of the company.

“Controlling Shares” means the set of shares that directly or indirectly entitles its holder(s) to the individual and/or shared exercise of Control of the company.

“Economic Value” means the value of the company and of its shares as may be determined by a valuation firm using recognized methodology or based on other criteria as may be defined by the CVM.

“Group of Shareholders” means a group of persons tied together by a voting agreement with any person (including, without limitation, any individual or legal entity, investment fund, condominium, securities portfolio, rights agreement or

17

Table of Contents

other form of organization, resident, domiciled or headquartered in Brazil or abroad), or which represents the same interest as the shareholder, which may subscribe for and/or acquire shares of the company. Among the examples of a person representing the same interest as the shareholder, which may subscribe for and/or acquire shares of the Company, is any person (i) who is directly or indirectly controlled or managed by such shareholder, (ii) who controls or manages, in any way, the shareholder, (iii) who is directly or indirectly controlled or managed by any person who directly or indirectly controls or manages such shareholder, (iv) in which the controller of such shareholder holds, directly or indirectly, an equity interest equal to or greater than thirty percent (30%) of the capital stock, (v) in which such shareholder holds, directly or indirectly, an equity interest equal to or greater than thirty percent (30%) of the capital stock, or (vi) who directly or indirectly holds an equity interest equal to or higher than thirty percent (30%) of the shareholder’s capital stock.

“Independent Director” is a member of the board of directors characterized by: (i) not having any ties to the company, except as a shareholder; (ii) not being a Controlling Shareholder or spouse or relative up to the second degree of a Controlling Shareholder, or not being or not having been, in the last three (3) years, tied to a company or entity related to the Controlling Shareholder (persons tied to public education and/or research institutions are excluded from this restriction); (iii) not having been, in the last three (3) years, an employee or executive officer of the company, of its Controlling Shareholder or of a company controlled by the company; (iv) not being a direct or indirect supplier or purchaser of services and/or products of the company, in such an amount that would imply loss of independence; (v) not being an employee or administrator of a company or entity that is offering or purchasing services and/or products from the company, in such an amount that would imply loss of independence; (vi) not being a spouse or relative up to the second degree of any manager of the company; and (vii) not receiving any compensation from the company besides that related to the position as a director (cash compensation arising from equity ownership is excluded from such restriction).

“Outstanding Shares” means all shares issued by the company, except for shares held by the Controlling Shareholder, persons or legal entities related to such Controlling Shareholder or Administrators, shares kept in treasury and special class preferred shares.

“Purchaser” means the person to whom the Selling Controlling Shareholder transfers the Controlling Shares in a Sale of Control of the Company.

“Sale of Control of the Company” means the transfer to a third party, for consideration, of Controlling Shares.

“Selling Controlling Shareholder” means the Controlling Shareholder when it advances a Sale of Control of the Company.”

18

Table of Contents

“

Article 51

- Any person, shareholder or Group of Shareholders who acquires or becomes, or has become, by any means, the holder of an amount equal to or greater than 25% (twenty-five percent) of the company’s total issued common shares or of its total capital stock, excluding shares held in treasury, shall, within thirty (30) days after the date of acquisition or the event resulting in the ownership of shares in an amount equal to or greater than the aforementioned limit, make or request the registration of, as the case may be, a tender offer for all common shares issued by the company (oferta pública para aquisição, or “OPA”), in compliance with applicable CVM and BM&FBOVESPA regulations and the terms of this article.

§1

- The OPA shall be (i) addressed equally to all shareholders holding common shares issued by the company, (ii) made in an auction to be held at BM&FBOVESPA, (iii) launched at the price determined in accordance with the provisions of § 2 below, and (iv) paid in cash in Brazilian currency for the acquisition of the company’s common shares issued in the OPA.

§2

- The minimum purchase price in the OPA of each common share issued by the company shall be equal to the greater of:

(i) the Economic Value determined in an appraisal report;

(ii) 120% of the weighted average unit price of the common shares issued by the company during the period of 60 (sixty) trading sessions prior to the OPA ;

and

(iii) 120% of the highest price paid by the purchasing shareholder during the 12 (twelve) months before the purchasing shareholder attained a significant equity interest.

§3

- The OPA referred to in the head paragraph of this article shall not exclude the possibility of another shareholder of the company or, as the case may be, the company itself, formulating a competing OPA, pursuant to the applicable regulations.

§4

- The person, shareholder or Group of Shareholders shall be required to comply with any standard requests or requirements of the CVM related to the OPA, within the deadlines set forth in the applicable regulation.

§5

- Any person, shareholder or Group of Shareholders that purchases or becomes the holder of other rights, including usufruct or trustee rights, related to the shares issued by the company in an amount equal to or greater than 25% (twenty-five percent) of the total common shares issued by the company or of the total capital stock, excluding the shares held in treasury, shall be equally required to, within no later than 60 (sixty) days from the date of such purchase or the event

19

Table of Contents

resulting in the ownership of such rights related to shares in an amount equal to or higher than 25% (twenty-five percent) of the total common shares issued by the company or of the total capital stock, excluding the shares held in treasury, make or request the registration, as the case may be, of an OPA, as described in this Article 51.

§6 -

The obligations set forth in Article 254-A of Law No. 6,404/76 and in Articles 47, 48 and 49 hereof shall not exempt the person, shareholder or Group of Shareholders from performing the obligations included in this article.

§7 -

Until November 9th, 2020, the provisions set forth in this Article shall not apply:

(i)

to the shareholders or Group of Shareholders bound by a shareholders’ agreement filed at the headquarters of the company on the date that the deliberations approved at the EXTRAORDINARY GENERAL MEETING held on June 27th, 2017 became effective (“Base Date”), and which, on the Base Date, were holders of at least 25% (twenty-five percent) of the total common shares issued by the company or of the total capital stock, excluding the shares held in treasury (“Agreement”);

(ii)

to investors who may become party to an Agreement, provided that such investors’ equity participation is acquired in accordance with the terms of the respective Agreement ;

(iii)

to partners and/or shareholders of the signatories of an Agreement, who succeed such signatories in the ownership of their equity participation.

§8

- The provisions of this Article 51 are not applicable if a shareholder or Group of Shareholders becomes the holder of an amount exceeding 25% (twenty-five percent) of the total common shares issued by the company or of the total capital stock, excluding the shares held in treasury, as a result of (a) the merger of another company into Vale, (b) the merger of shares of another company into Vale or (c) the subscription of Vale’s shares, made in a single primary issuance approved at a general shareholders’ meeting convened by the Board of Directors, and which proposal of capital increase has determined the issue price of the shares based on an Economic Value obtained from an economic and financial appraisal report of the company prepared by an expert institution or firm with proven experience in the appraisal of publicly held companies.

§9

- Involuntary increases of equity interest resulting from the retirement of treasury stock, repurchase of shares or reduction of the company’s capital stock through the retirement of treasury stock shall not be included in the calculation of the percentage set forth in the head paragraph of this article.

20

Table of Contents

§10 -

If the CVM regulation applicable to the OPA set forth in this article provides for the adoption of a criterion for determining the OPA acquisition price of each share issued by the company that results in an acquisition price higher than the acquisition price established under §2 above, the acquisition price in the OPA set forth in this article shall be that determined pursuant to the terms of the CVM regulation.”

“

Article 52

- In the event that any person, shareholder or Group of Shareholders fails to comply with the obligation of making a tender offer in accordance with the rules, proceedings and provisions set forth in this Chapter (the “Defaulting

Shareholder”), including with respect to compliance with the deadlines for making and requesting registration of such offering, or compliance with potential requests by CVM:

(i) the Board of Directors of the company shall convene an Extraordinary Shareholders’ Meeting, in which the Defaulting Shareholder shall not be entitled to vote, to decide upon the suspension of the exercise of the rights of the Defaulting Shareholder, in accordance with Article 120 of Law No. 6,404/76; and

(ii) in addition to the obligation of making a tender offer under the terms set forth herein, the Defaulting Shareholder shall be required to cause the acquisition price of each of the company’s common shares in such tender offer to be fifteen percent (15%) higher than the minimum acquisition price determined for such tender offer.”

“

Article 53 -

In the tender offer to be made by the Controlling Shareholder or by the company with the purpose of canceling the company’s registration as a publicly held company, the minimum offering price shall correspond to the Economic Value as determined in the appraisal report prepared according to the terms contained in the head paragraph and in §1 of Article 54, in due compliance with the applicable legal rules and regulations.”

“

Article 54

- The appraisal report referred to in Articles 51 and 53 of these Bylaws shall be prepared by a specialized institution or firm with proven experience and with decision-making power independent from the company, its Administrators and/or the Controlling Shareholder(s), and the report shall also meet the requirements of Article 8, §1 of Law No. 6,404/76 and be subject to liability as set forth in §6 of the same article of Law No. 6,404/76.

§1 -

The choice of the specialized institution or firm responsible for determining the company’s Economic Value is attributed exclusively to the general meeting, based on a list of three options submitted by the Board of Directors. The respective resolution, not counting blank votes, shall be taken by majority vote of shareholders representing the Outstanding Shares present at that meeting, which, if initiated at first call shall be attended by shareholders

21

Table of Contents

representing at least 20% (twenty percent) of the total Outstanding Shares, or if initiated at second call may be attended by any number of shareholders representing the Outstanding Shares.

§2

- The costs for preparation of the appraisal report shall be fully borne by

the offeror.

“

Article 55

- The company shall not register any transfer of common shares to the Purchaser or to any person(s) who acquire(s) Control until such person(s) have complied with the provisions set forth in these Bylaws, subject to the provisions of Article 51.”

“

Article 56

- No shareholders’ agreement that provides for the exercise of Control may be filed at the company’s headquarters unless the signatories thereof have complied with the provisions set forth in these Bylaws, subject to the provisions of Article 51.”

“

Article 57

- Cases not expressly addressed in these Bylaws shall be resolved by the General Meeting and in accordance with Law No. 6,404/76.”

“CHAPTER IX — ARBITRATION

“

Article 58

- The company, its shareholders, Administrators and members of the Fiscal Council and of the Committees undertake to resolve by arbitration before the Market Arbitration Chamber (Câmara de Arbitragem do Mercado) any and all disputes or controversies that may arise between or among them, related to or resulting from, in particular, the application, validity, effectiveness, interpretation, breach and its effects of the provisions of Law No. 6,404/76, these Bylaws and the rules issued by the National Monetary Council, the Central Bank of Brazil and the CVM, as well as other rules applicable to the operation of capital markets in general.”

Were computed 3.861.734.505 votes in favor, 67.828.980 dissenting votes, and 4.667.768 abstention votes, including the dissenting vote and written protest presented by Tempo Capital Principal Fundo de Investimento de Ações and received by the Panel.

6.9. It’s recorded that as a result of the resolutions adopted at this Meeting: (i) if the conditions for the resolutions adopted by this Meeting become effective, the Company’s Bylaws, shall become effective considering the amendments adopted in items 6.7 and 6.8 above; and (ii) the Company’s managers were authorized to take all actions necessary to implement and formalize the Voluntary Conversion, Statutory Amendment, the Merger and the other approved items. It was also registered that all matters approved in this Meeting will only become effective upon the approval of the Filling and all other deliberations related to the Merger at the Extraordinary General Meeting of Valepar, pursuant to article 227 of Law

22

Table of Contents

#6.404/1976; and (ii) after the 45 (forty five) days-period set forth for the Voluntary Conversion to obtain Minimum Adhesion.

08 — CLOSING:

After been drafted and approved, these Minutes were signed by the presents.

Rio de Janeiro, June 27

th

2017.

23

Table of Contents

Final Summary Statement

|

Resolution

|

|

|

|

Approve

|

|

Reject

|

|

Abstain

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i. Voluntary conversion of class “A” preferred shares issued by Vale into common shares at the ratio of 0.9342 common shares to each class “A” preferred share classe A

|

|

TOTAL

|

|

1.494.435.660

|

|

418.004.259

|

|

2.021.791.334

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii. Amendment of Vale’s By-Laws to adapt them, as much as possible, to the rules of the “Novo Mercado” special listing segment of BM&FBOVESPA S.A. - Bolsa de Valores Mercadorias e Futuros stock exchange, as well as to implement certain adjustments and improvements.

|

|

TOTAL

|

|

3.861.734.505

|

|

67.828.980

|

|

4.667.768

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii. Pursuant to articles 224, 225, 227 and 264 of Law 6,404/1976, the Instrument of Filing and Justification of Merger of Valepar S.A., Vale’s controller, into the Company, including rendering of Valepar’s assets to Vale as a result of the transaction.

|

|

TOTAL

|

|

1.487.405.281

|

|

417.384.497

|

|

2.029.441.475

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iv. Ratify the appointment of KPMG Auditores Independentes, a specialized company nominated by the boards of Vale and Valepar to appraise Valepar’s shareholders’ equity, for the purposes of its merger into the Company

|

|

TOTAL

|

|

1.482.637.414

|

|

417.361.310

|

|

2.034.232.529

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v. Appraisal Report of Valepar’s shareholders’ equity, prepared by the specialized company mentioned above.

|

|

TOTAL

|

|

1.484.667.993

|

|

417.496.389

|

|

2.032.066.871

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vi. Merger of Valepar into the Company, with an issuance of 1,908,980,340 new common shares of Vale to replace 1,716,435,045 common shares and 20,340,000 preferred shares issued by Vale currently held by Valepar, which will be cancelled as a result of such merger

|

|

TOTAL

|

|

1.488.247.899

|

|

417.516.993

|

|

2.028.466.361

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vii. As a result of item vi, the consequent amendment of the head paragraph of Art 5. of the Company’s By- Laws.

|

|

TOTAL

|

|

3.505.525.667

|

|

417.463.603

|

|

11.241.983

|

|

24

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Vale S.A.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: June 27, 2017

|

|

Director of Investor Relations

|

25

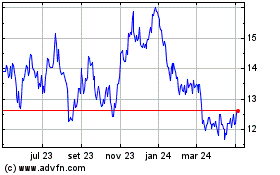

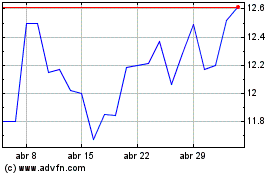

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024