ROKU Stock: How Did the Streaming Giant Perform In Q1 of 2023?

27 Abril 2023 - 7:55AM

Finscreener.org

Shares of online streaming

company Roku (NASDAQ: ROKU) are

trading higher in pre-market today following its Q1 results. In the

quarter that ended in March, Roku reported revenue of $741 million

and an adjusted loss of $1.38 per share or $193 million. In the

year-ago quarter, Roku’s sales and adjusted losses per share stood

at $733.69 million and $0.19, respectively.

Comparatively, Wall Street

forecast Roku to report revenue of $708.5 million and an adjusted

loss of $1.37 per share. So, Roku beat revenue estimates and

reported losses almost in line with consensus forecasts, driving

the stock higher.

But let’s see what impacted

Roku’s financials in Q1 of 2023.

Roku stock is up 40% in 2023

In the first four months of 2023,

shares of Roku are up 40% due to the rally surrounding beaten-down

tech stocks. However, ROKU stock is still down 88% from all-time

highs valuing the company at a market cap of $7.9

billion.

It ended Q1 with 71.6 million

active accounts globally, adding 1.6 million accounts on a

sequential basis. In fact, its active accounts in the U.S. is fast

approaching 50% of all broadband households, indicating the

unmatched scale of its business model, which in turn leads to

higher engagement and monetization opportunities.

Roku’s operating system was once

again the best-selling smart TV OS in the U.S., accounting for a

share of 43%, which is more than the next three players combined.

With over 20 licensed TV partners worldwide, Roku TV enables the

company to expand its user base consistently.

Global users streamed 25.1

billion hours in Q1, indicating an average of 3.9 hours of

streaming per active account each day. As the cord-cutting

phenomenon continues in the U.S., where over 50% of households have

transitioned away from traditional pay-TV, Roku’s streaming hours

were up 20% year over year in Q1.

Roku remains focused on improving

user engagement. In a recent survey conducted by Roku, 50% of

streamers said they abandoned watching a show or movie as they

couldn’t recollect the streaming platform. So, it now has a feature

where it aggregates recently viewed content from a dozen streaming

services at a centralized location.

Roku’s platform sales were down

1% year over year at $635 million. This segment earns revenue from

ad sales, distribution of streaming services, and related promotional

capabilities. A difficult macro environment drove ad sales in the

U.S. lower by 7.4% in Q1, resulting in a tepid

performance.

Roku explained, “We expect macro

uncertainties to persist throughout 2023. Consumers remain

pressured by inflation and recessionary fears, and thus

discretionary spend is likely to remain muted.”

What next for Roku stock price and

investors?

Roku expects revenue to touch

$770 million with a gross profit of $335 million and an adjusted

EBITDA (earnings before interest, tax, depreciation, and

amortization) loss of $75 million in Q2 of 2023. In the year-ago

period, Roku reported revenue of $764 million.

Analysts expect Roku’s sales to

increase by 4.5% to $3.27 billion in 2023 and by 16.3% to $3.8

billion in 2024. Its loss per share is estimated to narrow from

$3.62 in 2022 to $2.63 in 2024.

Roku stock is priced at 2x

forward sales, which is very reasonable for a tech

stock.

But there are risks associated

with investing in loss-making stocks such as Roku. Armed with more

than $1.5 billion in cash, Roku will have to move toward

profitability within the next two years to avoid shareholder

dilution.

ROKU stock is currently priced at

a discount of 20% to consensus price target estimates.

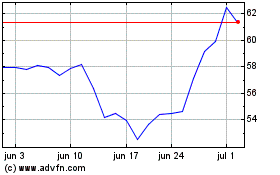

Roku (NASDAQ:ROKU)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Roku (NASDAQ:ROKU)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024