Park Aerospace Corp. (NYSE-PKE) reported results for the 2024

fiscal year second quarter ended August 27, 2023. The Company will

conduct a conference call to discuss its financial results and

other matters at 5:00 p.m. EDT today. A live audio webcast of the

event, along with presentation materials, will be available at

https://edge.media-server.com/mmc/p/4ux8vz3r at 5:00 p.m. EDT

today. The presentation materials will also be available at

approximately 4:15 p.m. EDT today at

https://parkaerospace.com/shareholders/investor-conference-calls/

and on the Company’s website at www.parkaerospace.com under

“Investor Conference Calls” on the “Shareholders” page.

Park reported net sales of $12,481,000 for the

2024 fiscal year second quarter ended August 27, 2023 compared to

$13,875,000 for the 2023 fiscal year second quarter ended August

28, 2022 and $15,551,000 for the 2024 fiscal year first quarter

ended May 28, 2023. Park’s net sales for the six months ended

August 27, 2023 were $28,032,000 compared to $26,658,000 for the

six months ended August 28, 2022. Net earnings for the 2024 fiscal

year second quarter were $1,746,000 compared to $1,885,000 for the

2023 fiscal year second quarter and $1,854,000 for the 2024 fiscal

year first quarter. Net earnings were $3,600,000 for the current

year’s first six months compared to $3,795,000 for last year’s

first six months.

Net earnings before special items for the 2024

fiscal year second quarter were $1,746,000 compared to $1,885,000

for the 2023 fiscal year second quarter and $2,407,000 for the 2024

fiscal year first quarter. Net earnings before special items for

the six months ended August 27, 2023 were $4,153,000 compared to

$3,795,000 for last fiscal year’s first six months.

Adjusted EBITDA for the 2024 fiscal year second

quarter was $2,669,000 compared to $2,709,000 for the 2023 fiscal

year second quarter and $3,311,000 for the 2024 fiscal year first

quarter. Adjusted EBITDA for the current year’s first six months

was $5,980,000 compared to $5,513,000 for last year’s first six

months.

During the 2024 fiscal year’s first six months,

the Company recorded $570,000 of pre-tax activist shareholder

defense costs, $65,000 of pre-tax losses on sales of investments to

fund the $1.00 per share special dividend paid on April 6, 2023 to

shareholders of record on March 9, 2023 and a $109,000 pre-tax

charge for the modification of previously granted stock options in

connection with the special dividend in the 2024 fiscal year first

quarter.

Park reported basic and diluted earnings per

share of $0.09 for the 2024 fiscal year second quarter compared to

$0.09 for the 2023 fiscal year second quarter and $0.09 for the

2024 fiscal year first quarter. Basic and diluted earnings per

share before special items were $0.09 for the 2024 fiscal year

second quarter compared to $0.09 for the 2023 fiscal year second

quarter and $0.12 for the 2024 fiscal year first quarter.

Park reported basic and diluted earnings per

share of $0.18 for the 2024 fiscal year’s first six months compared

to $0.19 for the 2023 fiscal year’s first six months. Basic and

diluted earnings per share before special items were $0.20 for the

2024 fiscal year’s first six months compared to $0.19 for the 2023

fiscal year’s first six months.

The Company will conduct a conference call to

discuss its financial results at 5:00 p.m. EDT today.

Forward-looking and other material information may be discussed in

this conference call. The conference call dial-in number is (877)

407-3982 in the United States and Canada, and (201) 493-6780 in

other countries. The required passcode for attendance by phone is

13741264.

For those unable to listen to the call live, a

conference call replay will be available from approximately 8:00

p.m. EDT today through 11:59 p.m. EDT on Thursday, October 12,

2023. The conference call replay will be available at

https://edge.media-server.com/mmc/p/4ux8vz3r and on the Company’s

website at www.parkaerospace.com under “Investor Conference Calls”

on the “Shareholders” page. It can also be accessed by dialing

(844) 512-2921 in the United States and Canada, and (412) 317-6671

in other countries. The required passcode for accessing the replay

by phone is 13741264.

Any additional material financial or statistical

data disclosed in the conference call, including the investor

presentation, will also be available at the time of the conference

call on the Company's web site at

https://parkaerospace.com/shareholders/investor-conference-calls/.

Park believes that an evaluation of its ongoing

operations would be difficult if the disclosure of its operating

results were limited to accounting principles generally accepted in

the United States of America (“GAAP”) financial measures, which

include special items, such as activist shareholder defense costs,

losses on sales of investments and charges for modification of

previously granted stock options. Accordingly, in addition to

disclosing its operating results determined in accordance with

GAAP, Park discloses non-GAAP measures, including Adjusted EBITDA,

and operating results that exclude special items in order to assist

its shareholders and other readers in assessing the Company’s

operating performance, since the Company’s on-going, normal

business operations do not include such special items. The detailed

operating information presented below includes a reconciliation of

the non-GAAP operating results before special items to earnings

determined in accordance with GAAP and a reconciliation of GAAP

pre-tax earnings to Adjusted EBITDA. Such non-GAAP financial

measures are provided to supplement the results provided in

accordance with GAAP.

Park Aerospace Corp. develops and manufactures

solution and hot-melt advanced composite materials used to produce

composite structures for the global aerospace markets. Park’s

advanced composite materials include film adhesives

(Aeroadhere®) and lightning strike protection

materials (Electroglide®). Park offers an array of

composite materials specifically designed for hand lay-up or

automated fiber placement (AFP) manufacturing applications. Park’s

advanced composite materials are used to produce primary and

secondary structures for jet engines, large and regional transport

aircraft, military aircraft, Unmanned Aerial Vehicles (UAVs

commonly referred to as “drones”), business jets, general aviation

aircraft and rotary wing aircraft. Park also offers specialty

ablative materials for rocket motors and nozzles and specially

designed materials for radome applications. As a complement to

Park’s advanced composite materials offering, Park designs and

fabricates composite parts, structures and assemblies and low

volume tooling for the aerospace industry. Target markets for

Park’s composite parts and structures (which include Park’s

proprietary composite SigmaStrut™ and AlphaStrut™ product lines)

are, among others, prototype and development aircraft, special

mission aircraft, spares for legacy military and civilian aircraft

and exotic spacecraft. Park’s objective is to do what others are

either unwilling or unable to do. When nobody else wants to do it

because it is too difficult, too small or too annoying, sign us

up.

Additional corporate information is available on

the Company’s web site at

www.parkaerospace.com

Performance table, including non-GAAP

information (in thousands, except per share amounts

–unaudited):

| |

13 Weeks Ended |

|

26 Weeks Ended |

| |

|

|

|

|

|

|

| |

August 27, 2023 |

|

|

August 28, 2022 |

|

|

May 28, 2023 |

|

August 27, 2023 |

|

|

August 28, 2022 |

|

Sales |

$ |

12,481 |

|

|

|

$ |

13,875 |

|

|

|

$ |

15,551 |

|

|

$ |

28,032 |

|

|

|

$ |

26,658 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings

before Special Items1 |

$ |

1,746 |

|

|

|

$ |

1,885 |

|

|

|

$ |

2,407 |

|

|

$ |

4,153 |

|

|

|

$ |

3,795 |

|

| Special

Items, Net of Tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs |

|

- |

|

|

|

|

- |

|

|

|

|

(424 |

) |

|

|

(424 |

) |

|

|

|

- |

|

|

Stock Option Modification |

|

- |

|

|

|

|

- |

|

|

|

|

(81 |

) |

|

|

(81 |

) |

|

|

|

- |

|

|

Loss on Sale of Marketable Securities |

|

- |

|

|

|

|

- |

|

|

|

|

(48 |

) |

|

|

(48 |

) |

|

|

|

- |

|

| Net

Earnings |

$ |

1,746 |

|

|

|

$ |

1,885 |

|

|

|

$ |

1,854 |

|

|

$ |

3,600 |

|

|

|

$ |

3,795 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

Earnings per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings before Special Items1 |

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

|

$ |

0.12 |

|

|

$ |

0.20 |

|

|

|

$ |

0.19 |

|

|

Special Items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs |

|

- |

|

|

|

|

- |

|

|

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

|

|

- |

|

|

Stock Option Modification |

|

- |

|

|

|

|

- |

|

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

|

- |

|

|

Loss on Sale of Marketable Securities |

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

Basic Earnings per Share |

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

$ |

0.18 |

|

|

|

$ |

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings before Special Items1 |

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

|

$ |

0.12 |

|

|

$ |

0.20 |

|

|

|

$ |

0.19 |

|

|

Special Items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Activist Shareholder Defense Costs |

|

- |

|

|

|

|

- |

|

|

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

|

|

- |

|

|

Stock Option Modification |

|

- |

|

|

|

|

- |

|

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

|

- |

|

|

Loss on Sale of Marketable Securities |

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

Diluted Earnings per Share |

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

|

$ |

0.09 |

|

|

$ |

0.18 |

|

|

|

$ |

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

20,256 |

|

|

|

|

20,461 |

|

|

|

|

20,461 |

|

|

|

20,359 |

|

|

|

|

20,460 |

|

|

Diluted |

|

20,338 |

|

|

|

|

20,503 |

|

|

|

|

20,526 |

|

|

|

20,432 |

|

|

|

|

20,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1Refer to

"Reconciliation of non-GAAP financial measures" below for

information regarding Special Items. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparative balance sheets (in

thousands):

| |

August 27, 2023 |

|

February 26, 2023 |

| Assets |

(unaudited) |

|

|

| Current

Assets |

|

|

|

|

Cash and Marketable Securities |

$ |

74,214 |

|

|

$ |

105,440 |

|

|

Accounts Receivable, Net |

|

9,374 |

|

|

|

9,989 |

|

|

Inventories |

|

8,457 |

|

|

|

6,768 |

|

|

Prepaid Expenses and Other Current Assets |

|

2,587 |

|

|

|

2,844 |

|

|

Total Current Assets |

|

94,632 |

|

|

|

125,041 |

|

| |

|

|

|

| Fixed

Assets, Net |

|

23,980 |

|

|

|

24,251 |

|

| Operating

Right-of-use Assets |

|

123 |

|

|

|

150 |

|

| Other

Assets |

|

9,884 |

|

|

|

9,891 |

|

|

Total Assets |

$ |

128,619 |

|

|

$ |

159,333 |

|

| |

|

|

|

| Liabilities

and Shareholders' Equity |

|

|

|

| Current

Liabilities |

|

|

|

|

Accounts Payable |

$ |

1,535 |

|

|

$ |

4,545 |

|

|

Accrued Liabilities |

|

1,167 |

|

|

|

1,346 |

|

|

Dividend Payable |

|

- |

|

|

|

20,471 |

|

|

Operating Lease Liability |

|

53 |

|

|

|

53 |

|

|

Income Taxes Payable |

|

4,033 |

|

|

|

2,171 |

|

|

Total Current Liabilities |

|

6,788 |

|

|

|

28,586 |

|

| |

|

|

|

| Long-term

Operating Lease Liability |

|

106 |

|

|

|

129 |

|

| Non-current

Income Taxes Payable |

|

5,259 |

|

|

|

10,938 |

|

| Deferred

Income Taxes |

|

1,942 |

|

|

|

1,995 |

|

| Other

Liabilities |

|

1,812 |

|

|

|

1,751 |

|

|

Total Liabilities |

|

15,907 |

|

|

|

43,399 |

|

| |

|

|

|

|

Shareholders’ Equity |

|

112,712 |

|

|

|

115,934 |

|

| |

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

128,619 |

|

|

$ |

159,333 |

|

| |

|

|

|

| Additional

information |

|

|

|

| Equity per

Share |

$ |

5.57 |

|

|

$ |

5.66 |

|

| |

|

|

|

Comparative statements of operations (in

thousands – unaudited):

| |

13 Weeks Ended |

|

26 Weeks Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

August 27, 2023 |

|

|

August 28, 2022 |

|

|

May 28, 2023 |

|

August 27, 2023 |

|

|

August 28, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

12,481 |

|

|

|

$ |

13,875 |

|

|

|

$ |

15,551 |

|

|

$ |

28,032 |

|

|

|

$ |

26,658 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

Sales |

|

8,402 |

|

|

|

|

9,789 |

|

|

|

|

10,718 |

|

|

|

19,120 |

|

|

|

|

18,480 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

Profit |

|

4,079 |

|

|

|

|

4,086 |

|

|

|

|

4,833 |

|

|

|

8,912 |

|

|

|

|

8,178 |

|

| %

of net sales |

|

32.7 |

% |

|

|

|

29.4 |

% |

|

|

|

31.1 |

% |

|

|

31.8 |

% |

|

|

|

30.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling,

General & Administrative Expenses |

|

1,853 |

|

|

|

|

1,732 |

|

|

|

|

2,615 |

|

|

|

4,468 |

|

|

|

|

3,365 |

|

| %

of net sales |

|

14.8 |

% |

|

|

|

12.5 |

% |

|

|

|

16.8 |

% |

|

|

15.9 |

% |

|

|

|

12.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

from Operations |

|

2,226 |

|

|

|

|

2,354 |

|

|

|

|

2,218 |

|

|

|

4,444 |

|

|

|

|

4,813 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and

Other Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income |

|

139 |

|

|

|

|

221 |

|

|

|

|

324 |

|

|

|

463 |

|

|

|

|

354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

from Operations before Income Taxes |

|

2,365 |

|

|

|

|

2,575 |

|

|

|

|

2,542 |

|

|

|

4,907 |

|

|

|

|

5,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Tax

Provision |

|

619 |

|

|

|

|

690 |

|

|

|

|

688 |

|

|

|

1,307 |

|

|

|

|

1,372 |

|

| Net

Earnings |

$ |

1,746 |

|

|

|

$ |

1,885 |

|

|

|

$ |

1,854 |

|

|

$ |

3,600 |

|

|

|

$ |

3,795 |

|

| %

of net sales |

|

14.0 |

% |

|

|

|

13.6 |

% |

|

|

|

11.9 |

% |

|

|

12.8 |

% |

|

|

|

14.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of non-GAAP financial measures

(in thousands – unaudited):

| |

13 Weeks EndedAugust 27, 2023 |

|

|

13 Weeks EndedAugust 28, 2022 |

|

|

13 Weeks EndedMay 28, 2023 |

|

|

GAAP |

|

Specials Items |

|

Before Special Items |

|

|

GAAP |

|

Specials Items |

|

Before Special Items |

|

|

GAAP |

|

Specials Items |

|

Before Special Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General & Administrative Expenses |

$ |

1,853 |

|

|

$ |

- |

|

|

$ |

1,853 |

|

|

|

$ |

1,732 |

|

|

$ |

- |

|

|

$ |

1,732 |

|

|

|

$ |

2,615 |

|

|

$ |

(679 |

) |

|

$ |

1,936 |

|

| %

of net sales |

|

14.8 |

% |

|

|

|

|

14.8 |

% |

|

|

|

12.5 |

% |

|

|

|

|

12.5 |

% |

|

|

|

16.8 |

% |

|

|

|

|

12.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

from Operations |

|

2,226 |

|

|

|

- |

|

|

|

2,226 |

|

|

|

|

2,354 |

|

|

|

- |

|

|

|

2,354 |

|

|

|

|

2,218 |

|

|

|

679 |

|

|

|

2,897 |

|

| %

of net sales |

|

17.8 |

% |

|

|

|

|

17.8 |

% |

|

|

|

17.0 |

% |

|

|

|

|

17.0 |

% |

|

|

|

14.3 |

% |

|

|

|

|

18.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

Income |

|

139 |

|

|

|

- |

|

|

|

139 |

|

|

|

|

221 |

|

|

|

- |

|

|

|

221 |

|

|

|

|

324 |

|

|

|

65 |

|

|

|

389 |

|

| %

of net sales |

|

1.1 |

% |

|

|

|

|

1.1 |

% |

|

|

|

1.6 |

% |

|

|

|

|

1.6 |

% |

|

|

|

2.1 |

% |

|

|

|

|

2.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

before Income Taxes |

|

2,365 |

|

|

|

- |

|

|

|

2,365 |

|

|

|

|

2,575 |

|

|

|

- |

|

|

|

2,575 |

|

|

|

|

2,542 |

|

|

|

744 |

|

|

|

3,286 |

|

| %

of net sales |

|

18.9 |

% |

|

|

|

|

18.9 |

% |

|

|

|

18.6 |

% |

|

|

|

|

18.6 |

% |

|

|

|

16.3 |

% |

|

|

|

|

21.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Tax

Provision |

|

619 |

|

|

|

- |

|

|

|

619 |

|

|

|

|

690 |

|

|

|

- |

|

|

|

690 |

|

|

|

|

688 |

|

|

|

191 |

|

|

|

879 |

|

|

Effective Tax Rate |

|

26.2 |

% |

|

|

|

|

26.2 |

% |

|

|

|

26.8 |

% |

|

|

|

|

26.8 |

% |

|

|

|

27.1 |

% |

|

|

|

|

26.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Earnings |

|

1,746 |

|

|

|

- |

|

|

|

1,746 |

|

|

|

|

1,885 |

|

|

|

- |

|

|

|

1,885 |

|

|

|

|

1,854 |

|

|

|

553 |

|

|

|

2,407 |

|

| %

of net sales |

|

14.0 |

% |

|

|

|

|

14.0 |

% |

|

|

|

13.6 |

% |

|

|

|

|

13.6 |

% |

|

|

|

11.9 |

% |

|

|

|

|

15.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings Before Special Items |

|

|

|

|

1,746 |

|

|

|

|

|

|

|

|

1,885 |

|

|

|

|

|

|

|

|

2,407 |

|

| Addback

non-cash expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

|

|

|

619 |

|

|

|

|

|

|

|

|

690 |

|

|

|

|

|

|

|

|

879 |

|

|

Interest Income |

|

|

|

|

|

(139 |

) |

|

|

|

|

|

|

|

(221 |

) |

|

|

|

|

|

|

|

(389 |

) |

|

Depreciation |

|

|

|

|

|

339 |

|

|

|

|

|

|

|

|

261 |

|

|

|

|

|

|

|

|

305 |

|

|

Stock Option Expense |

|

|

|

|

|

104 |

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

109 |

|

| Adjusted

EBITDA |

|

|

|

|

|

2,669 |

|

|

|

|

|

|

|

|

2,709 |

|

|

|

|

|

|

|

|

3,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of non-GAAP financial measures -

continued (in thousands – unaudited):

| |

26 Weeks EndedAugust 27, 2023 |

|

|

26 Weeks EndedAugust 28, 2022 |

|

|

GAAP |

|

Specials Items |

|

Before Special Items |

|

|

GAAP |

|

Specials Items |

|

Before Special Items |

|

Selling, General & Administrative Expenses |

$ |

4,468 |

|

|

$ |

(679 |

) |

|

$ |

3,789 |

|

|

|

$ |

3,365 |

|

|

$ |

- |

|

|

$ |

3,365 |

|

| %

of net sales |

|

15.9 |

% |

|

|

|

|

13.5 |

% |

|

|

|

12.6 |

% |

|

|

|

|

12.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

from Operations |

|

4,444 |

|

|

|

679 |

|

|

|

5,123 |

|

|

|

|

4,813 |

|

|

|

- |

|

|

|

4,813 |

|

| %

of net sales |

|

15.9 |

% |

|

|

|

|

18.3 |

% |

|

|

|

18.1 |

% |

|

|

|

|

18.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

Income |

|

463 |

|

|

|

65 |

|

|

|

528 |

|

|

|

|

354 |

|

|

|

- |

|

|

|

354 |

|

| %

of net sales |

|

1.7 |

% |

|

|

|

|

1.9 |

% |

|

|

|

1.3 |

% |

|

|

|

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

before Income Taxes |

|

4,907 |

|

|

|

744 |

|

|

|

5,651 |

|

|

|

|

5,167 |

|

|

|

- |

|

|

|

5,167 |

|

| %

of net sales |

|

17.5 |

% |

|

|

|

|

20.2 |

% |

|

|

|

19.4 |

% |

|

|

|

|

19.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Tax

Provision |

|

1,307 |

|

|

|

191 |

|

|

|

1,498 |

|

|

|

|

1,372 |

|

|

|

- |

|

|

|

1,372 |

|

|

Effective Tax Rate |

|

26.6 |

% |

|

|

|

|

26.5 |

% |

|

|

|

26.6 |

% |

|

|

|

|

26.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Earnings |

|

3,600 |

|

|

|

553 |

|

|

|

4,153 |

|

|

|

|

3,795 |

|

|

|

- |

|

|

|

3,795 |

|

| %

of net sales |

|

12.8 |

% |

|

|

|

|

14.8 |

% |

|

|

|

14.2 |

% |

|

|

|

|

14.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings Before Special Items |

|

|

|

|

4,153 |

|

|

|

|

|

|

|

|

3,795 |

|

| Addback

non-cash expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

|

|

|

1,498 |

|

|

|

|

|

|

|

|

1,372 |

|

|

Interest Income |

|

|

|

|

|

(528 |

) |

|

|

|

|

|

|

|

(354 |

) |

|

Depreciation |

|

|

|

|

|

644 |

|

|

|

|

|

|

|

|

521 |

|

|

Stock Option Expense |

|

|

|

|

|

213 |

|

|

|

|

|

|

|

|

179 |

|

| Adjusted

EBITDA |

|

|

|

|

|

5,980 |

|

|

|

|

|

|

|

|

5,513 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact: Donna D’Amico-Annitto |

486 North Oliver Road, Bldg. ZNewton, Kansas 67114(316)

283-6500 |

| |

|

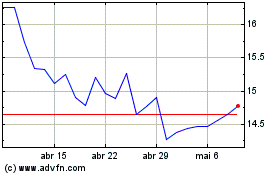

Park Aerospace (NYSE:PKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

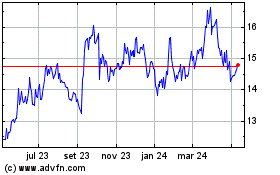

Park Aerospace (NYSE:PKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024