Remitly Global, Inc. (NASDAQ: RELY), a leading digital financial

services provider for immigrants and their families in over 170

countries around the world, reported results for the third quarter

ended September 30, 2023.

“We are pleased with our third quarter results

which reflect the continued strong execution by our global teams

and the resilience and trust our customers have placed in us,” said

Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

“We are in a very strong position to deliver robust long term

growth rates at compelling unit economics, sustain targeted high

return generating investments for long term value creation and to

deliver operating leverage. We expect to close the year strongly

and are increasing our revenue and Adjusted EBITDA outlook for

2023.”

Third Quarter 2023 Highlights and Key

Operating Data(All comparisons relative to the third

quarter of 2022)

- Active customers increased to 5.4

million, from 3.8 million, up 42%.

- Send volume increased to $10.2

billion, from $7.5 billion, up 36%.

- Revenue totaled $241.6 million,

compared to $169.3 million, up 43%.

- Net loss was $35.7 million, compared

to a net loss of $33.1 million.

- Adjusted EBITDA was $10.5 million,

compared to $(3.7) million.

2023 Financial

OutlookFor fiscal year 2023,

Remitly currently expects:

- Total revenue in the range of $935

million to $943 million, representing a growth rate of 43% to 44%

year over year. This outlook reflects an increase from our prior

outlook of $915 million to $925 million.

- To remain in a GAAP net loss position

for 2023 and for Adjusted EBITDA to be in the range of $36 million

to $41 million. This outlook reflects an increase from our prior

Adjusted EBITDA outlook of $33 million to $40 million.

Reconciliation of GAAP to

Non-GAAP Financial MeasuresA reconciliation of GAAP to

non-GAAP financial measures has been provided in the financial

statement tables included in this earnings release. An explanation

of these measures is also included below under the heading

“Non-GAAP Financial Measures.” We have not provided a quantitative

reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net

income (loss) or to forecasted GAAP income (loss) before income

taxes within this earnings release because we cannot, without

unreasonable effort, calculate certain reconciling items with

confidence due to the variability, complexity, and limited

visibility of the adjusting items that would be excluded from

forecasted Adjusted EBITDA. These items include, but are not

limited to, income taxes and stock-based compensation expense,

which are directly impacted by unpredictable fluctuations in the

market price of our common stock. The variability of these items

could have a significant impact on our future GAAP financial

results.

Note: All percentage changes described within this

press release are calculated using amounts in the Company’s Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q filed with

the Securities and Exchange Commission (the “SEC”), for which

revenue and active customers are presented in thousands and send

volume is presented in millions. Rounding differences may occur

when individually calculating percentages or totals from rounded

amounts included within the press release body as compared to the

amounts included with the Company’s SEC filings.

Webcast InformationRemitly will

host a webcast at 5:00 p.m. Eastern time on Wednesday,

November 1, 2023 to discuss its third quarter 2023 financial

results. The live webcast and investor presentation will be

accessible on Remitly’s website at https://ir.remitly.com. A

webcast replay will be available on our website at

https://ir.remitly.com following the live event.

We have used, and intend to continue to use, the

Investor Relations section of our website at https://ir.remitly.com

as a means of disclosing material nonpublic information and for

complying with our disclosure obligations under Regulation FD.

Non-GAAP Financial

MeasuresSome of the financial information and data

contained in this earnings release, such as Adjusted EBITDA and

non-GAAP operating expenses, have not been prepared in accordance

with United States generally accepted accounting principles

(“GAAP”). We regularly review our key business metrics and non-GAAP

financial measures to evaluate our performance, identify trends

affecting our business, prepare financial projections, and make

strategic decisions. We believe that these key business metrics and

non-GAAP financial measures provide meaningful supplemental

information for management and investors in assessing our

historical and future operating performance. Adjusted EBITDA and

non-GAAP operating expenses are key output measures used by our

management to evaluate our operating performance, inform future

operating plans, and make strategic long-term decisions, including

those relating to operating expenses and the allocation of internal

resources. Remitly believes that the use of Adjusted EBITDA and

non-GAAP operating expenses provides additional tools to assess

operational performance and trends in, and in comparing Remitly’s

financial measures with, other similar companies, many of which

present similar non-GAAP financial measures to investors. Remitly’s

non-GAAP financial measures may be different from non-GAAP

financial measures used by other companies. The presentation of

non-GAAP financial measures is not intended to be considered in

isolation or as a substitute for, or superior to, financial

measures determined in accordance with GAAP. Because of the

limitations of non-GAAP financial measures, you should consider the

non-GAAP financial measures presented herein in conjunction with

Remitly’s financial statements and the related notes thereto.

Please refer to the non-GAAP reconciliations in this press release

for a reconciliation of these non-GAAP financial measures to the

most comparable financial measure prepared in accordance with

GAAP.

We calculate Adjusted EBITDA as net loss adjusted

by (i) interest (income) expense, net, (ii) provision for income

taxes, (iii) noncash charge of depreciation and amortization, (iv)

gains and losses from the remeasurement of foreign currency assets

and liabilities into their functional currency, (v) noncash charges

associated with our donation of common stock in connection with our

Pledge 1% commitment, (vi) noncash stock-based compensation

expense, net, and (vii) certain acquisition, integration, and

restructuring costs. We calculate non-GAAP operating expenses as

our GAAP operating expenses adjusted by (i) noncash stock-based

compensation expense, net, (ii) noncash charges associated with our

donation of common stock in connection with our Pledge 1%

commitment, as well as (iii) certain acquisition, integration, and

restructuring costs.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact are

forward-looking statements. These statements include, but are not

limited to, statements regarding our future operating results and

financial position, including our fiscal year 2023 financial

outlook, including forecasted fiscal year 2023 revenue and Adjusted

EBITDA, anticipated future expenses and investments, expectations

relating to certain of our key financial and operating metrics, our

business strategy and plans, market growth, our market position and

potential market opportunities, and our objectives for future

operations. The words “believe,” “may,” “will,” “estimate,”

“potential,” “continue,” “anticipate,” “intend,” “expect,” “could,”

“would,” “project,” “plan,” “target,” and similar expressions are

intended to identify forward-looking statements. Forward-looking

statements are based on management’s expectations, assumptions, and

projections based on information available at the time the

statements were made. These forward-looking statements are subject

to a number of risks, uncertainties, and assumptions, including

risks and uncertainties related to our ability to successfully

execute our business and growth strategy, our ability to achieve

and maintain future profitability, our ability to further penetrate

our existing customer base and expand our customer base in existing

and new corridors, our ability to expand into broader financial

services, our ability to expand internationally, the effects of

seasonal trends on our results of operations, the current

inflationary environment, our expectations concerning relationships

with third parties, including strategic, banking, and disbursement

partners, our ability to obtain, maintain, protect, and enhance our

intellectual property and other proprietary rights, our ability to

keep data and our technology platform secure, the success of any

acquisitions or investments that we make, our ability to compete

effectively, our ability to stay in compliance with applicable laws

and regulations, our ability to buy foreign currency at generally

advantageous rates, and the effects of changes to immigration laws,

macroeconomic conditions, and geopolitical forces, such as the

conflict in Israel, on our customers and business operations. It is

not possible for our management to predict all risks, nor can we

assess the impact of all factors on our business or the extent to

which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks,

uncertainties, and assumptions, our actual results could differ

materially and adversely from those anticipated or implied in the

forward-looking statements. Further information on risks that could

cause actual results to differ materially from forecasted results

is included in our quarterly report on Form 10-Q for the quarter

ended September 30, 2023 to be filed with the SEC, and within our

annual report on Form 10-K for the year ended December 31,

2022 filed with the SEC, which are or will be available on our

website at https://ir.remitly.com and on the SEC’s website at

www.sec.gov. Except as required by law, we assume no obligation to

update these forward-looking statements, or to update the reasons

if actual results differ materially from those anticipated in the

forward-looking statements.

About RemitlyRemitly is a leading

digital financial services provider for immigrants and their

families in over 170 countries around the world. Remitly helps

immigrants send money home in a safe, reliable and transparent

manner. Its digitally native, cross-border remittance app

eliminates the long wait times, complexities and fees typical of

traditional remittance processes. Building on its strong

foundation, Remitly is expanding its suite of products to further

its mission and transform financial services for immigrants all

around the world.

Contacts

Media:Kendall

Sadlerkendall@remitly.com

Investor Relations:Stephen

Shulsteinstephens@remitly.com

REMITLY GLOBAL,

INC.Condensed Consolidated Statements of

Operations(unaudited)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in thousands, except share and per share data) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

$ |

241,629 |

|

|

$ |

169,259 |

|

|

$ |

679,527 |

|

|

$ |

462,528 |

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

Transaction expenses(1) |

|

85,742 |

|

|

|

69,872 |

|

|

|

239,995 |

|

|

|

186,961 |

|

|

Customer support and operations(1) (2) |

|

21,190 |

|

|

|

18,142 |

|

|

|

62,604 |

|

|

|

48,867 |

|

|

Marketing(1) (2) |

|

61,351 |

|

|

|

43,337 |

|

|

|

159,074 |

|

|

|

127,807 |

|

|

Technology and development(1) (2) |

|

57,014 |

|

|

|

36,178 |

|

|

|

160,699 |

|

|

|

95,836 |

|

|

General and administrative(1) (2) |

|

49,817 |

|

|

|

35,504 |

|

|

|

130,715 |

|

|

|

96,355 |

|

|

Depreciation and amortization |

|

3,418 |

|

|

|

1,843 |

|

|

|

9,634 |

|

|

|

4,870 |

|

|

Total costs and expenses |

|

278,532 |

|

|

|

204,876 |

|

|

|

762,721 |

|

|

|

560,696 |

|

|

Loss from operations |

|

(36,903 |

) |

|

|

(35,617 |

) |

|

|

(83,194 |

) |

|

|

(98,168 |

) |

|

Interest income |

|

1,808 |

|

|

|

1,400 |

|

|

|

5,200 |

|

|

|

1,875 |

|

|

Interest expense |

|

(585 |

) |

|

|

(330 |

) |

|

|

(1,566 |

) |

|

|

(975 |

) |

|

Other income (expense), net |

|

283 |

|

|

|

1,765 |

|

|

|

(2,774 |

) |

|

|

4,121 |

|

|

Loss before provision for income taxes |

|

(35,397 |

) |

|

|

(32,782 |

) |

|

|

(82,334 |

) |

|

|

(93,147 |

) |

|

Provision for income taxes |

|

258 |

|

|

|

287 |

|

|

|

485 |

|

|

|

1,477 |

|

|

Net loss |

$ |

(35,655 |

) |

|

$ |

(33,069 |

) |

|

$ |

(82,819 |

) |

|

$ |

(94,624 |

) |

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.20 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.57 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

182,598,013 |

|

|

|

168,604,378 |

|

|

|

178,956,602 |

|

|

|

166,517,398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________(1) Exclusive of depreciation and

amortization, shown separately, above.(2) Includes stock-based

compensation expense, net. The condensed consolidated financial

statements for the nine months ended September 30, 2022 include an

adjustment of $4.4 million to stock-based compensation expense and

additional paid-in capital, to correct for an error identified by

management during the preparation of the financial statements for

the three and six months ended June 30, 2022. This adjustment

relates to the understatement of stock-based compensation expense

during prior periods. Management has determined that this error was

not material to the historical financial statements in any

individual period or in the aggregate and did not result in the

previously issued financial statements being materially misstated.

Substantially all of the cumulative adjustment was related to

share-based compensation for personnel who support our general and

administrative functions and was recorded to 'General and

administrative expenses' in the three months ended June 30,

2022.

REMITLY GLOBAL,

INC.Condensed Consolidated Balance

Sheets(unaudited)

|

|

September 30, |

|

December 31, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

223,273 |

|

|

$ |

300,635 |

|

|

Disbursement prefunding |

|

216,232 |

|

|

|

158,055 |

|

|

Customer funds receivable, net |

|

259,316 |

|

|

|

191,402 |

|

|

Prepaid expenses and other current assets |

|

30,015 |

|

|

|

19,327 |

|

|

Total current assets |

|

728,836 |

|

|

|

669,419 |

|

| Property and equipment,

net |

|

14,713 |

|

|

|

11,546 |

|

| Operating lease right-of-use

assets |

|

10,299 |

|

|

|

8,675 |

|

| Goodwill |

|

54,940 |

|

|

|

— |

|

| Intangible assets, net |

|

17,856 |

|

|

|

— |

|

| Other noncurrent assets,

net |

|

6,106 |

|

|

|

6,313 |

|

|

Total assets |

$ |

832,750 |

|

|

$ |

695,953 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

17,861 |

|

|

$ |

6,794 |

|

|

Customer liabilities |

|

143,116 |

|

|

|

111,075 |

|

|

Short-term debt |

|

2,354 |

|

|

|

— |

|

|

Accrued expenses and other current liabilities |

|

131,671 |

|

|

|

87,752 |

|

|

Operating lease liabilities |

|

5,395 |

|

|

|

3,521 |

|

|

Total current liabilities |

|

300,397 |

|

|

|

209,142 |

|

| Operating lease liabilities,

noncurrent |

|

5,749 |

|

|

|

5,674 |

|

| Other noncurrent

liabilities |

|

812 |

|

|

|

1,050 |

|

|

Total liabilities |

$ |

306,958 |

|

|

$ |

215,866 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity |

|

|

|

|

Common stock |

$ |

19 |

|

|

$ |

17 |

|

|

Additional paid-in capital |

|

983,197 |

|

|

|

854,276 |

|

|

Accumulated other comprehensive loss |

|

(1,142 |

) |

|

|

(743 |

) |

|

Accumulated deficit |

|

(456,282 |

) |

|

|

(373,463 |

) |

|

Total stockholders’ equity |

|

525,792 |

|

|

|

480,087 |

|

|

Total liabilities and stockholders’ equity |

$ |

832,750 |

|

|

$ |

695,953 |

|

|

|

|

|

|

|

|

|

|

REMITLY

GLOBAL, INC.Condensed

Consolidated Statements of Cash Flows(unaudited)

| |

Nine Months Ended September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

| Cash flows from

operating activities |

|

|

|

| Net loss |

$ |

(82,819 |

) |

|

$ |

(94,624 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

|

9,634 |

|

|

|

4,870 |

|

|

Stock-based compensation expense, net |

|

101,007 |

|

|

|

67,880 |

|

|

Donation of common stock |

|

4,600 |

|

|

|

1,972 |

|

|

Other |

|

4,674 |

|

|

|

268 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Disbursement prefunding |

|

(52,162 |

) |

|

|

(35,909 |

) |

|

Customer funds receivable |

|

(68,553 |

) |

|

|

(52,547 |

) |

|

Prepaid expenses and other assets |

|

(9,652 |

) |

|

|

(3,355 |

) |

|

Operating lease right-of-use assets |

|

3,796 |

|

|

|

2,743 |

|

|

Accounts payable |

|

10,448 |

|

|

|

6,863 |

|

|

Customer liabilities |

|

29,211 |

|

|

|

36,803 |

|

|

Accrued expenses and other liabilities |

|

34,164 |

|

|

|

40,399 |

|

|

Operating lease liabilities |

|

(3,470 |

) |

|

|

(3,152 |

) |

|

Net cash used in operating activities |

|

(19,122 |

) |

|

|

(27,789 |

) |

| Cash flows from

investing activities |

|

|

|

| Purchases of property and

equipment |

|

(2,268 |

) |

|

|

(2,197 |

) |

|

Capitalized internal-use software costs |

|

(4,249 |

) |

|

|

(2,444 |

) |

|

Cash paid for acquisition, net of acquired cash, cash equivalents,

and restricted cash |

|

(40,933 |

) |

|

|

(375 |

) |

|

Net cash used in investing activities |

|

(47,450 |

) |

|

|

(5,016 |

) |

| Cash flows from

financing activities |

|

|

|

| Proceeds from exercise of

stock options |

|

12,258 |

|

|

|

8,245 |

|

| Proceeds from revolving credit

facility borrowings |

|

424,000 |

|

|

|

— |

|

| Repayments of revolving credit

facility borrowings |

|

(424,000 |

) |

|

|

— |

|

| Taxes paid related to net

share settlement of equity awards |

|

(4,711 |

) |

|

|

(55 |

) |

| Repayment of assumed

indebtedness |

|

(17,068 |

) |

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(9,521 |

) |

|

|

8,190 |

|

| Effect of foreign exchange

rate changes on cash, cash equivalents, and restricted cash |

|

(599 |

) |

|

|

(2,166 |

) |

| Net decrease in cash, cash

equivalents, and restricted cash |

|

(76,692 |

) |

|

|

(26,781 |

) |

|

Cash, cash equivalents, and restricted cash at beginning of

period |

|

300,734 |

|

|

|

403,313 |

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

224,042 |

|

|

$ |

376,532 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

| Cash paid for interest |

$ |

1,329 |

|

|

$ |

690 |

|

| Cash paid for income

taxes |

|

4,691 |

|

|

|

1,397 |

|

| Supplemental

disclosure of noncash investing and financing

activities |

|

|

|

| Operating lease right-of-use

assets obtained in exchange for operating lease liabilities |

$ |

5,414 |

|

|

$ |

7,441 |

|

| Vesting of early exercised

options |

|

311 |

|

|

|

554 |

|

| Noncash issuance of common

stock in connection with ESPP |

|

6,046 |

|

|

|

3,516 |

|

| Stock-based compensation

expense capitalized to internal-use software |

|

2,194 |

|

|

|

1,368 |

|

| Issuance of common stock for

acquisition consideration |

|

6,635 |

|

|

|

— |

|

| Issuance of common stock,

subject to service-based vesting conditions, in connection with

acquisition |

|

581 |

|

|

|

— |

|

| Amounts held back for

acquisition consideration |

|

11,899 |

|

|

|

— |

|

| Settlement of preexisting net

receivable in exchange for net assets acquired in business

combination |

|

2,401 |

|

|

|

— |

|

| Reconciliation of

cash, cash equivalents, and restricted cash |

|

|

|

| Cash and cash equivalents |

$ |

223,273 |

|

|

$ |

376,451 |

|

| Restricted cash included in

prepaid expenses and other current assets |

|

715 |

|

|

|

— |

|

| Restricted cash included in

other noncurrent assets, net |

|

54 |

|

|

|

81 |

|

| Total cash, cash equivalents,

and restricted cash |

$ |

224,042 |

|

|

$ |

376,532 |

|

|

|

|

|

|

|

|

|

|

REMITLY GLOBAL,

INC.Reconciliation of GAAP to

Non-GAAP Financial

Measures(unaudited)

|

Reconciliation of net loss to Adjusted

EBITDA: |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net loss |

$ |

(35,655 |

) |

|

$ |

(33,069 |

) |

|

$ |

(82,819 |

) |

|

$ |

(94,624 |

) |

|

Add: |

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

(1,223 |

) |

|

|

(1,070 |

) |

|

|

(3,634 |

) |

|

|

(900 |

) |

|

Provision for income taxes |

|

258 |

|

|

|

287 |

|

|

|

485 |

|

|

|

1,477 |

|

|

Depreciation and amortization |

|

3,418 |

|

|

|

1,843 |

|

|

|

9,634 |

|

|

|

4,870 |

|

|

Foreign exchange (gain) loss |

|

(376 |

) |

|

|

(1,815 |

) |

|

|

2,611 |

|

|

|

(4,171 |

) |

|

Donation of common stock |

|

4,600 |

|

|

|

1,972 |

|

|

|

4,600 |

|

|

|

1,972 |

|

|

Stock-based compensation expense, net |

|

36,573 |

|

|

|

25,745 |

|

|

|

101,007 |

|

|

|

67,880 |

|

|

Acquisition, integration, and restructuring costs(1) |

|

2,901 |

|

|

|

2,385 |

|

|

|

4,390 |

|

|

|

2,385 |

|

|

Adjusted EBITDA |

$ |

10,496 |

|

|

$ |

(3,722 |

) |

|

$ |

36,274 |

|

|

$ |

(21,111 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________(1) Acquisition, integration, and restructuring

costs for the three and nine months ended September 30, 2023

consists of expenses related to the acquisition and integration of

Rewire (O.S.G) Research and Development Ltd., as well as

restructuring charges incurred. Acquisition and integration

expenses for the three and nine months ended September 30, 2023

were $1.5 million and $3.0 million, respectively. These

acquisition and integration expenses included the change in the

fair value of the holdback liability of $0.9 million and

$1.9 million, respectively, and professional fees incurred for

acquisition and integration costs of $0.6 million and

$1.1 million, respectively. Restructuring charges incurred for

both the three and nine months ended were $1.4 million.

|

Reconciliation of operating expenses to non-GAAP operating

expenses: |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Customer support and operations |

$ |

21,190 |

|

|

$ |

18,142 |

|

|

$ |

62,604 |

|

|

$ |

48,867 |

|

|

Excluding: Stock-based compensation expense, net |

|

386 |

|

|

|

226 |

|

|

|

1,010 |

|

|

|

596 |

|

|

Excluding: Acquisition, integration, and restructuring costs |

|

749 |

|

|

|

— |

|

|

|

749 |

|

|

|

— |

|

|

Non-GAAP customer support and operations |

$ |

20,055 |

|

|

$ |

17,916 |

|

|

$ |

60,845 |

|

|

$ |

48,271 |

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Marketing |

$ |

61,351 |

|

|

$ |

43,337 |

|

|

$ |

159,074 |

|

|

$ |

127,807 |

|

|

Excluding: Stock-based compensation expense, net |

|

4,525 |

|

|

|

3,352 |

|

|

|

12,235 |

|

|

|

7,149 |

|

|

Non-GAAP marketing |

$ |

56,826 |

|

|

$ |

39,985 |

|

|

$ |

146,839 |

|

|

$ |

120,658 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Technology and development |

$ |

57,014 |

|

|

$ |

36,178 |

|

|

$ |

160,699 |

|

|

$ |

95,836 |

|

|

Excluding: Stock-based compensation expense, net |

|

19,828 |

|

|

|

13,238 |

|

|

|

55,047 |

|

|

|

30,959 |

|

|

Excluding: Acquisition, integration, and restructuring costs |

|

510 |

|

|

|

— |

|

|

|

510 |

|

|

|

— |

|

|

Non-GAAP technology and development |

$ |

36,676 |

|

|

$ |

22,940 |

|

|

$ |

105,142 |

|

|

$ |

64,877 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

General and administrative |

$ |

49,817 |

|

|

$ |

35,504 |

|

|

$ |

130,715 |

|

|

$ |

96,355 |

|

|

Excluding: Stock-based compensation expense, net |

|

11,834 |

|

|

|

8,929 |

|

|

|

32,715 |

|

|

|

29,176 |

|

|

Excluding: Donation of common stock |

|

4,600 |

|

|

|

1,972 |

|

|

|

4,600 |

|

|

|

1,972 |

|

|

Excluding: Acquisition, integration, and restructuring costs |

|

1,642 |

|

|

|

2,385 |

|

|

|

3,131 |

|

|

|

2,385 |

|

|

Non-GAAP general and administrative |

$ |

31,741 |

|

|

$ |

22,218 |

|

|

$ |

90,269 |

|

|

$ |

62,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

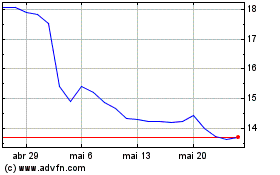

Remitly Global (NASDAQ:RELY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Remitly Global (NASDAQ:RELY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024