US index futures are moving with no clear direction, with a

bearish trend, due to anticipation around the June US jobs report,

Payroll. Investors are waiting for the data to assess the

performance of the job market and its possible influence on the

economy.

By 07:01 AM, Dow Jones Futures (DOWI:DJI) were down 3 points, or

0.01%. S&P 500 futures were down 0.05%, while Nasdaq-100

futures were down 0.14%. The 10-year Treasury yield is at

4,066%.

Elsewhere, European stocks are operating close to stability, but

are on track to end the week at their lowest levels since March,

due to indications throughout the week of a tightening stance by

central banks on monetary policy. In Asia, markets closed

lower, with the Hong Kong HSI index down 0.90% and the Shanghai

Composite down 0.28%. The Tokyo Stock Exchange’s Nikkei 225

index fell 1.17%.

Janet Yellen, Secretary of the US Treasury, held informal

discussions with Liu He, Vice Premier of China, and Yi Gang,

President of the People’s Bank of China, during their visit to the

Asian country. These meetings are part of the strategy to

promote stability in economic and diplomatic relations between the

two nations. Yellen said she was “concerned” about the new

export controls imposed by China, in her first speeches in

Beijing.

On Friday’s American economic agenda, the US Department of Labor

releases, at 8:30 am, the June Payroll, with an average expectation

of market agents for the creation of 225,000 formal job openings,

below the 339,000 in May. The Baker Hughes rig count will be

released at 1 pm.

Elsewhere in commodities markets, West Texas Intermediate crude

for August was up 0.58% to trade at $72.22 a barrel. Brent

crude for September is close to $76.91 a barrel. Iron ore

futures traded in Dalian, China, fell 1.87% to $112.16 a tonne.

At the close of Thursday, the numbers for the US economy

released yesterday continued to show the labor market’s resistance

to the Fed’s monetary tightening, which promotes greater caution

that the US BC will continue to raise interest rates in the coming

meetings. As a result, international risk assets closed the

day down, while they also await today’s Payroll data. After falling

more than 500 points in morning trading, the Dow Jones ended the

day down 366.38 points or 1.07% to 33,922.26 points. The

S&P 500 fell 35.23 points, or 0.79%, to 4,411.59 points. The

Nasdaq Composite fell 112.61 points, or 0.82%, to 13,679.04

points.

The ADP job creation data released yesterday showed a

number of 497,000 jobs in June, with a projection of

250,000. In the month of May, the number had been 278

thousand, that is, there was an acceleration in the pace of job

growth in the country. This was also reflected in the numbers

for the services sector, with the ISM PMI index for this

sector rising to 53.9 points against 51

expected. Employment and new orders rates also rose.

Investors are awaiting the start of the US second-quarter

earnings season starting next week.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple plans to

launch its Vision Pro headset in select US markets early next year

with in-store appointments and promotions. The company will

designate special areas with demo units and sizing tools. The

headset will also be sold online in the US before expanding to

other countries. Apple is working on a cheaper model and a

second-generation Pro version for later release.

Alphabet (NASDAQ:GOOGL) – Google delayed

the launch of its custom chip for Pixel smartphones, internally

called Redondo, to 2025. The company planned to replace Samsung’s

semi-custom chips and switch to TSMC (NYSE:TSM)

to manufacture the chips called Tensors. The new

chip, called Laguna, will be based on TSMC’s 3-nanometer

manufacturing process.

Meta

Platforms (NASDAQ:META), Twitter –

Twitter has threatened to sue Meta Platforms over its new Threads

platform, alleging hiring of former Twitter employees with access

to confidential information. Meta has denied the

allegations. Meanwhile, Elon Musk, owner of Twitter, commented

on the competition. Threads amassed 30 million subscriptions

within 18 hours of its launch.

Uber (NYSE:UBER), Meta –

PwC Australia has advised Uber and Facebook to restructure their

operations due to a law combating tax evasion in

Australia. However, both companies were surprised to discover

that PwC’s advice could have been based on leaked government

plans. PwC is under pressure to disclose all clients it has

advised based on this leaked information. Uber and Facebook

said they were unaware of PwC’s wrongdoing and had taken steps to

comply with the law.

Uber, DoorDash (NYSE:DASH)

– Delivery companies such as DoorDash, Uber and Grubhub have filed

lawsuits against New York City over a new law requiring couriers to

pay minimum wage. Companies question the fact that they are

required to pay couriers for the entire time they are connected to

the apps, and not just during deliveries. The law will take

effect next week unless blocked by the courts.

Amazon (NASDAQ:AMZN) – Andy Jassy, CEO

of Amazon, rejects the idea that the company has fallen behind in

the artificial intelligence race. He highlighted AI

investments across the company, with a particular focus on services

from Amazon Web Services (AWS). AWS launched the Bedrock

service, offering language templates for building chatbots, as well

as developing its own AI chips, Inferentia and Trainium. Jassy

believes that Amazon has a real advantage in AI with these

features. Despite recent cost cuts, Amazon continues to invest

in AI as a strategic area.

Amazon, iRobot (NASDAQ:IRBT)

– Amazon’s proposed $1.7 billion acquisition of iRobot is under

investigation by the European Commission over concerns that it

could reduce competition and strengthen Amazon’s position as a

market provider online. Antitrust regulators around the world

are increasing scrutiny of acquisitions made by tech giants,

seeking to avoid data hoarding and dominance in new

markets. Amazon says the acquisition will drive innovation and

lower prices for consumers.

Alibaba (NYSE:BABA) – Alibaba has launched

an artificial intelligence imager called Tongyi Wanxiang, competing

with rivals such as OpenAI’s DALL-E. Alibaba Cloud also

released Tongyi Qianwen, a ChatGPT-like text generator. Other

Chinese companies such

as Baidu (NASDAQ:BIDU)

and SenseTime (USOTC:SNTMF) have also

released AI generators. In other news, Ant Group will receive

a fine of at least $1.1 billion. The decision will allow Ant

Group to obtain a license as a financial holding company and revive

its IPO plans.

Broadcom (NASDAQ:AVGO) – Broadcom

announced that it will invest in an EU-funded program to develop

the semiconductor industry in Spain. The project, valued at up

to $1 billion, will involve the construction of large-scale

semiconductor facilities. The Spanish government has earmarked

billions of euros from EU pandemic relief funds to subsidize the

development of the sector. The initiative aims to strengthen

the European chip industry and reduce dependence on supply from the

US and Asia.

Zoom Video Communications (NASDAQ:ZM) –

Zoom is increasing its investments in the Asia-Pacific region to

drive growth despite post-pandemic challenges. The company is

expanding its presence with data centers in Singapore and research

and development centers in India. Additionally, the company is

investing in AI and expanding features like Zoom IQ.

Cronos

Group (NASDAQ:CRON), Altria

Group (NYSE:MO) – Cronos Group, a Canadian cannabis

producer backed by Altria Group, has confirmed that it is in talks

with potential buyers for a possible sale of the

company. Curaleaf Holdings is one of the interested

companies. Cronos posted a loss in the first quarter of

2023.

Johnson &

Johnson (NYSE:JNJ), Bausch +

Lomb (NYSE:BLCO) – Bausch + Lomb has acquired the

Blink brand from Johnson & Johnson for $106.5 million as part

of its efforts to strengthen its eye care product portfolio

. The Blink brand includes eye drops and drops to relieve dry

eye symptoms. This is Bausch + Lomb’s second acquisition in

two weeks, following the agreement

with Novartis (NYSE:NVS) to buy

ophthalmic products. The company is separating from Bausch

Health Companies. The global dry eye market is estimated at

US$5 billion.

Pfizer (NYSE:PFE), Caribou

Biosciences (NASDAQ:CRBU) – Pfizer invested $25

million to acquire a minority stake in Caribou Biosciences, a

biotechnology company specializing in cell therapy using CRISPR

genome-editing technology. Pfizer’s investment boosted Caribou

shares by more than 61%. The funds will be used to advance an

experimental CAR-T cell therapy, CB-011, in early-stage testing in

patients with blood cancer.

Biogen (NASDAQ:BIIB) – The Alzheimer’s

treatment called Leqembi, developed by Biogen in partnership with

Eisai, has received full approval from the Food and Drug

Administration (FDA). The Centers for Medicare and Medicaid

Services had already announced that they would cover most of the

cost of Leqembi, which costs $26,500 annually, for patients if it

gets full FDA approval.

Dish

Network (NASDAQ:DISH), EchoStar (NASDAQ:SATS)

– Charlie Ergen, president of Dish Network, is considering a merger

between Dish and EchoStar. The companies have hired

consultants, but there are no details on the timing or size of the

deal.

Comcast (NASDAQ:CMCSA) – Mike Cavanagh of

Comcast announced leadership changes at NBCUniversal, with Donna

Langley assuming the expanded role of President, NBCUniversal

Studio Group and Chief Content Officer. Mark Lazarus will be

the new president of NBCUniversal Media Group, while Cesar Conde

will have an expanded role as head of the news

division. Pearlena Igbokwe will continue to lead the TV

studios. Cavanagh will remain chairman of Comcast and will not

name a new CEO. These changes aim to facilitate

decision-making and promote collaboration within the company.

Shell (NYSE:SHEL) – Shell has informed

investors that its second-quarter earnings will be lower, following

Exxon’s announcement earlier this week. While official results

have yet to be released, the company expects gas trading profits to

be considerably lower compared to the first quarter. The drop

in profits comes after the record year of 2022, when energy prices

rose due to geopolitical tensions in Ukraine.

Ford Motor (NYSE:F) – Ford Motor announced

an increase in US auto sales in the second quarter, driven by

improved supply chain and pent-up demand. Quarterly sales were

up about 10% year-over-year, driven by an increase in truck

sales. However, overall electric vehicle sales have declined

due to supply issues.

Stellantis (NYSE:STLA) – Canada will

provide up to C$15 billion in manufacturing incentives for the

Stellantis-LG Energy Solution battery plant in Ontario. The

deal aims to attract clean tech projects and boost the electric

vehicle supply chain. Funding will be split between the

federal government and the province of Ontario, following a model

similar to the agreement with Volkswagen. Production is

scheduled to start in 2024, creating thousands of

jobs. Incentives will be based on the production and sale of

batteries.

Tesla (NASDAQ:TSLA) – Tesla has offered

cash rebates to boost sales in China, a day after making a pledge

with 15 other companies to avoid unusually high prices. At the

same time, workers at the Shanghai factory received notices of

layoffs. In other news, US auto safety regulators are seeking

updated responses from Tesla regarding its ongoing investigation

related to 830,000 vehicles and the Autopilot driver assistance

system. The National Highway Traffic Safety Administration

(NHTSA) sent a letter to Tesla requesting updates and responses by

July 19.

Nikola (NASDAQ:NKLA) – Nikola has again

postponed its annual shareholder meeting due to a lack of

sufficient votes for a proposed increase in the number of

shares. The company is looking to issue more shares to raise

funds. A proposed amendment to Delaware corporate law may

facilitate passage of the proposal.

Blackstone (NYSE:BX), TPG (NASDAQ:TPG)

– Private equity firms including Blackstone and TPG are considering

competing bids to acquire Standish Management, a third-party

services company for the buyout industry, in a deal that could

reach $ 1.7 billion. The company is being advised

by Morgan Stanley, and Thomas H. Lee Partners

has also expressed interest. Standish, which manages about

$450 billion in assets, is seen as an attractive investment given

its predictable revenue and ability to grow through

acquisitions. However, economic uncertainty may affect buyers’

decision due to the slowdown in private equity fundraising.

Goldman Sachs (NYSE:GS) – According to Goldman

Sachs, the increase in the use of electric vehicles is a crucial

factor for the growth in demand for copper. The bank predicts

that demand from the electric vehicle sector will reach 1 million

tonnes this year and reach 1.5 million tonnes in 2025. Copper is

ideal for power transmission in electric vehicles. Although

copper prices have fallen recently, the bank remains bullish on

electric vehicle sales in China. The amount of copper used in

electric vehicles could decrease in the long term. In other

news, a Chinese state-owned newspaper refuted Goldman Sachs

research that recommended selling shares in local banks. The

Securities Times argued that the negative assumptions were

misinterpretations of the facts, highlighting the efforts of

Chinese banks to reduce real estate lending risks. This public

rebuke reflects Beijing’s discomfort with the erosion of investor

confidence and highlights Wall Street banks’ complex relationship

with Chinese authorities.

Morgan Stanley (NYSE:MS) – Morgan Stanley

is more optimistic about the chip sector in China, Japan and South

Korea due to the long-term prospects for semiconductors related to

artificial intelligence. The broker raised the chip sector in

China and Japan to attractive and raised price targets for

companies including Samsung Electronics and SK Hynix. The

company has also seen an increase in demand for AI semiconductors

in recent weeks. Korean memory chip makers such as SK Hynix

are expected to benefit from the DRAM market growth in the coming

years.

UBS (NYSE:UBS) – UBS has announced

management changes stemming from the Credit Suisse acquisition,

including the hiring of former Credit Suisse managers. The

bank will return to Australia and India in the wealth management

sector and take over Credit Suisse’s remittance finance

business. In other news, Credit Suisse is facing a lawsuit in

Japan over securities linked to a fund managed in partnership with

Greensill Capital, which went bankrupt. The plaintiffs allege

that the bank provided inadequate information about the product

sold, the returns of which were linked to a fund that subsequently

collapsed.

Booking Holdings (NASDAQ:BKNG) – Booking

Holdings will seek to convince EU antitrust regulators to approve

the acquisition of Etraveli Group, despite concerns about

competition. The European Commission said the deal would

strengthen Booking’s dominant position in the accommodation market

and expand its reach into travel services. Booking will have a

hearing with regulators to address these concerns and may need to

offer solutions to avoid a deal rejection. The final decision

will be made by August 30th.

Levi Strauss & Co (NYSE:LEVI) – Levi

Strauss & Co lowered its full-year profit forecast due to

higher costs and declining sales in its North American wholesale

channels. The company plans to lower prices on certain

products to attract more price-sensitive

shoppers. Second-quarter net income was down 9%, and Levi’s

expects lower adjusted gross margin and reduced revenue

growth. The decline in wholesale sales is a trend that may

call for more promotions and price reductions. The company

posted a net loss of $1.6 million in the second quarter.

Macy’s (NYSE:M) – Macy’s jumped on the

bandwagon by launching its Black Friday-like summer savings event

in July. The sales event will run from Thursday July 6th to

July 12th to attract shoppers looking for great deals.

Costco (NASDAQ:COST) – Comparable sales

for Costco stores in June were down 1.4%. According to the

retailer, this decrease was largely attributed to lower gasoline

prices, which negatively affected sales by 4 percentage

points. However, excluding the effects of gasoline prices and

exchange rates, comparable sales in June were up 3%.

Market view

Xpeng (NYSE:XPEV) – Shares in XPeng, the

Chinese electric vehicle maker, are down 2% in premarket trading on

Friday after a ratings downgrade by Bocom International from

“Neutral” to “Sell”. The brokerage expressed concerns about

optimistic sales expectations for XPeng’s new G6 model and

highlighted challenges such as fierce competition and pressure on

the company’s margins.

KLA Corp (NASDAQ:KLAC) – KLA Corp has been

downgraded to “Sector Weight” from “Overweight” by KeyBanc due to

its position as a supplier of chip manufacturing equipment.

American Express (NYSE:AXP) – Shares in

American Express fell 2.4% on Thursday after a rating downgrade by

Baird from “Outperform” to “Neutral”, citing low expectations for

the upcoming quarterly results. The price target was

maintained at $185. The company’s forecast net interest margin was

considered softer due to rising funding costs and changing funding

mix. American Express will report second-quarter results on

July 21.

Keurig Dr Pepper (NASDAQ:KDP) – Keurig Dr

Pepper has been upgraded by Morgan Stanley analysts from “Equal

Weight” to “Overweight” who believe the company’s stock is ripe for

a new boost. The price target was left at $36. They

highlighted Keurig’s increased market share in the soft drink

sector, over-risk in the coffee segment and the low valuation of

the stock as the main reasons for the upgrade. Keurig will

report its second-quarter results on July 27.

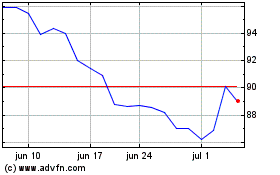

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024