US index futures are down in premarket trading on Wednesday, as

the downgrade of US credit ratings by Fitch Ratings ended up

weighing on investor sentiment.

By 7:17 AM, Dow Jones futures (DOWI:DJI) were down 110 points,

or 0.31%. S&P 500 futures were down 0.49%, while

Nasdaq-100 futures were down -0.73%. The 10-year Treasury

yield was at 4.015%.

The downgrade of the credit rating by Fitch from “AAA” to “A+”,

with a stable outlook, could overshadow some corporate indicators

and balance sheets. That fuels fears about the deterioration

of the world’s largest economy over the next three years. US

Treasury Secretary Janet Yellen reacted to the decision, noting

that the US economy had recovered quickly from the recession caused

by Covid-19, and considered Fitch data outdated, according to

Reuters.

In Europe, in addition to uncertainties regarding the world’s

largest economy, some data and corporate news are also

considered. Siemens Healthineers, Siemens’ healthcare

business, faces a nearly 7% drop in shares after reporting a drop

in quarterly profit, hit by the cancer therapy segment, which has

had problems with deliveries, according to

agencies. Meanwhile, Volkswagen is in talks with an electric

vehicle startup in China, which is sending the German company’s

shares down more than 1%.

On Wednesday’s American economic agenda, investors will follow

the release of interest rates for mortgages on 30-year contracts at

7:00 am. The ADP, in turn, is going to release at 8:15 am the

number of private jobs for July, with a consensus of 189,000 new

jobs. Later, at 10:30 am, EIA’s weekly oil inventory will be

released, with the market projecting a reduction of 900,000

barrels.

In commodities markets, West Texas Intermediate crude for

September is up 0.86% to trade at $82.07 a barrel. Brent crude

for October is up 0.73% near $85.53 a barrel. Iron ore futures

traded in Dalian, China, fell 1.07% to $115.60 a tonne on doubts

about the US economy following Fitch’s credit rating downgrade.

Stocks on Wall Street had a mixed day on Tuesday. The Dow

rose 71.15 points, or 0.20%, to 35,630.68 points, its best closing

level in more than a year. The S&P 500 fell 12.23 points,

or 0.27%, to 4,576.73 points. The Nasdaq Composite dropped

62.11 points, or 0.43%, to 14,283.91 points. The ISM PMI index

showed the worst case scenario. At the same time that the main

data fell to 46.4 points (expectation: 46.9), showing contraction,

the index of prices paid was higher than expected, to 44 points,

despite remaining at a contractionary level. Finally, the

long-awaited JOLTS employment report did not bring any major

surprises, with the indicator being very close to market

expectations.

Ahead of Wednesday’s corporate results, investors await reports

from CVS Health (NYSE:CVS), Humana (NYSE:HUM), Generac (NYSE:GNRC),

Kraft Heinz (NASDAQ:KHC), Ferrari (NYSE:RACE), Dupont (NYSE:DD)

before the market opened. Post-closing, reports are expected

from PayPal (NASDAQ:PYPL), Shopify (NYSE:SHOP), Qualcomm

(NASDAQ:QCOM), Occidental Petroleum (NYSE:OXY), Unity (NYSE:U),

Robinhood (NASDAQ:HOOD), Mercado Libre (NASDAQ:MELI), Etsy

(NASDAQ:ETSY), among others.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple will likely

report a more than 2% decline in iPhone sales in the second quarter

due to anticipation of a new model and a slow

economy. Analysts are waiting for details on using AI to drive

growth. Mac and iPad sales are also expected to decline, but

the services business could be a bright spot, with an increase in

the ad market and prices for iCloud subscriptions.

Amazon (NASDAQ:AMZN) – Amazon.com has announced

a $7.2 billion investment in Israel through 2037 to launch Amazon

Web Services (AWS) data centers in the country. Cloud services

will allow the government to run applications and store data

locally. With this expansion, AWS will be available in 32

regions, contributing $13.9 billion to Israel’s GDP. In other

news, Amazon is rolling out a major overhaul of its grocery

business, offering fresh food delivery to non-Prime customers and

planning to merge its online grocery offerings into a single

cart. The changes are aimed at expanding the company’s share

of an estimated $1.5 trillion US grocery

market. Refurbishments include renovating physical stores and

focusing on simplifying the purchasing process for customers.

Meta Platforms (NASDAQ:META) – Meta has

initiated the process to block access to news on Facebook and

Instagram in Canada in response to the new online news

law. The Canadian government denounced the measure as

irresponsible, while Meta claims the news has little economic

value. Canadian law is similar to Australian law. Meta

also plans to ask European Union users for consent before allowing

companies to target advertising based on their activities on

Facebook and Instagram. The move is aimed at meeting

regulatory requirements and stems from an order from Ireland’s data

protection commissioner. Meta will share more information

about the process in the coming months. In other news, Meta

plans to launch AI-powered chatbots with different personalities in

September.

Alphabet (NASDAQ:GOOGL) – Google is

restructuring its Assistant unit to drive advances in generative AI

and incorporate large language model technology. This is aimed

at improving voice software, competing with Apple’s Siri and

Amazon’s Alexa. The restructuring may include some job

cuts.

Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL)

– Indian cricket’s governing body has postponed auctioning the

series’ bilateral broadcasting rights to the next five years,

seeking interest from companies including Amazon and

Alphabet. The sale faces challenges due to weak advertising

revenue. The IPL remains the most valuable cricket property,

with BCCI hoping to raise at least $750 million from the sale of

the rights.

Uber (NYSE:UBER) – Uber is developing an

AI-powered chatbot to improve customer service in its app. CEO

Dara Khosrowshahi mentioned that the company uses AI in its

businesses, from algorithms to find cars to messengers.

Tesla (NASDAQ:TSLA) – Indian authorities have

asked Tesla to follow Apple’s (NASDAQ:AAPL) approach and

seek local partners to deal with Chinese suppliers, while Tesla

looks into building a factory in India. The conflict between

India and China could complicate Tesla’s plans to bring in Chinese

suppliers.

General Motors (NYSE:GM) – General Motors

will recall just over 900 older vehicles worldwide due to ruptured

Takata airbag inflators. The decision was taken after an

incident in Brazil involving a 2013 Chevrolet Camaro. The company

is investigating the cause, but suspects a manufacturing

defect. To date, there are no similar reports of inflator

ruptures in other GM vehicles. Since 2009, faulty Takata

inflators have been linked to more than 30 deaths worldwide, but

none have occurred in GM vehicles.

Ford Motor (NYSE:F) – Ford has resumed

assembly of the F-150 Lightning electric truck and plans to triple

its production rate to 150,000 vehicles per year by

October. The company is now allowing individual customers to

buy the F-150 Lightning Pro cheaper.

General Electric (NYSE:GE) – General

Electric is looking at a significant dividend return thanks to a

remarkable financial recovery. With projections of free cash

flow generation and other improvements to its business, analysts

suggest that a dividend of up to $2 per share is possible for GE

Aero following the planned 2024 spin-off. of 0.3%.

TSMC (NYSE:TSM) – Chipmaker TSMC leads

advanced chip packaging development with 2,946 patents, followed by

Samsung with 2,404 and Intel with 1,434, according to LexisNexis

data. Advanced packaging is essential for getting more power

out of chip designs and is relevant for contract chip

makers. TSMC and Samsung have consistently invested in the

technology, while Intel (NASDAQ:INTC)

has not kept up with its own patent filing in this field.

Intel (NASDAQ:INTC) – Intel sold all of

its shares in Kaltura (NASDAQ:KLTR) and

cut about a tenth of its stake in Joby

Aviation (NYSE:JOBY), according to a

filing. Kaltura provides a video-on-demand technology

platform, while Joby develops eVTOL aircraft. Kaltura and Joby

shares have fallen since the start of the second quarter, while

Intel shares have risen.

Tupperware (NYSE:TUP), Yellow

Corp (NASDAQ:YELL) – Shares of North American

companies such as Tupperware Brands, Yellow Corp and others rose

significantly, reminiscent of “meme shares”, boosted by retail

investors. Experts point out that the phenomenon may not

follow traditional logic and involves companies in difficulties

with high volatility. Yellow jumped more than 78% on Tuesday,

while Tupperware jumped more than 32%

after shooting more than 575% in the past

seven sessions.

Wells Fargo (NYSE:WFC) – Wells Fargo

expects to pay up to $1.8 billion to replenish the government’s

deposit insurance fund after three banks fail, under an FDIC

proposal. The bank may also overhaul its balance sheet due to

new US capital guidelines. In addition, Wells Fargo is in

negotiations to resolve SEC and CFTC investigations into employee

communications over unapproved channels. The bank authorized a

new share buyback program of up to $30 billion after second-quarter

earnings.

Goldman Sachs (NYSE:GS) – Lisa Opoku,

global head of Goldman Sachs Partner Family Office, is leaving the

firm after two decades. She oversaw wealth management

offerings for partners and senior executives. This departure

is part of a recent series of senior executive departures from

Goldman Sachs. The firm promoted 11 partners and hired nine

new investment-focused managing directors this year.

Bank of America (NYSE:BAC) – Bank of

America has revoked its US recession forecast, becoming the first

major Wall Street bank to officially do so. Better economic

results over the last three months, low unemployment and easing of

price pressures were cited as reasons for the change. Analysts

forecast GDP growth of 2% in the quarter ended December, 0.7% in

2024 and 1.8% in 2025. The resilience of the US economy this year

has forced many to revise their recession forecasts.

HSBC Holdings (NYSE:HSBC) – HSBC raised

its profitability target and announced a $2 billion share

buyback. Revenues increased in the first half, boosted by

central bank interest rates. The commercial and retail banking

and wealth management division was the main driver of

results. HSBC has warned of economic uncertainty and customer

pain, particularly in Britain. The bank continues to expand in

China and is considering exiting some countries to boost

profits. HSBC has sold businesses in Oman, Canada, France and

Greece, but the sale in Russia has not yet been completed due to

regulatory approval.

NatWest Group (NYSE:NWG) – NatWest Group

Plc was ordered to pay $112,440 to a former compliance manager,

Adeline Willis, who was wrongfully terminated after undergoing

cancer surgery. Willis stated that the discrimination had a

detrimental impact on her health. NatWest regretted what

happened and took steps to prevent it from happening

again. Wrongful dismissal awards are generally limited in the

UK, but may be unlimited if allegations or discrimination are

substantiated.

Blackrock (NYSE:BLK) – A US Congressional

committee is investigating BlackRock and MSCI for facilitating

investments in blacklisted Chinese companies. The companies

are alleged to allow the flow of capital to companies accused of

contributing to the Chinese military advance and human rights

abuses. BlackRock has denied wrongdoing, and MSCI is reviewing

the inquiry.

Blackstone (NYSE:BX) – Blackstone’s $68

billion retail real estate fund, Blackstone Real Estate Income

Trust (Breit), limited investor withdrawals for the ninth

consecutive month in July, facing large withdrawal

requests. Redemption requests reached US$3.7 billion, with 34%

of this amount being paid to investors. Breit’s semi-liquid

structure has worked as expected, although redemption requests

remain high. The fund holds a portfolio of US$122 billion in

assets. Blackstone shares rose 0.2% on Tuesday.

Apollo Global

Management (NYSE:APO), Bain

Capital (NYSE:BCSF), KKR &

Co (NYSE:KKR) – These companies are among the

candidates selected in the tender to acquire a controlling interest

in the chip packaging unit Shinko Electric Industries Co., from

Fujitsu Ltd. State-owned Japan Investment Corp. is also

seeking a 50% stake in the company. The next round of bidding

is scheduled for September. Shinko Electric is valued at

around $2.7 billion. Fujitsu has sought to streamline its

business and focus on communication and information technology.

Apollo Global

Management (NYSE:APO), Yellow (NASDAQ:YELL)

– Apollo Global Management and other creditors are close to an

agreement to provide Yellow Corp with new money during an impending

bankruptcy. The trucking company faces financial difficulties,

including $1.54 billion in debt and payments due in 2024.

Coca-Cola Europacific

Partners (NASDAQ:CCEP) – Coca-Cola Europacific

Partners plans to acquire Coca-Cola Beverages Philippines together

with Aboitiz Equity Ventures (AEV) for $1.8 billion, seeking to

become the world’s largest bottler of cola . The ownership

structure will be 60% CCEP and 40% AEV. The agreement is still

under negotiation. CCEP also expects to return to the adjusted

earnings range of 2.5 to 3 times its net debt by 2024.

Li-Cycle (NYSE:LICY) – Li-Cycle has

started operations at its battery recycling plant in Germany, part

of its expansion into the European market. The factory in

Magdeburg has the capacity to process 10,000 metric tons of battery

parts annually, with the potential to grow to 30,000 tons. The

company is also building facilities in Norway and France to feed an

Italian recycling plant in the future. Li-Cycle plans to

become one of Europe’s leading lithium producers.

Zillow (NASDAQ:Z), Redfin (NASDAQ:RDFN)

– Zillow and Redfin announced a partnership to expand the reach of

home builder listings on Zillow and allow Redfin customers to

explore a wider range of new homes for sale. The partnership

comes amid rising demand for new homes and outperforming housing

technology and homebuilder stocks. Zillow newbuild listings

will begin appearing on Redfin in the fourth quarter. The two

companies will release their quarterly results in the coming

days.

Earnings

CVS Health Corp (NYSE:CVS) – Shares in CVS

were up 0.7% premarket after reporting better-than-expected

second-quarter earnings and revenue, driven by strong performance

in the health benefits business. Total revenue grew 10.3% to

$88.92 billion. Net income fell to $1.90 billion, or $1.48 per

share, from $3.03 billion, or $2.29 per share, in the prior-year

period. The company reaffirmed its 2023 adjusted EPS guidance

range of between $8.50 and $8.70. CVS also reported on

progress in its restructuring plan to improve efficiency and reduce

costs.

Generac Holdings (NYSE:GNRC) – Shares of

Generac fell premarket after reporting mixed quarterly results and

a softer consumer backdrop. Second-quarter net income was $45

million, or $0.70 per share, compared to $156 million, or $2.21 per

share, in the prior-year period. Net sales fell to $1.00

billion from $1.29 billion. The chief executive said that the

backup energy megatrends remain attractive.

Fresh Del Monte Produce (NYSE:FDP) – The

company reported an increase in second-quarter profit

year-over-year, but revenue declined due to lower avocado prices

and declining non-tropical fruit volume. Net income was $47.7

million, or $0.99 per share. Sales fell 2.6% to $1.18

billion. Banana sales increased 6.5% to $448.8

million. Fresh produce and value-added sales fell 7.5% to

$677.6 million. The stock has lost 7.4% over the past three

months.

Pinterest (NYSE:PINS) – Despite beating

expectations on both the revenue and earnings line, Pinterest was

down 4.7% premarket on Wednesday. The image-sharing platform

reported adjusted earnings of 21 cents a share on revenue of $708

million, according to Refinitiv.

Match Group (NASDAQ:MTCH) – Stocks were up

7.7% in premarket Wednesday after Match Group beat analyst

expectations in the second quarter. The dating app company

posted earnings of 48 cents a share and revenue of $830

million. Analysts polled by Refinitiv had expected earnings

per share of 45 cents and revenue of $811 million.

Electronic Arts (NASDAQ:EA) – Electronic

Arts was down 4.5% in premarket trading on Wednesday after its

fiscal first-quarter revenue missed analyst expectations. The

video game company reported revenue of $1.58 billion, below the

consensus estimate of $1.59 billion, according to

Refinitiv. However, it posted earnings per share of $1.47,

beating the forecast of $1.02 per share.

Starbucks (NASDAQ:SBUX) – After reporting

a loss of revenue, Starbucks was down 2% in premarket

Wednesday. The coffee chain reported fiscal revenue of $9.17

billion in the third quarter, below the $9.29 billion estimated by

analysts polled by Refinitiv. However, the company reported

adjusted earnings per share of $1.00, beating the estimate of 95

cents.

Advanced Micro Devices (NASDAQ:AMD) –

Following the release of better-than-expected quarterly results by

Advanced Micro Devices (AMD), chips stock jumped 0.9% in premarket

trading on Wednesday. For the second quarter, AMD reported

adjusted earnings of 58 cents per share and revenue of $5.36

billion. Analysts polled by Refinitiv had forecast earnings

per share of 57 cents and revenue of $5.31 billion. AMD

predicts a strong end to the year, driven by the MI300 artificial

intelligence chips that could compete with Nvidia’s. AMD has

not yet created special chips for the Chinese market, but is

evaluating strategies to meet the country’s demand. The

company forecasts 2023 sales in its data center business to exceed

2022’s $6.04 billion.

Fortis (NYSE:FTS) – Canadian utility

company Fortis reported an increase in second-quarter profit to net

income of $221.4 million, driven by strong performance from its

utilities in the United States and western Canada. Rate base

growth, particularly at ITC, its US electricity transmission

company, and Western Canadian utilities, contributed to this

increase. Additionally, the company is delivering on its plan

to invest C$4.3 billion during the year, with C$2 billion invested

in the first half.

Freshworks (NASDAQ:FRSH) – Freshworks was

up a significant 22.5% in premarket trading on Wednesday after

reporting second-quarter results that beat expectations. The

software company posted adjusted earnings of 7 cents a share and

revenue of $145 million. Analysts polled by Refinitiv had

expected earnings per share of 2 cents and revenue of $141

million.

SolarEdge Technologies (NASDAQ:SEDG) –

Shares of SolarEdge were down 13.1% in premarket trading on

Wednesday. In the second quarter, SolarEdge missed

expectations for revenue, reaching $991 million compared to the

$992 million expected by analysts surveyed by

Refinitiv. However, the company beat earnings estimates,

posting an adjustment of $2.62 per share, which was better than the

estimate of $2.52 per share.

Devon Energy (NYSE:DVN) – Shares were down

1.8% in premarket Wednesday after Devon Energy missed revenue

expectations for its second quarter. The company posted

revenue of $3.45 billion, down from the $3.74 billion estimated by

analysts polled by Refinitiv. However, earnings came in line

with estimates, with Devon reporting adjusted earnings of $1.18 per

share.

Chesapeake Energy (NASDAQ:CHK) –

Chesapeake Energy reported lower second-quarter profit due to lower

natural gas prices and production. The company’s profit fell

to $391 million, with gas prices nearly 63% lower than the previous

year. The company expects to drill more wells in the third

quarter.

Marathon Petroleum (NYSE:MPC) – Marathon

Petroleum posted a 63% drop in second-quarter profit as improved

fuel supplies and the economic slowdown squeezed its

margins. Resilient US fuel demand was impacted by increased

global refining capacity and the economic slowdown. The

company expects a gradual recovery, but gross capacity utilization

has dropped to 93% due to planned maintenance. The refining

and marketing margin fell to $22.10 a barrel, and attributable net

income fell to $2.2 billion.

elf Beauty (NYSE:ELF) – Shares in elf

Beauty were flat premarket after beating analyst expectations in

its most recent quarter. The company posted adjusted earnings

of $1.10 per share and first-quarter revenue of $216

million. Analysts polled by Refinitiv had expected earnings

per share of 56 cents and revenue of $184 million.

Caesars Entertainment (NASDAQ:CZR) –

Caesars Entertainment was flat in the premarket after the casino

company posted revenue of $2.88 billion in the second quarter,

beating the estimate of $2.87 billion, according to Refinitiv.

.

Frontier Group (NASDAQ:ULCC) – Frontier

Group was flat premarket after reporting revenue and earnings that

beat expectations. The airline reported second-quarter

adjusted earnings of 31 cents per share on revenue of $967

million. Analysts polled by Refinitiv had expected earnings

per share of 28 cents and revenue of $966 million.

Jetblue Airways (NASDAQ:JBLU) – JetBlue

Airways lowered its full-year profit forecast, citing the

termination of its alliance with American

Airlines (NASDAQ:AAL) and changes in travel

demand. The company also faces issues with the RTX Pratt &

Whitney engines that power its Airbus A320neo jets, resulting in

aircraft on the ground doubling this year. JetBlue now expects

adjusted earnings of 5 cents to 40 cents a share, down from a

previous forecast of 70 cents to $1 a share.

Norwegian Cruise Line (NYSE:NCL) –

Norwegian Cruise Line forecast a bearish profit for the third

quarter due to high costs, although it experienced strong demand

and higher ticket prices in the second quarter. The company is

focused on reducing costs, optimizing crew movements and

reformulating food. Second-quarter revenue was $2.21 billion,

with adjusted earnings of 30 cents per share.

Virgin Galactic (NYSE:SPCE) – Shares in

Virgin Galactic were down 6.8% in premarket trading on Wednesday

after the space tourism company posted a drop in revenue during the

second quarter. The company reported revenue of $1.9 million,

missing the consensus estimate of $2.7 million, according to

Refinitiv. However, the company beat earnings expectations,

posting a loss per share of 46 cents, which was better than the

estimated loss of 51 cents per share.

American International Group (NYSE:AIG) –

AIG beat expectations for second-quarter earnings, driven by growth

in its life and retirement unit and lower catastrophe

losses. Net premiums written in its general insurance arm grew

by 10%. Adjusted net income attributable to common

stockholders rose to $1.75 per share. The life and retirement

unit saw a 42% jump in premiums and deposits. Investment

income increased by 37%. General insurance underwriting

revenue declined 26% due to catastrophe-related expenses. AIG

also increased its share repurchase authorization to $7.5

billion.

Carlyle Group (NASDAQ:CG) – The Carlyle

Group reported lower second-quarter earnings, reflecting the

challenges faced by new CEO Harvey Schwartz in replacing the

private equity firm. Distributable earnings were down 26%

year-on-year but still beat analysts’ estimates. The pace of

investments and new business has slowed down, reinforcing the

unpredictable scenario for Schwartz’s administration, which seeks

to boost share prices and stabilize the business. The company

reaffirmed its outlook, predicting a drop in fee-related earnings

in 2023 from last year.

Qualcomm (NASDAQ:QCOM) – Qualcomm may

present a low-key forecast when reporting its fiscal third-quarter

earnings. Global demand for smartphones is weak, making it

challenging for the company to achieve solid results. Analysts

project quarterly revenue of $8.5 billion and adjusted earnings per

share of $1.81. Qualcomm shares are down 11% over the last 12

months.

Sysco Corp (NYSE:SYY) – Food distributor

Sysco posted quarterly sales below expectations due to the impact

of inflation on consumer spending. The volatility and

sensitivity of demand for out-of-home food has prevented the

company from raising prices despite cost pressures. Profit for

the period topped analysts’ estimates. Net sales increased to

$19.73 billion in the fourth quarter, but were still below

estimates.

Lumen Technologies (NYSE:LUMN) – Lumen

Technologies posted a quarterly net loss of $8.74 billion, impacted

by a non-cash impairment charge of $8.8 billion. The company

faces continued weakness and massive debt amid the digitization of

its operations. Second-quarter revenue was $3.66 billion, just

short of analysts’ average estimate of $3.67 billion, according to

Refinitiv data.

Pfizer (NYSE:PFE) – Pfizer plans to

initiate a cost-cutting program if demand for its Covid-19 vaccine

and antiviral treatment remains lower than expected in the coming

months. CEO Albert Bourla mentioned the possibility of

reducing investments for the virus, including combination

vaccines. Second-quarter sales of the Comirnaty vaccine were

down 83%, but were still above analysts’ estimates. Total

second-quarter revenue fell 54% to $12.73 billion. The company

is also facing challenges related to tornado damage to its

facilities and stricter-than-expected recommendation for its RSV

vaccine by regulators, among others.

Merck (NYSE:MRK) – Merck & Co raised

its full-year revenue forecast due to strong sales of its Keytruda

and Gardasil products in the second quarter, beating Wall Street

estimates. The company expects to earn between $2.95 and $3.05

per share in 2023.

Haleon (NYSE:HLN) – Haleon raised its

annual revenue growth forecast due to demand for oral and

respiratory health products despite rising cost of living. The

company expects revenue growth between 7% and 8% and adjusted

operating profit between 9% and 11%. The results highlight the

benefits of its split from drugmaker GSK last year. Organic

revenue in the first half increased 10.4%, with volumes up

2.9%. The respiratory health business saw strong growth,

driven by sales of Theraflu. Adjusted operating earnings grew

8.9% in the first half.

Altria Group (NYSE:MO) – Tobacco giant

Altria beat Wall Street’s revenue and profit expectations, buoyed

by demand for nicotine sachets and higher prices. Its share in

the premium segment of Marlboro cigarettes is 58.6%. The

company also benefited from strong demand for spit-free nicotine

pouches, with volumes growing 47.8% in the quarter

year-over-year. Altria has reaffirmed its full-year profit

forecast after completing the acquisition of e-cigarette startup

NJOY Holdings.

Molson Coors (NYSE:TAP) – Molson Coors

beat expectations with earnings of $1.78 per share and

second-quarter revenue of $3.27 billion. The company expects

high single-digit sales growth for the full year, but some analysts

believe its projections are conservative.

Uber (NYSE:UBER) – Uber warned of price

competition from Lyft and set a lower-than-expectations profit

forecast. Second-quarter revenue missed estimates despite

Uber’s first quarter operating profit. Uber forecast adjusted

earnings before interest, taxes, depreciation and amortization

(EBITDA) for the third quarter above analyst

expectations. Revenue grew 14% in the quarter, but the pace of

growth slowed from previous quarters.

Toyota (NYSE:TM) – Toyota reported

first-quarter operating profit of $7.85 billion, nearly double the

prior year, driven by increased sales and productivity, and also

benefited by the weaker yen. Toyota sold about 2.53 million

cars in the quarter, with about 34% being hybrids and other

electrified vehicles. Performance in Japan was particularly

strong.

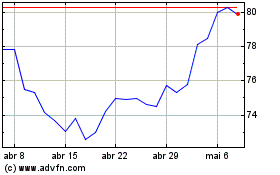

American (NYSE:AIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

American (NYSE:AIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024