US index futures are up in premarket trading on Friday, in a day

with few major indicators around the world, awaiting Federal

Reserve Chairman Jerome Powell’s speech at the Jackson Hole

symposium.

By 6:40 AM, Dow Jones (DOWI:DJI) futures were up 109

points, or 0.32%. S&P 500 futures rose 0.30% and

Nasdaq-100 futures were up 0.16%. The yield on the 10-year

Treasury bond was at 4.249%.

On Friday’s US economic agenda, investors await, at 10:00 am,

the release of the Michigan consumer confidence index, which has a

consensus of 71.2 points, in addition to the number of oil probes

for the week by Baker Hughes, at 1 pm.

Powell’s speech at the Jackson Hole symposium, scheduled for 10

am, is the big event of the day. The market’s expectation is

that the chairman of the Fed will give some signal about the

American monetary policy.

Another speech expected at the event is from the president of

the European Central Bank, Christine Lagarde, scheduled for 3 pm,

since the latest economic data in the bloc were not encouraging,

which may reinforce a less harsh path in Europe’s economic

policy.

German GDP remained stable in the second quarter, as expected,

reflecting challenges in the economic recovery due to high interest

rates impacting consumption and investment. The Ifo index, an

indicator of the German business climate, fell to 85.70 points in

August, below expectations. In the UK, the Gfk index, which

measures consumer confidence, fell 25 points in August, better than

expected. These European figures suggest a softer monetary

policy by the European Central Bank, possibly benefiting stock

markets.

In Asia, markets closed lower, influenced by the fall in US

stock markets and expectations of Powell’s speech in Jackson Hole,

and by stimulus measures in China. China has extended a tax

refund policy for certain property sellers until 2025. In Japan,

inflation was 2.8% in August, slightly lower than in July.

In commodities markets, West Texas Intermediate crude for

October rose 1.16% at $79.97 a barrel. Brent crude for October

rose 1.18% at $84.34 a barrel. Iron ore futures traded in

Dalian, China, rose 0.55% to $113.42 a tonne, recovering from

recent declines, supported by expectations of further stimulus in

China.

As of Thursday’s close, there was a drop in momentum for US

stock markets as well as the technology sector. This was due

to yet another rise in interest rates on US government bonds,

despite the impressive performance reported by Nvidia. The Dow

Jones dropped 373.56 points or 1.08% to 34,099.42 points. The

S&P 500 fell 59.70 points or 1.35% to 4,376.31 points. The

Nasdaq plunged 257.06 points or 1.87% to 13,463.97 points.

Nvidia (NASDAQ:NVDA) posted earnings per share of $2.70,

substantially beating the $2.07 estimate. Despite that,

investors were turning their attention to Jerome Powell’s speech at

the Jackson Hole Symposium event today. At the same time, data

on jobless claims in the US indicated a tight job market. As a

result, the brief rally seen in technology stocks has lost

steam.

Wall Street Corporate Highlights for Today

Big Tech – Big tech companies

including Alphabet (NASDAQ:GOOGL)

and Meta (NASDAQ:META) face stricter EU

rules on content moderation and privacy. The Digital Services

Act (DSA) impacts platforms with more than 45 million

users. Violations can carry significant fines, and some

companies, such as Amazon (NASDAQ:AMZN)

and Zalando (USOTC:ZLDSF), object to its

inclusion. Compliance is challenging, and reports indicate

that Facebook has approved problematic ads.

Alphabet (NASDAQ:GOOGL), Meta

Platforms (NASDAQ:META) – Canadian regulator CRTC

will establish a framework for negotiations between media and

technology companies in the fall, aiming to implement mandatory

negotiations by 2025. Google and Meta criticized the Online News

Act of Canada, adopted in June.

Meta Platforms (NASDAQ:META) – Meta

Platforms will launch “Code Llama”, an AI model to assist in

writing code, free of charge and based on human prompts. The

initiative follows trends such as OpenAI’s ChatGPT. Code Llama

will compete with Microsoft ‘s GitHub

Copilot (NASDAQ:MSFT).

Nvidia (NASDAQ:NVDA) – After its shares

tripled this year, Nvidia decided to buy back $25 billion in

shares, surprising some investors even with a solid second-quarter

report. The move raised questions as the company is growing

fast and could reinvest profits. The buyback represents just

2.1% of Nvidia’s market value. Other investors see the

decision as a show of confidence.

Amazon (NASDAQ:AMZN) – Amazon is in talks

with Disney (NYSE:DIS) about collaborating on the streaming version

of ESPN, potentially acquiring a minority stake. ESPN reckons

charging between $20 and $35 for the service, arguably the most

expensive in the US.

Disney (NYSE:DIS) – Shares of Disney

fell 3.9% on Thursday, hitting a nearly nine-year

low. Investors anticipate further declines after Bob Iger’s

announcement of recovery plans. The high activity in put

options suggests bearishness among traders.

General Motors (NYSE:GM) – Following

criticism from US senators, Ultium Cells, a partnership between GM

and LG Energy, will raise wages in Ohio by 25%. The increase

will be retroactive to December 2022, with workers receiving up to

$7,000. Negotiations with the UAW union continue.

Tesla (NASDAQ:TSLA) – Investors hurt

by Elon Musk’s tweet about Tesla could receive a share of a $42.3

million fund. The US Securities and Exchange Commission

approved the payment to 3,350 claimants, covering 51.7% of

losses. In other news, NHTSA will conclude its two-year

investigation into Tesla’s Autopilot, with an announcement expected

soon.

Spirit Airlines (NYSE:SPR) – Spirit

Airlines has agreed to pay up to US$8.25 million to settle a claim

by passengers caught with baggage fees when purchasing tickets on

third-party platforms. Eligible passengers will receive up to

75% of their fees back. The original lawsuit sought $100

million in damages.

Lockheed Martin (NYSE:LMT) – Lockheed

Martin’s Sikorsky has won a $2.7 billion US Navy contract to build

35 CH-53K helicopters. This model, which debuted in 2018, has

triple the capacity of its predecessor. Deliveries will start

in 2026.

Nike (NYSE:NKE) – Institutional

Shareholder Services recommended that Nike investors support Arjuna

Capital’s resolution for greater transparency on pay equity for

women and minorities. Although Nike has already disclosed some

disparities, the proposal seeks greater clarity. Nike faces

gender discrimination lawsuit.

Walmart (NYSE:WMT), Hugo

Boss (USOTC:HUGPF) – The Canadian Ombudsman for

Responsible Business (CORE) is investigating Canadian units of

Walmart, Hugo Boss and Diesel over allegations of Uighur forced

labor. The decision came after complaints from 28

organizations in 2022. Walmart refuted the allegations.

Visa (NYSE:V), Mastercard (NYSE:MA)

– Visa and Mastercard have reduced partnerships with cryptocurrency

exchange Binance due to global regulatory scrutiny. Visa has

stopped issuing new cards in Europe, and Mastercard will end the

partnership in September. Binance, recently isolated from some

banking systems, disputes the allegations.

Ericsson (NASDAQ:ERIC) – Ericsson forecast

revenues of USD 1 billion in IPR licensing to 2023 after renewing a

patent agreement with Huawei. Both will have global access to

the other’s proprietary technologies.

Whirlpool (NYSE:WHR) – Whirlpool has

agreed to pay $11.5 million to settle CPSC allegations of delayed

communication about self-starting cooktops, risk of burns and

fire. The problem has affected brands like JennAir and

KitchenAid. The company performed a recall in 2019.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment will convert preferred stock to common stock on

Friday. The conversion is aimed at raising funds to pay off

debt, as previous attempts in 2021 have failed. The company

recently performed a reverse share split, allowing it to issue more

shares. Disputes with shareholders led to additional payments

in shares. With the conversion, AMC will be able to issue an

additional 550 million shares. Despite dilution concerns, the

CEO defends fundraising as essential.

TD Bank Group (NYSE:TD) – TD Bank Group

anticipates fines due to US investigations into its anti-money

laundering program. The information was revealed in quarterly

earnings, sending TD shares down 3% on Thursday after third-quarter

earnings missed estimates. The bank canceled the acquisition

of First Horizon.

HSBC (NYSE:HSBC) – HSBC has expanded debt

offering to early start-ups in the US through its innovation

division. This strategy comes as funding declines

globally.

Bank of America (NYSE:BAC) – Strategists

at Bank of America predict trouble in technology stocks due to

higher interest rates, overshadowing optimism about artificial

intelligence. We see “hassle in the second half rather than an

era of new AI rules,” strategists led by Michael Hartnett wrote in

a note on Friday. The Nasdaq, affected, is still up 35% this

year. Hartnett warns of more volatility after record

inflows.

Novartis (NYSE:NVS) – Novartis has

received FDA approval for the first biosimilar treatment for

multiple sclerosis. This biosimilar, Tyruko, is a version of

Biogen’s Tysabri (NASDAQ:BIIB). Novartis plans to spin

off its biosimilars business in October.

Hawaiian Electric (NYSE:HE) – Hawaiian

Electric suspended its dividend to strengthen its cash position and

focus on rebuilding after the Maui wildfires. Although a

dividend has already been declared, the company is seeking to

understand the weather events that caused the fires. Maui sued

the company for failing to turn off power in adverse

conditions. Shares are down 22.0% in premarket trading on

Friday.

Better Home & Finance (NASDAQ:BETR) –

Better Home & Finance, a mortgage origination company,

completed a merger with SPAC Aurora Acquisition

Corp (NASDAQ:AURCU), despite the challenging

environment of rising mortgage rates. Shares of the combined

company plummeted 93% after listing. The motivation for the

merger was financing, seeking $565 million, primarily from

SoftBank. Despite the difficult circumstances of the mortgage

market in 2022, Better promises efficiency and innovation. The

merger has seen several tweaks since the initial announcement in

2021.

Earnings

Affirm (NASDAQ:AFRM) – After delivering

better-than-expected quarterly results, the stock gained 9.8% in

premarket trading on Friday. Affirm lost 69 cents a share on

revenue of $446 million, beating Refinitiv’s estimate of a loss of

85 cents on revenue of $406 million. The CEO highlighted

sequential credit improvements and accelerated growth.

Marvell Technology (NASDAQ:MRVL) – Despite

beating Wall Street forecasts, the chip company’s stock was down

about -4.4% premarket. Marvell reported a profit of 33 cents

per share, excluding items, beating Refinitiv’s expectation of 32

cents. Its revenue was $1.34 billion, slightly above the

analysts’ forecast of $1.33 billion.

Ulta Beauty (NASDAQ:ULTA) – Despite

beating second-quarter expectations, the cosmetics retailer’s stock

was flat in premarket trading on Friday. Ulta earned $6.02 a

share and revenue was in line with estimates of $2.51

billion. According to Refinitiv, forecasts were for a profit

of $5.85 per share. In addition, the company has adjusted its

annual forecast upwards.

Intuit (NASDAQ:INTU) – Even as the company

posted fourth-quarter earnings above expectations in terms of

earnings and financial results, the stock was flat in premarket

trading. Intuit projected revenue for the next quarter that

missed forecasts. The company’s expectation is that revenue

will grow from 10% to 11% in the first quarter, but analysts

predicted an increase of 13%.

Workday (NASDAQ:WDAY) – The enterprise

cloud management company reported better-than-estimated financial

performance in the second quarter. In addition, the company

has adjusted its subscription revenue estimate for fiscal 2024

upwards.

GAP (NYSE:GPS) – Gap Inc predicted lower

sales due to lower demand and competition from rivals such as Shein

and Amazon. It missed Q2 revenue expectations as consumers

spent less. In the second quarter, Gap’s net sales declined 8%

to $3.55 billion, missing analysts’ forecast of $3.57 billion. Gap

earned an adjusted 34 cents per share through July 29, beating

expectations of 9 cents. The brand has hired Mattel’s Richard

Dickson as CEO, seeking to revitalize sales.

Nordstrom (NYSE:JWN) – Nordstrom issued a

similar warning to Macy’s about cautious demand and rising

defaults. Sales slowed at its flagship stores and discount

Nordstrom Rack line. Nordstrom earned 84 cents a share for the

quarter, above expectations for a profit of 44 cents. Total

revenue fell about 8% to $3.77 billion, compared with expectations

of $3.65 billion, according to Refinitiv data.

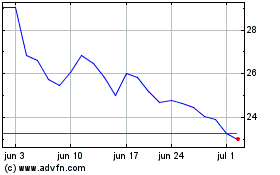

Gap (NYSE:GPS)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Gap (NYSE:GPS)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024