US index futures are lower in premarket trading on Wednesday,

weighed down by disappointing numbers in Europe and a rise in the

cost of oil the day before. These factors heighten inflation

concerns as investors await new US indicators, including the Beige

Book.

By 6:52, Dow Jones futures (DOWI:DJI) were down 51 points, or

0.14%. S&P 500 futures were down 0.20% and Nasdaq-100

futures were down 0.28%. The yield on the 10-year Treasury

bond was at 4.248%.

On Wednesday’s US economic agenda, investors await, at 7:00 am,

the weekly MBA mortgage index, while trade balance data, which

should give an indication of how business is going, will be

released at 8:30 am. The forecast is that the balance will

have a deficit of US$68 billion in July.

Also at 8:30 am, Susan Collins, chairman of the Federal Reserve

Bank of Boston, delivers a speech. At 9:45 am, S&P Global

releases the Purchasing Managers’ Indices (PMIs) for August,

forecast above 50 points for August, but below what was seen in

July.

The most awaited release of the day is the Beige Book, at 2

pm. The Fed document should show the country’s economic

conditions after recent inflation and employment data. Dallas

Fed President Lorie Logan will speak shortly after at 3

pm. The API releases the weekly oil inventory at 4:30 pm,

closing the schedule.

In the European Union, retail sales decreased by 0.20% in July,

on a monthly basis, surpassing estimates that pointed to a drop of

0.10%. Industrial orders in Germany fell 11.7%, bucking the

forecast for a 4% decline.

This sobering result in Europe’s most robust economy highlights

the challenges for business in a tight economic

environment. Such data should be considered by the European

Central Bank (ECB) at its next monetary policy meeting on September

14th.

For this reason, the speech by Elizabeth McCaul, member of the

ECB’s supervisory board, scheduled for 8:00 am today, gains

importance.

In Asia, markets had a mixed close, once again reflecting the

possibility of economic stimulus in China. Potential changes

to ease constraints in the real estate sector are also under

discussion.

According to reports in the Chinese press, there may be an

easing of price limits for new homes. Country Garden, a major

Chinese real estate company, brought forward bond interest payments

of $22.5 million, easing concerns of a possible default.

This movement resulted in a significant increase in the shares

of Chinese real estate companies. Evergrande appreciated by

more than 50%, Sunac by 73%, Shimano by 46% and Country Garden by

more than 20%.

In commodities markets, West Texas Intermediate crude for

October fell 0.29% to trade at $86.44 a barrel. Brent crude

for November fell 0.39% near $89.69 a barrel. Iron ore with

62% concentration grade rose 0.12% to $116.77 a tonne.

At the close of Tuesday, the US stock market suffered a

pullback, influenced by an increase in US Treasury bond rates and

the strengthening of the dollar. Dow closed with a loss of 195.74

points or 0.56% at 34,641.97 points. S&P 500 closed down 18.94

points or 0.42% to 4,496.83 points, while Nasdaq ended with a

marginal loss of 10.86 points or 0.08% to 14,020.95 points.

The situation was aggravated by the increase of more than 1% in

the price of oil, following the announcement of production

reduction by OPEC+, which fueled fears of an accelerated return of

inflation. At the same time, lower-than-expected PMI indices

in China and Europe indicated an unstable economic scenario in

these regions. Federal Reserve members Christopher Waller and

Loretta Mester stressed the need to proceed with caution in

tightening monetary policy, with Mester even considering the

possibility of future rate hikes.

Ahead of Wednesday’s corporate results, traders are watching

reports from Express (NYSE:EXPR), Zerofox (NASDAQ:ZFOX),

Core&Main (NYSE:CNM), among others. After the close,

reports will be expected from C3.ai (NYSE:AI), UiPath (NYSE:PATH),

GameStop (NYSE:GME), Chargepoint (NYSE:CHPT), American Eagle

Outfitters (NYSE:AEO), Sprinklr (NYSE:CXM), Couchbase

(NASDAQ:BASE), Verint (NASDAQ:VRNT), Dave & Busters

(NASDAQ:PLAY), and more.

Wall Street Corporate Highlights for Today

Arm – Arm Holdings, part of the

SoftBank Group, has started its roadshow for an IPO estimated to be

worth up to $52 billion, the biggest this year. The company

met with influential investors including T Rowe Price and Sands

Capital. SoftBank expects to raise up to $4.87 billion from

the IPO, offering 95.5 million shares of Arm for $47 to $51

each.

TSMC (NYSE:TSM) – The chairman of TSMC,

the world’s largest third-party chip maker, announced that the

company will decide this week on whether to invest in Arm Holdings’

IPO.

Apple (NASDAQ:AAPL) – Apple has entered

into a long-term agreement with Arm for chip technology that

extends beyond 2040. Apple also invested $735 million in Arm’s

IPO. In other news, BofA Securities analyst Wamsi Mohan

suggests that Huawei could threaten Apple’s growth in China,

especially with its new Mate 60 phones, equipped with high-speed

chips.

Intel (NASDAQ:INTC) – Intel has partnered

with Tower Semiconductor (NASDAQ:TSEM),

which will invest $300 million in Intel’s New Mexico

facility. The deal follows the failure of a $5.4 billion

merger plan blocked by Chinese regulators. The collaboration

will help both companies meet the growing demand for advanced

chips.

Advanced Micro Devices (NASDAQ:AMD) – At

the Goldman Sachs conference, AMD CEO Lisa Su expressed optimism

about strong demand in AI, saying she has seen “a continued

acceleration of commitments” in this sector. Su highlighted

AMD’s unique position with a complete portfolio in AI

technology.

Alphabet (NASDAQ:GOOGL) – Google has

reached a tentative settlement in a class action lawsuit brought by

more than 30 US states, alleging antitrust practices in the Play

Store. The settlement, the details of which were not

disclosed, would cancel the trial scheduled for Nov. 6. The

deal still requires court approval.

Amazon (NASDAQ:AMZN) – Amazon could face a

Federal Trade Commission antitrust lawsuit, which could lead to its

split. However, analysts at DA Davidson suggest that the split

could benefit shareholders, raising the value per share to between

$148 and $193.

Zoom Video Communications (NASDAQ:ZM) –

Zoom CEO Eric Yuan has asked the Federal Trade Commission to

investigate Microsoft (NASDAQ:MSFT) for

bundling its Teams video conferencing software, especially after

the company spun off the software in Europe due to to antitrust

concerns. Yuan emphasized the need for fair competition.

Big Techs – The European Union is stepping

up scrutiny of tech giants like Apple, Microsoft, Google and Amazon

under the new Digital Markets Act. Companies have six months

to comply with rules that prohibit monopolistic practices and

improve data privacy.

Verb Technology (NASDAQ:VERB) – Shares of

Verb Technology plunged 25% in premarket Wednesday after a 347%

jump on Tuesday, following the announcement of a new strategic

partnership with TikTok.

Chevron (NYSE:CVX) – Workers at Chevron’s

Gorgon and Wheatstone LNG projects in Australia are planning a

two-week strike starting Sept. 14, intensifying disputes over wages

and conditions. The strike could affect volatility in global

gas markets.

General Motors (NYSE:GM) – Gerald Johnson

of General Motors stated in a video that the demands of the United

Auto Workers union could negatively impact the company’s

production. Together with GM chairman Mark Reuss, both

emphasized the search for a “fair” deal without shutdowns.

Tesla (NASDAQ:TSLA) – Tesla Shanghai is

suing Bingling Intelligent Technology for breach of technology

secrets and unfair competition. The case will be heard in

Shanghai on 10 October. A Xiaomi unit owns 11.9% of

Bingling. Furthermore, Tesla’s Shanghai factory has achieved

production of 2 million vehicles, as announced on the company’s

WeChat account on Wednesday.

Lordstown Motors (NASDAQ:RIDE) – Amidst

bankruptcy, electric vehicle maker Lordstown Motors does not plan

to pay for Foxconn preferred stock. The company will focus on

paying off other debts if it manages to generate enough funds from

the sale of its assets.

Toyota Motor (NYSE:TM) – A server

malfunction after maintenance shut down all Toyota plants in Japan

for a day. The problem, which was not a cyberattack, occurred

due to a lack of disk space during an update to the parts ordering

system.

Boeing (NYSE:BA) – Boeing and Aviation

Capital Group have confirmed an order for 13 737 MAX jets,

increasing Aviation Capital’s backlog to 47 of these aircraft.

Telefonica (NYSE:TEF) – Saudi Telecom is

buying a 9.9% stake in Telefonica for $2.25 billion. The

transaction, which will face regulatory scrutiny in Spain, is part

of Saudi Telecom’s growth efforts and does not seek a majority

control.

Illumina (NASDAQ:ILMN) – Jacob Thaysen

of Agilent Technologies (NYSE:A) has

been named CEO of Illumina, succeeding Francis deSouza, who left

following a proxy battle with billionaire Carl Icahn. The

appointment comes as Illumina faces regulatory pressure and

financial forecast revisions. Thaysen takes over on September

25.

Horizon

Therapeutics (NASDAQ:HZNP), Amgen (NASDAQ:AMGN)

– The US Federal Trade Commission allowed Amgen’s acquisition of

Horizon Therapeutics, contrary to its own antitrust goals. The

deal, worth $27.8 billion, allows Amgen to purchase drugs that are

not subject to price negotiation and potentially reduce its tax

burden.

Kroger (NYSE:KR), Albertsons (NYSE:ACI)

– SoftBank-backed C&S Wholesale Grocers is close to a deal to

buy stores that Kroger and Albertsons plan to sell to gain

regulatory approval for their $25 billion merger, according to

Reuters.

Bank of America (NYSE:BAC) – Bank of

America has been increasing its cash reserves in response to a

slowing economy and stricter liquidity rules. This cautious

approach comes on the heels of uncertainties in the banking sector

and could lead to credit constraints.

Wells Fargo (NYSE:WFC) – Wells Fargo

announced the hiring of Jill Ford, formerly Co-Head of Capital

Markets for the Americas at Credit Suisse, as its new Head of

Capital Markets. Based in New York, Ford will report to Tim

O’Hara, head of banking at Wells Fargo.

UBS (NYSE:UBS) – After the emergency

acquisition of Credit Suisse, UBS CEO Sergio Ermotti argues that

the expanded bank is not too big for Switzerland. With a

balance of US$ 1.6 trillion, Ermotti points out that size is

relative and does not threaten the Swiss economy. In other

news, UBS will integrate Credit Suisse’s securities research

service into its own operations by the end of the

month. Institutional clients will be transferred to UBS Global

Research, while Credit Suisse’s wealth management will remain

unchanged.

Citigroup (NYSE:C) – The underperformance

of Citigroup stock is worrying analyst Mike Mayo, who nonetheless

maintains an ‘Outperform’ rating for the bank. While the stock

has dropped 37% since Jane Fraser took over as CEO, Mayo sees

potential for recovery and estimates an increase in tangible book

value. He also highlights Fraser’s efficiency initiatives and

the fact that Warren Buffett is still a shareholder.

Nubank (NYSE:NU) – Nubank, a leading

fintech in Latin America, is launching personal loans in

Mexico. The new service allows quick loans through its

platform, Nu Mexico, and will follow a trial period between

employees. The launch expands the company’s service offer in

the country.

Coinbase (NASDAQ:COIN) – Coinbase Global

will launch a cryptocurrency lending platform for institutional

investors, having raised $57 million for the project. The move

follows a recent regulatory win allowing the company to offer

cryptocurrency futures to US retail customers.

Blackstone (NYSE:BX) – Acquisition firms

are increasingly turning to private loan funds to finance

purchases, highlighting the growing role of the $1.5 trillion

private credit market. Blackstone’s Dwight Scott sees

advantages such as greater confidentiality and certainty of

execution.

BlackRock (NYSE:BLK) – BlackRock

Investment Institute has become less pessimistic about short-term

government bonds, attracted by high yields, but is more cautious

about high-quality corporate debt over the long term. The

institution cited the limited offset of these assets against

sovereign bonds: “To become positive on long-dated bonds, we

would need to see the term premium rise much higher or think that

market expectations of future interest rates are too

high. We’re not there yet“.

S&P Global (NYSE:SPGI) – S&P

Global has raised its reinsurance sector outlook from negative to

stable due to higher reinsurance rates and growing investment

income. Moody’s has maintained a stable view as rates continue

to rise in response to challenges such as natural disasters and

inflation.

Mastercard (NYSE:MA) – Mastercard has

denied reports that it plans to increase interchange fees charged

to US merchants, contradicting an earlier Wall Street Journal

report. Visa (NYSE:V) has also denied similar claims, saying

its fees have remained stable.

Albemarle (NYSE:ALB) – Albemarle, the

world’s largest lithium producer, plans to acquire

Australia’s Liontown

Resources (USOTC:LINRF) for $4.3 billion by 2024 to

expand its supply of lithium for electric vehicle

batteries. CEO Kent Masters sees the Liontown asset as an

opportunity to meet growing demand.

BHP Group (NYSE:BHP) – BHP CEO Mike Henry

acknowledges the company needs to do more to create a safe

environment following a 20% increase in reports of sexual

harassment. Although he has invested $191 million in security

measures, Henry claims there is still “way to go.”

Manchester United (NYSE:MANU) – Shares of

Manchester United fell 18.2% on Tuesday, marking their biggest drop

since going public in 2012, following reports that the Glazer

family plans to take the club off the market. The decision

dashes expectations of an imminent sale, possibly to Sheikh Jassim

of Qatar.

Spotify (NYSE:SPOT) – AI-focused Air

Street Capital has raised a second $121 million fund, with backing

from Daniel Ek, CEO of Spotify, and Jeff Dean of Google

(NASDAQ:GOOGL). Specializing in AI startups, the company has

seen success particularly in the area of drug discovery.

Earnings

Warner Bros Discovery (NASDAQ:WBD) –

Warner Bros Discovery anticipates a drop in annual profit due to

the continuing strike by actors and writers in Hollywood, the

industry’s first double shutdown in 63 years. The studio has

postponed the release of “Dune 2” and expects a reduction of up to

$500 million in adjusted profits for 2023. The strike also affects

other movie theater chains still reeling from the pandemic.

Zscaler (NASDAQ:ZS) – Shares in Zscaler

fell -1.1% in premarket Wednesday despite a strong quarter that

beat Wall Street expectations. CEO Jay Chaudry cited a

“challenging macro environment” as a reason for slower

business. The company forecast solid earnings of 48 cents to

49 cents per share on revenue of $472 million to $474 million for

the fiscal first quarter, while FactSet estimates are 45 cents per

share on revenue of $464, 8 million. However, Zscaler warns of

economic uncertainties.

Gitlab (NASDAQ:GTLB) – Shares of Gitlab

rose 6.3% in premarket trading on Wednesday after the company

reported a surprise adjusted Q2 profit and raised its full-year

forecasts. Gitlab now expects annual revenue of between

$555-557 million, above previous estimates, and has also lowered

its loss-per-share projections.

Asana (NYSE:ASAN) – Shares in Asana fell

-2.5% in premarket trading on Wednesday even as the company beat

estimates for second-quarter revenue and earnings. With a net

loss of $71.4 million and revenue of $162.5 million, Asana beat

analyst forecasts. The stock has grown 57% this year.

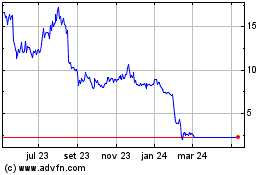

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Express (NYSE:EXPR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024