Bitcoin movement follows varied perspectives

On September 12, Bitcoin (COIN:BTCUSD) attempted to consolidate

above $26,000, generating optimism among investors. Records

indicated that Bitcoin maintained much of its 24-hour advance,

reaching 5.5% at one point. Jelle, a renowned trader, showed

enthusiasm for a retest of the $27,000 level. Meanwhile,

Crypto Ed projected a possibility of reaching $28,000 in the short

term. However, Keith Alan highlighted significant resistance,

emphasizing the need to hold $24,750 as support. Analyzing the

last quarter, QCP Capital predicted selling pressures, anticipating

a more robust recovery only in October.

Binance extends humanitarian aid after Morocco earthquake

Following the devastating magnitude 7 earthquake that affected

Morocco on September 8, resulting in over 2,000 deaths in

Marrakesh, Binance announced donations of up to $3 million in

Binance Coin (COIN:BNBUSD) to assist

those affected. Those in the hardest hit region,

Marrakech-Safi, will receive $100 in BNB. Other Moroccans will

have US$10 of BNB credited. Changpeng Zhao, CEO of Binance,

expressed solidarity and encouraged unaffected beneficiaries to

pass on donations. Binance has also created a public wallet

for more contributions. In March, Binance had already taken a

similar action following earthquakes on the Turkey-Syria

border.

Franklin Templeton proposes Bitcoin ETF

Asset management giant Franklin Templeton proposed to SEC on

September 12 to launch a physical Bitcoin ETF. The request

comes after the SEC postponed decisions on other potential Bitcoin

ETFs, including Grayscale’s. Under the proposal, the ETF would

act as a trust, with Coinbase (NASDAQ:COIN) holding Bitcoin

(COIN:BTCUSD) and Bank of New York Mellon (NYSE:BK) managing the

money. The shares would be traded on the Cboe BZX Exchange.

SEC’s verdict is expected on October 16. The company warned of

regulatory uncertainty in its submission.

PayPal enhances crypto ecosystem with conversion cervice

PayPal (NASDAQ:PYPL) has introduced a new service that allows

users to convert cryptocurrencies into US dollars directly in their

wallets. The functionality, called “Off Ramps”, allows

cryptocurrency holders in the US to easily transfer their digital

assets into dollars, which can be used for purchases, bank

transfers, among others. This innovation, integrated into

MetaMask and accessible via dApps and NFT marketplaces, aims to

provide a smooth transition between the crypto and traditional

financial worlds, reinforcing PayPal’s position in crypto

space.

Coinbase launches web3 wallet for institutions to access NFTs and

DeFi

Coinbase (NASDAQ:COIN) has expanded its reach into the

professional sector by introducing a Web3 wallet through its

Coinbase Prime division. This wallet was developed to allow

institutions to engage with NFTs and decentralized finance (DeFi)

more broadly. It not only offers secure token storage and

interaction with dapps, but also integrates with Prime account

security. Kevin Johnson, from Coinbase, highlighted the

importance of ensuring adequate controls over assets, meeting the

specific demands of institutions. “ We’re just giving

institutions the resources they need to participate in on-chain

applications ”, said Johnson.

MetaMask launches “Snaps” to expand Blockchain compatibility

Popular web3 wallet MetaMask has introduced “Snaps,” software

modules designed to expand the platform’s compatibility beyond

Ethereum-based networks. While MetaMask has traditionally

supported blockchains like Ethereum, BNB Chain, and Polygon, Snaps

will facilitate integration with networks like Cosmos and

Solana. This initiative, which involved the collaboration of

more than 150 developers, aims for an open innovation platform

without barriers, as highlighted by Christian Montoya, project

leader: “We believe that permissionless innovation is the

cornerstone of a decentralized system – without

gatekeepers .”

HSBC explores partnership with Fireblocks on crypto custody

technology

Renowned London bank HSBC (NYSE:HSBC) is considering a

collaboration with cryptocurrency custody specialist

Fireblocks. Fireblocks already has experience in the area,

having previously been chosen as a custody technology provider by

BNY Mellon (NYSE:BK) and also has a link with BNP

Paribas. However, big banks are cautious about crypto due to

regulatory uncertainty, especially in the US. HSBC, holding $3

trillion in assets, allows BTC and ETH trading at its Hong Kong

unit but maintains a reserved stance.

Sony and Startale Labs drive the evolution of Web3

Sony Network Communications (NYSE:SONY) invested US$3.5 million

in Startale Labs, strengthening its position in the web3

universe. Startale Labs, a key contributor to the Astar

Network, seeks to expand the scope of web3 globally. With

Sony’s contribution, Startale intends to double its team and

increase its contributions to networks such as Astar and

Polkadot. Regulatory uncertainty in the US is driving focus

towards Asian markets, and the partnership between Sony and

Startale Labs highlights this trend, aiming for wider adoption of

web3 globally.

Bitfinex celebrates new legal victory in class action

Cryptocurrency exchange Bitfinex scored a significant legal

victory when a class action lawsuit filed against it was dismissed

by Chief Judge Laura Taylor Swain in New York. According to a

statement from Bitfinex on September 12, the lawsuit, filed by

Shawn Dolifka, attempted to revive arguments that had already been

refuted. The decision highlighted that the suggested change

did not address the main issues with the allegations. This

recent decision echoes the resolution of a similar case faced by

Tether the previous month.

Alex Mashinsky challenges FTC allegations of fraudulent conduct

Celsius founder Alex Mashinsky is disputing the charges brought

by the US Federal Trade Commission, arguing that the allegations

are insufficient. His lawyers claim that the facts presented

do not meet the criteria of the Gramm-Leach-Bliley Act of 1999,

which deals with fraudulent information in financial

institutions. Furthermore, it was highlighted that, having

resigned as CEO in September 2023, Mashinsky cannot currently be

considered in violation of the law. Meanwhile, Celsius

co-founders also face legal scrutiny, with defenders questioning

the basis of the accusations.

It is confirmed that Vitalik Buterin, co-founder of Ethereum,

suffered a sim-swap attack on his account

On September 11, via Warpcast, Vitalik Buterin, co-founder of

Ethereum, revealed that his X (formerly Twitter) account was

compromised by a sim-swap attack. This type of attack exploits

flaws in two-factor authentication systems using calls or messages

as verification. Buterin acknowledged the weakness of phone

numbers in security and mentioned that he may have linked his phone

when signing up for Twitter Blue. Following the attack, around

$700,000 worth of digital assets were lost, and the community was

warned about security risks on X.

CoinEx suspected of $27 million hack

On September 12, CoinEx, a cryptocurrency exchange, had

suspicious outflows of funds to an unknown address, causing

concerns about a possible hack. Blockchain Cyvers Alerts

estimates that around $27 million was lost. Notably, an amount

of $7.9 million in Ether (COIN:ETHUSD) was transferred to an

account with no previous records. Other tokens were also sent

to the same address. CoinEx has not yet officially commented

on the matter.

Problems in Milady Maker: Fee embezzlement and invasion on social

networks

Milady Maker, a recognized NFT project, has faced significant

exploitation affecting its fees and social media

accounts. Charlotte Fang, co-founder, revealed on X that a

developer linked to Milady embezzled around US$1 million from

Remilia Corporation, the DAO responsible for the

project. While key assets and NFTs remain safe, the attacker

has also taken control of several social accounts. Fang

identified those involved and promised strict legal action against

them. After Elon Musk’s endorsement in 2023, Milady NFTs

experienced an appreciation, but later showed a drop in prices.

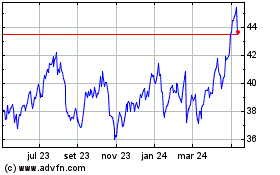

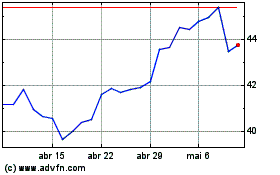

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024