Keep An Eye Out: Pre-Market Movers And Recommendations

20 Setembro 2023 - 11:12AM

IH Market News

On Wednesday, U.S. futures showed slight gains as investors

anxiously awaited the Federal Reserve’s imminent interest rate

decision and economic update. Here are some notable movers in the

premarket U.S. stock scene today:

Don’t Trade Without Seeing

The Orderbook

Instacart (NASDAQ:CART) shares slipped 3.2%,

retracing a portion of the 12% surge seen on its inaugural trading

day following a successful listing for the online grocery delivery

service.

Apple (NASDAQ:AAPL) shares declined by 0.2% as

unions representing employees at the tech giant’s French stores

called for a strike ahead of the iPhone 15 launch on Friday and

Saturday, demanding improved compensation and working

conditions.

Goldman Sachs (NYSE:GS) shares gained 0.3% as

the investment bank’s asset management division successfully raised

over $15 billion for funds enabling investors to participate in

existing private equity deals as secondary investments.

Coty (NYSE:COTY) shares climbed 6.2% after the

beauty company raised its annual core sales forecast, citing

increased pricing and robust demand for its high-end

fragrances.

General Mills (NYSE:GIS) shares rose by 0.9% as

the food processing company surpassed analysts’ expectations for

quarterly sales. Price hikes on breakfast cereals, snack bars, and

pet food products helped mitigate the impact of slowing demand.

Dollar General (NYSE:DG) shares dipped 1.6%

following a downgrade by JPMorgan from ‘neutral’ to ‘underweight,’

citing significant financial stress among its core low-end consumer

base.

Chewy (NYSE:CHWY) shares declined 1.9% after

Oppenheimer downgraded the pet food retailer from ‘outperform’ to

‘perform,’ anticipating a persistently challenging business

environment for at least a few more quarters.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

RECOMMENDATIONS

Applied Material (NASDAQ:AMAT): Goldman Sachs

maintains its buy recommendation with a target price of $152.

Autozone (NYSE:AZO): BNP Paribas Exane

maintains its outperform rating with a target price of $3,215.

Dollar General (NYSE:DG): JP Morgan downgrades

to underweight from neutral with a target price reduced from $132

to $116.

Western Digital (NASDAQ:WDC): BNP Paribas Exane

upgrades to outperform from neutral with a target price raised from

$36 to $58.

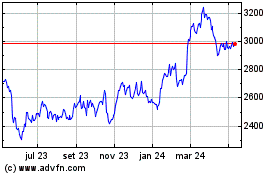

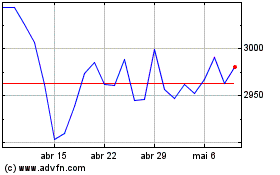

AutoZone (NYSE:AZO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

AutoZone (NYSE:AZO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024