Stocks in focus in premarket trade on Tuesday, October 3rd.

Don’t Trade Without Seeing

The Orderbook

Point Biopharma (NASDAQ:PNT) shares spiked

after Eli Lilly & Co (NYSE:LLY) announced that it had agreed to

buy the cancer biotech for around $1.4 billion to expand its

oncology therapies into radioligand treatments, which deliver

radiation to tumor cells at a closer range.

ALX Oncology (NASDAQ:ALXO) shares soared

after it unveiled interim mid-stage data for a trial of its drug

treating advanced gastric cancer.

McCormick (NYSE:MKC) stock slid after the

spice maker posted weaker-than-expected net sales for the recent

quarter and a bigger-than-anticipated drop in product volume due in

part to flagging demand in its Asia-Pacific operations.

Airbnb (NASDAQ:ABNB) shares fell after

analysts at KeyBanc Capital Markets lowered their rating of the

short-term home rental business, citing an easing in post-pandemic

travel activity.

Warner Music Group (NASDAQ:WMG) shares

moved higher after analysts at UBS raised their rating of the

entertainment firm to buy from neutral.

HP (NYSE:HPQ) shares gained following an

upgrade of the stock by Bank of America analysts to buy from

underperform.

Oddity Tech Ltd. (NASDAQ:ODD) stock

climbed after analysts at Truist Securities improved their rating

to buy from hold, citing the beauty and wellness platform’s

“compelling” valuation.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

ANALYST RECOMMENDATIONS:

Albemarle Corp: KeyBanc Capital Markets

maintains its overweight recommendation with a price target reduced

from $291 to $254.

Alexandria Real: Wedbush maintains its

outperform rating with a target price of $120.

American Express: Morgan Stanley maintains its

cautious overweight recommendation with a target price reduced from

$188 to $185.

Baker Hughes: Wells Fargo maintains its

equalweight recommendation and reduces the target price from $37 to

$36.

Bank of America: Morgan Stanley maintains its

equal weight/in-line recommendation with a target price reduced

from $34 to $32.

Boohoo Group: Jefferies maintains its buy

recommendation with a price target reduced from £85 to £75.

Canadian National Railway: Stifel maintains its

hold recommendation with a price target reduced from $125 to

$122.

Capital One: Morgan Stanley maintains its

underweight/cautious recommendation with a price target reduced

from $92 to $86.

Celanese Corp: KeyBanc Capital Markets

maintains its overweight recommendation with a price target raised

from $149 to $150.

Cintas Corp: Baptista Research maintains its

underperform recommendation with a price target reduced from $510

to $500.

Citigroup Inc: Morgan Stanley maintains its

underweight/in-line recommendation with a target price reduced from

$45 to $43.

Corteva: Baptista Research upgrades to buy from

hold with a price target raised from $63.30 to $71.80.

Costco Wholesale: Baptista Research maintains

its underperform recommendation with a price target raised from

$514 to $549.50.

Dell: Morgan Stanley maintains its

overweight/in-line recommendation and raises the target price from

$70 to $87.

Dow: KeyBanc Capital Markets upgrades to sector

weight from underweight.

Enphase Energy: Raymond James maintains its

outperform rating and reduces the target price from $225 to

$175.

Fmc Corp: KeyBanc Capital Markets maintains its

overweight rating and reduces the target price from $117 to

$107.

Ford Motor: Goldman Sachs maintains its neutral

recommendation and reduces the target price from $14 to $13.

General Electric: Wolfe Research maintains its

outperform rating and raises the target price from $131 to

$134.

General Mills: Baptista Research upgrades to

buy from hold with a price target reduced from $91 to $82.20.

General Motors: Goldman Sachs maintains its buy

recommendation and reduces the target price from $49 to $47.

Goldman Sachs: Morgan Stanley maintains its

equalwt/in-line recommendation with a target price reduced from

$347 to $329.

Halliburton: Wells Fargo maintains its

overweight rating and reduces the target price from $53 to $52.

Hewlett Packard: Baptista Research downgrades

to underperform from hold with a price target reduced from $18.10

to $17.80.

Hp Inc: Baptista Research upgrades to

outperform from hold with a price target reduced from $32.50 to

$29.70.

JPMorgan Chase: Morgan Stanley maintains its

overweight/in-line recommendation with a price target raised from

$179 to $187.

Lyondellbasell: KeyBanc Capital Markets

upgrades to sector weight from underweight.

Mcdonald’s: Jefferies maintains its buy

recommendation and reduces the target price from $340 to $325.

Moody’s: Oppenheimer maintains its outperform

rating and reduces the target price from $398 to $375.

Nike: Daiwa Securities maintains a neutral

recommendation with a price target reduced from $114 to $100.

Norfolk Southern: Stifel maintains its buy

recommendation and reduces the target price from $260 to $253.

Northern Trust: Morgan Stanley maintains its

equal weight/in-line recommendation and reduces the target price

from $92 to $86.

Nvidia: KeyBanc Capital Markets maintains its

overweight recommendation and raises the target price from $670 to

$50.

Paychex: Wedbush maintains its neutral

recommendation with a price target raised from $115 to $125.

Pepsico: JP Morgan maintains its overweight

rating and reduces the target price from $203 to $188.

Pnc Financial: Morgan Stanley maintains its

underweight/in-line recommendation with a target price reduced from

$144 to $142.

Procter & Gamble: Deutsche Bank maintains

its buy recommendation with a price target reduced from $167 to

$166.

Regeneron Pharm: Baptista Research downgrades

to underperform from hold with a price target reduced from $793 to

$767.30.

Royal Caribbean: Morgan Stanley maintains its

equal weight/in-line recommendation with a target price reduced

from $100 to $95.

S&P Global: Morgan Stanley maintains its

overweight/in-line recommendation with a price target reduced from

$450 to $424.

Schlumberger: Wells Fargo maintains its

overweight recommendation and raises the target price from $72 to

$76.

Starbucks: Jefferies maintains its hold

recommendation with a price target reduced from $107 to $100.

Tesla: Goldman Sachs maintains its neutral

recommendation with a price target reduced from $275 to $265.

Truist Financial: Morgan Stanley maintains its

equal weight/in-line recommendation with a price target reduced

from $41 to $40.

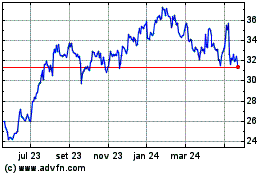

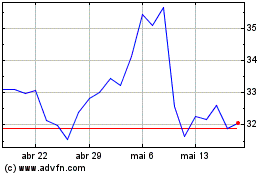

Warner Music (NASDAQ:WMG)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Warner Music (NASDAQ:WMG)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025