American Express Surpasses Q3 Earnings Expectations Thanks to Strong Consumer Spending

20 Outubro 2023 - 9:33AM

IH Market News

American Express (NYSE:AXP), the prominent credit card issuer,

reported a third-quarter profit that surpassed market expectations.

This feat was achieved with the support of affluent customers who

displayed strong spending habits, disregarding concerns about an

impending economic downturn.

Catering primarily to a premium clientele, AmEx has adeptly

navigated the challenges posed by inflation and the Federal

Reserve’s interest rate hikes, which have heightened borrowing

costs and curtailed discretionary expenditures.

CEO Stephen Squeri noted, “Travel and Entertainment (T&E)

spending remained robust, with restaurant spending ranking among

our fastest-growing T&E categories,” in a recent statement.

The company’s profits reached $2.45 billion, or $3.30 per share,

marking an increase from $1.88 billion, or $2.47 per share,

recorded in the previous year. Analysts had, on average,

anticipated earnings of $2.94 per share, as reported by LSEG IBES

data.

However, in a sign of prudent risk management, AmEx raised its

provisions for credit losses to $1.23 billion, reflecting a 58%

increase from the previous year. This move was made to account for

the heightened likelihood of consumers defaulting on their

debts.

Furthermore, the company reported a significant revenue increase

of 13%, amounting to $15.38 billion, after accounting for interest

expenses.

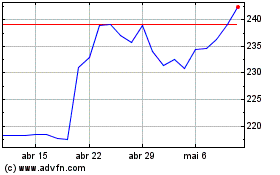

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

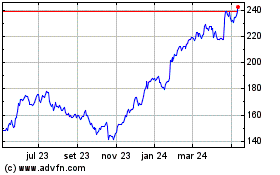

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024