Pre-Market U.S. Stock Movers

Pinterest Inc (NYSE:PINS) soared over +16% in

pre-market trading after the company reported upbeat Q3

results.

NVIDIA Corporation (NASDAQ:NVDA) fell about

-0.5% in pre-market trading following a report by the Wall Street

Journal, which indicated that the latest U.S. export restrictions

on high-end chips could potentially lead the company to cancel

orders worth billions of dollars destined for China next year.

Lattice Semiconductor Corporation (NASDAQ:LSCC)

tumbled over -17% in pre-market trading after providing

weaker-than-expected Q4 revenue guidance.

Wolfspeed Inc (NYSE:WOLF) climbed more than

+15% in pre-market trading after the company issued

stronger-than-expected Q2 guidance.

Western Digital Corporation (NASDAQ:WDC) slid

over -4% in pre-market trading after announcing a proposed offering

of $1.3 billion aggregate principal amount of convertible senior

notes due 2028.

Chewy Inc (NYSE:CHWY) rose more than +2% in

pre-market trading after Morgan Stanley upgraded the stock to

Overweight from Equal Weight.

Don’t Trade Without Seeing

The Orderbook

Analyst Recommendations:

Arista Networks (NYSE:ANET): Morgan Stanley

upgrades to overweight from equal weight with a price target raised

from $185 to $220.

Avalonbay (NYSE:AVB): Piper Sandler & Co

upgrades to overweight from neutral with a price target reduced

from $197 to $194.

Centene (NYSE:CNC): Bernstein maintains its

outperform rating and raises the target price from $90 to $95.

Chevron (NYSE:CVX): DZ Bank AG Research

maintains its buy recommendation and reduces the target price from

$187 to $170.

Chewy (NYSE:CHWY): Morgan Stanley upgrades to

overweight from equal weight with a price target reduced from $31

to $28.

Epam Systems (NYSE:EPAM): HSBC maintains its

hold recommendation and reduces the target price from $255 to

$245.

Hartford (NYSE:HIG): Raymond James maintains

its outperform rating with a target price raised from $85 to

$90.

Hubspot (NYSE:HUBS): Citi maintains its buy

recommendation with a price target reduced from $695 to $658.

Kenvue (NYSE:KVUE): HSBC maintains its hold

recommendation and reduces the target price from $23 to $21.

L3harris (NYSE:LHX): Baird upgrades to

outperform from neutral with a price target raised from $198 to

$216.

Linde (NYSE:LIN): DZ Bank AG Research maintains

its buy recommendation and reduces the target price from $439 to

$428.

Mcdonald’s (NYSE:MCD): DZ Bank AG Research

upgrades to buy from hold with a price target reduced from $315 to

$300.

Meta Platforms (NASDAQ:META): Societe Generale

maintains its sell recommendation and raises the target price from

$100 to $175.

Mid-America (NYSE:MAA): Piper Sandler & Co

downgrades to neutral from overweight with a price target reduced

from $182 to $130.

On Semiconductor (NASDAQ:ON): Baird downgrades

to neutral from outperform with a price target reduced from $120 to

$60.

Revvity (NYSE:RVTY): Jefferies maintains its

hold recommendation with a price target reduced from $110 to

$87.

T. Rowe Price (NYSE:TGRT): Citi downgrades to

neutral from sell with a price target reduced from $100 to $95.

Transunion (NYSE:TRU): Redburn Atlantic

maintains its buy recommendation and reduces the target price from

$105 to $53.

Udr (NYSE:UDR): Piper Sandler & Co

downgrades to underweight from neutral with a price target reduced

from $46 to $30.

Willis Towers: Raymond James maintains its

outperform rating and raises the target price from $250 to

$255.

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

Today’s U.S. Earnings Spotlight: Tuesday – October

31st

Pfizer (PFE), AMD (AMD), Amgen (AMGN), Caterpillar (CAT), Eaton

(ETN), Marathon Petroleum (MPC), Enterprise Products Partners LP

(EPD), Stellantis NV (STLA), Ecolab (ECL), Ambev SA (ABEV), ONEOK

(OKE), MSCI (MSCI), Sysco (SYY), Ametek (AME), Ares Management

(ARES), Public Service Enterprise (PEG), Global Payments (GPN), WEC

Energy (WEC), Yum China Holdings (YUMC), Xylem (XYL), Equity

Residential (EQR), Cameco (CCJ), Sirius XM (SIRI), Hubbell (HUBB),

First Solar (FSLR), Paycom Soft (PAYC), Leidos (LDOS), Incyte

(INCY), Chesapeake Energy (CHK), Franklin Resources (BEN), Zebra

(ZBRA), Neurocrine (NBIX), Unum (UNM), Match Group (MTCH), Axa

Equitable (EQH), Bio-Techne (TECH), Caesars (CZR), AGCO (AGCO),

Assurant (AIZ), Voya Financial Inc (VOYA), Topbuild Corp (BLD),

Noble (NE), Repligen (RGEN), Graphic Packaging (GPK), Cognex

(CGNX), Ufp Industries (UFPI), EnLink Midstream LLC (ENLC),

Littelfuse (LFUS), IGT (IGT), Sensata Tech (ST), Freshworks (FRSH),

Sonoco Products (SON), MGIC Investment (MTG), Zurn Water Solutions

(ZWS), Phillips Edison Co (PECO), Sprouts Farmers (SFM), Huntsman

(HUN), Meritage (MTH), IPG Photonics (IPGP), Equitrans Midstream

(ETRN), Insperity (NSP), Blackbaud (BLKB), Skyline (SKY), Consol

Energy (CEIX), Advanced Energy (AEIS), PJT Partners Inc (PJT),

CommVault (CVLT), Livent (LTHM), Artisan Partners AM (APAM), Kadant

(KAI), Hayward Holdings (HAYW), USA Compression Partners LP (USAC),

O-I Glass (OI), Enpro Industries (NPO), LXP Industrial Trust (LXP),

Dorman (DORM), Gulfport Energy Operating (GPOR), Douglas Emmett

(DEI), Macerich (MAC), LGI Homes (LGIH), Banco Itau Chile (ITCL),

Perficient (PRFT), Green Brick Partners Inc (GRBK), Urban Edge

Properties (UE), Green Plains Energy (GPRE), Mercury General (MCY),

HNI (HNI), Granite Construction (GVA), Lumen Technologies (LUMN),

Equinox Gold (EQX), Claros Mortgage Trust (CMTG), Tennant (TNC),

JetBlue (JBLU), Vita Coco (COCO), Xenia Hotels & Resorts Inc

(XHR), Shutterstock (SSTK), Global Industrial Co (GIC), John B

Sanfilippo&Son (JBSS), Harmony Bio (HRMY), Centerra Gold

(CGAU), Kiniksa Pharma (KNSA).

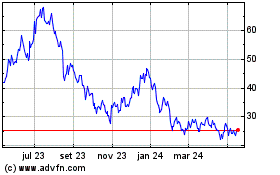

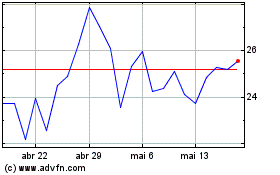

Wolfspeed (NYSE:WOLF)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Wolfspeed (NYSE:WOLF)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024