Baidu Places Order for Huawei AI Chips Instead of Nvidia Sources

07 Novembro 2023 - 7:30AM

IH Market News

Baidu (NASDAQ: BIDU) commissioned artificial intelligence chips

from Huawei this year, said two people familiar with the matter,

adding to signs that U.S. pressure is leading China to embrace the

company’s products as an alternative to Nvidia (NASDAQ: NVDA).

One of the sources said that Baidu, one of China’s leading AI

companies operating the large Ernie (LLM) language model, placed

the order in August, before the widely anticipated new rules by the

U.S. government in October that strengthened restrictions on chip

exports and chip tools to China, including those from the American

chip giant Nvidia.

The information comes from Reuters.

Baidu ordered 1,600 Huawei Technologies Ascend AI 910B

chips—developed by the Chinese company as an alternative to

Nvidia’s A100 chip—for 200 servers, the source said, adding that in

October, Huawei delivered more than 60% of the order, or around

1,000 chips, to Baidu.

The second person said the total value of the order was

approximately 450 million yuan ($61.83 million), and Huawei was

expected to deliver all the chips by the end of this year. Both

sources declined to be identified because the details of the

agreement were confidential.

While the order is small compared to the thousands of chips that

major Chinese tech companies have historically ordered from Nvidia,

the sources said it was significant as it showed how some companies

might distance themselves from the American company.

Baidu, alongside Chinese competitors like Tencent and Alibaba,

is known to be a long-time customer of Nvidia. It was previously

unknown that Baidu was a customer for Huawei’s AI chips.

Although Huawei’s Ascend chips are still seen as much inferior

to Nvidia’s in terms of performance, the first source said they

were the most sophisticated domestic option available in China.

“They were ordering 910B chips to prepare for a future where

maybe they couldn’t buy from Nvidia anymore,” said the first

source.

Baidu and Huawei did not respond to requests for comments.

Nvidia declined to comment.

Another source said they have been collaborating with Baidu

since 2020 to make its AI platform compatible with Huawei hardware.

In August, both companies announced plans to deepen compatibility

between Baidu’s Ernie AI model and Huawei’s Ascend chips.

Baidu has developed its own line of Kunlun AI chips, which the

company claims supports large-scale AI computing, but it has mainly

relied on Nvidia’s A100 chip to train its LLM.

After the U.S. imposed rules last year that prevented Nvidia

from selling its A100 and H100 chips to China, the company issued

new A800 and H800 chips as alternatives for Chinese customers,

including Baidu. Nvidia can no longer sell these chips to China due

to the October rules.

HUAWEI OPPORTUNITY

Analysts predicted last month that U.S. restrictions would

create an opening for Huawei to expand in its $7 billion domestic

market. The company has been subject to U.S. export controls since

2019.

The order adds to signs of technological advancements for Huawei

as Beijing invests in its domestic semiconductor industry to help

it catch up with foreign counterparts and urges state firms to

replace foreign technology with domestic alternatives.

Huawei attracted substantial global attention in August when it

unexpectedly unveiled a new smartphone that analysts say uses

internally developed processors with advanced semiconductor

technology, highlighting the company’s progress in chip development

despite sanctions.

In September, Reuters reported that Huawei’s in-house chip

design unit, HiSilicon, had begun shipping newly developed

Chinese-made processors for surveillance cameras to customers in

2023, another sign of resurgence.

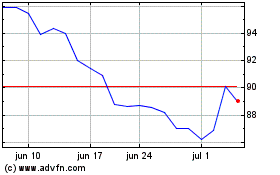

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024