December S&P 500 futures are trending up this morning as

investors looked ahead to comments from Fed Chair Jerome Powell for

further clues on the U.S. central bank’s monetary policy path while

also awaiting an earnings report from Disney.

U.S. rate futures have priced in a 9.8% probability of a 25

basis point rate increase at the next central bank meeting in

December and a 14.8% chance of a 25 basis point rate hike at the

conclusion of the Fed’s January meeting.

Third-quarter earnings season rolls on, with investors awaiting

fresh reports from notable companies today, including

Disney (NYSE:DIS), Warner Bros

Discovery (NASDAQ:WBD), Biogen

(NASDAQ:BIIB), and Take-Two Interactive

(NASDAQ:TTWO).

Meanwhile, Federal Reserve Chair Jerome Powell is set to deliver

opening remarks before the Federal Reserve Division of Research and

Statistics Centennial Conference later in the day and will

participate in a panel discussion at the IMF’s annual research

conference on Thursday. In addition, several other Fed officials

will be making appearances today, including Williams, Barr, and

Jefferson.

On the economic data front, investors will likely focus on U.S.

Wholesale Inventories data due later in the day. Economists foresee

this figure to stand at 0.0% m/m in September, compared to -0.1%

m/m in August.

In the bond markets, United States 10-year rates are at 4.580%,

up +0.20%.

Don’t Trade Without Seeing

The Orderbook

Pre-Market U.S. Stock Movers

Upstart Holdings (NASDAQ:UPST) tumbled about

-22% in pre-market trading after the company reported downbeat Q3

results and provided below-consensus Q4 revenue guidance.

Upwork (NASDAQ:UPWK) surged over +21% in

pre-market trading after reporting upbeat Q3 results and raising

its FY23 revenue guidance.

eBay Inc (NASDAQ:EBAY) slumped more than -6% in

pre-market trading after the company offered weaker-than-expected

guidance for the holiday quarter.

Robinhood Markets Inc (NASDAQ:HOOD) slid over

-7% in pre-market trading after the company reported

weaker-than-expected Q3 revenue and raised its expectations for

FY23 total operating expenses.

Lucid Group Inc (NASDAQ:LCID) fell over -3% in

pre-market trading after the company posted mixed Q3 results and

lowered its full-year production outlook.

NXP Semiconductors NV (NASDAQ:NXPI) dropped

more than -2% in pre-market trading after Citi downgraded the stock

to Sell from Neutral.

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

ANALYST RECOMMENDATIONS

Advanced Micro Devices: CTBC Securities

Investment Service Co LTD maintains its add recommendation and

reduces the target price from $135 to $125.

Air Products & Chemicals: Wells Fargo

maintains its overweight rating and reduces the target price from

$345 to $320.

Akamai Technologies: Baird maintains a neutral

recommendation with a price target raised from $108 to $120.

Avalonbay Communities: Morgan Stanley resumes

coverage with an equal weight rating and a target price raised from

$180.50 to $193.

Celanese Corporation: Baird maintains its

outperform rating and reduces the target price from $140 to

$135.

Chevron Corporation: HSBC maintains its buy

recommendation and reduces the target price from $184 to $169.

Constellation Energy Corporation: BMO Capital

Markets maintains its outperform rating and raises the target price

from $123 to $131.

Datadog: Baird maintains a neutral

recommendation with a price target raised from $84 to $103.

Devon Energy Corporation: Peters & Co.

maintains its sector perform recommendation and reduces the target

price from $56 to $52.

Diamondback Energy: JP Morgan maintains its

overweight recommendation and raises the target price from $174 to

$180.

Dr Horton: Barclays maintains its overweight

recommendation and raises the target price from $130 to $143.

Ebay: Baird maintains its outperform rating and

reduces the target price from $52 to $48.

Emerson Electric: Baird maintains a neutral

recommendation with a price target reduced from $99 to $88.

Expeditors International Of Washington: JP

Morgan maintains its underweight recommendation and reduces the

target price from $110 to $107.

Extra Space Storage: Stifel maintains its buy

recommendation and reduces the target price from $185 to $165.

Exxon Mobil Corporation: HSBC maintains its

hold recommendation with a price target raised from $116 to

$119.

Fidelity National Information Services: Wolfe

Research upgrades to outperform from peerperform with a target

price of $65.

Gilead Sciences: Jefferies maintains its buy

recommendation and raises the target price from $90 to $95.

Globalfoundries: Baird maintains its outperform

rating and reduces the target price from $100 to $70.

Gsk plc: Berenberg maintains its buy

recommendation and reduces the target price from $44 to $41.

International Flavors & Fragrances: Baird

maintains its outperform rating and raises the target price from

$75 to $80.

Martin Marietta Materials: Thompson Research

Group maintains its not rated recommendation with a price target

raised from $501 to $527.

Match Group: Baird maintains its outperform

rating and reduces the target price from $49 to $36.

Mondelez International: Berenberg maintains its

buy recommendation and reduces the target price from $87 to

$84.

Nxp Semiconductors: Citi downgrades to sell

from neutral with a price target reduced from $216 to $150.

Pultegroup: Wells Fargo maintains its

overweight recommendation and raises the target price from $80 to

$92.

Quanta Services: Goldman Sachs upgrades to buy

from neutral with a price target reduced from $214 to $211.

Rivian Automotive: Canaccord Genuity maintains

its buy recommendation and reduces the target price from $44 to

$30.

Shopify: Loop Capital Markets maintains its

hold recommendation with a price target raised from $57 to $62.

Uber Technologies: Bernstein maintains its

outperform rating and raises the target price from $55 to $60.

United Parcel Service: Loop Capital Markets

maintains its hold recommendation with a price target reduced from

$172 to $162.

Waters Corporation: Baird maintains a neutral

recommendation with a price target reduced from $275 to $253.

Zimmer biomet Holdings: Citigroup maintains

market perform recommendation with a price target reduced from $148

to $123.

Today’s U.S. Earnings Spotlight: Wednesday – November

8th

Walt Disney (DIS), TC Energy (TRP), Biogen (BIIB), Corteva

(CTVA), Manulife Financial (MFC), Warner Bros Discovery (WBD), CGI

Inc (GIB), Franco-Nevada (FNV), Take-Two (TTWO), Fair Isaac (FICO),

HubSpot Inc (HUBS), Roblox (RBLX), Ke Hldg (BEKE), Kellanova (K),

FleetCor (FLT), Royalty Pharma (RPRX), Atmos Energy (ATO), Applovin

(APP), MGM (MGM), Endeavor Group (EDR), U-Haul Holding (UHAL),

Twilio (TWLO), Performance Food Group Co (PFGC), Charles River

Laboratories (CRL), Jazz Pharma (JAZZ), UWM Holdings (UWMC),

Instacart (CART), Ralph Lauren A (RL), Duolingo (DUOL), NewYork

Times (NYT), Affirm Holdings (AFRM), Kinross Gold (KGC), Genpact

(G), ICL Israel Chemicals (ICL), Middleby Corp (MIDD), Starwood

Property (STWD), New Fortress Energy (NFE), Owl Rock Capital

(OBDC), Reynolds (REYN), Kinetik Holdings (KNTK), Natera Inc

(NTRA), Ultrapar Participacoes (UGP), Southwest Gas Hold (SWX),

B2Gold (BTG), LYFT (LYFT), Ashland Global (ASH), Shift4 Payments

Inc (FOUR), Ormat (ORA), Helmerich Payne (HP), Enersys (ENS),

Cactus (WHD), Installed Building (IBP), Amicus (FOLD), Adient

(ADNT), Ginkgo Bioworks (DNA), Jackson Financial (JXN), Vishay

Intertechnology (VSH), Playtika (PLTK), Diodes (DIOD), SeaWorld

Entertainment (SEAS), Azenta (AZTA), Ziff Davis (ZD), Genworth

(GNW), Lumentum Holdings Inc (LITE), Clear Secure (YOU), Hagerty

(HGTY), Steven Madden (SHOO), Callaway Golf (MODG), Lifestance

Health Group (LFST), IONQ (IONQ), Bloom Energy (BE), ViaSat (VSAT),

Prospect Capital (PSEC), Sovos Brands (SOVO), Rocket Lab USA

(RKLB), Envestnet (ENV), Nuvei (NVEI), Jamf (JAMF), Xenon

Pharmaceuticals (XENE), Payoneer Global Inc (PAYO), Certara (CERT),

Liveramp (RAMP), Marathon Digital (MARA), ODP (ODP), Vericel Corp

Ord (VCEL), Siriuspoint (SPNT), Excelerate Energy (EE), Warby

Parker (WRBY), AvidXchange Holdings (AVDX), GCM Grosvenor (GCMG),

SFLoration Ltd (SFL), Fisker (FSR), Xpel (XPEL), Catalyst

Pharmaceuticals (CPRX), Luminar Tech (LAZR), Hillman Solutions

(HLMN), Kodiak Gas Services (KGS), Supernus (SUPN), Target

Hospitality (TH), Taboola (TBLA), ANI Pharma (ANIP), Sphere

Entertainment (SPHR), Ziprecruiter (ZIP), Sterling Check (STER),

Cadre Holdings (CDRE), PDF Solutions (PDFS), Everi Holdings (EVRI),

TTEC (TTEC), Magnite (MGNI).

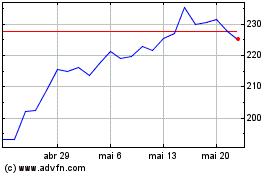

Biogen (NASDAQ:BIIB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Biogen (NASDAQ:BIIB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024