Crypto market reaction to the slowdown of inflation in October

The latest data indicates an unexpected drop in the annual US

inflation rate in October. Contrary to expectations of 3.3%,

inflation came in at 3.2%, showing a reduction compared to

September’s 3.7%. Similarly, core inflation, excluding volatile

food and energy prices, reached 4%, below the forecast of 4.1% and

marginally lower than the September rate. This slight deceleration

in inflationary pressures is a positive signal for the US economy.

In response to these numbers, Bitcoin (COIN:BTCUSD) recorded a

modest increase, rising from $36,300 to $36,600 before stabilizing

around $36,390. Fernando Pereira, an analyst at Bitget, commented

on the current state of the crypto market, predicting a pullback in

prices: “After a lot of excitement in recent weeks, the market

is poised to pull back a bit, a perfectly normal move. I believe

neither BTC nor altcoins will rise much more than they have already

by the end of November. Significant new highs should be a Christmas

gift.“

MOON surges after decentralization announcement

The cryptocurrency MOON (COIN:MOONRUSD), from the Reddit

sr/cryptocurrency community, saw a significant increase of nearly

160% in a day following the announcement of a 34% supply burn and a

shift to full decentralization. The coin reached a peak of

$0.170233 before retracing and is currently trading at $0.167200.

Despite a monthly drop of -29.5%, it recorded a 175% increase in

one week. Reddit plans to burn all MOONs in the Community Tank,

reducing the total supply and making the coin deflationary. The

change aims for complete decentralization, with the moderation team

relinquishing control of the contract. The Reddit community is

discussing the future of MOON, including the distribution of

remaining coins and the use of bots to enhance the cryptocurrency’s

functionality.

Plasma blockchain reformation: Vitalik Buterin’s perspective

In a blog post, Vitalik Buterin, co-founder of Ethereum

(COIN:ETHUSD), revisits and highlights Plasma, a previously

essential scaling solution, powered by technological advancements

in blockchain. Buterin discusses Plasma Cash, which treats coins as

NFTs and uses a sparse Merkle tree. He emphasizes surveillance over

the Plasma operator and the importance of “exit games” for

security. Acknowledging challenges in extending Plasma to the

Ethereum Virtual Machine (EVM), Buterin suggests the use of

ZK-SNARKs for simplification and security. He proposes parallel

UTXO graphs for ETH and ERC20 tokens, aiming for greater

compatibility with the EVM. Buterin believes that, despite rollups

dominating, the renewed Plasma has a significant role in the future

of blockchain, promising faster and more secure transactions.

Animoca Brands boosts Chiliz Chain blockchain as a new validator

Animoca Brands, a renowned venture capital company, joins the

Chiliz Chain blockchain as a validator, strengthening the platform

supporting fan tokens used by major sports teams. This partnership

with Chiliz Chain, known for Socios.com, allows Animoca to

integrate its NFT and gaming expertise into the sports universe.

Animoca co-founder Yat Siu highlights the growth opportunity in the

SportFi sector, aiming to revolutionize fan engagement and

financial dynamics in sports. “We have already seen the rise of

DeFi and GameFi, and we believe SportFi represents the next big

growth area that will redefine fan engagement and create new

financial dynamics in the sports industry,” said Siu.

Circle launches CCTP on the Noble blockchain to facilitate USDC

transfers

Circle will implement its Cross-Chain Transfer Protocol (CCTP)

on the Noble blockchain to simplify transfers of the stablecoin

USDC between supported blockchains. Launched in March 2023, Noble

integrates into the Cosmos ecosystem, allowing users to migrate

USDC easily. CCTP, already operational on networks like Arbitrum

and Ethereum, will be launched on the Noble mainnet on November 28,

promoting greater liquidity and USDC integration into the Cosmos

ecosystem.

dYdX Chain advances to Beta stage on the Cosmos network

dYdX Chain, an independent blockchain based on Cosmos, has

advanced to the Beta stage of mainnet, commencing active trading

operations. The beta launch followed a community vote, with over

99% approval, transitioning from the alpha stage. Users can now

trade on more than 33 perpetual markets, although rewards

distribution is not yet in effect. The beta phase is crucial for

testing the trading environment. dYdX’s transition from an Ethereum

scaling solution to an autonomous Layer 1 on Cosmos is a

significant milestone, highlighting its role as the largest

decentralized cryptocurrency derivatives trading platform.

Crypto.com progresses with partial regulatory license in Dubai

Crypto.com, a renowned cryptocurrency exchange, has obtained a

partial license as a Virtual Asset Service Provider (VASP) from the

Dubai Virtual Assets Regulatory Authority (VARA). The license,

secured by the entity CRO DAX Middle East FZE of the company,

authorizes specific operations in the virtual asset sector. To

achieve full VASP license approval, Crypto.com must meet additional

conditions set by VARA. Once achieved, the company will be able to

provide a full range of regulated digital asset services, including

exchange, brokerage, and investment management. Kris Marszalek, CEO

of Crypto.com, celebrated the milestone, emphasizing the company’s

commitment to compliance and security. “Dubai continues to

demonstrate that it is a leading market by designing effective

regulation for the crypto space while supporting adoption and

innovation“, said Marszalek.

FTX and BlockFi make progress in post-bankruptcy claims resolution

Court-authorized, FTX and BlockFi are advancing in negotiations

to settle post-bankruptcy claims. Judge Michael Kaplan allowed FTX

to proceed with legal actions against BlockFi following the

bankruptcy of both companies in November 2022. Court-ordered

mediation is set to begin by December 24, 2023. BlockFi’s Zac

Prince testified in the trial of Sam Bankman-Fried, the former CEO

of FTX, highlighting the connection between the bankruptcies of the

two companies.

Rise of digital assets in France revealed by OECD study

An OECD study published by the French financial authority shows

that 9.4% of French adults own cryptocurrencies, and 2.8% have

NFTs. Real estate is the most common investment, closely followed

by crypto assets. The research indicates that 24% of adults are

financial investors, with an influx of new investors since 2020,

many drawn to the digital asset sector.

Disney partners with Dapper Labs for a new era of NFTs with Disney

Pinnacle

Disney (NYSE:DIS), known for its innovation and entertainment,

is partnering with blockchain specialist Dapper Labs to explore the

world of NFTs with “Disney Pinnacle,” an app that will offer

collectible digital tokens. This app, initially available to

invited users, will be launched on the Apple App Store and later on

the web and Google Play Store. Dapper Labs, known for projects like

CryptoKitties and NBA Top Shot, is collaborating with Disney to

create NFTs inspired by iconic characters. Dapper Labs CEO Roham

Gharegozlou and Vice President Ridhima Kahn highlight the potential

of NFTs as a bridge to Web3 adoption despite market challenges.

“Digital collectibles based perhaps on the most popular

products of all time… are a path to Web3 technology adoption and

also a way to show people what is possible,” said Gharegozlou.

Disney Pinnacle promises to revitalize interest in NFTs, offering

digital collectibles based on Disney, Lucasfilm, Pixar, and Walt

Disney Animation Studios properties.

Fnality International raises $95 million in funding round

Fnality International, specializing in tokenized cash on

blockchain, has raised $95.2 million in investments led by Goldman

Sachs (NYSE:GS) and BNP Paribas (EU:BNP). Founded in 2019, the

company emerged from a UBS (NYSE:UBS) project, focusing on digital

versions of currencies for payments and digital securities

transactions. The Series B round will support the development of

Fnality’s blockchain payment system. Initially, the system will

operate with the British pound, expanding to other major

currencies. Fnality is also working on the Utility Settlement Coin

project, aiming for efficiency in liquidity management across

multiple currencies. CEO Rhomaios Ram emphasizes the significance

of the investment and the growing optimism in the sector: “It

wasn’t easy to close this round, but the fact that they [investors]

put money in is quite significant. It seems like small pockets of

optimism are emerging, and that’s an indication of that.”

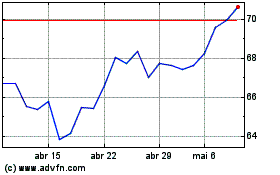

BNP Paribas (EU:BNP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BNP Paribas (EU:BNP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024