In Thursday’s pre-market, United States index futures show mixed

behavior, influenced by positive economic data that suggest a

possible end to the monetary tightening cycle by the Federal

Reserve. Investors are also analyzing recent corporate earnings and

the implications of the meeting between Joe Biden and Xi Jinping

for the markets.

At 6:28 am, Dow Jones futures (DOWI:DJI) rose 3

points, or 0.01%. S&P 500 futures were down

0.02% and Nasdaq-100 futures were down 0.15%. The

yield on 10-year Treasury bonds stood at 4.496%.

In the commodities market, West Texas Intermediate crude oil for

December fell 0.07% to $76.61 per barrel. Brent crude for January

fell 0.05% to close to US$81.14 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, fell 1.53%,

quoted at US$ 133.07 per ton.

On this Thursday’s economic agenda, investors await, at 08:30

am, the release of unemployment insurance claims for the week,

which has a forecast of 220,000 new claims, in addition to import

and export prices and the Philadelphia Fed’s manufacturing index.

Industrial production, which will be released at 09:15 am, is

projected to fall by 0.30% in October. At 10 am, it will be the

turn of the NAHB real estate index, while at 11 am the Kansas Fed

manufacturing index will be released.

Throughout the day, many Fed members speak. At 6 am, Fed

Governor Lisa Cook speaks; at 7:10 am it will be the turn of

Michael Barr, vice president of supervision at the Fed; at 08:30

am, the president of the Cleveland Fed, Loretta Mester, speaks; at

09:25 am, John Williams, president of the New York Fed, speaks; and

at 10:30 am, Fed member Christopher Waller.

During the bilateral meeting between the US and China, Biden and

Xi highlighted the differences between their countries, but

recognized interdependence in areas such as exports, climate

change, trade, and agriculture. At the same time, the approval of

an aid package by the American Legislature, avoiding a government

shutdown, was positively received.

In Asian markets, there was a drop in response to the meeting

between the two largest economies. China, facing a sharp decline in

new housing prices in its major cities in October, announced plans

to inject $137 billion into the property market.

In Europe, with a light economic agenda, investors await

speeches from the president of the European Central Bank, Christine

Lagarde, and vice-president Luis de Guindos that could provide

indications on future monetary policy.

At Wednesday’s close, U.S. stocks were up slightly, driven by

inflation data that suggested the Federal Reserve may not raise

interest rates. The Dow Jones rose 0.47%, while the Nasdaq and

S&P 500 advanced 0.07% and 0.16%, respectively.

Producer price index fell 0.5% in October, after rising 0.4% in

September, in a revision. Output prices were expected to rise 0.1%,

compared to the 0.5% increase originally reported for the previous

month. Retail sales fell slightly in October. Airlines and banking

sectors gained, while oil services and pharmaceutical stocks

fell.

On Thursday’s corporate earnings front, investors will be

watching reports from Alibaba (NYSE:BABA),

Walmart (NYSE:WMT), Macy’s

(NYSE:M), NetEase Games (NASDAQ:NTES),

Bath & Body Works (NYSE:BBWI), Warner

Music Group (NASDAQ:WMG), Williams-Sonoma

(NYSE:WSM), before the market opens. After the closing, reports

from Applied Materials (NASDAQ:AMAT),

Ross (NASDAQ:ROST), Gap

(NYSE:GPS), Dolby (NYSE:DLB), among others, will

be expected.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – US lawmakers questioned

Apple over the abrupt cancellation of Jon Stewart’s show,

suspecting Chinese influence. The show’s end, cited as being caused

by creative differences, raises questions about the censorship of

content critical of the Chinese government.

Microsoft (NASDAQ:MSFT) – Microsoft is

launching two custom chips for AI and cloud services, focusing on

optimizing costs and efficiency. The Maia and Cobalt chips, not

intended for sale, aim to leverage Microsoft’s software and compete

with Amazon Web Services (NASDAQ:AMZN).

Meta Platforms (NASDAQ:META) – TikTok,

following Meta, has appealed against its “gatekeeper” designation

under the EU Digital Markets Law, which imposes stricter rules on

big tech companies. Meta contested for its Messenger and

Marketplace platforms, but not for Facebook, Instagram, and

WhatsApp. TikTok argues that its designation as a gatekeeper may

protect incumbents rather than promote competition, highlighting

its position as a challenger in the European market.

Spotify (NYSE:SPOT), Alphabet

(NASDAQ:GOOGL) – Spotify is expanding its collaboration with Google

Cloud, applying advanced language models to personalize podcast and

audiobook recommendations. Aiming to innovate in non-musical

content, the company is betting on AI to improve the listening

experience and safety.

Intel (NASDAQ:INTC) – Intel board member Lip-Bu

Tan repurchased shares of the company, acquiring 66,000 shares at

prices between $37.77 and $37.95 on November 9, totaling about $

$2.5 million. This purchase follows a previous $2.9 million

acquisition last November. Additionally, Mizuho analyst Vijay

Rakesh upgraded Intel shares to “Buy,” highlighting potential

catalysts for further upside after a 54% rally this year. Rakesh

highlights opportunities with new server products and expectations

for Intel’s foundry business. He anticipates 2024 as a significant

year of launches, with products such as Sierra Forest and Granite

Rapids. His price target for the stock was raised to $50.

Adobe (NASDAQ:ADBE) – Adobe, known for

Photoshop, anticipates an EU antitrust warning over its proposed

$20 billion acquisition of Figma, a cloud-based design platform.

Its chief advisor expressed willingness to discuss solutions to

regulatory issues, with a view to approving the agreement.

Sonos (NASDAQ:SONO) – Sonos is laying off

employees in its product development department to focus on

launching headphones. Maxime Bouvat-Merlin, product director,

reported on the cuts after the company faced a 6% drop in annual

sales.

Disney (NYSE:DIS) – ValueAct Capital has

acquired a substantial stake in Walt Disney, anticipating that the

media and entertainment company’s shares could nearly double.

Having known the Disney team for more than a decade, ValueAct

collaborates with management while growing its ownership. The news

comes as Disney faces challenges such as declining advertising

revenue and still-unprofitable streaming. ValueAct could become a

preferred director, providing advice on business reform and

silencing investor criticism.

General Motors (NYSE:GM) – gigacasting

specialist TEI was acquired by GM in 2023, strengthening its

strategy against Tesla (NASDAQ:TSLA). While Tesla

depends on other suppliers and seeks internal expertise, GM

integrates this exclusive technology, aiming for efficiency and

reduced costs in car manufacturing. In other news, GM’s interim

labor agreement with the UAW is close to ratification after

majority support in Arlington, Texas. The vote, which will

determine the first agreement by April 2028 with a Detroit

automaker, shows a favorable trend despite votes against it at

other factories.

Toyota Motor (NYSE:TM) – In 2025, the Toyota

Camry will be exclusively hybrid, with a 2.5-liter engine and

electric drive, aiming to lead in the US market. The change

reflects Toyota’s commitment to fuel efficiency and improved

performance while aligning with stricter environmental

regulations.

Tesla (NASDAQ:TSLA) – A US federal appeals

court ruled that Tesla did not violate labor laws by banning

pro-union t-shirts at its Fremont, California factory. Tesla,

requiring company uniforms but allowing union stickers, was found

to be in compliance with the law. On the other hand, Swedish unions

are pushing Tesla for a collective bargaining agreement, supporting

the mechanics’ strike. Around 130 mechanics went on strike, with

dockworkers and dealerships also refusing to handle Tesla products.

Workers at Hydro Extrusions plan to strike, intensifying

pressure.

Goodyear Tire & Rubber (NASDAQ:GT) –

Richard Kramer, CEO of Goodyear Tire & Rubber Co since 2010,

has announced his retirement next year, coinciding with the company

unveiling plans to streamline operations. Goodyear, which recently

struck a deal with activist investor Elliott, is considering

candidates to replace him. The company also plans to restructure,

including selling its chemicals business and the Dunlop brand,

aiming to double the segment’s operating margin by the end of

2025.

Exxon Mobil (NYSE:XOM) – Exxon Mobil announced

it will host a conference call on December 6, with presentations

from CEO Darren Woods and Chief Financial Officer Kathy Mikells.

The presentation will be made available on the Exxon website prior

to the conference.

BP (NYSE:BP) – Petrol Ofisi, a subsidiary of

Vitol, has agreed to purchase BP’s gas station operations in

Turkey, expanding its leadership in the country’s supply network.

Vitol’s Turkish network will increase by 770 stations to more than

2,700 locations. The deal, pending regulatory approval in 2024,

also includes BP’s stake in the ATAS oil terminal. Financial terms

were not revealed.

Goldman Sachs (NYSE:GS) – Goldman Sachs

strategists predict the S&P 500 (SPI:SP500) will reach 4,700 by

the end of 2024, an increase of approximately 6% with dividends.

Based on modest economic growth, earnings increased by 5% and a

valuation ratio of 18, expect a stable market in the first half,

with gains following interest rate cuts by the FED and the end of

the US election cycle.

UBS (NYSE:UBS) – France’s top court has ordered

a new trial to reassess the $1.95 billion fine imposed on UBS for

illegal banking practices and money laundering. While maintaining

the bank’s guilt, the court demands a new trial at the Paris

appeals court to determine an appropriate fine, following correct

legal procedures.

Barclays (NYSE:BCS) – Barclays warns that SEC

reform to increase central clearing of U.S. Treasury securities

could elevate cybersecurity risks. The proposal, which would expand

the use of the Fixed Income Clearing Corporation, creates a

potential risk of single-point failure, exacerbated by recent cyber

attacks such as the ICBC incident, increasing the systemic

vulnerability of the market.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway sold its shares in General Motors

(NYSE:GM), Johnson & Johnson (NYSE:JNJ), and

Procter & Gamble (NYSE:PG), and reduced its

stake in Amazon (NASDAQ:AMZN), accumulating a

record US$157.2 billion in cash. Additionally, it sold stakes in

Celanese (NYSE:CE), Mondelez

International (NASDAQ:MDLZ), and UPS

(NYSE:UPS), acquiring a new position in Atlanta Braves Holdings

(NASDAQ:BATRK). The net sales contributed to Berkshire’s cash

boost, roughly equivalent to its stake in Apple

(NASDAQ:AAPL).

Blackstone (NYSE:BX) – Blackstone is finalizing

the raising of approximately US$400 million for its Blackstone

Private Credit Fund, aiming to improve its investment

opportunities. Blackstone plans to raise funds through

collateralized loan securities secured by loans from its $52

billion core fund. The strategy includes selling BCRED loans to the

CLO, increasing its competitiveness in the market.

Catalent (NYSE:CTLT) – Catalent anticipates

that its prefilled syringe production capacity will soon be

exhausted by fiscal 2026 due to high demand for new weight loss

drugs. The company, which fills self-injection pens for

Novo Nordisk ‘s Wegovy (NYSE:NVO), is expanding

rapidly due to the success of drugs in the GLP-1 class. Catalent

plans to accelerate investments in facilities in the US and Italy

in anticipation of a significant increase in revenue from these

medicines. Catalent shares were upgraded from Neutral to Outperform

by Baird, which highlighted the attractiveness of the stock’s

valuation, as reported by The Fly. The pharmaceutical company saw

its shares rise 11% on Wednesday despite reporting a loss of $3.94

per share in the fiscal first quarter and a drop in revenue.

Yum China (NYSE:YUMC) – Yum China announced

plans on Thursday to repurchase shares in the US and Hong Kong

markets totaling US$750 million in 2024. This move is part of a

broader effort to return US$3 billion to shareholders through

buybacks between 2024 and 2026. The company’s shares are down 16%

year-to-date, in contrast to the S&P 500’s 17% gain.

Diageo (NYSE:DEO) – Debra Crew, CEO of Diageo,

expressed uncertainty about when the company will resolve inventory

issues in Latin America that have negatively impacted profits.

Following an unexpected profit warning that sent the company’s

shares down 16%, the world’s largest spirits maker faces challenges

with visibility into inventory levels in the region. Crew cited

efforts to overcome the disruption, including retail activities

during the holiday season.

Earnings

Cisco Systems (NASDAQ:CSCO) – Cisco Systems’

stocks experienced nearly an 11% drop in pre-market trading on

Thursday due to the digital communications company providing

outlooks for the current quarter and the full year that fell short

of expectations. For the second quarter, Cisco expects revenues

between $12.6 billion and $12.8 billion, below analysts’ estimates

of $14.19 billion. This shifted the focus away from Cisco’s strong

performance in the first fiscal quarter, where the company

surpassed the average forecasts of analysts polled by LSEG in both

metrics. Excluding items, Cisco earned $1.11 per share in the first

quarter, exceeding estimates of $1.03.

Palo Alto Networks (NASDAQ:PANW) – Shares of

Palo Alto Networks, a cybersecurity company, dropped 5.7% in

pre-market trading. Although the company reported

better-than-expected earnings and provided a solid profit outlook

for the second fiscal quarter and the full year, it issued a

revenue forecast below what analysts were expecting for the current

quarter. Additionally, Palo Alto revised its revenue projections

for the full year downwards. For fiscal year 2024, Palo Alto stated

it expects revenues of $10.7 billion to $10.8 billion, representing

a 16% to 17% increase from the previous year but falling short of

the consensus estimate of $10.96 billion.

Maxeon Solar Technologies (NASDAQ:MAXN) –

Maxeon Solar Technologies’ shares fell 6.6% in pre-market trading

after reporting a larger-than-expected loss in the third quarter.

Maxeon reported a loss of $2.21 per share during the quarter, a

surprising figure compared to the average per-share loss estimate

of 91 cents, according to analysts polled by FactSet. Although the

solar company exceeded analysts’ revenue expectations for the

quarter, it provided a weaker-than-expected revenue forecast for

both the current quarter and the full year.

Aegon (NYSE:AEG) – Dutch insurer Aegon raised

its capital generation forecast for 2023 following strong results

in the third quarter, particularly in the United States. The

company is focused on its U.S. operations and expects to generate

approximately $1.3 billion in operational capital this year, ahead

of its 2025 target.

Gambling.com (NASDAQ:GAMB) – Despite

Gambling.com, a gambling services evaluation website, surpassing

expectations in both metrics for the third quarter, the company

chose not to revise its projections for the full year. In the

quarter, the company’s adjusted earnings before interest, taxes,

depreciation, and amortization reached $6.1 million, slightly below

the average forecast of $6.2 million made by analysts polled by

FactSet.

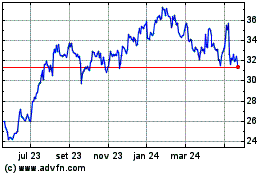

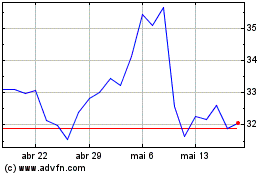

Warner Music (NASDAQ:WMG)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Warner Music (NASDAQ:WMG)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025