Home Depot’s Q4 Sales Dip Amid Rising Mortgage Rates and Inflation Pressures

20 Fevereiro 2024 - 8:57AM

IH Market News

Home Depot (NYSE:HD) experienced a decline in sales during the

fourth quarter as the leading home improvement retailer in the

country dealt with the repercussions of elevated mortgage rates and

inflation affecting its clientele.

Although the quarterly outcomes surpassed the expectations set

by Wall Street, the company’s projected sales for the upcoming year

put early pressure on its stock value.

The stock value dipped over 3% prior to Tuesday’s market

opening. Competitor Lowe’s, set to announce its fourth-quarter

earnings the following week, saw a decrease of over 2%.

Home Depot disclosed a fourth-quarter revenue of $34.79 billion,

a drop from the $35.83 billion reported in the same period the

previous year. However, this figure still exceeded the $34.55

billion anticipated by analysts according to Zacks Investment

Research.

Comparable store sales, a crucial measure of a retailer’s

performance, decreased by 3.5%. Specifically, in the U.S.,

comparable store sales saw a 4% reduction.

CEO Ted Decker remarked in a statement, “Following three years

of remarkable growth for our business, 2023 was a year of scaling

back.”

The past week saw the average long-term mortgage rate in the

U.S. escalate to its peak in 10 weeks. Freddie Mac, a mortgage

purchaser, reported that the rate for a 30-year mortgage climbed to

6.77% from 6.64% the previous week. This rate was at an average of

6.32% a year earlier.

This rise mirrors the trends in the 10-year Treasury yield,

which is a benchmark for loan pricing by lenders. Unexpectedly high

inflation reports, a robust job market, and the general economic

vigor have heightened concerns that the Federal Reserve might

postpone the reduction of interest rates.

An increase in mortgage rates can significantly raise the

monthly expenses for homeowners, thereby limiting their purchasing

power in an already challenging market for many Americans. It also

deters homeowners who secured extremely low rates a couple of years

ago from putting their properties on the market. The current

average rate for a 30-year mortgage is significantly higher than

the 3.92% observed just two years back.

In the quarter ending January 28, Home Depot Inc. reported

earnings of $2.8 billion, or $2.82 per share, down from the $3.36

billion, or $3.30 per share, earned the previous year.

This performance exceeded the Wall Street projection of $2.77

per share.

Home Depot forecasts a sales growth of approximately 1% for

fiscal 2024, including an additional 53rd week. The company expects

a nearly 1% decline in comparable store sales over the 52-week

span.

Furthermore, the company announced on Tuesday a 7.7% increase in

its quarterly dividend, raising it to $2.25 per share.

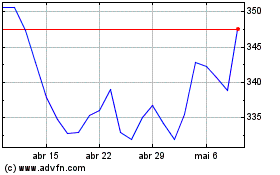

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024