U.S. Futures Climb in Pre-Market Trading Amid Tech Gains and Upcoming Inflation Data

26 Abril 2024 - 8:47AM

IH Market News

U.S. futures indicate a rise in pre-market trading this Friday,

pointing to a recovery following significant declines on Thursday.

This advance is partly due to impressive results from technology

companies Alphabet (NASDAQ:GOOGL) and

Microsoft (NASDAQ:MSFT), and comes in anticipation

of new inflation data to be released.

At 06:37 AM, the Dow Jones Industrial Average futures (DOWI:DJI)

were up 38 points, or 0.10%. S&P 500 futures advanced 0.70%,

and Nasdaq-100 futures gained 1.01%. The yield on 10-year Treasury

notes was at 4.694%.

In the commodities market, West Texas Intermediate crude for

June was up 0.47%, at $83.96 per barrel. Brent crude for June rose

0.45%, near $89.41 per barrel. Iron ore traded on the Dalian

exchange was up 0.06%, at $122.05 per metric ton.

On Friday’s economic calendar, the U.S. Commerce Department will

publish the PCE index, which measures individual expenditures,

along with personal income and spending data for March, at 08:30

AM. The LSEG consensus estimates a monthly increase of 0.3% and an

annual rise of 2.6%. Later, at 10:00 AM, the revised

Michigan/Reuters consumer sentiment index for April, a

collaboration between the University of Michigan and Thomson

Reuters, will be released.

European markets are on the rise, recovering after a pullback in

the previous session. Shares in the technology and construction

sectors are leading the gains, with increases of 1.6% and 1.48%,

respectively. In contrast, the chemical and insurance sectors are

showing more modest performances, with declines of less than 1%

each.

Asian markets displayed mixed movements in response to regional

economic events. Japan’s Nikkei rose by 0.81%, while the Shanghai

SE in China was up 1.17%. In contrast, Australia’s ASX 200 fell by

1.39%. These fluctuations were influenced by the Bank of Japan’s

decision to maintain interest rates and a slowdown in inflation in

Tokyo.

After an initial significant drop, U.S. stocks recovered some of

their losses throughout the day, ending lower on Thursday. The

decline in shares of Meta Platforms (NASDAQ:META),

which plummeted by 10.6%, negatively impacted the market.

Additionally, economic data indicated slowing growth and persistent

inflation. U.S. GDP growth was at 1.6%, below expectations, and the

personal consumption expenditures price index rose by 3.4%. The Dow

Jones fell by 0.98%, while the S&P 500 and Nasdaq retreated by

0.46% and 0.64%, respectively.

In the quarterly earnings front, reports are scheduled from

Exxon Mobil (NYSE:XOM), Chevron

(NYSE:CVX), Abbvie (NYSE:ABBV),

Colgate-Palmolive (NYSE:CL), HCA

Healthcare (NYSE:HCA), Charter

Communications (NASDAQ:CHTR), ACM

Research (NASDAQ:ACMR), Autoliv

(NYSE:ALV), Centene Corporation (NYSE:CNC), and

Ball Corporation (NYSE:BALL).

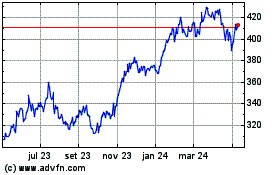

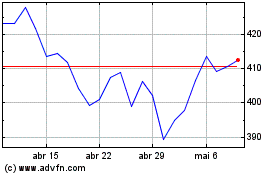

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024