Earnings

Nvidia (NASDAQ:NVDA) – Nvidia’s earnings,

viewed as a barometer for the growing AI industry, will be released

after the market closes on Wednesday. The results will also serve

as a critical indicator for the US stock market, which has reached

record highs. Analysts estimate that Nvidia will report earnings

per share of $5.17 on total revenue of $24.65 billion, representing

increases of 630% and 343%, respectively, compared to the same

quarter last year. Net income is anticipated to be $12.87 billion,

compared to $2.04 billion in the same quarter last year. Nvidia

shares have risen 90% this year, making it the third largest US

company by market value, behind only Microsoft and Apple.

Target (NYSE:TGT) – The American department

store chain will report results shortly before the market opens.

Analysts project earnings of $2.06 per share for the quarter, with

total revenue of $25.42 billion.

XPeng (NYSE:XPEV) – Shares of the Chinese

electric vehicle manufacturer jumped 1.6% after it announced

revenue growth in its R&D services for Volkswagen and expressed

optimism about its autonomous driving technology goals. XPeng also

announced that its EV MONA will be on sale next month. In the first

quarter, the company highlighted that R&D services doubled

their revenue to 1 billion yuan, or approximately $138 million. The

company’s gross margin also rose to 12.9%, compared to 1.7% the

previous year and 6.2% in the last quarter. Additionally, XPeng

projected an increase in deliveries for the second quarter between

25% and 38% year-over-year.

XP Inc (NASDAQ:XP) – In the first quarter, XP

reported earnings per share of 37 cents, below the estimates of 40

cents per share. Revenue was $818.80 million, surpassing estimates

of $784.08 million by 4.43%. Shares are stable.

Urban Outfitters (NASDAQ:URBN) – The fast

fashion retailer’s shares rose 7.33% after posting adjusted

earnings of 69 cents per share on revenue of $1.2 billion, beating

analysts’ expectations of 52 cents per share on revenue of $1.18

billion.

Toll Brothers (NYSE:TOL) – The home financing

company beat second-quarter estimates with earnings of $4.55 per

share, and total revenue of $2.65 billion. Analysts’ forecasts were

earnings of $4.14 per share and revenue of $2.53 billion.

Modine Manufacturing (NYSE:MOD) – Shares of the

thermal management company fell 9.15% pre-market after it posted

fourth-quarter revenue of $603.5 million, slightly below analysts’

expectations of $605.4 million. Earnings per share were $0.77,

above estimates of $0.76. Modine projected fiscal year 2025

earnings per share between $3.55 and $3.85, compared to analysts’

average estimate of $3.80. Additionally, the company expects net

sales growth of 5% to 10% and adjusted EBITDA growth between 16%

and 22%, resulting in an adjusted EBITDA range of $365 million to

$385 million.

Viasat (NASDAQ:VSAT) – Shares of the military

and commercial communications company plunged about -11.62% after

Viasat reported a loss of 80 cents per share in the last fiscal

quarter, on revenue of $1.15 billion. The result was worse than

analysts’ estimates of a loss of 63 cents per share. Revenue,

however, exceeded expectations of $1.09 billion.

Corporate highlights on Wall Street today

Citigroup (NYSE:C) – UK regulators fined

Citigroup approximately $78.5 million for failures in its trading

systems and controls. The fine relates to incidents including a

trader error in 2022 that resulted in an accidental $1.4 billion

sell-off on European exchanges.

Goldman Sachs (NYSE:GS) – According to Goldman

Sachs, the dollar could remain stronger for longer if the Federal

Reserve keeps interest rates steady while other countries reduce

borrowing costs. Analysts foresee interest rate cuts in Canada, the

UK, and the eurozone in June, which could further strengthen the

dollar.

Bank of America (NYSE:BAC) – Bank of America

maintains its optimistic view of the Indian rupee despite increased

volatility due to elections. The rupee’s implied volatility and

distortions in options markets reflect electoral risks, but the

currency remains stable, signaling that the central bank will

protect against sharp moves after the election results.

Barclays (NYSE:BCS) – Barclays is considering

requiring employees to return to the office five days a week due to

new remote work supervision rules from US regulators.

First Solar (NASDAQ:FSLR) – On Tuesday, UBS

stated that First Solar would benefit from increased electricity

demand driven by AI. Analysts raised the stock’s price target from

$252 to $270, maintaining a buy rating. Analysts argued that tech

companies like Amazon and Google use more electricity due to AI,

increasing demand for renewable energy.

Visa (NYSE:V), Mastercard

(NYSE:MA) – The UK payment regulator criticized Visa and Mastercard

for raising their fees without significant service improvements.

These increases, totaling more than 30% adjusted for volume over

the past five years, do not correspond to service quality

improvements. The PSR warned of the lack of effective competition,

impacting costs evaluated at $317.78 million annually for UK

businesses, and proposed measures for greater transparency and

oversight.

Apple (NASDAQ:AAPL) – Apple on Tuesday asked a

federal judge in New Jersey to dismiss an antitrust lawsuit filed

by the Department of Justice and 15 states. The lawsuit accuses

Apple of monopolizing the smartphone market, harming competitors

and raising prices. Apple argues it faces intense competition and

denies being able to impose excessive prices or restrict

production.

Snowflake (NYSE:SNOW) – Cloud computing company

Snowflake failed to acquire the startup Reka AI for over $1

billion, frustrating Snowflake’s effort to strengthen its

generative AI capabilities.

Sonos (NASDAQ:SONO) – The electronics

manufacturer is launching its first pair of headphones, the Sonos

Ace, for $449, entering the consumer technology market. The

over-ear model will compete with Apple, Sony, and Bose, standing

out for its audio performance and integration with other Sonos

products. Sales begin on June 5.

Mercado Libre (NASDAQ:MELI) – The e-commerce

and fintech giant is negotiating with Mexican authorities to obtain

a banking license, aiming to expand its products in the country.

According to Osvaldo Gimenez, president of Mercado Pago, the formal

process will begin soon and is expected to last 12 to 24

months.

Amazon (NASDAQ:AMZN) – Amazon’s cloud services

unit, AWS, clarified on Tuesday that it did not cancel orders for

Nvidia’s Grace Hopper chip but opted to use Nvidia’s latest

Blackwell chip for a supercomputer project in collaboration with

the company. The transition was decided jointly to leverage

performance improvements in Project Ceiba while maintaining other

services on the Hopper chip.

Walt Disney (NYSE:DIS) – Pixar Animation

Studios, a Disney unit known for “Toy Story” and “Up,” began

layoffs that will cut 14% of its staff to reduce streaming series

development. About 175 employees will be affected.

eBay (NASDAQ:EBAY) – Japan’s Rakuten Group is

collaborating with eBay to assess US demand for used Japanese

fashion, benefiting from the weak yen. The partnership, which began

on May 8 with seven sellers from Rakuma, Rakuten’s second-hand

goods unit, explores the growing interest in bargains amid global

economic constraints. eBay handles shipping and customer service in

the US, charging commissions on sales.

Uber Technologies (NYSE:UBER),

Lyft (NASDAQ:LYFT) – The California Supreme Court

is reviewing whether a voter-approved measure, Proposition 22, is

constitutional. This proposal allows companies like Uber and Lyft

to classify their drivers as independent contractors rather than

employees, excluding them from certain labor benefits. The case was

brought by the SEIU and four drivers, challenging the measure’s

legality.

Toyota Motor (NYSE:TM) – Toyota Motor is

seeking tax incentives for a $531.7 million investment in its Texas

facilities, where it produces Tundra and Sequoia models. The

project aims to build a new building, create 411 jobs, and expand

the San Antonio plant, which has received $4.2 billion in

investments since 2003.

Stellantis (NYSE:STLA) – Stellantis plans to

offer electric vehicles developed with Zhejiang Leapmotor

Technologies in South America, including Brazil, following a

manufacturing and sales agreement outside China. The Betim plant in

Brazil will expand its capacity to 1.1 million engines annually

with an initial investment of R$ 454 million ($88.9 million).

Regarding the European market, Stellantis CEO Carlos Tavares

foresees intense competition with Chinese manufacturers,

anticipating significant social consequences. Tavares criticized

tariffs on Chinese vehicles as counterproductive, arguing they will

not prevent the need for restructuring in Western automakers and

will only inflate prices, exacerbating inflation.

Faraday Future Intelligent Electric

(NASDAQ:FFIE) – The smart electric vehicle startup had a

spectacular increase without apparent reason during last week’s

“meme stock” rally. Without justifiable fundamentals, the shares

soared 367.5% on May 14, with gains of 147.2% and 134% in the

following days. The stock price rose 8,359.9% in one week.

Boeing (NYSE:BA) – NASA has once again

postponed Boeing’s Starliner crewed capsule flight, previously

scheduled for May 25, due to a helium leak in the propulsion

system. The next launch date is still under discussion. This latest

delay follows the discovery of additional problems with the Atlas

rocket used in the mission. In Canada, Boeing announced an

investment of about $176 million in three aerospace development

projects following an agreement with Ottawa for Poseidon

surveillance aircraft. The projects include aerospace innovation,

air taxis, and landing gear research in Quebec.

American Airlines (NASDAQ:AAL) – A US appeals

court on Tuesday reinstated a class action lawsuit by American

Airlines pilots, who argue that the company failed to pay for

short-term military leaves. The court highlighted that these leaves

could be equated with paid jury duty or bereavement leaves, setting

a precedent for potential compensation for the pilots.

PepsiCo (NASDAQ:PEP) – PepsiCo announced on

Tuesday the expansion of its electric fleet in California, adding

50 Tesla Semi trucks and 75 Ford E-Transit vans. This initiative,

partially funded by California state agencies, aims to accelerate

the electrification of its service operations and contribute to its

goal of net-zero emissions by 2040. In 2017, PepsiCo made the

largest vehicle order of the time, acquiring 100 Tesla Semis, but

by April, it was only using 36.

Haemonetics (NYSE:HAE) – The blood and plasma

supply and services company saw its stock price decrease by 8%

after announcing a proposal for a $525 million private offering of

senior convertible notes. These notes would mature in 2029 and be

available only to qualified institutional buyers.

Caterpillar (NYSE:CAT) – The leading

manufacturer of construction, mining, and engine equipment agreed

to pay $800,000 to resolve allegations of hiring discrimination

against Black applicants in Illinois. The settlement includes back

wages, employment for 34 eligible individuals, ensuring

non-discriminatory hiring policies, and providing employee

training. The case involved 60 Black applicants.

General Electric (NYSE:GE) – GE Aerospace CEO

Larry Culp announced on Tuesday the hiring of 900 engineers in 2024

to drive next-generation technologies and support existing engine

programs. The hiring aims to strengthen current programs and

innovate. The hires will be global, but the majority are expected

in the US.

TotalEnergies (NYSE:TTE) – French President

Emmanuel Macron stated that France supports companies that believe

in the country, responding to discussions about TotalEnergies

considering a US listing. Macron highlighted the importance of

TotalEnergies, a major oil company and a pillar of the CAC 40

index, remaining in France, emphasizing its role as a significant

employer and influencer in the country.

Shell (NYSE:SHEL) – Shell shareholders on

Tuesday rejected a climate resolution from an activist group,

receiving only 18.6% of the votes amid protests. Shell weakened its

2030 carbon reduction target, prioritizing profitable oil and gas

operations despite pressure to align its goals with the Paris

Agreement.

Hess (NYSE:HES) and Chevron

(NYSE:CVX) – Oil producer Hess faces three lawsuits over alleged

failures in disclosures related to its sale to Chevron. Chevron

seeks to acquire Hess for $53 billion to access oil fields in

Guyana, but the deal, still pending regulatory approval, faces

obstacles, including litigation and a conflict with Exxon Mobil.

Hess shareholders are set to vote on May 28.

BHP Group (NYSE:BHP) and Anglo

American (LSE:AAL) – The deadline for BHP to make a new

offer to buy Anglo American Plc or drop the acquisition is this

Wednesday. The $43 billion proposal would create a global copper

giant. Anglo has already rejected two offers.

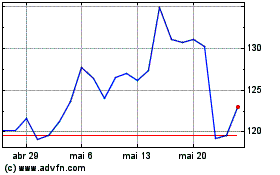

Toll Brothers (NYSE:TOL)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Toll Brothers (NYSE:TOL)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024