Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group’s stocks fell by 6.1% in

pre-market trading after Donald Trump’s conviction for falsifying

documents to silence a porn star before the 2016 elections.

Sentencing is scheduled for July 11.

UBS Group (NYSE:UBS) – UBS has reshuffled its

senior management, splitting the wealth management role between two

executives seen as potential successors to CEO Sergio Ermotti.

Ermotti expressed a desire to increase the chances of an internal

successor when he steps down in 2026 or 2027.

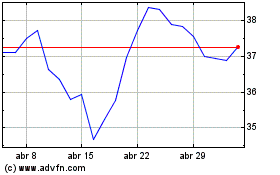

Bank of America (NYSE:BAC) – Bank of America’s

investment bank fees are expected to increase by 10% to 15% in the

second quarter, according to CEO Brian Moynihan. Trading revenues

will also grow, with equities driving performance.

Blackstone (NYSE:BX) – Blackstone has agreed to

acquire 55.1% of Infocom Corp. (USOTC: IFFOF), a Japanese provider

of electronic comics, for about $1.66 billion. Blackstone may seek

to acquire all shares subsequently.

KKR & Co (NYSE:KKR) – KKR has received

antitrust approval from the EU to acquire up to $24 billion of

Telecom Italia, marking the first sale of the fixed network of a

former telephone monopoly in Europe. The European Commission

concluded that the deal would not significantly affect competition.

KKR has committed to maintaining Telecom Italia’s existing

contracts with rivals, soothing EU concerns and allowing the deal

to be finalized soon.

US Steel Corp (NYSE:X) – The US Steel Corp and

Nippon Steel merger has received global regulatory approvals,

except in the US, where it faces political obstacles. The union and

the US government have expressed concerns. Nippon has agreed to

honor unionagreements and relocate its headquarters to Pittsburgh.

The completion of the deal is expected in the second half of this

year.

Apple (NASDAQ:AAPL) – Apple plans a revamp of

Siri, allowing greater voice control of apps. With a more advanced

AI approach, users will be able to execute specific functions. The

initiative, part of a broader AI strategy, will be unveiled at the

Worldwide Developers Conference and includes voice transcripts,

automatic replies, and other enhancements for iPhone, iPad, and

Mac. In other Apple-related news, a Chinese court dismissed a

lawsuit against App Store fees, claiming the company did not abuse

its dominant status. This represents relief for the company, which

faces global scrutiny. The decision is part of complex legal

battles in different regions, including the US and Europe.

Nvidia (NASDAQ:NVDA) – At Computex 2024 in

Taipei, business leaders like Nvidia’s Jensen Huang, and others

from the tech industry will gather to discuss the future of

computing and artificial intelligence (AI). They are expected to

share product advancements and discuss collaborations to address

challenges, especially related to AI.

Nvidia (NASDAQ:NVDA), Advanced Micro

Devices (NASDAQ:AMD) – US authorities are reviewing export

licenses for AI chips to the Middle East, delaying approvals for

Nvidia and AMD. Concerns about national security and control of

advanced technology are leading to a review, as countries like the

UAE and Saudi Arabia seek to import in large volume.

Alphabet (NASDAQ:GOOGL) – Google and augmented

reality startup Magic Leap are forming a strategic partnership to

build immersive experiences. The collaboration suggests a potential

return for Google to the augmented and virtual reality market,

currently dominated by Meta and Apple. Additionally, Google is

investing $2 billion in Malaysia to build its first data center and

Google Cloud region in the country, boosting local digital

ambitions. With the expansion, Google aims to strengthen

technological infrastructure and promote innovation in the

Southeast Asian region.

Meta Platforms (NASDAQ:META) – Meta has

revamped its strategy to attract younger users, adjusting the

Facebook algorithm to recommend a wider variety of external

content. This change has driven growth in the user base in the US

and Canada, even amidst competition from TikTok.

Amazon (NASDAQ:AMZN) – CNBC reported that

Twitch, an Amazon subsidiary, is expanding its safety advisory

council, including members from the “Twitch Ambassadors” community

who contribute positively. Started in 2020, the council provides

guidance to improve online safety. Previous contracts will be

terminated to make room for new perspectives. Additionally, Amazon

has expanded its partnership with Grubhub in the US, allowing

customers to place orders directly through the shopping app and

website. Prime members remain eligible for a free subscription to

Grubhub+, reinforcing the benefits of Amazon’s loyalty program.

Furthermore, Amazon has received approval to expand the reach of

its Prime Air drone program in the US, enabling deliveries beyond

the line of sight of pilots. This authorization will enhance

delivery efficiency, allowing more customers to benefit from the

service. The expansion will begin in College Station, Texas.

Paramount Global (NASDAQ:PARA) – Skydance Media

has presented an improved offer for a merger with Paramount Global,

offering better terms and more cash to shareholders. Specific

details have not been disclosed. Meanwhile, Sony Pictures

Entertainment (NYSE:SONY) and Apollo Global

Management (NYSE:APO) have backed away from an initial $26

billion cash offer.

Sony (NYSE:SONY) – Sony sees the anime

streaming service Crunchyroll as a growth catalyst for Sony

Pictures Entertainment (SPE), leveraging the global rise of anime.

With expansion plans in Asia and India, Crunchyroll aims to

capitalize on the growing anime market, projected to double by

2030. Meanwhile, Sony emphasized user engagement to drive

continuous revenue in its gaming business as PlayStation 5 sales

slow down. Users are spending more on content and services like

PlayStation Plus, ensuring a steady revenue base. The company plans

for a continuous game pipeline.

Flutter Entertainment (NYSE:FLUT) – Paul

Edgecliffe-Johnson has stepped down as CFO of Flutter

Entertainment, replaced by Rob Coldrake, who will focus on the US

market. The change reflects the growing importance of this market

for the company. Flutter faces challenges, including lawsuits and

regulatory changes, impacting its stock performance.

Palantir Technologies (NYSE:PLTR) – Palantir

has won a $480 million contract from the US Department of Defense

for the Maven Smart System, a prototype aimed at accelerating the

work of military intelligence analysts by collecting and analyzing

data from various sources. AI-assisted target identification has

sparked controversy in the technology sector.

STMicroelectronics NV (NYSE:STM) –

STMicroelectronics, a global semiconductor manufacturer, will

invest about $5.4 billion in a chip factory in Catania, Italy, with

€2 billion subsidized by the Italian government under the EU Chip

Law. The factory, specialized in silicon carbide, will meet the

growing demand driven by the global shortage during the

pandemic.

Walmart (NYSE:WMT) – Bloomberg reported

Walmart’s efforts to improve working conditions and technology.

Walmart managers have seen significant changes in their

compensation, reflecting a policy redesign after Walmart lagged

behind in employee retention. With stock grants and bonuses,

salaries can reach up to $530,000 annually.

Nike (NYSE:NKE) – Nike has laid off employees

from its Archives Department, part of a multi-year cost-cutting

plan. This department maintains over 200,000 shoes and historical

artifacts. The move comes as part of a plan to reduce costs by $2

billion. About 750 employees have been affected so far.

VF Corp. (NYSE:VFC) – VF Corp. has announced

the appointment of Michelle “Sun” Choe as global president of the

Vans brand, scheduled to start at the end of July. Previously, Choe

served as the product director at Lululemon Athletica.

WeWork (NYSE:WE) – A bankruptcy judge has

approved WeWork’s Chapter 11 restructuring plan, allowing the

company to eliminate $4 billion in debt and hand control to

creditors and Yardi. WeWork is set to emerge from bankruptcy

debt-free soon after negotiating significant rent cost reductions.

Despite rapid growth, the company has faced challenges, including

losses and corporate governance issues.

PepsiCo (NASDAQ:PEP) – Frito-Lay, a subsidiary

of PepsiCo, plans to lay off nearly a third of its workforce at the

Middletown, NY factory. The 88 layoffs, representing one-third of

the employees, will begin in August.

Tyson Foods (NYSE:TSN) – Tyson Foods vehemently

denied allegations of discrimination made by America First Legal,

led by former Trump administration officials. Allegations of

favoritism toward immigrants and hiring minors were refuted,

emphasizing the legal requirement for all authorized employees in

the US.

Mondelez International (NASDAQ:MDLZ) – Mondelez

has resumed Oreo cookie production in Ukraine following damage from

the Russian invasion. The factory in Trostyanets has been rebuilt

and does not export to Russia. The company aims to make its Russian

operations self-sufficient by 2023 and continues to invest in

Ukraine.

Tesla (NASDAQ:TSLA) – Tesla is preparing to

register its ‘Full Self-Driving’ software in China and considering

offering it as a monthly subscription. This marks a new revenue

strategy for the company as it faces sales and competition

challenges in a crucial market. Meanwhile, ISS recommended voting

against Tesla CEO Elon Musk’s $56 billion compensation package,

citing excessive compensation. It also suggested voting against

director James Murdoch but in favor of Kimbal Musk and the

company’s state change. ISS and Glass Lewis recommendations are

under debate, despite their significant impact on votes.

Additionally, a Morgan Stanley report stated that Musk ignored

warnings about Twitter stock disclosure, resulting in a lawsuit. It

is alleged that Musk and Jared Birchall delayed disclosure to

accumulate shares at reduced prices, saving $200 million. Musk

subsequently bought Twitter for $44 billion.

Ford Motor (NYSE:F), General

Motors (NYSE:GM) – Ford and GM CEOs expressed contrasting

views on hybrid vehicles. Ford’s Farley defended hybrids as a

profitable and crucial solution for the future, while GM’s Barra

emphasized the transition to fully electric vehicles. Both

companies are pursuing distinct strategies to keep up with

automotive market trends.

Hertz Global (NASDAQ:HTZ) – The vehicle rental

company is seeking financing after challenges with electric

vehicles. Bloomberg News reported that the company is in touch with

financial advisors to evaluate alternatives. Despite a

larger-than-expected quarterly loss, stocks rose in pre-market

trading after the announcement.

Boeing (NYSE:BA) – The Federal Aviation

Administration (FAA) has postponed approval for Boeing to increase

737 MAX production, citing ongoing safety concerns. Enhanced

oversight will continue, focusing on quality and safety

improvements. Boeing has released an improvement plan, prioritizing

critical production and safety areas. Meanwhile, Boeing

firefighters have approved a new four-year contract, ending a

deadlock. The agreement offers annual salary increases, promotion

opportunities, and compensation improvements. Boeing expects

firefighters to return to work without disclosing additional

financial costs.

United Airlines (NASDAQ:UAL) – United Airlines

may receive new aircraft as US aviation regulators review the

company. The FAA is collaborating with the company’s growth plan.

Recently, some certification activities were halted due to safety

concerns, but the FAA is closely overseeing the process.

American Airlines (NASDAQ:AAL) – Following an

analysis by Bain & Co., American Airlines has fired its chief

commercial officer, Vasu Raja, due to a poorly executed marketing

strategy that alienated corporate customers. The change reflects

the company’s urgency to reverse declining revenues resulting from

a controversial sales approach.

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024